BitMine (BMNR) Stock Jumps 15% But Misses Critical Recovery Signal By Inches

BitMine Immersion Technologies has seen intense volatility this month, with its share price plunging 42% since the start of January. The company sparked renewed optimism on Monday after announcing a significant purchase of 69,822 ETH, a move that briefly lifted BMNR by 15%. However, despite the rally, a confirmed reversal signal has yet to emerge.

BitMine Immersion Technologies has seen intense volatility this month, with its share price plunging 42% since the start of January.

The company sparked renewed optimism on Monday after announcing a significant purchase of 69,822 ETH, a move that briefly lifted BMNR by 15%. However, despite the rally, a confirmed reversal signal has yet to emerge.

BitMine Continues To Accumulate ETH

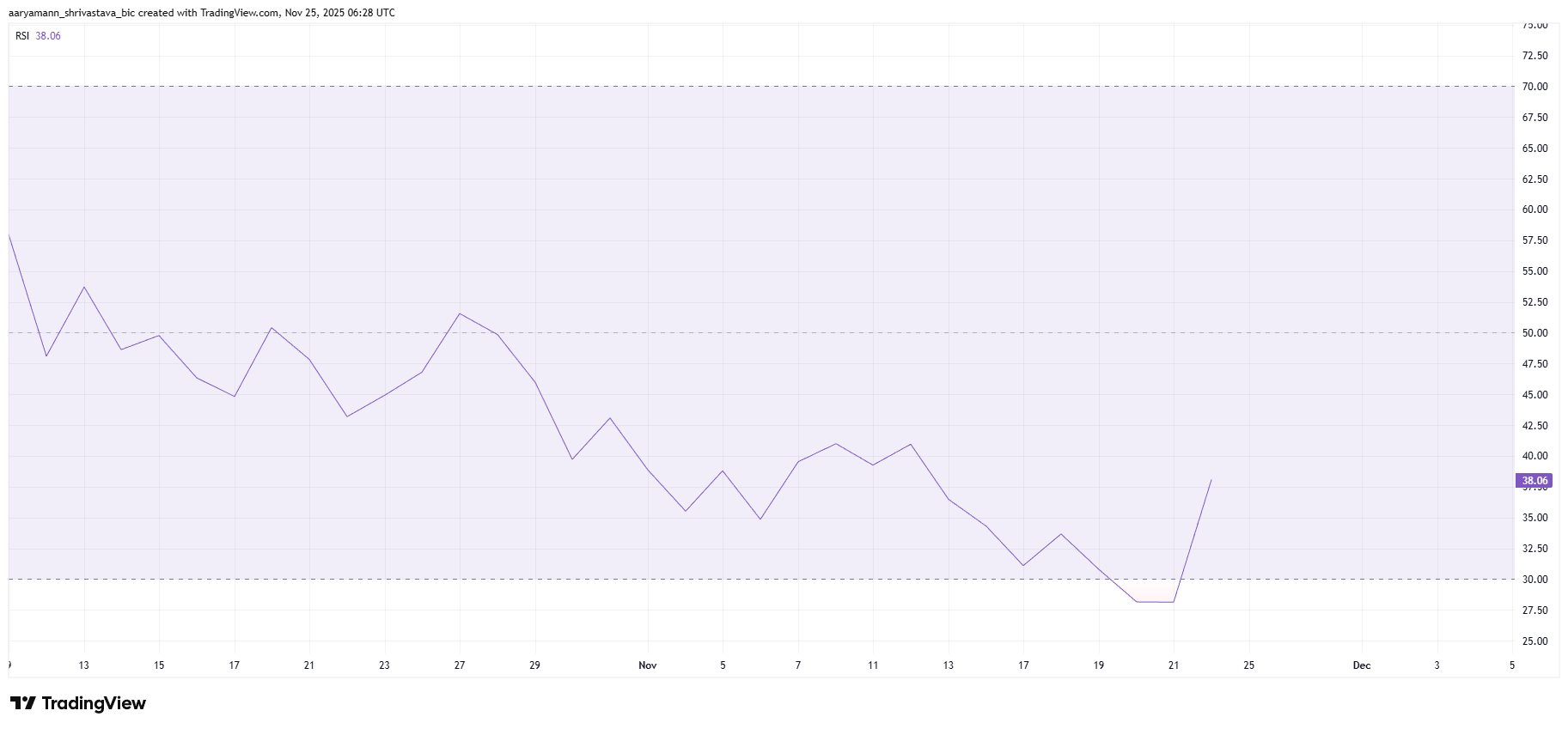

The relative strength index is showing a sharp uptick following BitMine’s major ETH acquisition. The purchase, equivalent to roughly 3% of Ethereum’s total circulating supply, sent a clear signal of confidence from the company. This triggered widespread optimism among investors and lifted the RSI out of oversold territory, a zone that typically precedes trend reversals.

However, the RSI alone cannot confirm a sustained bullish shift. While the indicator’s rise suggests improving sentiment, BMNR still requires consistent buying pressure to support a full recovery.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

BMNR RSI. Source:

BMNR RSI. Source:

BMNR RSI. Source:

BMNR RSI. Source:

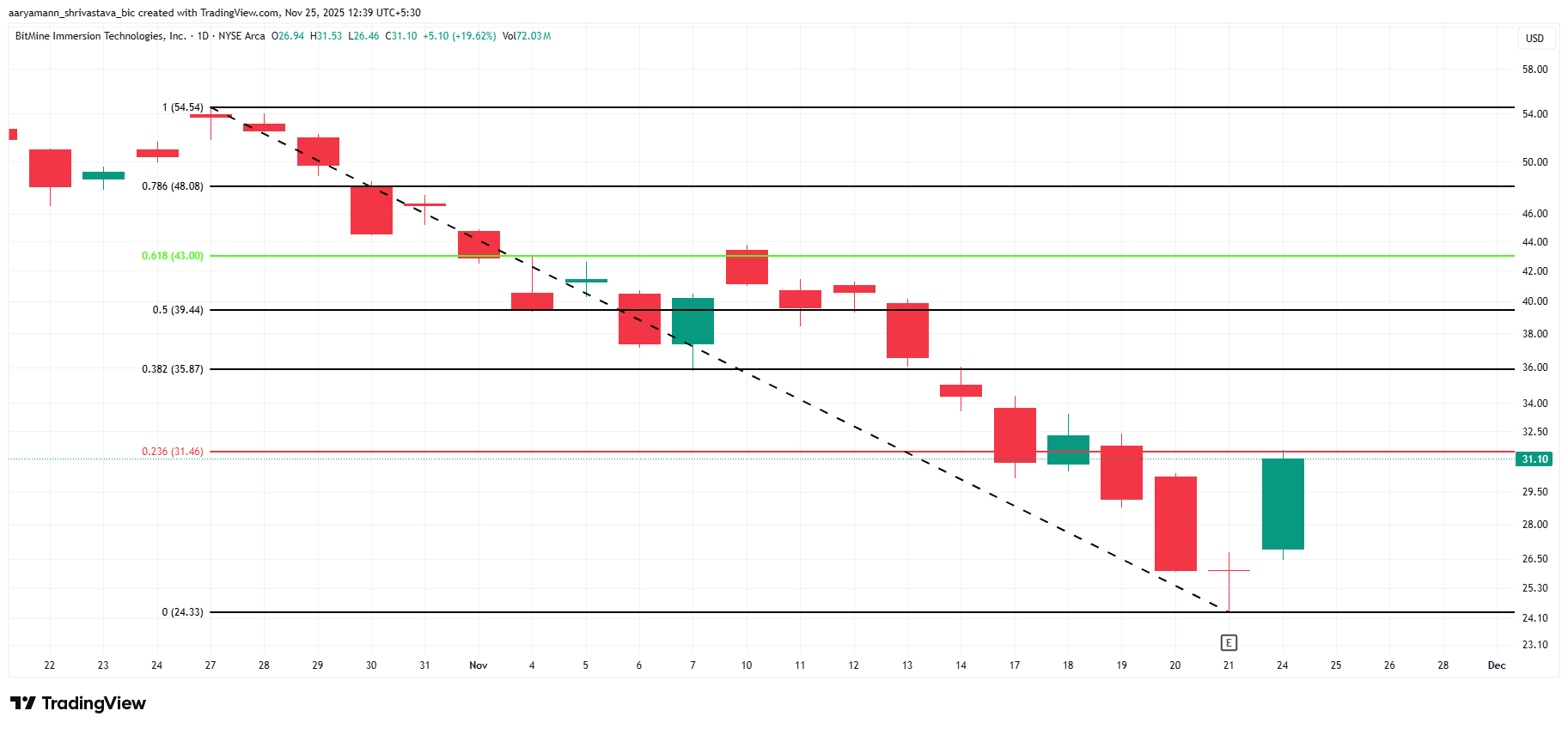

Macro momentum indicators highlight another critical area to watch. The Fibonacci Retracement tool shows that BMNR is approaching the 23.6% Fib line, a historically important support level during bearish phases. This threshold, positioned at $31.46, represents a potential pivot point for the stock.

Reclaiming this level as support would strengthen BitMine’s recovery outlook and enable a more convincing bounce. However, the stock remains just below this threshold and still requires stronger bullish participation to break through.

BMNR Fibonacci Retracement. Source:

BMNR Fibonacci Retracement. Source:

BMNR Fibonacci Retracement. Source:

BMNR Fibonacci Retracement. Source:

BMNR Price Reclaims $30

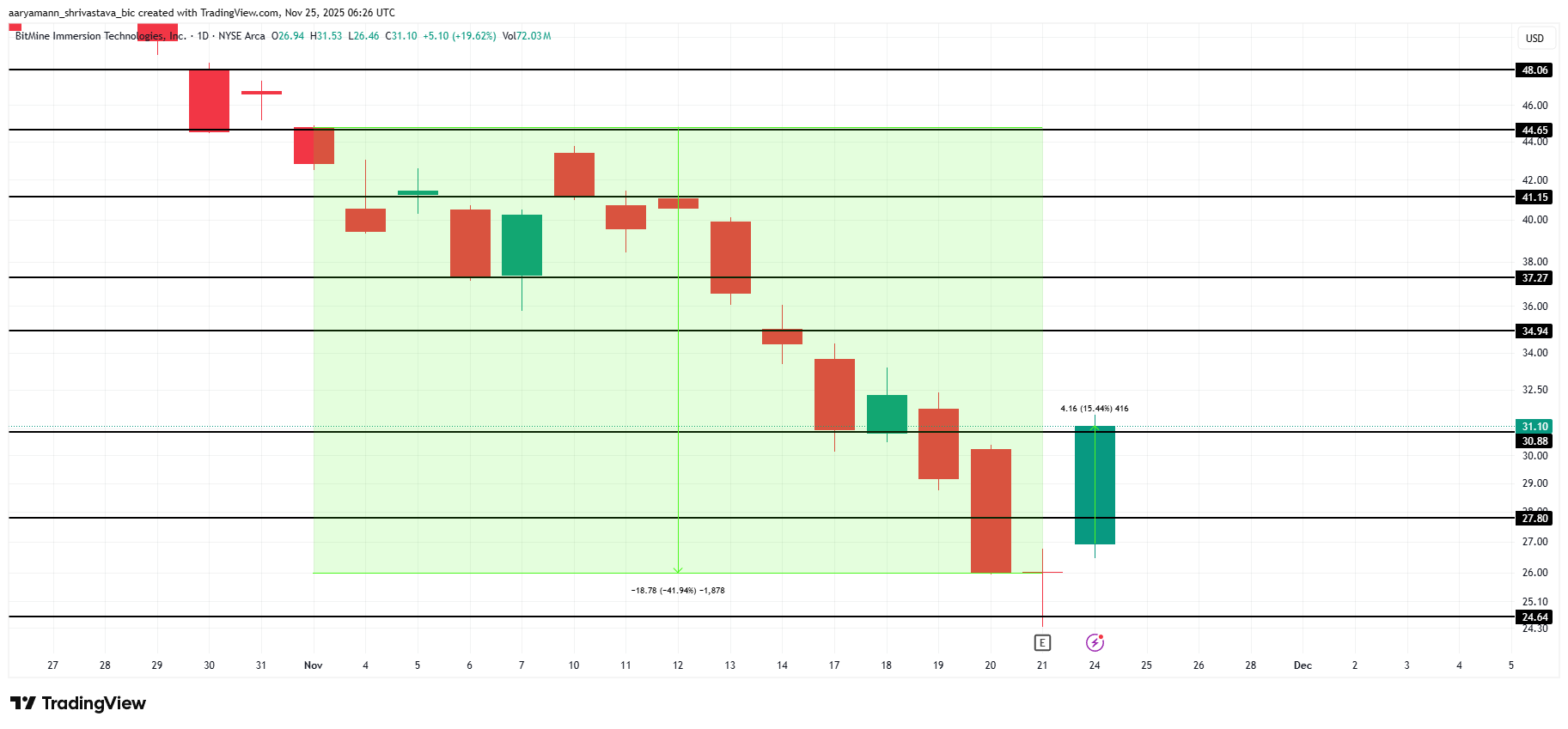

BMNR is trading at $31.10, hovering above the crucial $30.88 support zone. Despite the recent ETH-driven rally, the stock remains down nearly 42% for the month. This positions Monday’s surge as an important—but not yet decisive—step toward recovery.

If bullish momentum persists, BMNR could climb toward the $34.94 resistance level. A break above this barrier may pave the way for further gains toward $37.27 and beyond. This is especially true if investor confidence strengthens around BitMine’s aggressive accumulation strategy.

BMNR Price Analysis. Source:

BMNR Price Analysis. Source:

BMNR Price Analysis. Source:

BMNR Price Analysis. Source:

If uncertainty prevails and the company fails to capitalize on the excitement surrounding its ETH purchase, BMNR risks losing the $30.88 support. A breakdown could send the stock to $27.80 or even $24.64. This would invalidate the bullish thesis and signal continued weakness in the short term.

Read the article at BeInCryptoDisclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Global Crypto Regulation Era Begins as UK Implements OECD Disclosure Standards

- UK adopts OECD's CARF framework for crypto regulation, avoiding tax hikes but enforcing stricter compliance by 2026. - HMRC updates guidelines requiring crypto providers to report user data globally, aligning with 70+ countries' 2027 data exchange plans. - Compliance demands automated data collection, KYC upgrades, and penalties for non-compliance under new transparency rules. - Framework excludes self-custody wallets but covers major transactions, reshaping crypto's integration into global financial sys

Cosmos Addresses ATOM’s Inflation and Price Fluctuations through Community-Led Tokenomics Reform

- Cosmos community proposes ATOM tokenomics overhaul to shift from artificial scarcity to usage-based fees and network activity-driven inflation. - Five-step governance process emphasizes transparency, stakeholder collaboration, and addressing 25% price drop, high inflation, and speculative volatility. - Framework separates core economics from add-ons, incentivizes long-term stakers, and aligns ATOM as reserve/settlement asset across Cosmos Stack. - Ecosystem partners like Akash and Pocket Network advance

"Virtual Gold, Real Firearms: The Emerging Security Threat in Cryptocurrency"

- A $11M crypto heist in SF targeted Lachy Groom, a former OpenAI CEO partner, via an armed "wrench attack" by a delivery-worker impersonator. - Global "wrench attacks" surged to over 60 in 2025, exploiting blockchain's anonymity and irreversibility to steal digital assets through physical coercion. - Experts warn of rising crypto security risks as attackers profile victims via social media, prompting calls for institutional-grade storage and multi-signature wallets. - The incident highlights vulnerabiliti

Strategic Development of Infrastructure within Webster Economic Corridor in Upstate New York

- Upstate NY's Webster Economic Corridor is transforming into a hub for advanced manufacturing and semiconductors via strategic infrastructure investments. - $9.8M FAST NY grants and $4.5M NY Forward funds modernize industrial sites and downtown areas, enhancing business readiness and community engagement. - A $650M fairlife® facility will create 250 jobs, demonstrating how public-private partnerships (PPPs) catalyze private investment through site readiness. - Federal infrastructure bank proposals aim to