The cryptocurrency market is experiencing massive waves, and once legendary trading experts are now facing their darkest moments. On November 5, the cryptocurrency market was hit by a storm, with two highly watched whale investors suffering what could be the most devastating losses of their careers. This plunge, which began during the Asian trading session, plunged the entire market into panic and uncertainty.

I. Whale P&L Overview Today: A Brutal Battle Worth Tens of Millions of Dollars

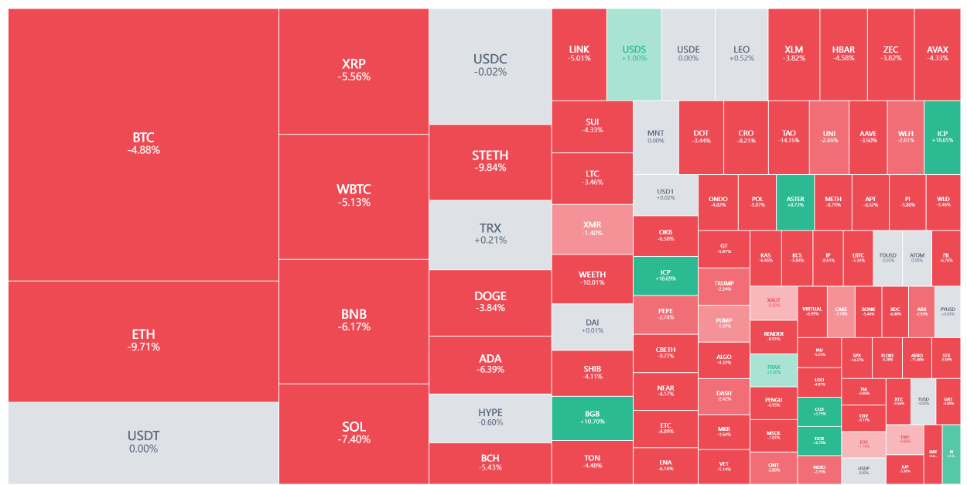

The Harsh Reality of Market Data

● BTC briefly fell below the key psychological threshold of $100,000 on the morning of November 5, hitting a low of $98,500, marking a near three-month low.

● Meanwhile, ETH plunged to an intraday low of $3,057, with a single-day drop of over 15%. This sudden crash became the last straw for many long position holders, including the two once-glorious whales in the spotlight.

The Complete Collapse of the Former [100% Win Rate] Whale

● This trader, who once achieved an impressive 14 wins out of 18 trades and was revered by the community as the "100% win rate insider whale," suffered a devastating blow during the market crash on November 5. According to on-chain analyst Ai Yi (@ai_9684xtpa), this whale's positions quickly hit the liquidation line during the morning's sharp drop, ultimately forcing the liquidation of all remaining long positions.

● "This is one of the largest single-investor losses we've witnessed this year," Ai Yi wrote in the report. "The whale closed all positions within 10 minutes, with a single loss amounting to a staggering $39.37 million."

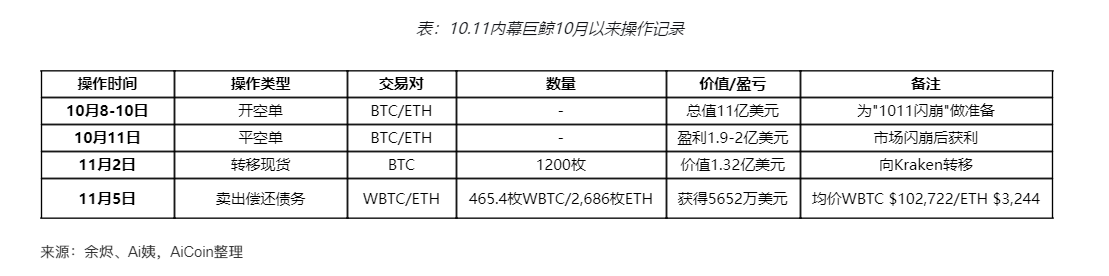

The Difficult Self-Rescue of the 10.11 Insider Whale

● Another market focus—the "10.11 insider whale"—was also unable to escape misfortune. This whale's leveraged loan positions neared liquidation due to the market downturn, forcing the sale of 465.4 WBTC and 2,686 ETH in exchange for $56.52 million to repay debt.

● "This is a typical self-rescue move by a leveraged trader facing liquidation risk," analysts at blockchain data platform Arkham noted in their report. "Although selling assets temporarily eased liquidation pressure, this means the whale has effectively admitted defeat in this round of long strategy."

As shown in the table, the once-glorious "100% win rate whale" has fallen from grace, while the "10.11 insider whale" is struggling to avoid liquidation. These two whales, who once dominated the market, now face an unprecedented survival crisis.

II. Market Background and Chain Reactions: A Storm Sweeping the Entire Crypto World

The market crash on November 5 was not an isolated event, but the result of multiple factors working together. Understanding this background helps us better grasp the deeper reasons behind the whales' massive losses.

Deterioration of the Global Macroeconomic Environment

● This round of cryptocurrency crash is closely related to changes in the global macroeconomic environment. The Federal Reserve's hawkish stance at its October meeting dashed hopes for a rate cut in the short term. "The current market environment is extremely unfavorable for risk assets," said veteran Wall Street analyst Mark Douglas. "The continued strengthening of the US Dollar Index is causing capital to flow out of high-risk assets like cryptocurrencies."

● At the same time, rising global geopolitical risks have increased market uncertainty. Tensions in the Middle East, the ongoing Russia-Ukraine conflict, and the reshaping of global trade patterns have all led investors to prefer holding more cash assets. "In such an environment, highly volatile assets like cryptocurrencies naturally become the first to be sold off," Douglas added.

Compounding Effects of Internal Crypto Factors

● In addition to external factors, structural issues within the crypto market cannot be ignored. The DeFi protocol Balancer suffered a hacker attack, with security incidents causing losses of over $100 million, further shaking investor confidence.

The Scale and Impact of the Liquidation Wave

● This crash triggered large-scale liquidation of long positions. In the past 24 hours, nearly 470,000 people worldwide were liquidated, with total liquidation amount reaching $2.055 billion, over 80% of which were long positions.

III. The 10.11 Insider Whale's Trading Trajectory: From the Altar to the Mundane

The "10.11 insider whale" got its name from its precise operations before the market flash crash on October 11. At a time when the market was still booming, this whale keenly sensed the risks and took a series of astonishing actions.

Brilliant Shorting Performance

● Between October 8 and 10, while most investors were still dreaming of further market gains, this whale had already begun to build large-scale short positions. According to Hyperliquid platform data, the whale opened BTC and ETH shorts worth a total of $1.1 billion at the time, attracting widespread market attention.

● On October 11, the market indeed experienced a flash crash, with bitcoin dropping more than 20% in a single day and ethereum falling even further. Analysts estimate that the whale made a single-day profit of $190 million to $200 million during this process, setting a personal trading record.

Strategy Shift and Dilemma

However, after the successful short, the whale gradually shifted to a long strategy. On November 2, he transferred 1,200 BTC (worth about $132 million) to the Kraken exchange, which the market interpreted as a signal to take profits. But subsequent developments exceeded everyone's expectations.

● The market crash on November 5 put the whale's leveraged loan positions at risk of liquidation. According to Arkham Intelligence, the whale was forced to sell 465.4 WBTC at $102,722 and 2,686 ETH at $3,244, raising a total of $56.52 million to repay debt.

● "It was a painful but necessary decision," noted an analyst at blockchain venture capital firm Pantera Capital. "When facing liquidation risk, proactively reducing positions is much wiser than being passively liquidated. Although this means admitting a mistake, at least most of the position was preserved."

IV. The Rise and Fall of the 100% Win Rate Whale: The Shattering of a Myth and Its Lessons

The experience of another whale in the spotlight—the "100% win rate whale"—is even more dramatic. This whale once achieved 14 consecutive wins and a profit of $15.83 million, earning the community's reverence as the "100% win rate insider whale." However, from the end of October, his fate took a stunning turn.

The Art of Trading During the Glory Days

● For most of October, this whale demonstrated amazing trading skills. On October 23, he closed all BTC short positions, earning $835,000 and maintaining his perfect record. At this point, his win rate was still 100%, and total account profits continued to hit new highs.

● At the end of October, as the market showed signs of stabilizing, the whale switched to going long. Initially, this strategy once again proved his "magic"—within three days of establishing long positions, unrealized profits exceeded $10 million. On October 27, his unrealized profit peaked at over $20 million, the high point of this round of long trades.

The Key Turning Point from Prosperity to Decline

However, market reversals are always unexpected. Starting October 28, as the market re-entered a downward channel, the whale's positions began to incur losses.

● On October 30, the whale reopened BTC and ETH long positions, but this time the market gave him no chance. That day, futures positions showed an unrealized loss of $3.33 million. On October 31, as the market fell further, his unrealized loss expanded to over $16 million.

● "This was a major turning point in his trading career," analyzed Li Wei, chief analyst at crypto hedge fund Arcane Research. "From this point on, he had actually fallen into the classic 'averaging down on losses' trap."

● On November 2, the whale continued to add to his SOL long positions, spending about $4.39 million in an attempt to average down and reverse the situation. This move briefly narrowed his unrealized loss to $6.3 million, but it was only a short calm before the storm.

● On November 5, the market crash shattered all his hopes. After prices quickly broke through key support levels, his positions rapidly hit the liquidation line, ultimately forcing him to close all longs at a loss of $39.37 million.

"This is a classic case of failure due to overconfidence," Li Wei pointed out. "When previous trades are always successful, it's easy to develop an illusion of invincibility, which leads to neglecting the importance of risk management."

V. Lessons for Ordinary Investors from the Whales' Collapse

Risk Management Always Comes First

● Whether it's the total liquidation of the "100% win rate whale" or the forced reduction of the "10.11 insider whale," both reveal a common issue: lack of risk management awareness.

● "In these cases, we see the dangers of excessive leverage," noted Professor Wang Xiaomei, an expert in financial risk management. "When investors use too much leverage, they put themselves in a very vulnerable position. Even small market fluctuations can lead to huge losses or even liquidation."

View 'Trading Myths' Correctly

● The collapse of the "100% win rate whale" myth once again proves a truth of financial markets: no one can beat the market forever.

● "In investing, survivorship bias is a common phenomenon," analyzed Dr. Zhang Qiang, a behavioral finance expert. "We tend to focus only on the success stories and ignore the many cases of failure. When a trader achieves consecutive successes, the media and community often mythologize them, which is actually a cognitive bias."