Ethereum News Update: Ethereum’s Unsteady Recovery: Weighing Optimism Against Ongoing Downward Pressures

- Ethereum rose 2.36% to $3,533 on Nov 13, 2025, with $37B trading volume, showing a rebound from $3,373 lows amid crypto market volatility. - Technical analysis warns of fragile recovery, with key support at $3,053 holding but bearish signals from MACD and a broken upward channel. - Broader crypto pressure persists as Bitcoin and Ethereum ETFs face outflows, while macroeconomic uncertainties like U.S. government shutdown risks dampen institutional participation. - Analysts advise caution below the 200-day

Ethereum market observers have spotted preliminary indications of a possible recovery, even as uncertainty persists regarding leadership within the wider cryptocurrency landscape. As of November 13, 2025, Ethereum was valued at $3,533, reflecting a 2.36% rise over the previous day and a 24-hour trading volume of $37 billion,

Still, technical experts warn that Ethereum’s upward move is on shaky ground.

Across the broader crypto sector, downward pressure persists, with both institutional and retail interest remaining muted.

Despite these challenges, some market watchers believe Ethereum’s price movement could present opportunities. The recent bounce from $3,373 hints at a potential double-bottom pattern, though a drop below $3,053 may lead to further declines toward $3,057

Ethereum’s technical picture is further muddled by mixed signals from major indicators. While the RSI has dropped to an oversold level of 33,

As the market navigates these uncertain conditions, the outlook will depend on greater macroeconomic clarity and renewed institutional engagement. “Crypto has made meaningful strides this year, but with prices still 32% below the August peak of $4,950, patience remains essential,” one analyst observed

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

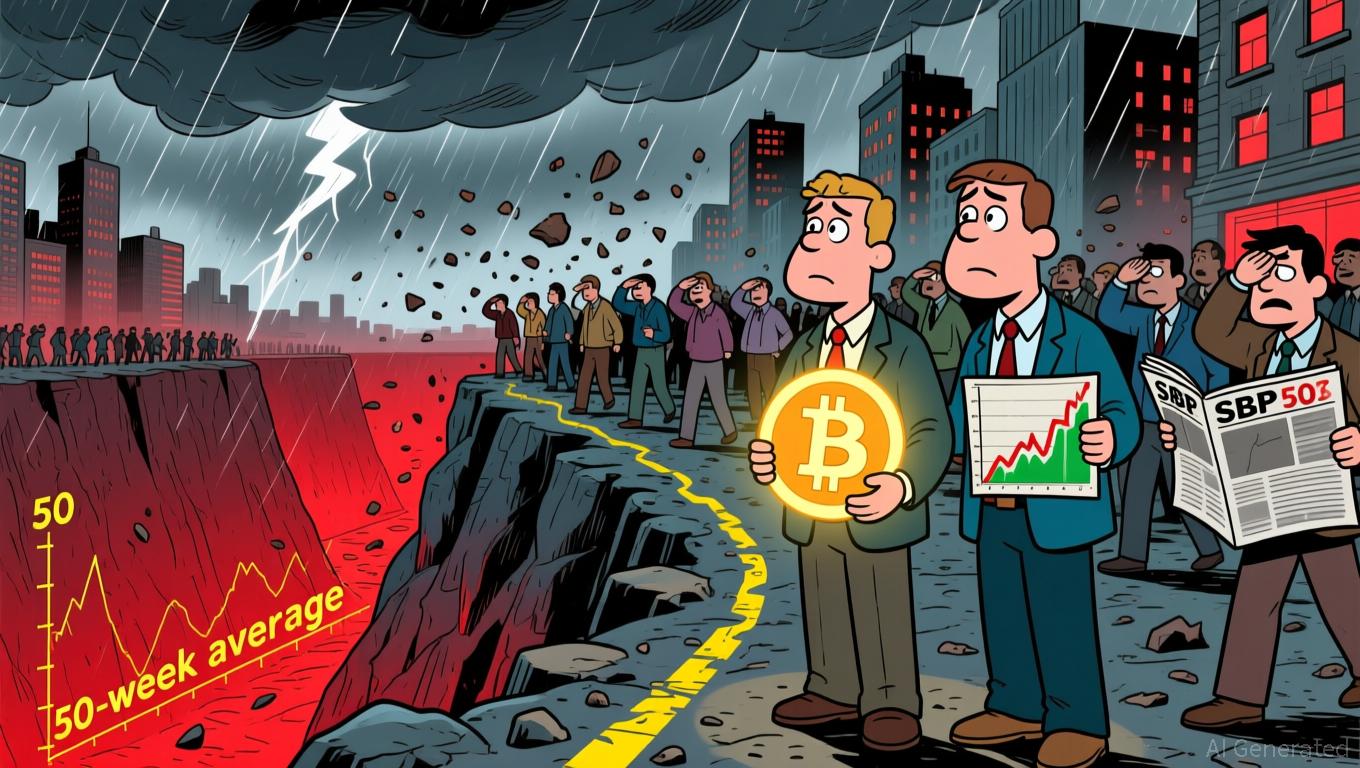

Bitcoin Updates Today: Is Bitcoin’s Drop Indicating a Bear Market or Revealing Foundational Strength?

- Bitcoin's drop below $95,000 triggered a 2.8% S&P 500 decline, raising fears of synchronized market downturns. - American Bitcoin (ABTC) reported $3.47M profit but shares fell 13% as BTC price erosion offset mining gains. - 43-day U.S. government shutdown created information vacuum, while $869M Bitcoin ETF outflows highlighted investor panic. - Fed rate cut odds dropped to 45% amid inflation concerns, with analysts warning of cascading price drops below $90,000. - Institutional ETF adoption and $835M Mic

Hyperliquid News Today: Goldman: AI's $19 Trillion Buzz Surpasses Actual Progress, Bubble Concerns Rise

- Goldman Sachs warns U.S. stock markets have overvalued AI's economic potential, pricing $19T gains ahead of actual productivity impacts. - The bank identifies "aggregation" and "extrapolation" fallacies as key risks, mirroring historical tech bubbles from 1920s/1990s over-optimism. - AI expansion extends beyond tech sectors, with blockchain compliance tools and energy management markets projected to grow via AI integration. - Regulatory challenges persist as DeFi collapses expose gaps in AI token definit

SGX Connects Conventional Finance and Digital Assets through Launch of Professional-Grade Futures

- SGX launches institutional-grade Bitcoin/Ethereum perpetual futures on Nov 24, 2025, benchmarked to CoinDesk indices. - Contracts offer no-expiry leveraged positions, targeting accredited/expert investors amid $187B+ global crypto derivatives volumes. - Aims to redirect Asian crypto flows to regulated on-exchange trading, aligning with Singapore's fintech innovation and investor protection balance. - SGX President Michael Syn emphasizes institutional adoption, restricting retail access to mitigate risks

XRP News Today: Federal Uncertainty and Worldwide Regulations Trigger $1 Trillion Crypto Market Crash

- Bitcoin fell below $92,000, erasing $1 trillion in crypto value as major altcoins faced double-digit weekly losses. - Fed rate cut uncertainty and Japan's regulatory scrutiny intensified selling, with analysts warning of further declines to $80,000–$86,000. - XRP's 14% drop and whale-driven selling pressured prices, though new ETFs sparked speculation about potential rebounds to $2.75.