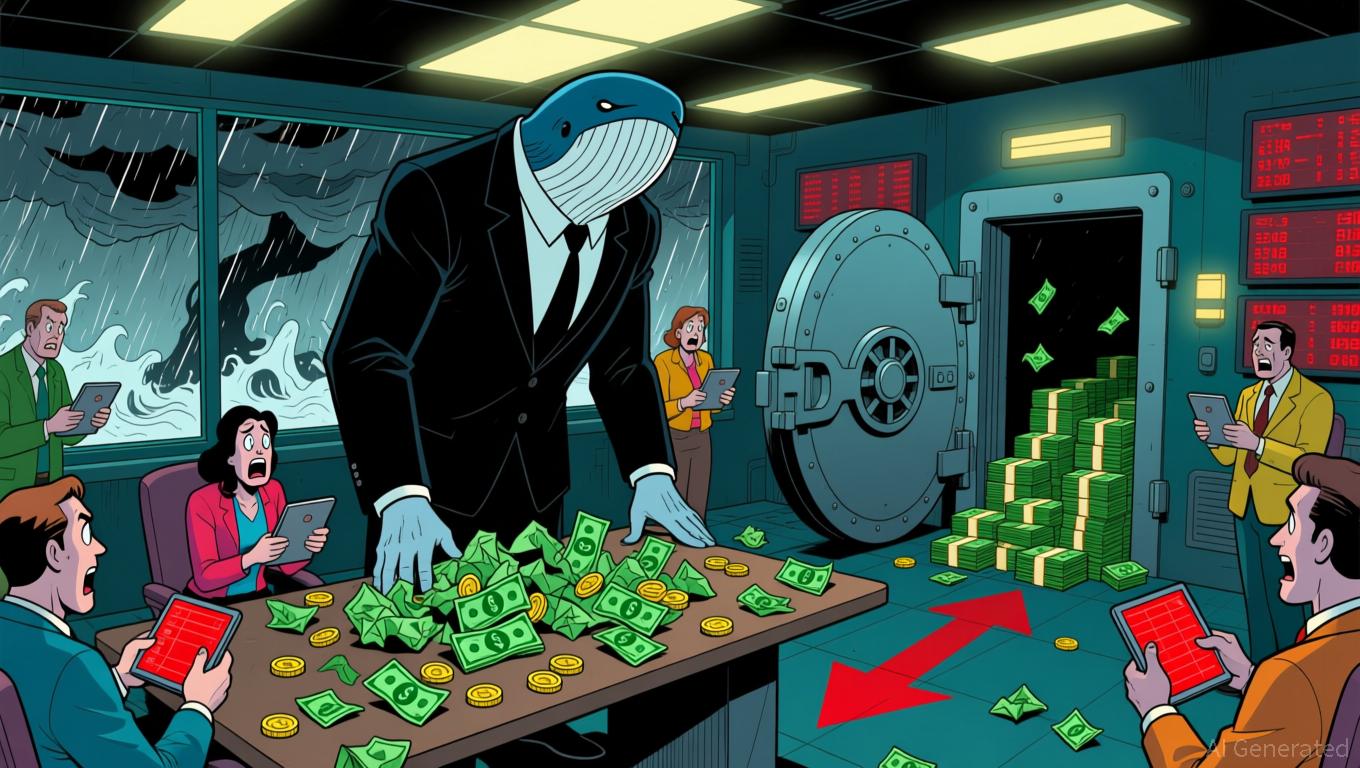

Hackers Allegedly Drain $550,000 From Citibank Customer’s Account in Fake Fraud Department Scheme: Report

A medical practice has filed suit against Citibank, N.A. after hackers allegedly accessed a client’s sensitive login information and drained approximately $550,000 from the account.

The plaintiff, Vitality Psychiatric Group Practice, P.C., filed the complaint in the U.S. District Court for the Southern District of New York.

The lawsuit alleges that on March 28, 2025, an account was compromised following a call to the practice’s operator that appeared to be from Citibank’s fraud department. The caller asked personal questions and then used the client’s password to access the checking account.

The complaint alleges that Citibank delayed in reversing the transfers, froze both the old and newly opened accounts, and told the practice the investigation could last up to 90 days, during which the business was unable to access funds needed for payroll and other obligations.

The practice is seeking claims of negligence and breach of contract, demanding over $1 million in damages, including the $550,000 loss.

The incident is part of a growing trend of hackers targeting financial institutions’ clients by exploiting authentication and internal controls.

In a similar case, the City of Hope National Medical Center has agreed to pay $8.5 million to settle a class action lawsuit that was filed after a “data security incident” that happened in late 2023.

The California-based healthcare firm says the impacted information varies by person but may have included their name, email address, phone number, date of birth, social security number, driver’s license or other government identification, bank account numbers, credit card details, health insurance information, medical records, information about medical history and unique patient record numbers.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DASH Aster DEX: Could This Be the Upcoming Breakthrough in On-Chain Trading?

- Aster DEX merges AMM and CEX models for improved usability, targeting both retail and institutional traders. - Backed by Binance's ecosystem and CZ endorsements, it achieved top-50 crypto status via aggressive airdrops and CMC campaigns. - Hidden orders and AI-driven liquidity optimization drive growth, but regulatory risks and token supply concerns threaten sustainability. - With $27.7B daily volume and 2,200% token price surge, Aster challenges DeFi norms but faces competition from Hyperliquid and cent

Bitcoin News Update: Short-Term Holders Increase Holdings While Long-Term Holders Realize Gains—$100K Becomes Key Level

- Bitcoin fell below $100,000 as Coinbase premium hit a seven-month low, reflecting weak U.S. demand and ETF outflows. - On-chain data shows short-term holders (STHs) accumulating Bitcoin while long-term holders (LTHs) moved 363,000 BTC to STHs, signaling mixed market dynamics. - Analysts highlight a "mid-bull phase" with STHs absorbing selling pressure, and a $113,000 support level critical for potential rallies to $160,000–$200,000 by late 2025. - The Fear and Greed Index entered "Extreme Fear," and exch

Bitcoin Update: Large Holders Depart and Economic Instability Push Bitcoin Under $100K

- Bitcoin fell below $100,000 as OG whales BitcoinOG and Owen Gunden moved $1.8B BTC to exchanges, signaling bearish bets. - $260M in long positions liquidated amid SOPR spikes, while Trump's crypto policies and China's $20.7B BTC holdings added macro risks. - Bit Digital staked 86% of ETH holdings for 2.93% yield, while Coinbase's negative premium highlighted waning U.S. buyer demand. - Analysts warn consolidation phases often follow whale profit-taking, with geopolitical tensions and derivatives volatili

Aster DEX's Latest Protocol Enhancement and What It Means for DeFi Liquidity Providers

- Aster DEX upgraded its protocol on Nov 5, 2025, enabling ASTER token holders to use their assets as 80% margin collateral for leveraged trading and receive 5% fee discounts. - Binance's CZ triggered a 30% ASTER price surge and $2B trading volume spike via a $2M token purchase three days prior, highlighting market speculation and utility convergence. - The platform introduced a "Trade & Earn" model allowing yield-generating assets like asBNB and USDF to be used as trading margin, enhancing capital efficie