XRP News Today: XRP Surges to $90—Is This a Retail Buying Craze or the Start of Institutional Investment?

- XRP surged to $90 on Kraken amid institutional interest and the exchange's $800M funding round, valuing it at $15B ahead of a 2026 IPO. - Kraken's U.S. XRP ETF (XRPC) generated $58.6M in first-day trading, but XRP dropped 4.3% as macroeconomic pressures offset ETF inflows. - The exchange's Citadel Securities partnership and global expansion highlight its push to integrate crypto into mainstream finance, though XRP remains in a medium-term downtrend. - Analysts caution that real-world adoption and regulat

XRP experienced a dramatic price jump to $90 on Kraken, fueled by heightened institutional interest and key strategic moves at the exchange, reigniting discussions about Ripple’s future in the broader market. This price rally happened alongside Kraken’s recent $800 million capital raise,

The

Kraken’s recent initiatives have boosted confidence in XRP’s practical use. Its collaboration with Citadel Securities—a major force in traditional finance—

The central issue remains: Will XRP’s story shift beyond being a target for retail speculation? Analysts warn that while the ETF debut and Kraken’s fundraising are encouraging, lasting price stability will depend on tangible utility—such as greater uptake by financial institutions or clearer regulations.

Kraken’s rising valuation and XRP’s price swings highlight significant changes in the crypto landscape. As Kraken moves toward a public listing and broadens its product lineup, institutional players are watching to see if Ripple can achieve what

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Billion-dollar Ethereum DAT plan quietly collapses amid market slide

Adam Back Discusses Bitcoin’s Long-Term Quantum Security

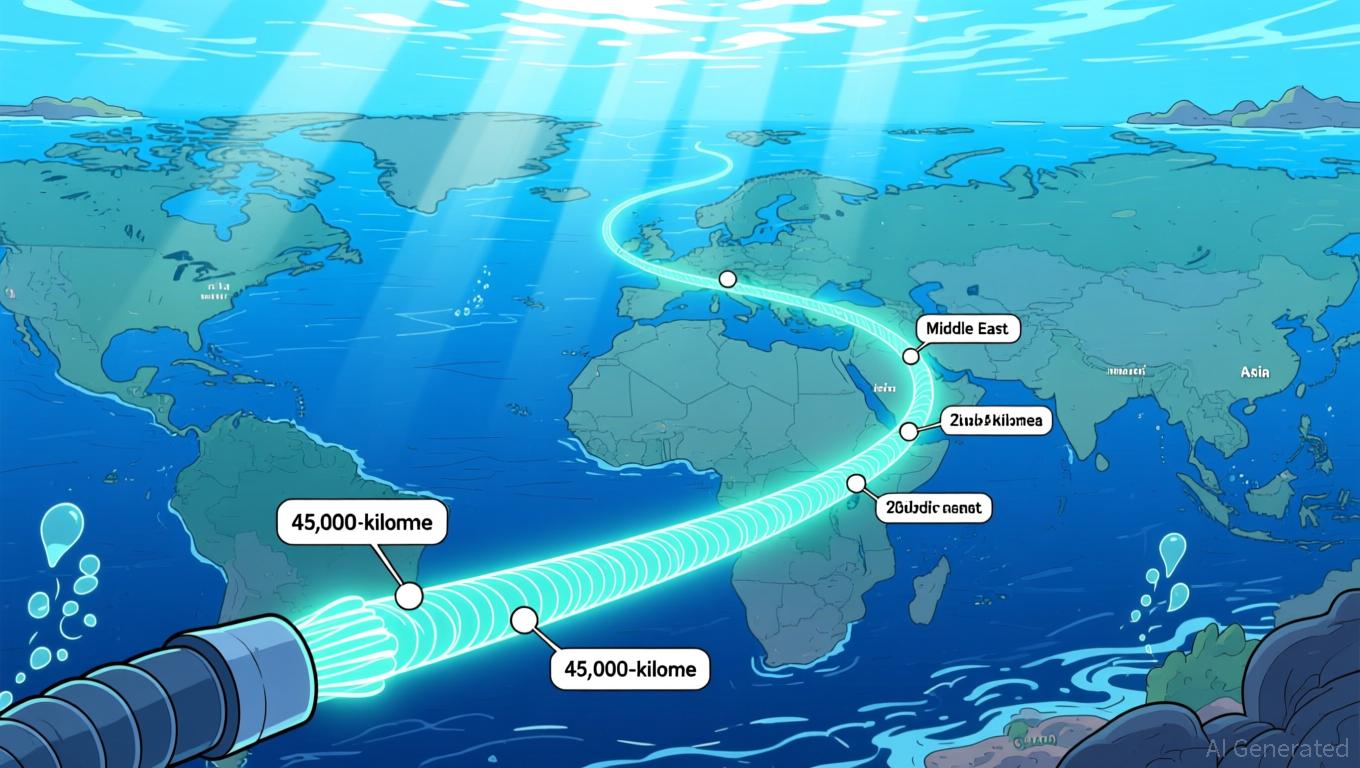

2Africa Cable Project Expected to Contribute $36.9B to Africa’s Economy and Enhance Worldwide Connectivity

- Meta completes 2Africa, the world's longest open-access subsea cable, enhancing Africa's global connectivity. - The 45,000km system with SDM technology doubles capacity, enabling 180Tbps bandwidth to reduce costs and boost 5G/data center investments. - Projected to add $36.9B to Africa's GDP within 3 years, it fosters competition through equal access for providers across 33 countries. - Facing seabed hazards and geopolitical delays, the $1.3B project aligns with Meta's AI infrastructure goals and global

ICP Network Expansion and Its Impact on Web3 Infrastructure Investments

- ICP Network's growth is driven by AI upgrades, Microsoft/Google Cloud partnerships, and institutional interest in its decentralized cloud infrastructure. - Price volatility (30% surge then 11% drop) and SEC scrutiny highlight regulatory risks, while technical upgrades like Fission aim to enhance scalability. - Institutional investors leverage ICP's governance model (NNS) and enterprise partnerships in healthcare/industrial IoT to diversify portfolios with real-world applications. - Discrepancies in DeFi