HBAR Price Needs A Near 40% Rally To Recover November Losses

Hedera (HBAR) has been trading sideways for several days, with the altcoin struggling to gather enough momentum to stage a meaningful recovery. After a steep drop this month, HBAR is waiting for a decisive catalyst to break its stagnation. However, the support needed to drive that recovery appears limited, and the broader market’s uncertainty is

Hedera (HBAR) has been trading sideways for several days, with the altcoin struggling to gather enough momentum to stage a meaningful recovery. After a steep drop this month, HBAR is waiting for a decisive catalyst to break its stagnation.

However, the support needed to drive that recovery appears limited, and the broader market’s uncertainty is not helping its case.

Hedera Traders Are Placing Shorts

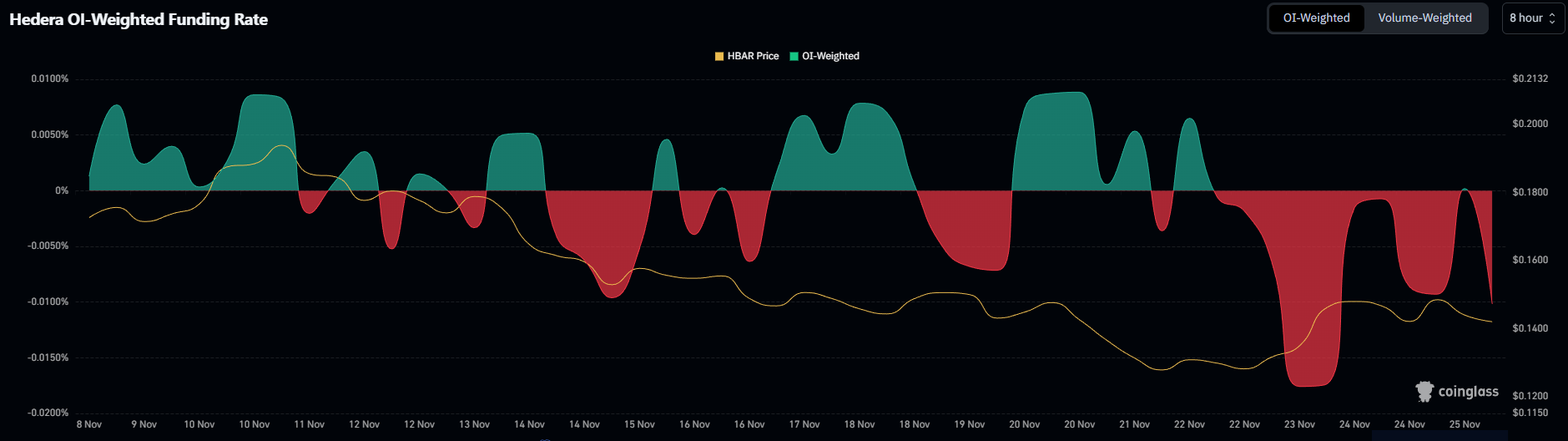

Funding rates across major exchanges indicate that traders remain hesitant. The current negative funding rate suggests that market participants expect more downside and are opening short positions to profit from a potential decline. This type of sentiment often emerges during extended consolidation phases, where traders lose confidence in the asset’s ability to rebound.

However, funding rates are highly reactive and can shift quickly. Their frequent fluctuations signal volatility and uncertainty rather than a firmly bearish trend. If sentiment flips and traders begin to unwind shorts, HBAR could benefit from a sudden surge in buying pressure, helping it regain lost ground.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

HBAR Funding Rate. Source:

Coinglass

HBAR Funding Rate. Source:

Coinglass

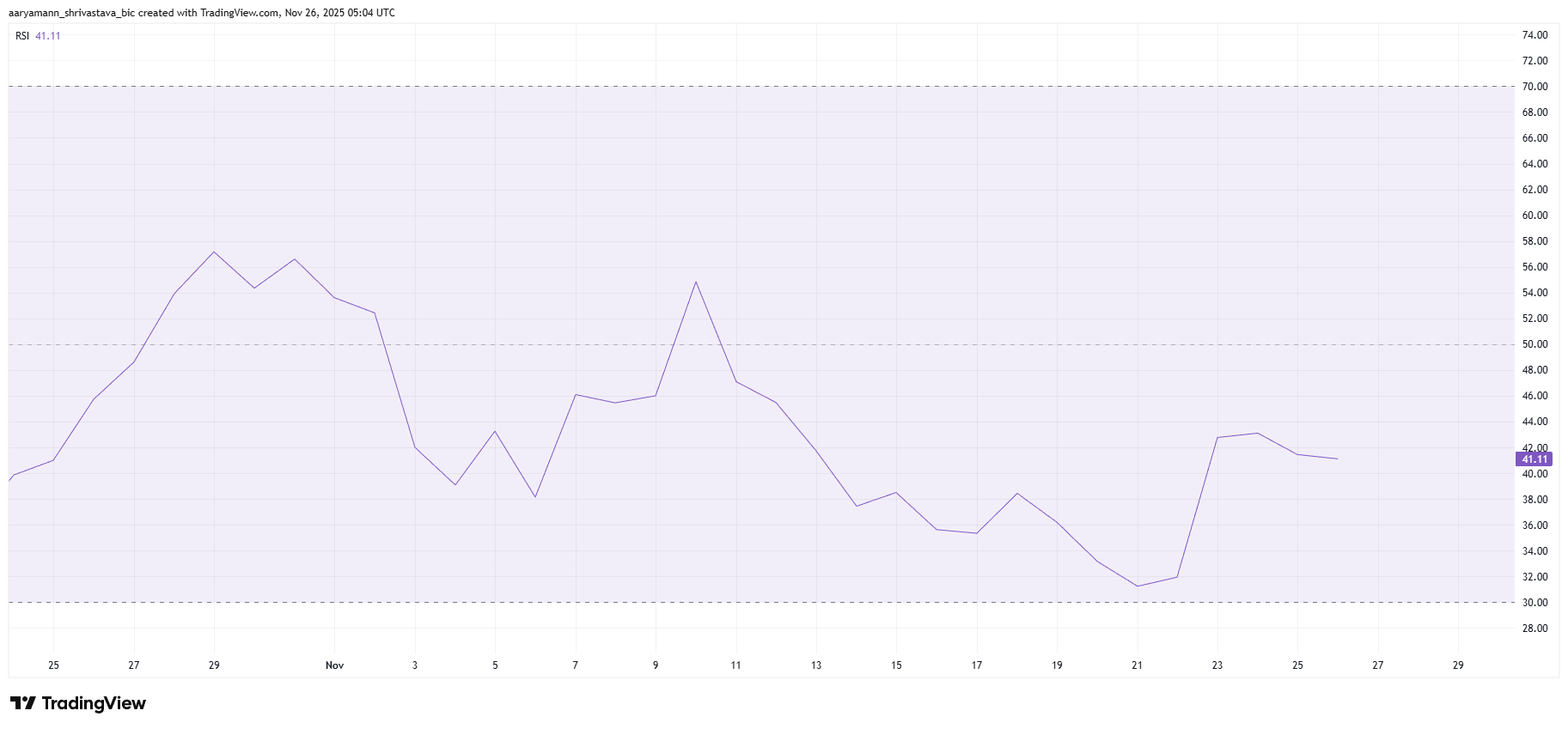

The broader momentum picture remains weak. Hedera’s relative strength index is sitting below the neutral 50.0 level, firmly in bearish territory. This positioning reflects ongoing market pressure and a lack of strong bullish conviction. When the RSI holds in the negative zone, price action often struggles to form higher highs or generate sustainable rallies.

The persistent market-wide caution also weighs on HBAR’s ability to mount a recovery. Unless momentum indicators shift upward, the altcoin could remain stuck in its current range.

HBAR RSI. Source:

TradingView

HBAR RSI. Source:

TradingView

HBAR Price Has A Long Way To Go

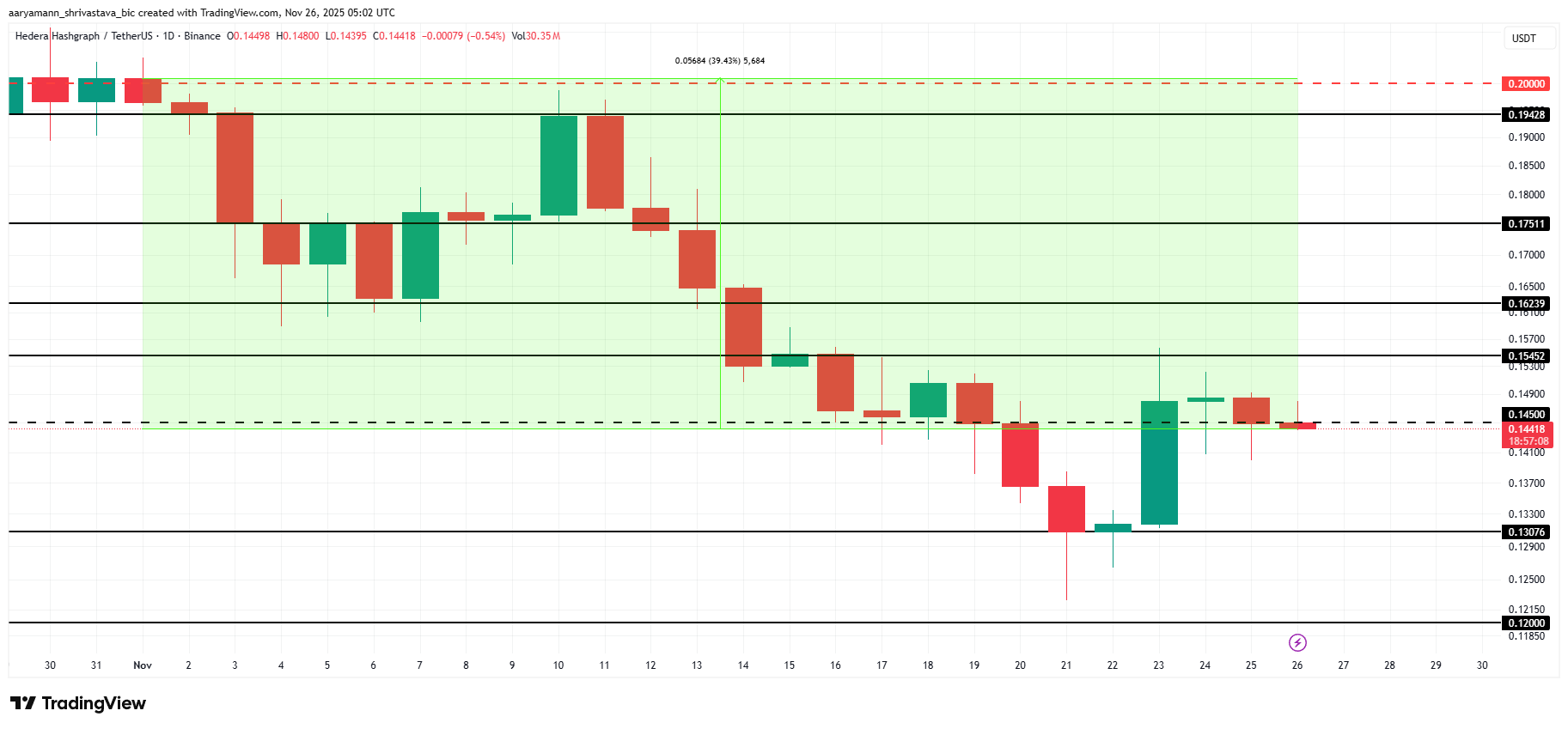

HBAR is trading at $0.144, sitting just under the important $0.145 resistance level. To begin a meaningful climb, the altcoin must flip this resistance into support. This would allow it to move toward $0.154 — a level that has previously acted as a ceiling.

Based on current indicators, HBAR may continue consolidating between $0.154 and $0.130. Bearish sentiment and weak macro signals suggest the altcoin could remain trapped in this zone unless a strong catalyst emerges.

HBAR Price Analysis. Source:

TradingView

HBAR Price Analysis. Source:

TradingView

To recover its November losses, HBAR needs roughly a 40% rally, pushing it toward the $0.200 region. This requires breaking through several resistance levels, starting with $0.154. If HBAR can reclaim that barrier, a move to $0.162 and higher becomes possible, giving the altcoin a chance to invalidate the bearish thesis.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Global Crypto Regulation Era Begins as UK Implements OECD Disclosure Standards

- UK adopts OECD's CARF framework for crypto regulation, avoiding tax hikes but enforcing stricter compliance by 2026. - HMRC updates guidelines requiring crypto providers to report user data globally, aligning with 70+ countries' 2027 data exchange plans. - Compliance demands automated data collection, KYC upgrades, and penalties for non-compliance under new transparency rules. - Framework excludes self-custody wallets but covers major transactions, reshaping crypto's integration into global financial sys

Cosmos Addresses ATOM’s Inflation and Price Fluctuations through Community-Led Tokenomics Reform

- Cosmos community proposes ATOM tokenomics overhaul to shift from artificial scarcity to usage-based fees and network activity-driven inflation. - Five-step governance process emphasizes transparency, stakeholder collaboration, and addressing 25% price drop, high inflation, and speculative volatility. - Framework separates core economics from add-ons, incentivizes long-term stakers, and aligns ATOM as reserve/settlement asset across Cosmos Stack. - Ecosystem partners like Akash and Pocket Network advance

"Virtual Gold, Real Firearms: The Emerging Security Threat in Cryptocurrency"

- A $11M crypto heist in SF targeted Lachy Groom, a former OpenAI CEO partner, via an armed "wrench attack" by a delivery-worker impersonator. - Global "wrench attacks" surged to over 60 in 2025, exploiting blockchain's anonymity and irreversibility to steal digital assets through physical coercion. - Experts warn of rising crypto security risks as attackers profile victims via social media, prompting calls for institutional-grade storage and multi-signature wallets. - The incident highlights vulnerabiliti

Strategic Development of Infrastructure within Webster Economic Corridor in Upstate New York

- Upstate NY's Webster Economic Corridor is transforming into a hub for advanced manufacturing and semiconductors via strategic infrastructure investments. - $9.8M FAST NY grants and $4.5M NY Forward funds modernize industrial sites and downtown areas, enhancing business readiness and community engagement. - A $650M fairlife® facility will create 250 jobs, demonstrating how public-private partnerships (PPPs) catalyze private investment through site readiness. - Federal infrastructure bank proposals aim to