Monero Surges 20% as Privacy Coin Rotation Intensifies

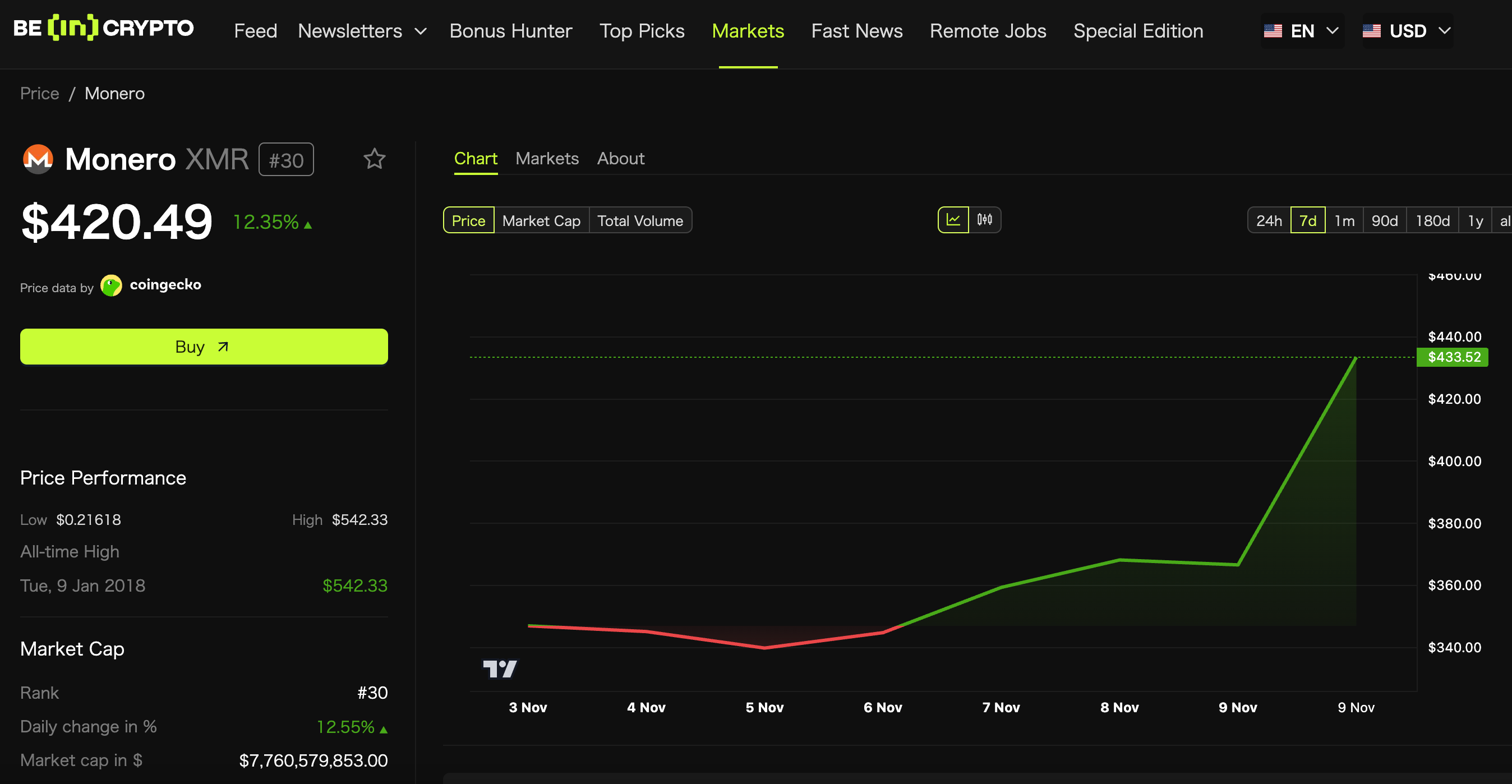

Privacy-focused cryptocurrency Monero (XMR) has surged approximately 20% over the past week, climbing from $352 on November 3 to a temporary high of $433.

The rally, which has sustained XMR above $420, follows Zcash’s explosive gains earlier this month and signals a potential shift in trader attention toward privacy-oriented digital assets. The move comes as technical breakouts align with network upgrades and renewed interest in censorship-resistant transactions.

Profit Rotation from Zcash Triggers Short Squeeze

Following Zcash’s 200% surge in early November, traders began rotating profits into other privacy coins, with Monero emerging as the primary beneficiary. Santiment data shows “privacy coins” became a trending social topic starting November 6, confirming increased trader interest in the sector.

Open interest in XMR futures on Bybit and Binance reached record levels, triggering a cascade of forced short liquidations. CoinGlass reports that approximately $12 million in short positions were liquidated over the seven days, accelerating the upward price momentum as bearish traders were squeezed out of their positions.

The capital rotation pattern reflects a broader trend in which investors seek the “next privacy coin” after securing gains from initial movers. This dynamic has historically characterized altcoin rallies, where momentum shifts sequentially across related assets within a sector.

Seven-Year Breakout Coincides with Network Upgrade

Chart analysis reveals XMR/USD has completed a massive “cup and handle” pattern dating back to 2018, breaking through the psychological $400 level.

“Monero targeting at least $1,000 based on this multi-year setup,” a popular analyst posted a technical outlook projecting a minimum target of $1,000.

$xmr feels like it’s been building a 7 year breakout set up

— mo (@mo_xbt) November 9, 2025

$1k pic.twitter.com/w1eAVLiek9

Beyond technical factors, Monero developers are preparing to implement Full-Chain Membership Proofs (FCMP++) in 2025, a protocol upgrade expected to enhance transaction speed and privacy significantly. The anticipated improvement has attracted long-term investors who are positioning ahead of implementation, adding fundamental support to the technical breakout.

Privacy Demand Re-Emerges Despite Regulatory Pressure

While numerous exchanges have delisted Monero under regulatory pressure, the coin’s uncompromising anonymity features are experiencing renewed appreciation. Crypto influencer described Monero as “the greatest cryptocurrency ever” and noted its undervaluation.

Monero is the best cryptocurrency of all time

— Crash (@CrashiusClay69) November 9, 2025

And when you’re truly the best, you will rise to the top with time even when you’re criminally underrated or less known by casuals for a little pic.twitter.com/uTs9sV5LS3

Another prominent trader, TheCryptoDog, highlighted that low liquidity amplifies price movements, explaining that modest buying pressure can generate substantial rallies. Decentralized exchange trading volume for XMR has increased markedly, suggesting organic demand independent of centralized platforms.

The past week’s rally appears driven by converging technical, fundamental, and sentiment factors rather than pure speculation. The next resistance zone sits between $500 and $520. A decisive break above this range would bring the 2021 all-time high of $517 within reach and potentially signal a broader revival for privacy-focused cryptocurrencies after years of regulatory challenges and exchange delistings.

The post Monero Surges 20% as Privacy Coin Rotation Intensifies appeared first on BeInCrypto.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hyperliquid News Today: The Crypto Craze Versus Real Progress—Meme Tokens Face Off Against Privacy-Focused Infrastructure

- Trump's $TRUMP meme coin raises $148M via exclusive dinner, sparking political backlash and regulatory scrutiny over elected officials' crypto profits. - Canary Funds files first MOG Coin ETF, mirroring Bitcoin/Ethereum models, signaling institutional interest in meme coins despite speculative risks. - ZKP's $100M healthcare/finance infrastructure project leverages privacy-focused AI and hardware, contrasting with short-term volatility of XRP/Hyperliquid. - Hyperliquid's $4.9M stress test loss and unprov

Japan’s FSA Tightens Security on Crypto by Requiring Custodians to Register

- Japan's FSA mandates crypto exchanges to use registered custodians post-2024 DMM Bitcoin hack, requiring third-party providers to pre-register with regulators. - The rule addresses regulatory gaps exposing cold wallet vulnerabilities, as Tokyo-based Ginco's breach revealed unregulated external firms handling critical operations. - Parallel initiatives include JPYC stablecoin approval and a 2025 bank-led stablecoin payment pilot under the FSA's Payment Innovation Project. - The FSA plans 2026 legal reform

User Empowerment Fuels Valdora’s $10M TVL Growth in DeFi

- Valdora Finance, a ZIGChain liquid staking protocol, reached $10M TVL days post-launch, now tracked by DefiLlama. - Its non-custodial model enables ZIG token staking with liquidity retention via stZIG derivatives, aligning with DeFi sovereignty trends. - ZIGChain's strategic partnership with Valdora highlights its cross-chain ambitions and growing institutional confidence in its infrastructure. - Despite regulatory risks, the protocol's composability and scalability position ZIGChain as a rising DeFi hub

XRP News Today: BIS Risk Weighting Limits XRP's Function in Bank Liquidity

- XRP's limited adoption by banks stems from BIS's 1250% risk weight on unbacked crypto, not technical flaws. - Ripple tests RLUSD stablecoin with Mastercard/WebBank to enable blockchain-based credit card settlements. - Policy shift in crypto risk weighting is critical for XRP to replace USD as cross-border liquidity bridge. - RLUSD's $1B+ circulation and BNY Mellon backing demonstrate regulated stablecoin viability in payments. - Regulatory barriers persist despite industry progress, keeping XRP confined