Aster DEX's Latest Protocol Enhancement and What It Means for DeFi Liquidity Providers

- Aster DEX upgraded its protocol on Nov 5, 2025, enabling ASTER token holders to use their assets as 80% margin collateral for leveraged trading and receive 5% fee discounts. - Binance's CZ triggered a 30% ASTER price surge and $2B trading volume spike via a $2M token purchase three days prior, highlighting market speculation and utility convergence. - The platform introduced a "Trade & Earn" model allowing yield-generating assets like asBNB and USDF to be used as trading margin, enhancing capital efficie

As decentralized finance (DeFi) continues to evolve, progress is often driven by the fusion of speculative interest and practical application.

ASTER’s Expanded Role: Collateralization and Fee Incentives

Coinotag reports that Aster DEX’s protocol enhancement now lets ASTER holders use their tokens as collateral for perpetual trades, with an 80% margin ratio,

Moreover, ASTER holders now benefit from a 5% reduction in trading fees, directly encouraging longer-term holding,

On-Chain Advances: Privacy and Scalability

Aster DEX’s vision goes beyond token utility. The platform is building Aster Chain, a Layer-1 blockchain expected in Q1 2026, which will utilize zero-knowledge proofs to improve privacy and block front-running,

The timing of these changes is notable. CZ’s public purchase of ASTER on November 2, 2025, led to a 30% price jump and an 800% increase in daily trading volume, reaching $2 billion,

Maximizing Returns: The "Trade & Earn" Approach

The update also brings a "Trade & Earn" feature, letting users use yield-generating assets such as asBNB (a liquid staking token) and USDF (a yield-bearing stablecoin) as margin for trading,

This approach reflects a broader DeFi trend toward assets with multiple uses. By enabling cross-chain trading on

What This Means for DeFi Liquidity Providers

The impact of Aster DEX’s protocol changes is complex. First, using ASTER as collateral reduces the circulating supply during periods of high trading, which may help stabilize its price and lessen volatility—a positive for liquidity providers who are often exposed to price fluctuations. Second, allowing yield-bearing assets as margin introduces a new layer to liquidity provision, enabling providers to boost returns without giving up market exposure.

Still, there are hurdles. Leveraged trading naturally brings higher risk, especially in unstable markets. The effectiveness of Aster Chain’s zero-knowledge proofs will also depend on how well they are implemented and adopted. For liquidity providers, the challenge will be to take advantage of these innovations while managing risks specific to the platform’s new features.

Conclusion

Aster DEX’s protocol update represents a significant milestone in DeFi liquidity evolution. By making ASTER a practical asset and introducing new yield-enhancing tools, the platform addresses major industry challenges and aligns with current trends. For liquidity providers, the opportunity lies in leveraging these advancements for greater returns, while carefully navigating the risks of leveraged trading. As Aster DEX prepares for the Q1 2026 launch of Aster Chain, the industry will be watching to see if this ambitious plan fulfills its potential.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Updates Today: Regulatory Changes and Unprecedented Staking Returns Drive Institutional Growth for Ethereum

- Ethereum's institutional adoption accelerates due to SEC's in-kind ETF approval, boosting market efficiency and participation. - SharpLink and Bit Digital report record staking yields (up to 2.93%), highlighting Ethereum's "productive" treasury asset advantage over Bitcoin . - Justin Sun's $154M ETH staking via Lido signals growing confidence in Ethereum's infrastructure despite liquid staking centralization concerns. - Regulatory tailwinds and $12.5M ETH ETF inflows counterbalance price declines, with t

Vitalik Buterin Introduces New ZK Technology: What It Means for Ethereum's Development

- Vitalik Buterin leads Ethereum’s shift to ZK proofs, targeting modexp removal and GKR protocol integration to boost scalability and privacy. - Modexp precompile’s 50x computational burden on ZK-EVM proofs will be replaced by standard EVM code, prioritizing long-term efficiency over short-term gas costs. - GKR protocol enables 2M Poseidon2 hashes/sec on consumer hardware, accelerating verification and enhancing quantum resistance for Ethereum’s "Lean Ethereum" vision. - ZKsync’s 150% token surge and Citib

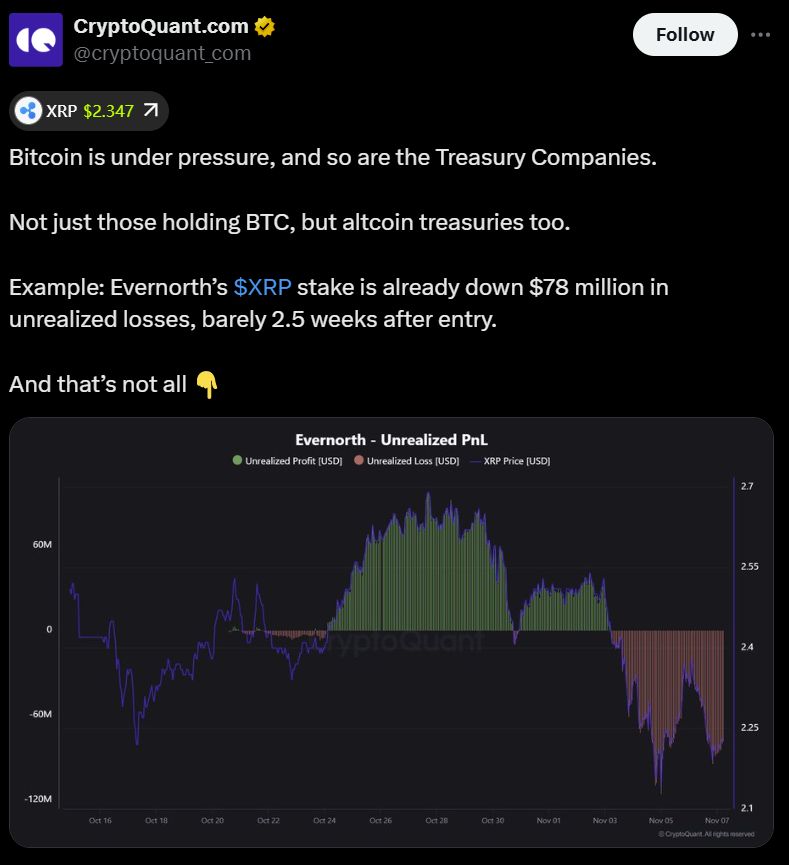

Evernorth’s unrealized XRP losses expose mounting pressure on DATs: CryptoQuant

Marina Protocol and Audiera Ally to Bring AI-Powered Music and Dance to Web3