Are Big Changes in Store for the Bitcoin Price?

Bitcoin’s recent price action hints that a potential turning point may be underway. After several weeks of steady decline, BTC price has started to rebound from its recent lows, supported by shifting macroeconomic signals that could reshape the landscape for risk assets. The daily chart shows a subtle but promising recovery that could gain strength if the broader financial narrative—centered around U.S. interest rates—tilts in Bitcoin’s favor.

Is Bitcoin’s Reversal Already Underway?

BTC/USD Daily Chart- TradingView

BTC/USD Daily Chart- TradingView

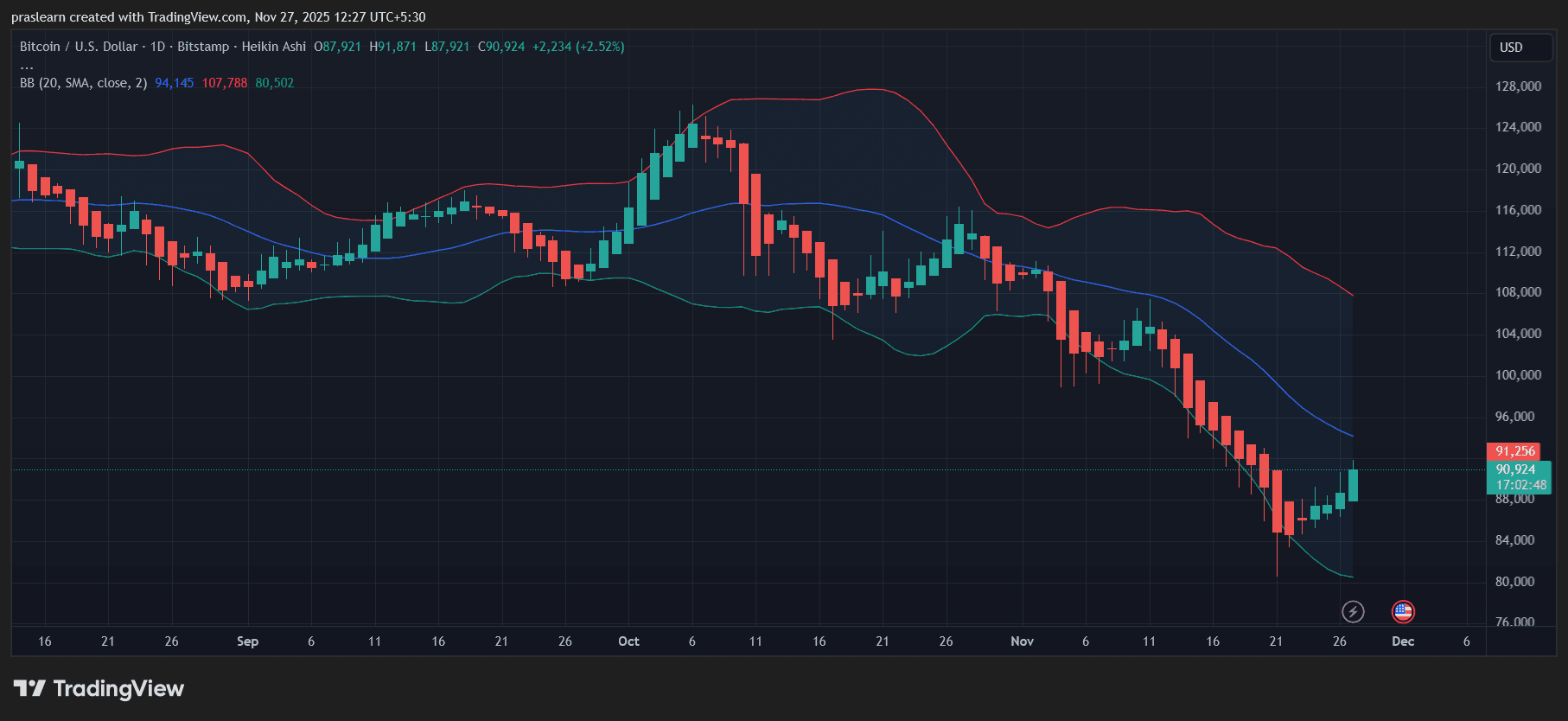

The chart tells a story of exhaustion among sellers. After sliding below $85,000 earlier this month, Bitcoin found support near the lower Bollinger Band, an area that often signals oversold conditions. Over the past few sessions, the Heikin Ashi candles have turned green again, and BTC price has pushed back toward the midline of the Bollinger Bands—around $94,000. This mid-band, a 20-day moving average, acts as the next key resistance zone. A decisive close above it could confirm the start of a short-term uptrend.

Momentum indicators (not shown here) likely reflect this recovery, with early bullish divergence forming as price makes higher lows while selling pressure weakens. In simpler terms, Bitcoin seems to be building a base, and traders are beginning to test the waters again.

Why the Fed Story Matters for Bitcoin Price Prediction?

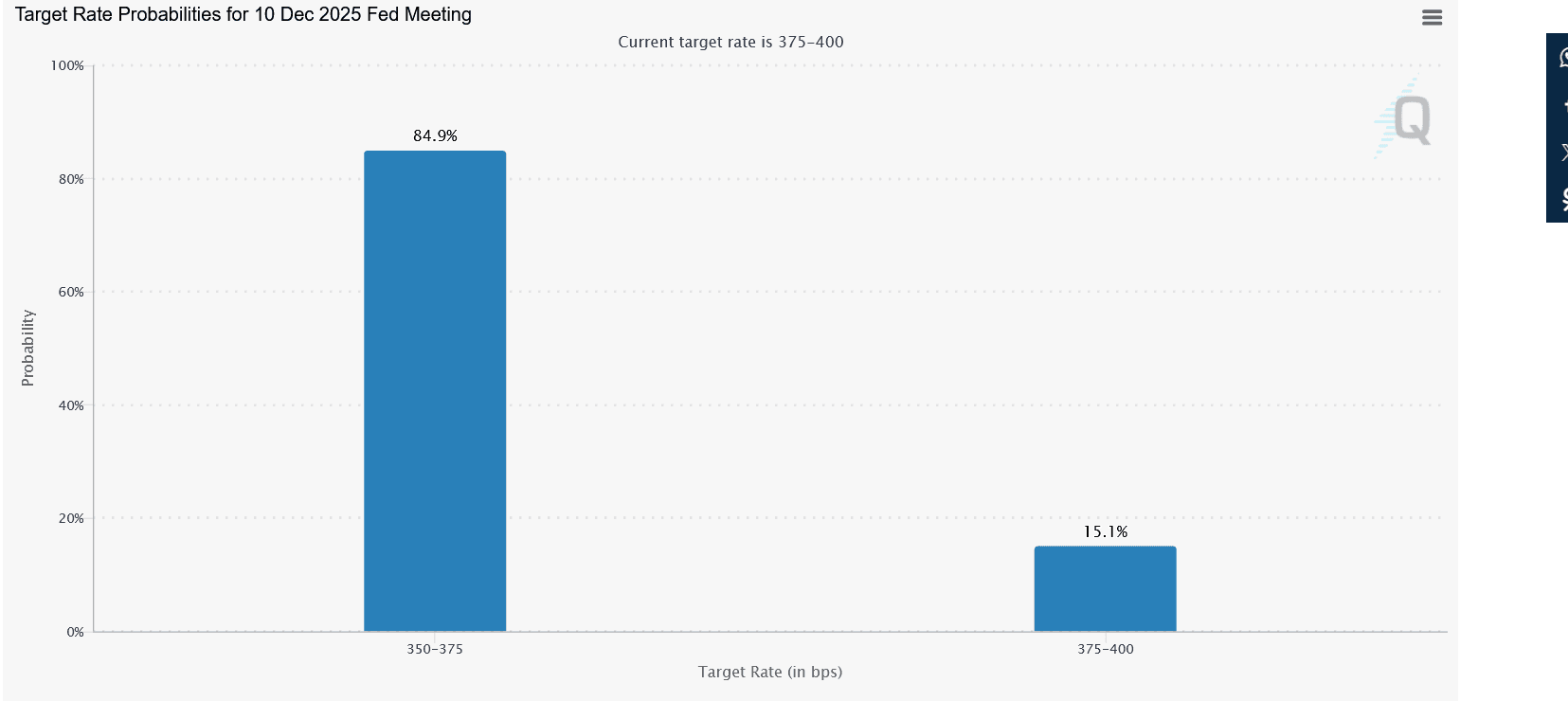

The macro environment could accelerate this shift. With Jerome Powell’s term as Federal Reserve Chair set to expire in May, reports that former Trump advisor Kevin Hassett may replace him have sparked fresh debate on future monetary policy. Hassett’s history of advocating for aggressive rate cuts suggests a more dovish Fed under his leadership—exactly the kind of environment that historically benefits Bitcoin.

Lower interest rates reduce the opportunity cost of holding non-yielding assets like Bitcoin. They also weaken the dollar and often trigger inflows into risk assets. If the market starts pricing in deeper cuts ahead of schedule, BTC could see renewed speculative momentum, particularly if U.S. inflation continues to cool as Hassett predicts.

Bitcoin Price Prediction: Key Levels to Watch

From a technical standpoint, Bitcoin price now trades around $90,900 , with short-term resistance at $94,000–$95,000, the midpoint of the Bollinger Bands. A breakout above this zone could open the path toward the $100,000–$104,000 region, aligning with the upper band. However, if BTC fails to sustain above the midline and faces rejection, the $88,000 and $84,000 levels could again come into play as support zones.

The tightening of the Bollinger Bands also suggests volatility is about to return. Historically, such compressions precede strong directional moves—either explosive rallies or sharp reversals. Given the macro backdrop and the current bullish momentum, the odds slightly favor an upward breakout, though confirmation is still pending.

Bitcoin Price Prediction: What Traders Should Expect Next

The next few weeks will likely be decisive. If Bitcoin maintains its climb above $91,000 and closes multiple sessions above the 20-day average, it could attract technical buyers and trigger short covering. Combine that with dovish Fed speculation, and BTC might regain the $100,000 threshold faster than many expect.

On the other hand, uncertainty around Fed leadership, potential Senate confirmation hurdles, or renewed inflation fears could delay this breakout and keep Bitcoin range-bound into December.

$Bitcoin’s structure is improving, and the narrative is shifting in its favor. The market seems to be quietly positioning for a macro-driven breakout, but confirmation requires sustained follow-through. The mix of a recovering chart, contracting volatility, and political pressure for lower interest rates could create the perfect setup for $BTC next big move.

In short, the question isn’t whether big changes are coming—it’s when they’ll unfold.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Deciphering How Municipal Infrastructure Grants Influence Real Estate Growth and Investment Prospects

- New York's FAST NY program allocated $283M to transform 7,700 acres of industrial land into "shovel-ready" sites for high-tech manufacturing and semiconductors . - Infrastructure upgrades like water/sewer systems directly increased land values by 20% in industrial zones, attracting anchor tenants like Chobani and Micron . - 2025 tax reforms (100% bonus depreciation) amplified private investment, with Q3 2025 real estate deals hitting $310B as manufacturers targeted upgraded sites. - Critics highlight rur

Bitcoin News Today: Bitcoin Faces a Pivotal Moment: Bulls Defend $93K While Bears Target $75K

- Bitcoin's price recovery loses momentum as key support levels break, risking a drop to $75,000 amid bearish technical indicators. - Bulls must reclaim $92,900+ resistance to avoid deeper correction, but weak RSI/MACD and LTH sell-offs signal structural vulnerability. - DXY consolidation below 100 and extreme fear index (15) reinforce macro risks, while analysts split between $90K consolidation and $75K-$103K dual scenarios. - Ethereum faces similar pressure at $2,939, with Tom Lee predicting a potential

The Role of Infrastructure Grants in Driving Economic Growth in Webster, NY

- Webster , NY leverages $9.8M FAST NY grant to transform Xerox campus and 600 Ridge Road site, boosting industrial real estate and mixed-use development. - Infrastructure upgrades at Xerox's 300-acre brownfield create 1M sq ft of industrial space by 2025, attracting high-tech manufacturers and aligning with state sustainability goals. - 600 Ridge Road's EPA-backed revitalization enables pedestrian-friendly mixed-use projects, synchronized with Xerox campus upgrades to drive 10.1% annual home price growth.

Bitcoin News Today: Bitcoin Faces a Pivotal Week: Optimistic Buying Meets Bearish Whales Amid Economic Uncertainty

- Bitcoin stabilizes near $87,000 after 11-day selloff, with analysts divided on whether the rebound signals a trend reversal or temporary relief. - US ETFs record $1.22B in outflows amid weak institutional demand, compounded by macroeconomic uncertainty and delayed Fed rate-cut expectations. - Technical indicators show mixed signals: RSI suggests waning bearish momentum, while a "Death Cross" pattern historically precedes deep corrections. - Institutional accumulation by mid-sized wallets contrasts with w