- Maple Finance (SYRUP) price rose 12% on strong volume.

- Gains see bulls converge near the key resistance zone of $0.50.

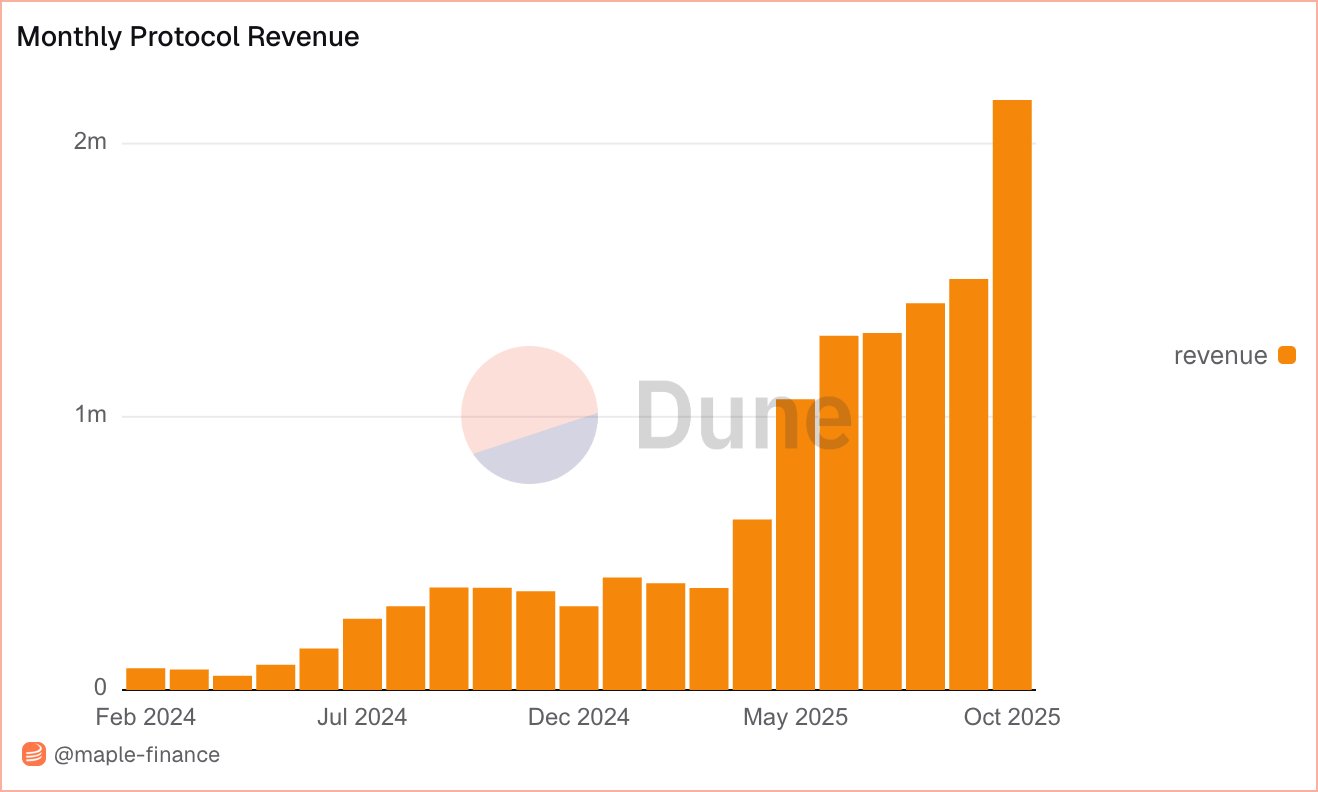

- The uptick comes as Maple hits a new all-time high in monthly protocol revenue.

Maple Finance (SYRUP) price is experiencing a notable outperformance.

According to CoinMarketCap data, the on-chain asset management platform’s native token has spiked more than 12% in the past 24 hours, outpacing the broader cryptocurrency market.

Notably, gains align with the platform’s record-breaking revenue performance in October 2025, and come amid key recent developments for the Maple Finance ecosystem.

SYRUP price jumps 12%, outpaces crypto market

Cryptocurrencies showed a muted reaction to the Federal Reserve’s 25 basis points interest rate cut on Oct. 29. Prices fell amid Fed chair Jerome Powell’s speech.

Bitcoin and top altcoins also showed a similar outlook during Asian hours on Thursday despite positive U.S.-China trade talks reports.

However, amid this generally subdued crypto market reaction, Maple Finance shone.

The SYRUP token registered an impressive 12% increase over the past 24 hours as it hit highs of $0.45.

This surge saw the DeFi token stand alongside Zcash, Euler and Aerodrome Finance as some of the top performers on the day with double digit gains. While selling has token’s price off intraday highs, bulls are looking to hold near $0.42.

SYRUP price chart by CoinMarketCap

SYRUP price chart by CoinMarketCap

For SYRUP, gains come amid robust trading activity.

CoinMarketCap data shows a sustained bullish momentum on the back of strong trading volume of $76.4 million – up 120% in 24 hours.

As bulls gather near a critical resistance level of $0.50, it appears fresh capital flows into Maple’s offerings and significant sector traction could aid the SYRUP price.

Maple Finance hits $2.16M in monthly protocol revenue

As SYRUP holders cheer their latest gains, also on the agenda is Maple Finance’s milestone of a new all-time high in monthly protocol revenue.

Per details , Maple reached $2.159 million for October 2025. This milestone represents a significant leap from previous months.

Maple Finance revenue chart from Dune Analytics

Maple Finance revenue chart from Dune Analytics

For context, revenue figures from earlier months showed a progressive climb.

The protocol started from modest levels around $100,000 in early 2024, before jumping to about $1.2 million by mid-2025. In October, that figure stood at over $2 million.

Notably, the revenue boost stems from increased activity in Maple’s lending and asset management services, which cater to institutional players seeking on-chain solutions.

Protocol fees from borrowing, lending, and yield-generating activities have increased substantially, reflecting the platform’s success in scaling its operations.

Key gains, in both price and revenue, are unfolding against a backdrop of strategic milestones for Maple Finance. One is the sunsetting of SYRUP staking to introduce buybacks.

MIP-019: Activate the SSF and Sunset Staking

The proposal introduces three new changes aimed at extending token buybacks, expanding governance eligibility to SYRUP, and sunsetting the staking mechanism to ensure long-term sustainability.

The vote is live on Snapshot:…

— Maple (@maplefinance) October 27, 2025

The platform recently forged a partnership with Aave, a leading DeFi lending protocol, to introduce institutional-grade credit options.

This collaboration allows for the listing of assets like syrupUSDT on Aave’s markets, enhancing liquidity and capital efficiency for users.

Additionally, Maple recently announced reaching $5 billion in assets under management (AUM), a testament to its growing influence in managing on-chain investments.