Pi Network’s approach to valuation, centered on productivity, poses a challenge to conventional cryptocurrency assessment methods.

- Pi Network's whale holdings near 375M tokens, signaling potential price surge amid technical upgrades and institutional interest. - Upcoming open mainnet launch and dApp growth validate network stability, supported by testnet success and productivity-driven valuation models. - Aggressive whale accumulation (1.23M tokens/day) and bullish chart patterns suggest a possible $0.50 rally, driven by AI-driven KYC and ISO certification efforts. - Expansion into decentralized AI training and a $100M investment in

Pi Network's token could be on the verge of a significant price jump, as large holders accumulate nearly 375 million tokens, supported by recent technical achievements and key network enhancements. The platform, which has achieved notable results on its testnet and seen a rise in decentralized app (dApp) development, is approaching the public launch of its mainnet. Analysts point to robust on-chain metrics and growing institutional attention as strong bullish indicators, according to

Testnet 1 demonstrated an almost flawless transaction success rate, which

The upcoming Pi DEX (Decentralized Exchange) mainnet aims to prevent price manipulation by linking Pi's value to actual productivity indicators. This DEX will utilize smart contracts to facilitate open, peer-to-peer trades, with Pi's price reflecting the activity of over 350,000 nodes, more than 20,000 dApps, and user engagement, as

A prominent whale has resumed heavy accumulation, acquiring over 1.23 million tokens in a single day and raising total holdings to 374.5 million, as

Pi Network is broadening its scope beyond just financial transactions. Through the OpenMind project, node operators are now able to provide computing power for distributed AI training, as

Industry watchers note that Pi's ecosystem, with 433 million users and 423 million tokens in circulation, is well-positioned for wider adoption, as

Despite ongoing price swings, the combination of whale accumulation, technical progress, and a productivity-based valuation model has led to comparisons with Ethereum's recent recovery driven by large holders, as

As Pi Network moves closer to launching its open mainnet, the interaction between whale activity, technical advancements, and decentralized functionality could reshape its market outlook. With 50 million Pioneers ready for the next stage, the network's future may depend on its ability to remain stable and deliver meaningful real-world solutions, as

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Clearer Regulations and Growing Institutional Interest Propel Crypto Market to $2.4 Trillion as Industry Evolves

- U.S. crypto market surges to $2.4T as institutional adoption, regulatory clarity, and macro optimism drive gains. - Bitcoin and Ethereum rebound post-government shutdown, with crypto-linked stocks like SBET and GLXY rising 3-5% pre-market. - Regulatory frameworks like CLARITY Act and Project Crypto aim to resolve ambiguity, boosting institutional confidence. - Analysts caution volatility risks despite ETF inflows and blockchain adoption milestones, urging diversified long-term strategies.

XRP News Today: SEC's 20-day review period begins, launching the XRP ETF competition toward mainstream adoption

- SEC's 20-day automatic review period for 21Shares' XRP ETF filing signals potential fast-tracked approval, mirroring Bitcoin/Ethereum precedents. - XRP's institutional adoption gains momentum with custodian partnerships and index-linked pricing, driving 6% price surge to $2.32. - Ripple's ecosystem growth (100M+ ledgers, Mastercard/WebBank deals) strengthens XRP's cross-border payment advantages over Ethereum's scalability challenges. - International XRP ETFs ($114.6M AUM) and institutional interest in p

Bitcoin Updates: Lawmakers Seek Solution to Ongoing SEC and CFTC Dispute Over Crypto Oversight

- U.S. Congress proposes two crypto regulatory frameworks: CFTC-led commodity model vs. SEC's "ancillary asset" approach, creating dual oversight challenges for exchanges. - Emerging projects like BlockDAG ($435M presale) and privacy coins gain traction amid market rebound, emphasizing utility over speculation post-government shutdown. - Bitcoin exceeds $102,000 with ETF inflows and Ethereum sees whale accumulation, though profit-taking risks and regulatory delays remain key headwinds. - Senate drafts and

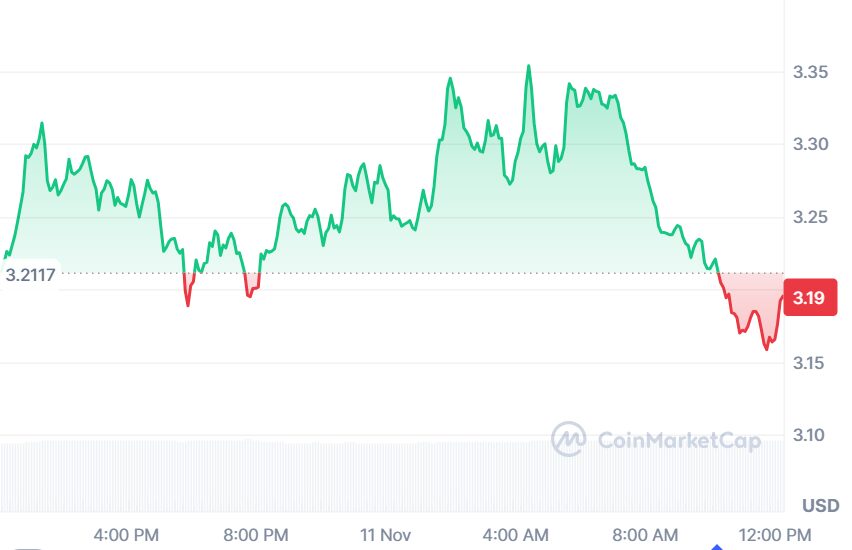

APT Price Update: Aptos Shows Early Recovery Signs to $3.50 as EV2 Presale Draws Web3 Gaming Interest