IREN's $9.7B Artificial Intelligence Agreement and Profit Jump Fail to Prevent 12% Share Decline

- IREN shares fell 12.37% despite $9.7B Microsoft AI cloud contract and record $240. 3M Q1 revenue, driven by Bitcoin-to-AI pivot. - $384.6M net income turnaround and $662.7M EBITDA highlight transition to vertically integrated AI infrastructure with 3GW renewable-powered data centers. - 140,000 GPU deployment and $1.8B cash reserves contrast with investor concerns over $1B convertible notes, execution risks, and contract dependency. - Microsoft's 10% capacity access with 20% prepayment ($1.9B annualized)

Shares of IREN Limited (IREN) dropped 12.37% after the company released its Q1 FY26 financial results, even though it landed a significant $9.7 billion AI cloud agreement with

IREN’s first-quarter revenue soared 355% from the previous year to $240.3 million, fueled by its shift away from

The expansion strategy features liquid-cooled data centers at its 750MW Childress, Texas campus, with phased rollouts planned through 2026. In British Columbia, 160MW of capacity is being shifted from Bitcoin mining to GPUs by year-end, while the 2GW Sweetwater Hub is set to power up two substations between 2026 and 2027, as noted by Parameter. IREN’s financial position remains strong, with $1.8 billion in cash and equivalents, and $1.0 billion in zero-coupon convertible notes issued in October 2025 to support its growth, Parameter also reported.

Despite these strengths, investors are cautious about increasing operating costs, the risks associated with executing large-scale projects, and the company’s reliance on major contracts like the Microsoft deal, according to an

The recent drop in share price reflects broader market doubts about whether IREN’s rapid expansion can be sustained. While the Microsoft deal affirms its AI infrastructure approach, the company’s ability to stay profitable amid heavy capital spending remains a key concern, as highlighted in a

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Update: Short-Term Holders Increase Holdings While Long-Term Holders Realize Gains—$100K Becomes Key Level

- Bitcoin fell below $100,000 as Coinbase premium hit a seven-month low, reflecting weak U.S. demand and ETF outflows. - On-chain data shows short-term holders (STHs) accumulating Bitcoin while long-term holders (LTHs) moved 363,000 BTC to STHs, signaling mixed market dynamics. - Analysts highlight a "mid-bull phase" with STHs absorbing selling pressure, and a $113,000 support level critical for potential rallies to $160,000–$200,000 by late 2025. - The Fear and Greed Index entered "Extreme Fear," and exch

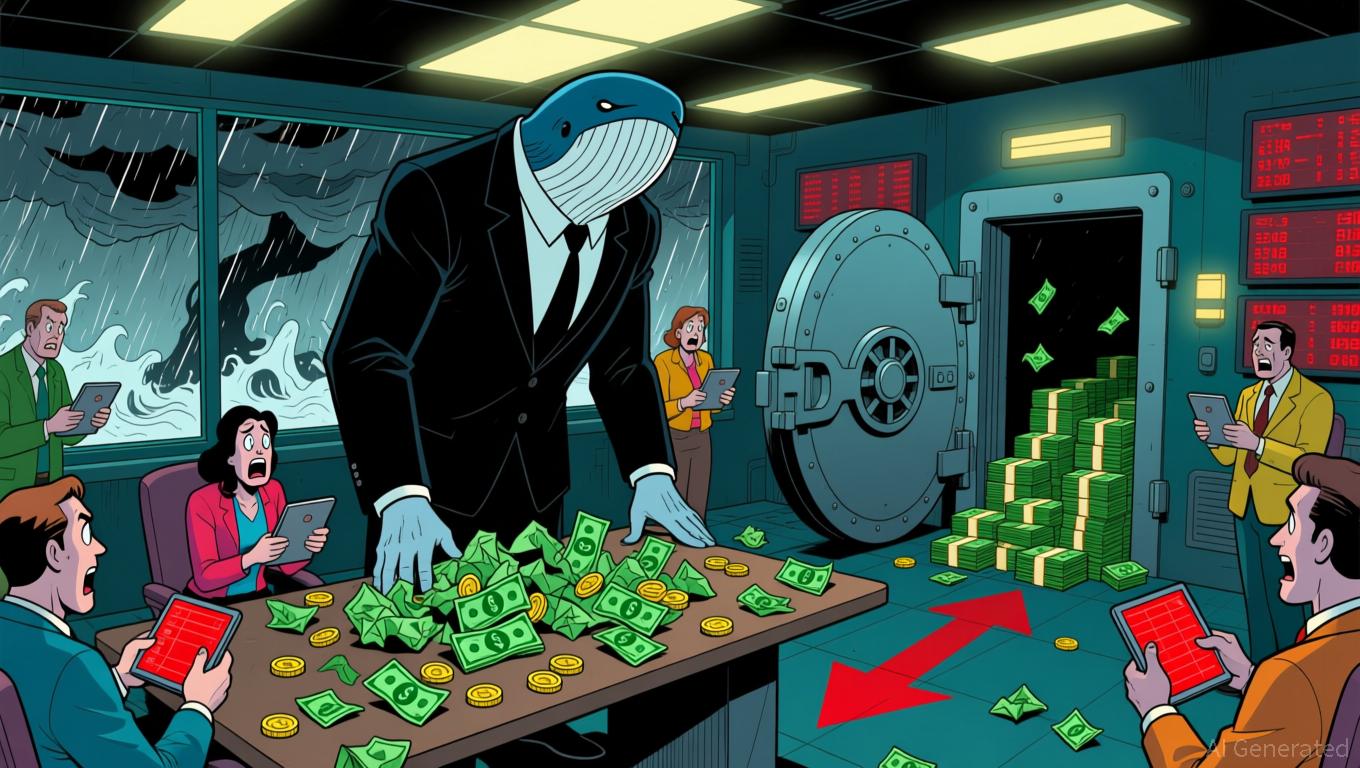

Bitcoin Update: Large Holders Depart and Economic Instability Push Bitcoin Under $100K

- Bitcoin fell below $100,000 as OG whales BitcoinOG and Owen Gunden moved $1.8B BTC to exchanges, signaling bearish bets. - $260M in long positions liquidated amid SOPR spikes, while Trump's crypto policies and China's $20.7B BTC holdings added macro risks. - Bit Digital staked 86% of ETH holdings for 2.93% yield, while Coinbase's negative premium highlighted waning U.S. buyer demand. - Analysts warn consolidation phases often follow whale profit-taking, with geopolitical tensions and derivatives volatili

Aster DEX's Latest Protocol Enhancement and What It Means for DeFi Liquidity Providers

- Aster DEX upgraded its protocol on Nov 5, 2025, enabling ASTER token holders to use their assets as 80% margin collateral for leveraged trading and receive 5% fee discounts. - Binance's CZ triggered a 30% ASTER price surge and $2B trading volume spike via a $2M token purchase three days prior, highlighting market speculation and utility convergence. - The platform introduced a "Trade & Earn" model allowing yield-generating assets like asBNB and USDF to be used as trading margin, enhancing capital efficie

XRP Update: Digitap's Practical Applications Put XRP's Delayed Ambitions to the Test

- Digitap ($TAP) raised $1.4M in November 2025, outpacing rivals like Bitcoin Hyper and Pepenode with an 80% early investor discount. - The project combines crypto and fiat banking via a live app, Visa cards, and deflationary tokenomics, positioning it as XRP's real-world competitor. - $TAP's fixed 2B token supply and transaction-burning model create scarcity, with analysts projecting 50x-70x price growth by late 2026. - Digitap's 124% APR staking rewards and privacy-focused features like offshore-shielded