Whoever can help the US reduce its debt with cryptocurrency will become Powell's successor.

The article explores the true motivation behind the change in the Federal Reserve chair, pointing out that the core issue is the massive U.S. national debt and fiscal deficit, rather than inflation. Trump has hinted at the possibility of using cryptocurrencies to address the debt problem, and the next chair may promote the integration of digital assets as national financial tools. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, are still in the process of iterative improvement.

The spotlight in Washington is burning hotly on a year-end drama: Who will succeed Jerome Powell as the head of the Federal Reserve?

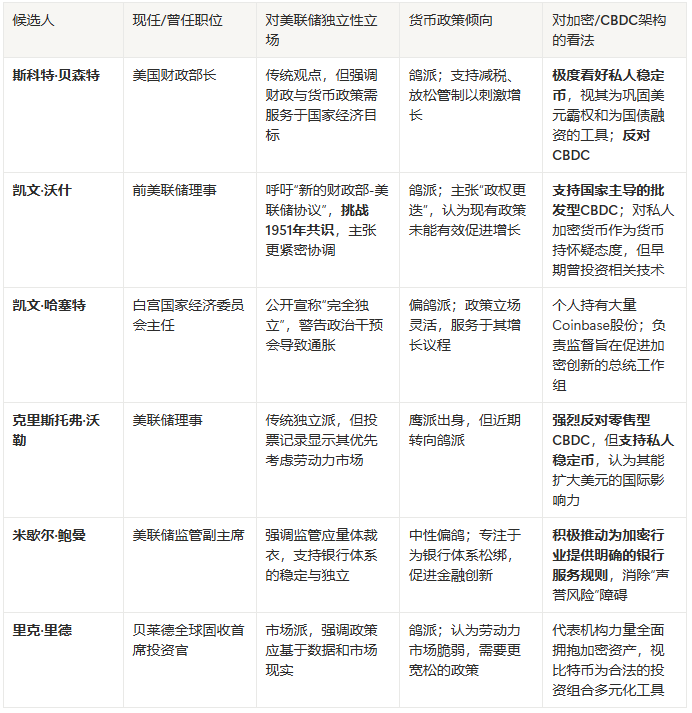

The list of candidates is already on the table: Waller, Bowman, Hassett, Warsh, Rieder. The media is analyzing their every word on interest rates and inflation. All of Wall Street is holding its breath, speculating on how this personnel change will shake up the markets.

But what if the real core of this contest has nothing to do with “inflation” at all?

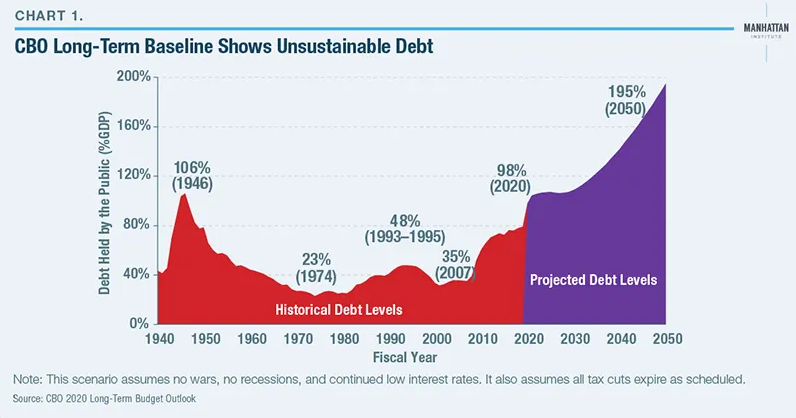

Behind the curtain of this political drama lurks a much larger and more urgent specter: America’s $35 trillion national debt. According to the grim forecast from the Congressional Budget Office (CBO), by 2035, the federal debt-to-GDP ratio will climb to 118%. This is the real “elephant in the room,” a beast that no traditional monetary policy can tame.

When traditional tools fail, an “unconventional” solution emerges.

According to Bitcoinist, a secret revealed by Trump at a private gathering happened to lay all the cards on the table. He stated that cryptocurrencies have a “bright future” and hinted at a shocking possibility: using cryptocurrencies to solve the $35 trillion debt problem.

“I would write on a little piece of paper: $35 trillion in cryptocurrency, we have no debt, that’s what I like to do.”

This is not an offhand joke, nor is it the first time. Trump has previously publicly declared multiple times that bitcoin could be used to “save America.”

Connecting all these dots, the true profile of the next Federal Reserve Chair becomes crystal clear.

This selection is not about finding an “inflation fighter.” It’s an interview to find someone willing to break the mold, even at the cost of sacrificing central bank independence—a “Chief Financing Officer.” Trump’s real mission is: Whoever can fully integrate the digital asset ecosystem (especially stablecoins) into the national fiscal machine, and find new, massive buyers for America’s huge national debt, will be Powell’s successor.

A Long-Planned “Regime Change”

To understand this selection, one must look beyond the surface of “changing personnel” and see the core of “changing the system.” Trump’s years-long attacks on Powell—the very chairman he nominated but soon turned against—have already rehearsed all of this.

From calling Powell “not smart at all” and “a fool,” to publicly pressuring him to cut rates to crisis levels, Trump’s anger was never just about Powell personally, but about the cornerstone of central bank independence established since the 1951 Treasury-Fed Accord. What Trump needs is a “compliant” central bank, one willing to make monetary policy serve his “growth-driven, high-debt” fiscal agenda.

Therefore, this unconventional selection timeline has become an extremely clever political maneuver.

Trump plans to finalize the candidate by the end of 2025, while Powell’s term doesn’t end until May 2026. This is not redundant. As “New Fed News” Nick Timiraos analyzed, the real trick of this arrangement is: The new chair nominee will first be nominated to fill the seat of current governor Stephen Miran, whose term ends in January next year.

This means that in March and April, before Powell steps down, the incoming chair will already be a full FOMC governor with full voting rights on interest rates.

Politically, this is a masterstroke. Just recall Miran himself—he participated in the FOMC vote on his second day in office and became the only hawkish “rebel” at the September meeting to vote for a 50-basis-point rate cut (instead of 25).

Trump is copying and upgrading this strategy. He wants to install an absolutely loyal and (very likely) extremely dovish shadow chair into the decision-making core during Powell’s caretaker period, forcibly pushing his agenda two months in advance. This is not a smooth transition; it’s a carefully orchestrated internal coup aimed at seizing control of monetary policy ahead of schedule.

The Two Competing Paths for Dollar Digitization

Once you realize that the fundamental purpose of this “coup” is to serve fiscal needs (i.e., debt financing), the policy spectrum of the five candidates becomes instantly clear. The media is still debating who is more “dovish,” but that’s no longer the point.

The real battlefield is: Will the future dollar hegemony rely on private sector innovation, or on state monopoly? This is not a simple policy disagreement, but a profound philosophical debate about the future architecture of money.

Path One: Public-Private Alliance—Turning Private Stablecoins into a Treasury Buying Machine

This is the most likely path and the one most directly beneficial to the crypto market. It represents a “public-private partnership” strategy, with the core idea of leveraging the vitality of the private sector to feed back into America’s fiscal machine. The lineup for this “alliance” is impressive.

The strategic designer is Scott Bessent. This former Chief Investment Officer of Soros Fund Management is far from a one-trick crypto pony. His “3-3-3 policy” (3% deficit, 3% growth, 3 million barrels of additional oil production) is a comprehensive supply-side reform agenda. But the real highlight is his prediction that the stablecoin market will grow 20-fold to $2.8 trillion and become one of the main buyers of U.S. Treasuries.

When Trump himself starts talking about using cryptocurrency to “wipe out” $35 trillion in debt, Bessent’s plan is no longer a radical statement, but a blueprint that translates presidential intent into executable policy. It’s a perfect closed loop: the government relaxes regulation, private sector players (like Circle, Tether) issue stablecoins, and the reserves of these stablecoins (cash and U.S. Treasuries) in turn finance America’s fiscal deficit.

The internal executors are current governors Waller (Christopher Waller) and Bowman (Michelle Bowman). Their presence means this path already has a solid foundation within the Fed. Waller is a staunch “anti-CBDC” advocate, famous for his quip that “CBDC is a solution in search of a problem.” But he is also a firm supporter of private stablecoins, believing they can “maintain and expand the international role of the dollar.”

As the Fed’s Vice Chair for Supervision, Bowman plays the role of “bomb disposal expert.” She is working to eliminate the barriers that prevent banks from serving crypto companies due to “reputational risk” (i.e., political pressure, such as “Operation Choke Point 2.0”). In short: Waller is responsible for giving the green light to private stablecoins at the macro level, while Bowman is responsible for clearing obstacles for crypto companies to access the banking system at the micro level.

The ultimate market integrator is Rick Rieder. As BlackRock’s Global Chief Investment Officer of Fixed Income, he represents the final institutionalization of Wall Street. His company has already demonstrated its power through the bitcoin ETF. Rieder’s involvement means traditional finance will fully embrace digital assets as legitimate stores of value and diversification tools.

Path Two: State Monopoly—Building a Fed-Controlled Digital Rail

Another frontrunner, Kevin Warsh, represents a completely opposite path philosophy.

Warsh’s credentials are impeccable; he served as a Fed governor during the 2008 financial crisis. His core proposition is to carry out a “regime change,” even calling for a “new Treasury-Fed Accord.” This is a highly disruptive proposal, essentially challenging the core principle established since 1951 that freed the central bank from the obligation to finance government spending.

On digital assets, Warsh’s attitude is extremely complex. On one hand, he is an angel investor in crypto startups (such as algorithmic stablecoin Basis) and deeply understands the technology’s potential; on the other, he is highly skeptical of privately issued cryptocurrencies “masquerading as money.”

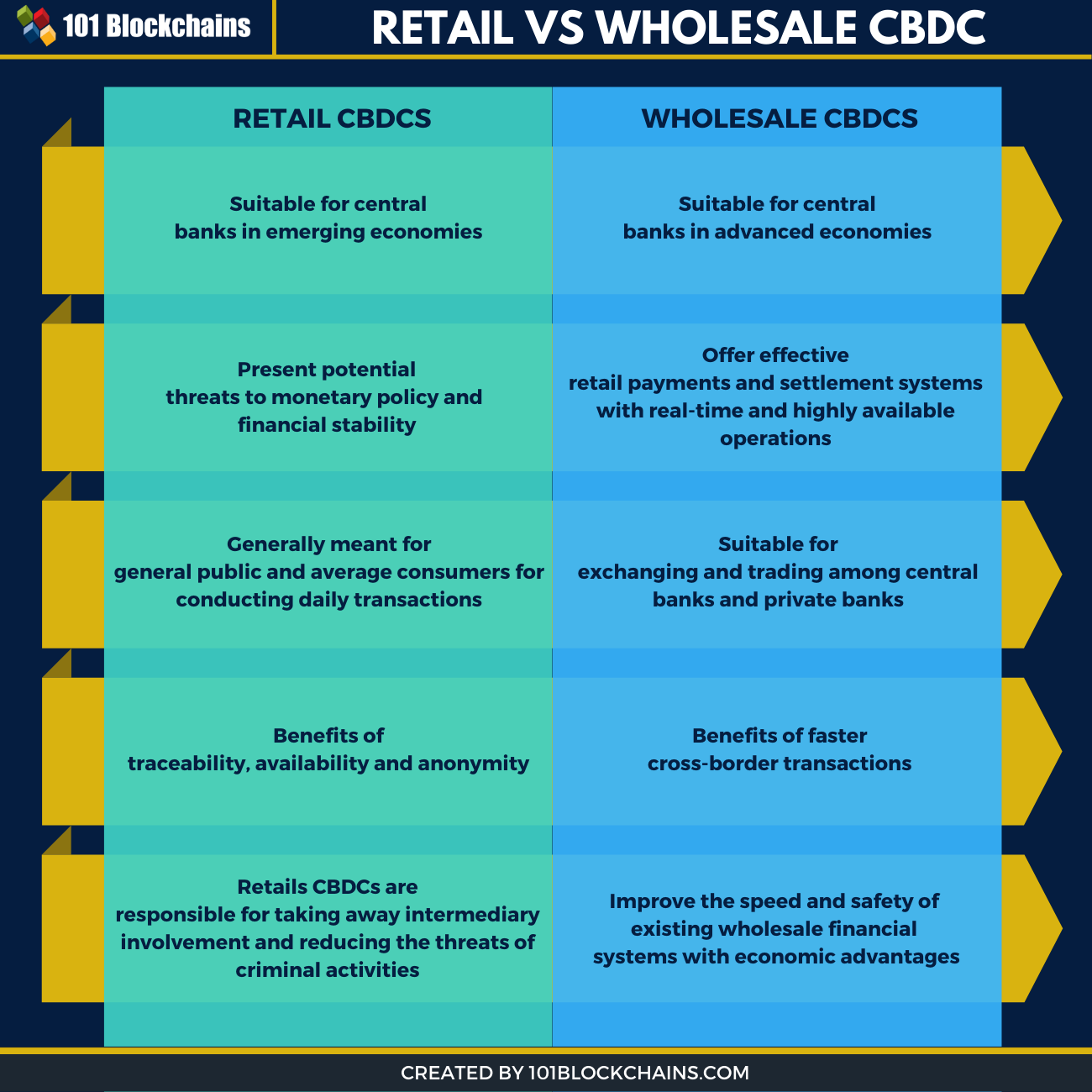

What he truly supports is a state-led “wholesale CBDC.”

To help readers understand, this is not a “digital yuan” or “digital dollar” for ordinary people (i.e., retail CBDC), but a super settlement network operated by the Fed and used only by banks and other financial institutions. Its aim is to make large-value interbank transfers instant, efficient, and nearly costless.

This poses a potentially huge threat to the crypto industry. A state-controlled, highly efficient interbank digital dollar system could fundamentally marginalize private stablecoin issuers. In Warsh’s vision, the future of money must be state-led, and any private innovation may be subject to regulatory crackdown.

The Next Fed Chair? Comparative Analysis of Top Candidates

The Crossroads for Cryptocurrency—Booster or Shackles?

A dovish turn for the new Fed is almost a foregone conclusion. But for the crypto industry, that’s far from the whole story. The liquidity boom brought by rate cuts is certainly tempting, but hidden behind the loose policy are two completely different regulatory paths—one is a fusion booster, the other is a state-imposed shackle.

If “Path One” (public-private alliance) prevails, the crypto industry will usher in an era of “integration and prosperity.” This would be an “integrative” Fed, led by figures like Bessent, Waller, or Bowman. We would see not only an aggressive rate-cutting cycle, but also comprehensive regulatory relaxation. Banks would be encouraged to serve the crypto industry, and institutions like BlackRock would lead a capital frenzy.

For the market, this would mean not only a bitcoin bull run, but also explosive growth in stablecoins and DeFi. A $2.8 trillion stablecoin market would reshape global finance. But all this comes at a cost. It’s more like a “co-optation”—as the crypto industry is embraced by the mainstream, its ideals of decentralization and censorship resistance may be sacrificed, reduced to an efficient settlement layer for traditional finance and a “life-support” tool for national finances.

Conversely, if “Path Two” (state monopoly) wins, the industry will face “competition from the state team.” This would be a “reformist” Fed led by Warsh. Rate cuts would still happen, but the regulatory iron fist would strike the private sector. The Fed would pour resources into developing its wholesale CBDC and might impose strict restrictions on the reserves of private stablecoins (such as USDC and USDT), treating them as competitors to the national digital currency.

Imagine if banks had an instant, zero-cost digital dollar settlement rail endorsed by the Fed—how much incentive would they have to use services from Circle or Tether? This would be a future full of conflict and uncertainty, with the market torn between loose monetary policy and regulatory crackdowns.

Fed Chair—America’s “Chief Debt Financing Officer”

Trump’s “joke” about Bessent is actually his most candid “confession.”

What he needs is no longer a traditional central bank governor anxious about inflation data. What he needs is a Chief Financing Officer who can find a “cure” for America’s astronomical debt.

When Trump himself begins to publicly talk about using a “little piece of paper” with cryptocurrency to “wipe out” $35 trillion in debt, Bessent is the only one among the five candidates to concretize this into a feasible path (stablecoins buying Treasuries). This selection marks the end of an era. Central bank independence is giving way to the urgent need for fiscal survival.

And cryptocurrency, once a fringe heresy, is being forcibly drawn into the core of the national machine, becoming the most critical weapon in this fiscal defense war.

For the crypto industry, this is both an unprecedented opportunity and the toughest survival test. We must prepare for a fundamental “regime change” in the central bank system—whether we like it or not, cryptocurrency is destined to be thrust onto the central stage of the future monetary system.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

When being the "chief trader" is not enough, is Trump going to "run the show" himself?

As Wall Street's "mainstream players" rush to enter the market, Trump—who naturally attracts attention and controversy—clearly does not want to miss out on this grand feast.

The mysterious team that dominated Solana for three months is about to launch a token on Jupiter?

With no marketing and no reliance on VC, how did HumidiFi win the Solana on-chain proprietary market maker war in just 90 days?

USDD completes fifth security audit report, ChainSecurity confirms high-level security

Web3 security auditing firm ChainSecurity has released the fifth security audit report for USDD 2.0, confirming its high level of security in token integration and application mechanisms, as well as improved reliability in multi-chain deployment. Summary generated by Mars AI This summary is generated by the Mars AI model, and the accuracy and completeness of the generated content are still being iteratively updated.