HYPE Token's Explosive Growth in November 2025: Hype-Driven Speculation or True DeFi Breakthrough?

- HYPE token's 2025 price surge reflects both speculative frenzy over asset tokenization and structural DeFi innovations. - Doma Protocol's domain tokenization expanded DeFi utility by enabling 24/7 fractional domain trading as ERC-20 tokens. - UAE's 2025 regulatory framework brought DeFi under formal oversight, balancing compliance challenges with institutional legitimacy. - Converging factors - tokenization narratives, domain liquidity, and regulatory clarity - created hybrid momentum for HYPE's surge. -

What Drove the Surge: Speculation or Genuine Progress?

DeFi’s Structural Advances: Building a New Base?

Although speculative trading was a factor, November 2025 also saw pivotal advancements that could mark a real turning point for DeFi. The launch of the Doma Protocol’s mainnet, for example, brought DeFi liquidity solutions to the $360 billion domain aftermarket, making it possible to trade fractional ownership of domains as ERC-20 tokens around the clock

Understanding HYPE: Where Trends and Innovation Meet

The rise of the HYPE token should be interpreted in light of these intersecting developments. On one side, the tokenization of physical goods and domain names injected new capital into DeFi,

Final Thoughts: Inflection Point or Speculative Bubble?

The November 2025 rally in HYPE token value seems to be a combination of both speculation and structural evolution. While hype around tokenization and market swings certainly played a part, the significant progress in DeFi—such as domain tokenization and regulatory acceptance—points to a more profound shift. Investors should carefully consider the risks of chasing short-term gains against the promise of sustainable value. At present, the surge appears to balance both aspects, and its future will depend on whether these foundational changes can maintain momentum after the initial excitement fades.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget Wallet Introduces Zero-Fee Feature for Its Crypto Card in Over 50 Markets

Are Big Changes in Store for the Bitcoin Price?

Secure Blockchain, Misleading Agreements: Spoofing Incidents Increase on Monad

- Monad's mainnet faces spoofing attacks as scammers use smart contracts to mimic ERC-20 token transfers, misleading users with fake logs. - Co-founder James Hunsaker clarifies the network remains secure, but external contracts exploit EVM openness to create deceptive transactions. - Over 76,000 wallets claimed MON tokens in airdrop, creating high-traffic conditions that attackers leverage through fabricated swaps and signatures. - Security experts warn users to verify contract sources and avoid urgent pro

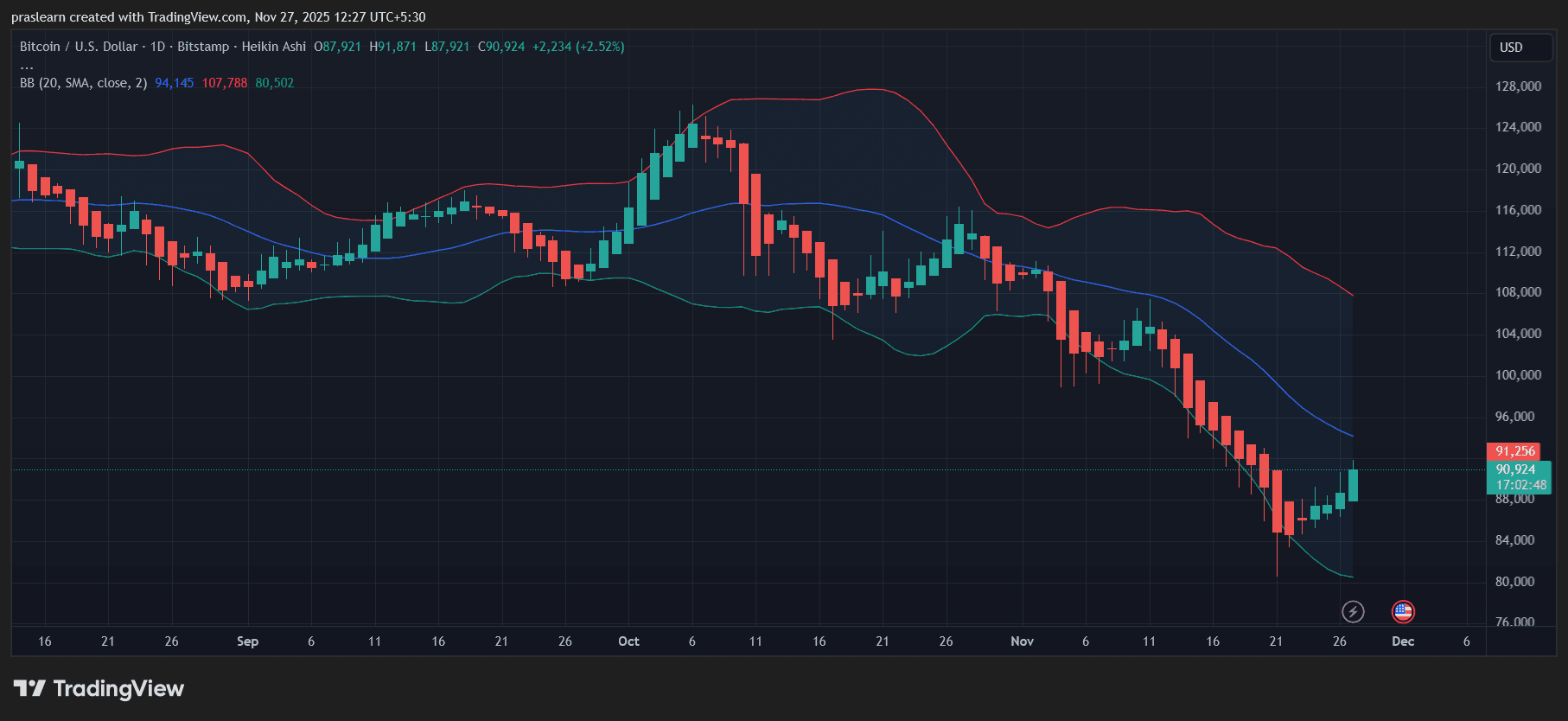

Bitcoin Latest Updates: Worldwide Regulatory Changes and Major Investors Propel Bitcoin and Brazil's Markets Upward

- Bitcoin surged to $91,500 amid institutional adoption, Fed rate cut expectations, and post-halving rebound, despite $3.79B ETF outflows and inherent volatility. - Brazil's stock market hit records after tax reforms exempted low-income households, aligning with global redistributive policies and boosting 15 million earners. - Binance delisted BTC pairs like GMT/BTC for regulatory compliance, while on-chain metrics signaled crypto market consolidation and mixed altcoin prospects. - Global macro risks persi