Malaysia’s Cryptocurrency Mining Challenge: Electricity Theft and Unexplored Economic Opportunities

- Malaysia's TNB lost $1.1B in revenue from 2020-2025 due to 13,827 illegal crypto mining sites bypassing electricity meters. - Multi-agency crackdowns now target operations in warehouses/residential buildings, with penalties up to RM1M fines or 10-year imprisonment. - TNB deploys smart meters and AI analytics to detect theft, while industry groups highlight RM700M investment potential if mining is legalized. - Regulatory gaps persist as unlicensed mining exploits unclear electricity pricing laws, strainin

Malaysia’s state-owned power provider, Tenaga Nasional Bhd (TNB), has suffered losses exceeding $1.1 billion in electricity revenue since 2020 due to unauthorized cryptocurrency mining, as revealed by the Energy Transition and Water Transformation Ministry. In a response to parliament, the ministry stated that

The ministry noted that TNB has taken steps to address the problem, such as developing a database to monitor suspicious properties and tenants, rolling out smart meters for instant energy tracking, and launching campaigns to raise public awareness and discourage theft

Those caught face harsh penalties under the Electricity Supply Act, including fines up to RM1 million, imprisonment for as long as 10 years, or both. The ministry stressed that these illegal activities threaten public safety, the stability of the national power supply, and the integrity of infrastructure

The increase in illegal mining has put pressure on Malaysia’s power grid, with operations often hidden in places like warehouses or homes to avoid being discovered. These setups typically bypass meters, drawing power directly from the grid and using as much electricity as entire neighborhoods, while frequently moving to stay ahead of authorities

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Billion-dollar Ethereum DAT plan quietly collapses amid market slide

Adam Back Discusses Bitcoin’s Long-Term Quantum Security

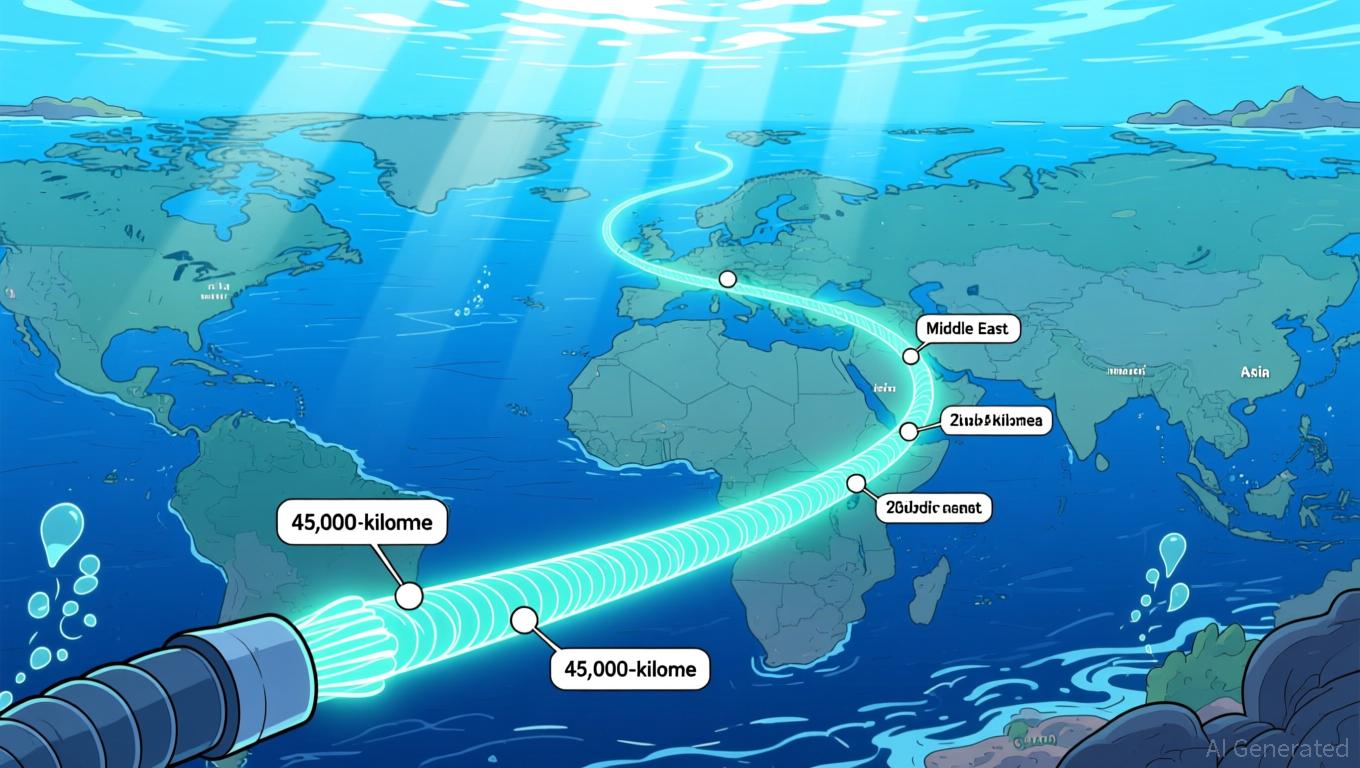

2Africa Cable Project Expected to Contribute $36.9B to Africa’s Economy and Enhance Worldwide Connectivity

- Meta completes 2Africa, the world's longest open-access subsea cable, enhancing Africa's global connectivity. - The 45,000km system with SDM technology doubles capacity, enabling 180Tbps bandwidth to reduce costs and boost 5G/data center investments. - Projected to add $36.9B to Africa's GDP within 3 years, it fosters competition through equal access for providers across 33 countries. - Facing seabed hazards and geopolitical delays, the $1.3B project aligns with Meta's AI infrastructure goals and global

ICP Network Expansion and Its Impact on Web3 Infrastructure Investments

- ICP Network's growth is driven by AI upgrades, Microsoft/Google Cloud partnerships, and institutional interest in its decentralized cloud infrastructure. - Price volatility (30% surge then 11% drop) and SEC scrutiny highlight regulatory risks, while technical upgrades like Fission aim to enhance scalability. - Institutional investors leverage ICP's governance model (NNS) and enterprise partnerships in healthcare/industrial IoT to diversify portfolios with real-world applications. - Discrepancies in DeFi