Canton: The Web3 financial infrastructure truly used by Wall Street

Is the institutional narrative behind Canton becoming impossible to hide?

$6 trillion in on-chain assets, $280 billion daily in US Treasury repo—Is Canton’s institutional narrative impossible to hide?

Written by: KarenZ, Foresight News

When blockchain technology meets Wall Street, the core challenge is not the technology itself, but how to balance the three seemingly contradictory demands of privacy protection, system interoperability, and regulatory compliance.

Canton Network was born to address this. It is neither a typical public chain nor a traditional private chain, but rather an AllFi blockchain that truly enables the synergy between traditional finance and DeFi.

Developer Digital Asset: Endorsed by Heavyweights

Earlier in July, I detailed the development history, team background, and financing of Canton’s developer Digital Asset in the article "The Invisible Hand Behind the $4 Trillion RWA Empire: Digital Asset and Canton’s Ambition for Financial Infrastructure."

Source: Digital Asset Official Website

Whether in terms of financing, team background, or early pilots, Digital Asset has close ties with trading giant DRW.

On the financing side, Digital Asset completed a $135 million strategic round in June, led by DRW’s investment arm DRW Venture Capital and Tradeweb Markets, with participation from BNP Paribas, Circle Ventures, Citadel Securities, Depository Trust & Clearing Corporation (DTCC), Virtu Financial, Paxos, and others.

For the team, co-founder and CEO Yuval Rooz managed the electronic algorithmic trading division at DRW before founding Digital Asset, later joining DRW Investment Group, and was also a trader and developer at Citadel. Co-founder Don Wilson founded the diversified trading firm DRW in 1992 and led its growth. Another co-founder and Head of Network Strategy, Eric Saraniecki, built a trading platform focused on illiquid commodity markets at DRW Trading before joining Digital Asset and co-founded Cumberland Mining.

In early pilots, DRW, along with Goldman Sachs, HSBC, and several asset management companies, banks, custodians, exchanges, and financial market infrastructures, participated.

Notably, the establishment of Canton Coin Treasury Company earlier this month further enhanced the institutional utility and capital market potential of the Canton token. On November 3, Tharimmune announced the completion of a private placement financing of about $540 million, led by DRW and Liberty City Ventures, to establish the Canton Coin Treasury strategy. Other participants included ARK Invest (founded by Cathie Wood), Bitwave, Broadridge, Clear Street, Copper, Digital Asset, and more.

Tharimmune also plans to operate as a super validator node and run other validator nodes on the Canton network, while investing in the development of applications on Canton.

It is worth emphasizing that after completing a $135 million Series E round in June, Digital Asset received investment from YZi Labs in July. Furthermore, in October, YZi Labs extended its reach into the Canton ecosystem by investing in Temple Digital Group, the developer of the native trading platform on Canton Network.

Canton: Wall Street’s Real Choice

The Canton ecosystem has already proven its value. In 2025, Canton’s adoption volume surged, and Canton currently has 31 super validators and 595 active validators. According to data disclosed by Canton at the end of October, there are over 15 million transactions per month using Canton Coin. Applications on Canton have processed over $6 trillion in on-chain assets, with daily US Treasury repo transactions exceeding $280 billion.

These numbers are not proof-of-concept—they represent real financial activity. Canton has become the place for real transactions on Wall Street. From bonds, repo agreements, money market funds, loan commitments, insurance, mortgages, to private equity and other real-world financial assets, companies like BNP Paribas, Deutsche Börse Group, EquiLend, and Goldman Sachs are adopting Canton.

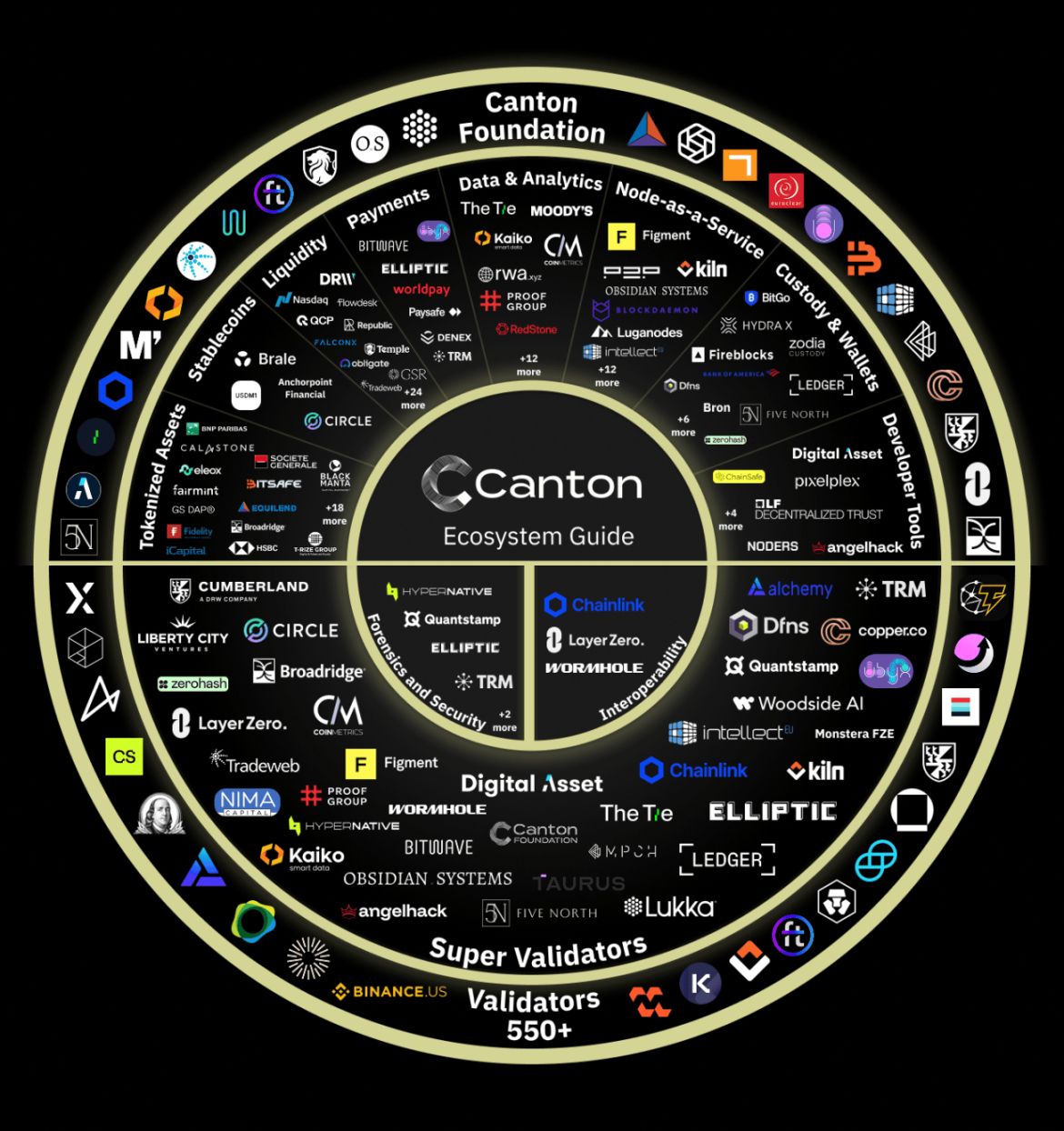

The Canton Network ecosystem has also formed a relatively complete financial infrastructure system. The official ecosystem page lists 185 partners, covering the full stack of finance and Web3.

- Tokenized Assets: From bonds, repo agreements, money market funds, loan commitments, insurance, mortgages, and private equity to wrapped crypto assets for institutional use (such as CBTC), Canton has already custodied trillions of dollars in tokenized real-world assets (RWA). Goldman Sachs’ digital asset platform (GS DAP), HSBC’s Orion platform, and Hong Kong Stock Exchange’s (HKEX) DLT settlement acceleration platform Synapse all run on Canton.

- Stablecoins: Providers such as Circle’s USYC (acquired via Hashnote), USDC, and stablecoin projects Brale and M1 are preparing or have already issued stablecoins on Canton.

- Payments: Some payment projects or applications in the Canton Network ecosystem include Circle, B2B cross-border payment network Bitwave, payment platform Paysafe, and payment technology provider Worldpay.

- Liquidity and Trading: Market makers such as QCP, DRW, GSR, and FalconX are already active on Canton, providing deep liquidity for tokenized assets.

- Interoperability: Currently, the Canton ecosystem is introducing cross-chain interoperability services from solutions such as Chainlink, LayerZero, and Wormhole.

- Custody and Wallets: From institutional custodians like Copper and Zodia to Five North’s Loop wallet, and the upcoming support for Canton by Ledger hardware wallets, Canton is ready to cover all user types in asset storage and custody, from high-net-worth individuals and large enterprises to retail users.

- Compliance: The Canton ecosystem has integrated Elliptic to provide on-chain anti-money laundering monitoring solutions trusted by regulators, and integrated TRM Labs for detecting and investigating crypto-related fraud and financial crime.

- Data and Analytics: Data providers such as The Tie, Coin Metrics, Kaiko, and RWA.xyz will or already do provide insights into Canton network activity.

Four Driving Forces Behind Institutional Adoption

Balancing Privacy, Interoperability, and Compliance

Privacy Protection—Institutional-Grade Data Safeguarding

For financial institutions, privacy is not optional—it is a necessity. Canton Network achieves an elegant balance through selective disclosure: transactions can be private, and different participants can only view the parts of the transaction relevant to them, while the integrity of the network remains publicly verifiable.

This means banks can conduct large transactions on Canton without broadcasting sensitive financial information to the entire network. This is crucial for OTC trading, derivatives trading, and corporate financing.

Interoperability—Connecting Fragmented Finance

The global financial system has long been fragmented. Canton, through the Global Synchronizer (enabling atomic transactions across sovereign blockchains) and the CIP-56 standardized token protocol (described below), builds bridges connecting different clearing systems, custodians, and trading platforms, enabling cross-system confirmation and execution of direct asset ownership.

Canton also supports the creation of custom subnets, allowing developers to launch applications on private subnets while still using Canton’s public decentralized infrastructure for cross-chain transactions.

Regulatory Compliance—Turning Compliance into Code

Canton was designed from the start for the regulated world, supporting data storage and pruning to comply with regulations such as the EU’s General Data Protection Regulation (GDPR), while using cryptographic commitments to ensure the immutability of historical data and preserve key audit proofs.

Additionally, the Canton ecosystem includes top compliance and forensic providers such as Elliptic and TRM Labs. They are directly integrated into the network and can provide on-chain AML monitoring and transaction surveillance.

CIP-56: Unified Asset Management Standard

As the Canton Network token interface standard, it covers most of the functions of the ERC-20 standard, such as querying balances, transferring tokens, and querying transaction history, but has been upgraded for the needs of regulated institutions and assets:

- Enhanced privacy protection—asset holding and transfer information is only shared when necessary.

- Token administrators can control transfer recipients, and token recipients have the right to control from whom they receive assets.

- Native support for atomic delivery-versus-payment (DvP) settlement.

Burn-Mint Economic Model

A long-standing issue with traditional public chain tokenomics is that economic rewards are mainly concentrated among infrastructure operators and early investors, while developers and users who truly drive network utility receive little meaningful token allocation.

Canton aims to rewrite this script. The token launch is fair, with no pre-mining and no VC allocation. Every Canton Coin is earned through actual contribution, not pre-distribution. Tokens are continuously allocated based on each participant’s real contribution to network utility: 35% to infrastructure providers (super validators), 50% to application developers, and 15% to users (validators) who transact and interact with applications.

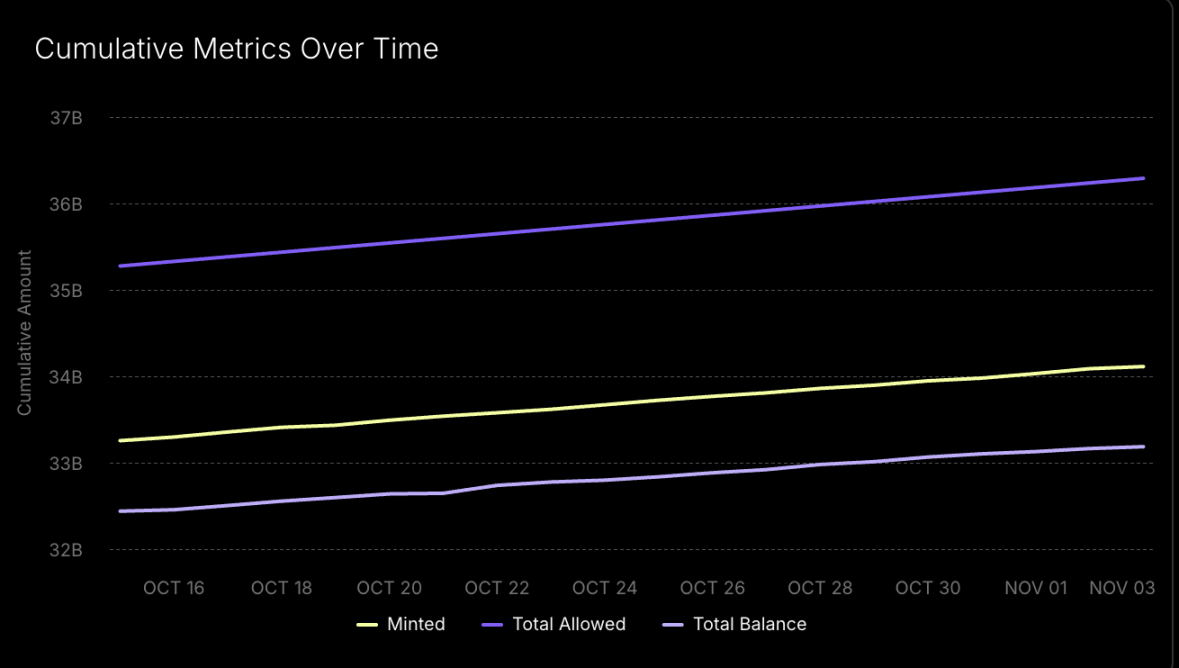

In terms of token mechanism, Canton adopts a “burn-mint equilibrium” mechanism, aiming to dynamically adjust token supply to align with network activity, participation, and long-term value creation.

- Burn mechanism: When users use Canton network applications or infrastructure, they pay fees denominated in USD and paid in Canton Coin. These fees are not paid directly to service providers but are burned, removing tokens from circulation and reducing supply.

- Mint mechanism: After service providers operate applications and infrastructure, they can mint new Canton Coins as rewards, achieving indirect payment from users to providers.

- Equilibrium operation: The entire mechanism is a closed loop. Fee burning reduces supply, increased participation triggers minting to replenish supply. This design allows token supply to respond to demand changes, supporting sustainable network growth.

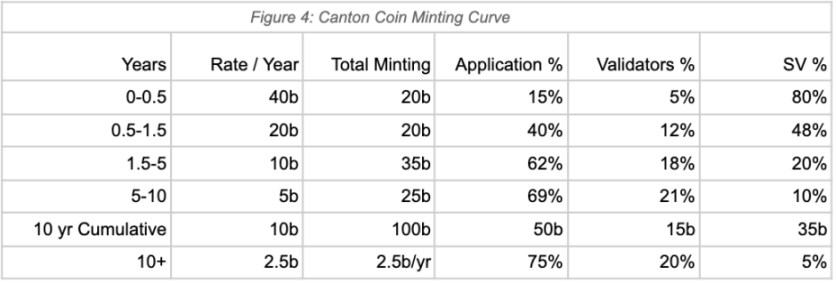

Regarding token supply and release, Canton states in its whitepaper that before the Global Synchronizer operates for 10 years, the total minted Canton Coin will be 100 billion. After ten years, annual minting will drop to 2.5 billion per year.

At the same time, Canton also states that its token’s FDV should be regarded as equivalent to its current market cap, since future supply depends on the dynamic balance between burning and minting, not a fixed cap. Additionally, starting January 1, 2026, block rewards will be reduced by 50%, and the super validator share will drop from 48% to 20%, further reducing inflation.

Based on the current supply of 33.06 billion and a pre-market price of 0.137 USDT, Canton token’s current market cap is about $4.5 billion. Of course, this cannot be viewed in isolation—the core still depends on the actual operational efficiency of its “burn-mint equilibrium” model.

Summary

Canton Network has dispelled institutional concerns about public chains regarding privacy, compliance, and interoperability, proving that all three can be achieved simultaneously. With its privacy-friendly L1 architecture, CIP-56 asset standard, and utility-driven economic model, it has become the core platform for institutional-grade RWA and crypto liquidity integration. As cross-chain capabilities upgrade and high-value assets continue to be brought on-chain, whether Canton can become a key hub in the global capital market’s digitalization process remains to be seen—we will continue to monitor its progress.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CZ Discusses the Memecoin Craze, Hyperliquid, and Offers Advice to Entrepreneurs

CZ's life after stepping down, reflections, and deep insights into the future of crypto.

Privacy coins surge against the trend—is this a fleeting moment or the dawn of a new era?

The whale myth has collapsed! No one can beat the market forever!

Still dare to play with DeFi? This feeling is all too familiar...