Crypto ETF Flows Show BTC Out, SOL and XRP In This Week

Quick Take Summary is AI generated, newsroom reviewed. BTC experienced $1.11B in outflows, while ETH saw $728.57M leave. SOL attracted $46.34M and XRP drew $243.5M in inflows. Investors are diversifying portfolios, balancing stability with growth potential. ETF movements reflect growing confidence in altcoins and selective market strategies.References Spot ETF flows last week saw $BTC outflows of $1.11B and SETH outflows of $728.57M.

Cryptocurrency exchange-traded funds (ETFs) are seeing some big changes in investor money. Bitcoin (BTC) and Ethereum (ETH) are experiencing large outflows. While, at the same time, Solana (SOL) and Ripple (XRP) are attracting fresh inflows.

🇺🇸 UPDATE: Spot ETF flows last week saw $BTC outflows of $1.11B and $ETH outflows of $728.57M.

— Cointelegraph (@Cointelegraph) November 17, 2025

Meanwhile $SOL saw $46.34M in inflows and $XRP saw $243.5M in inflows. pic.twitter.com/2yX4OejTYv

BTC saw about $1.11 billion withdrawn, and ETH experienced $728.57 million leaving. In contrast, SOL received $46.34 million in new investments, while XRP gained $243.5 million. These movements show that investors are adjusting their positions rather than exiting crypto entirely.

Why Bitcoin and Ethereum Are Seeing Outflows

Even though BTC and ETH are the largest and most well-known cryptocurrencies, money is still moving away from them. One reason could be that investors are taking profits after previous gains. Another reason may be caution due to changing market conditions and potential regulatory updates.

Some investors are also diversifying. They keep part of their funds in BTC and ETH, which are generally considered stable, while allocating new money to other cryptocurrencies with growth potential. This strategy helps spread risk without leaving the crypto market.

SOL and XRP Attract New Funds

Solana and XRP are drawing attention for different reasons. SOL’s $46.34 million inflows show confidence in its fast and low-cost blockchain. Solana’s growing ecosystem of applications makes it appealing to both retail and institutional investors.

XRP received $243.5 million in inflows, showing strong interest in its potential for cross-border payments and financial partnerships. Its legal progress and continued adoption give investors more confidence in its long-term prospects.

Investor Sentiment and Market Signals

Crypto ETF flows often reflect how investors feel about the market. Outflows can mean caution, profit-taking or portfolio adjustment. Inflows show optimism and growing interest.

The current data suggests investors are being selective. They still value BTC and ETH but are also seeking opportunities in high-potential altcoins like SOL and XRP.

What to Watch Moving Forward

Investors will likely continue monitoring ETF flows closely. If SOL and XRP maintain steady inflows while BTC and ETH see continued withdrawals, it could signal a shift in focus toward emerging cryptocurrencies.

Market conditions, regulatory news, and broader financial trends will also influence how money moves in and out of crypto ETFs. Investors should remain alert and adjust strategies based on these signals.

Shifts in Crypto Investment Trends

Crypto ETFs flows are showing a clear pattern, how while BTC and ETH remain foundational, altcoins like Solana and XRP are gaining traction. Investors are balancing stability with growth potential, adjusting portfolios strategically, and shaping the future flow of crypto funds in a rapidly evolving market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Billion-dollar Ethereum DAT plan quietly collapses amid market slide

Adam Back Discusses Bitcoin’s Long-Term Quantum Security

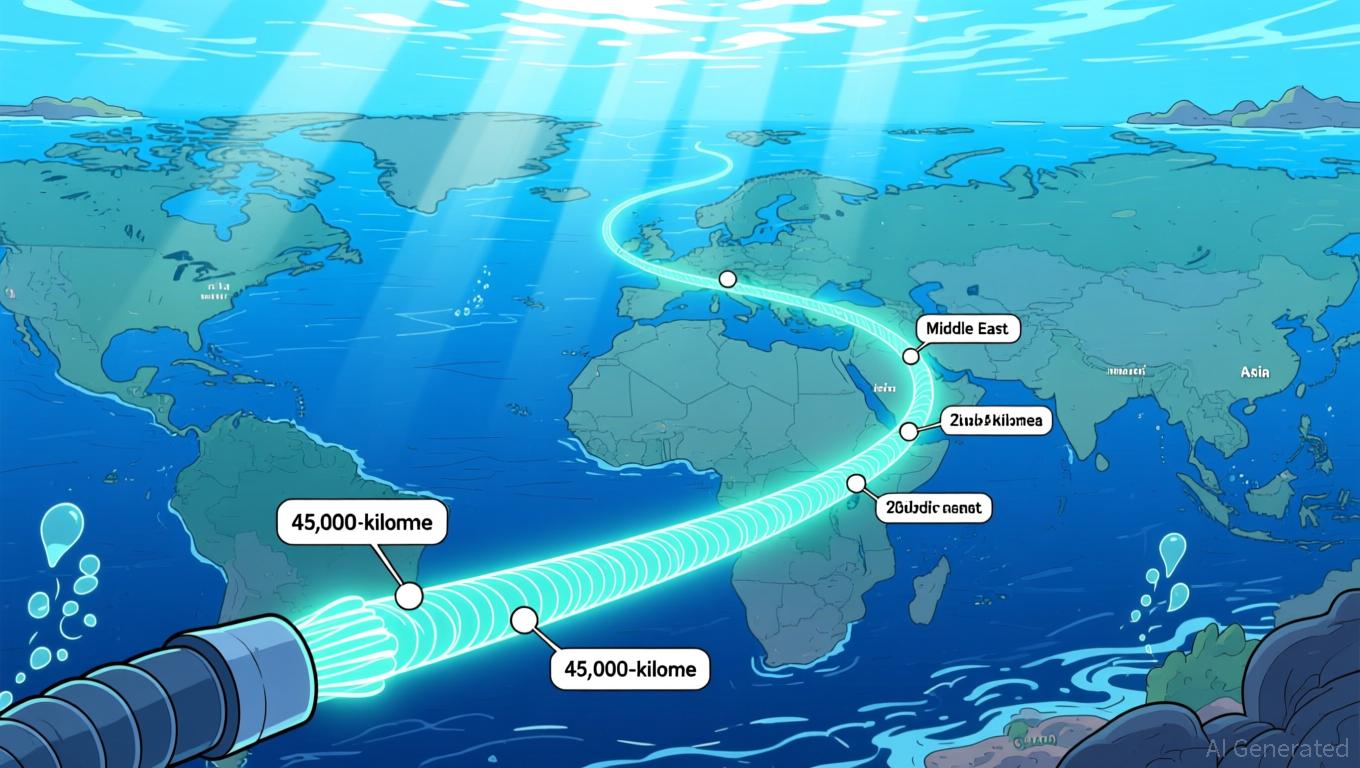

2Africa Cable Project Expected to Contribute $36.9B to Africa’s Economy and Enhance Worldwide Connectivity

- Meta completes 2Africa, the world's longest open-access subsea cable, enhancing Africa's global connectivity. - The 45,000km system with SDM technology doubles capacity, enabling 180Tbps bandwidth to reduce costs and boost 5G/data center investments. - Projected to add $36.9B to Africa's GDP within 3 years, it fosters competition through equal access for providers across 33 countries. - Facing seabed hazards and geopolitical delays, the $1.3B project aligns with Meta's AI infrastructure goals and global

ICP Network Expansion and Its Impact on Web3 Infrastructure Investments

- ICP Network's growth is driven by AI upgrades, Microsoft/Google Cloud partnerships, and institutional interest in its decentralized cloud infrastructure. - Price volatility (30% surge then 11% drop) and SEC scrutiny highlight regulatory risks, while technical upgrades like Fission aim to enhance scalability. - Institutional investors leverage ICP's governance model (NNS) and enterprise partnerships in healthcare/industrial IoT to diversify portfolios with real-world applications. - Discrepancies in DeFi