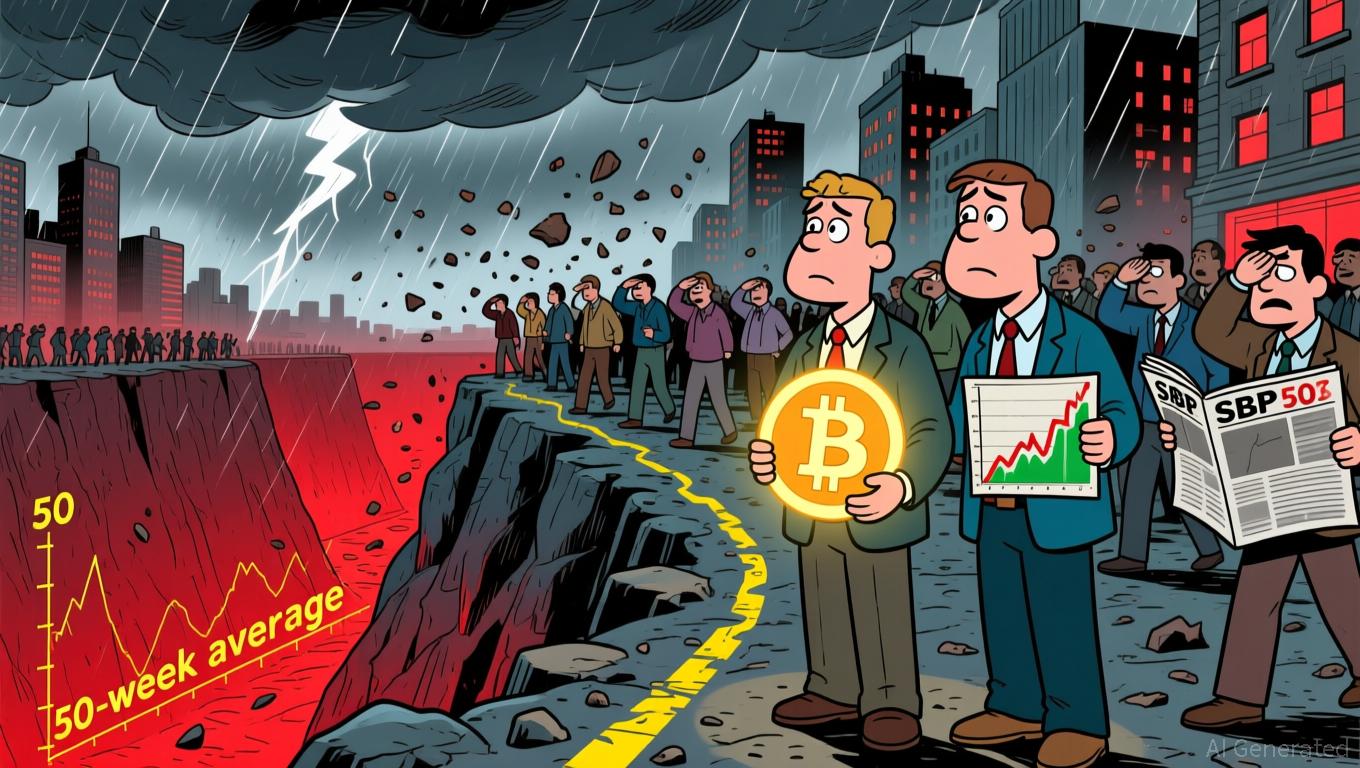

Bitcoin Updates Today: Is Bitcoin’s Drop Indicating a Bear Market or Revealing Foundational Strength?

- Bitcoin's drop below $95,000 triggered a 2.8% S&P 500 decline, raising fears of synchronized market downturns. - American Bitcoin (ABTC) reported $3.47M profit but shares fell 13% as BTC price erosion offset mining gains. - 43-day U.S. government shutdown created information vacuum, while $869M Bitcoin ETF outflows highlighted investor panic. - Fed rate cut odds dropped to 45% amid inflation concerns, with analysts warning of cascading price drops below $90,000. - Institutional ETF adoption and $835M Mic

The recent drop in Bitcoin’s value has heightened worries about its potential impact on U.S. stocks, as some experts caution that both markets could decline in tandem. Last week, the cryptocurrency slipped under $95,000—the lowest level since March—after a combination of fading optimism for Federal Reserve rate cuts, tightening liquidity, and profit-taking by long-term investors led to a steep selloff

This downturn has taken a toll on

Market confidence deteriorated further as the release of U.S. government data was halted during a 43-day shutdown,

Analysts attributed the crypto market’s slide to wider economic jitters.

Still, some analysts believe a bottom may be forming. Gautam Chhugani from Bernstein pointed out that institutional buying through ETFs and the pro-crypto stance of the Trump administration offer structural support.

Technical signals indicate a pivotal moment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

U.S. Job Market Slows Down Amid Rising Layoffs and Fed Considers Rate Reduction

- ADP data shows U.S. companies averaging 2,500 weekly layoffs in late October 2025, signaling a slowing labor market. - Major corporations like Amazon and Target announced large-scale layoffs, driven by shifting demand and cost-cutting pressures. - 55% of employed Americans fear job loss, while the Fed considers a December rate cut amid "near stall speed" labor conditions. - Global regulatory scrutiny of tech giants and AI-driven automation adds to concerns about employment impacts and economic stability.

Home Depot Faces Decline: Industry-Wide Slowdown or Company-Specific Challenge?

- Home Depot shares slumped 2–3% premarket after Q3 2025 earnings missed profit forecasts and slashed full-year guidance. - Weak comparable sales growth (0.2% vs 1.3% expected) and housing market pressures highlighted sector-wide challenges. - GMS acquisition added $900M revenue but couldn't offset 1.6% transaction volume decline and margin pressures. - Analysts revised 2025 EPS forecasts down 5% as Stifel downgraded HD to "Hold," reflecting cyclical uncertainty. - Mixed investor reactions persist, with in

Klarna Achieves Highest Revenue Yet, but Strategic Lending Leads to Losses

- Klarna reported $903M Q3 revenue (up 31.6%) but $95M net loss due to higher loan loss provisions as it expands "Fair Financing" loans. - Klarna Card drove 4M sign-ups (15% of October transactions) and 23% GMV growth to $32.7B, central to its AI-driven banking strategy. - Q4 revenue guidance of $1.065B-$1.08B reflects $37.5B-$38.5B GMV, supported by $1B facility to sell U.S. loan receivables. - CEO cites stable loan portfolio and AI-driven efficiency (40% workforce reduction) but warns of macro risks incl

PDD's Rising Profits Fail to Compensate for E-Commerce Expansion Challenges

- PDD Holdings reported mixed Q3 2025 results: $15.21B revenue missed forecasts by $90M despite $2.96 non-GAAP EPS beating estimates by $0.63. - E-commerce growth slowed amid intensified competition in China and U.S. regulatory shifts impacting Temu's operations. - Profitability showed resilience with 14% YoY net income growth to $4.41B, driven by cost discipline and 41% R&D spending increase. - $59.5B cash reserves highlight financial strength, but Q4 revenue projections face risks from pricing wars and g