Ethereum Price Struggles to Reclaim $4,000 Amid Long-Term Holder Pressure

Ethereum remains under $4,000 as long-term holders resume selling. Rising exchange inflows hint at profit-taking, but a breakout above $4,000 could spark recovery.

Ethereum (ETH) continues to face resistance at the $4,000 mark after multiple failed recovery attempts. Despite broader market stability, the second-largest cryptocurrency struggles to flip this key psychological level into support.

The selling pressure from long-term holders (LTHs) remains a major obstacle, limiting Ethereum’s ability to regain upward momentum.

Ethereum Holders Are Selling

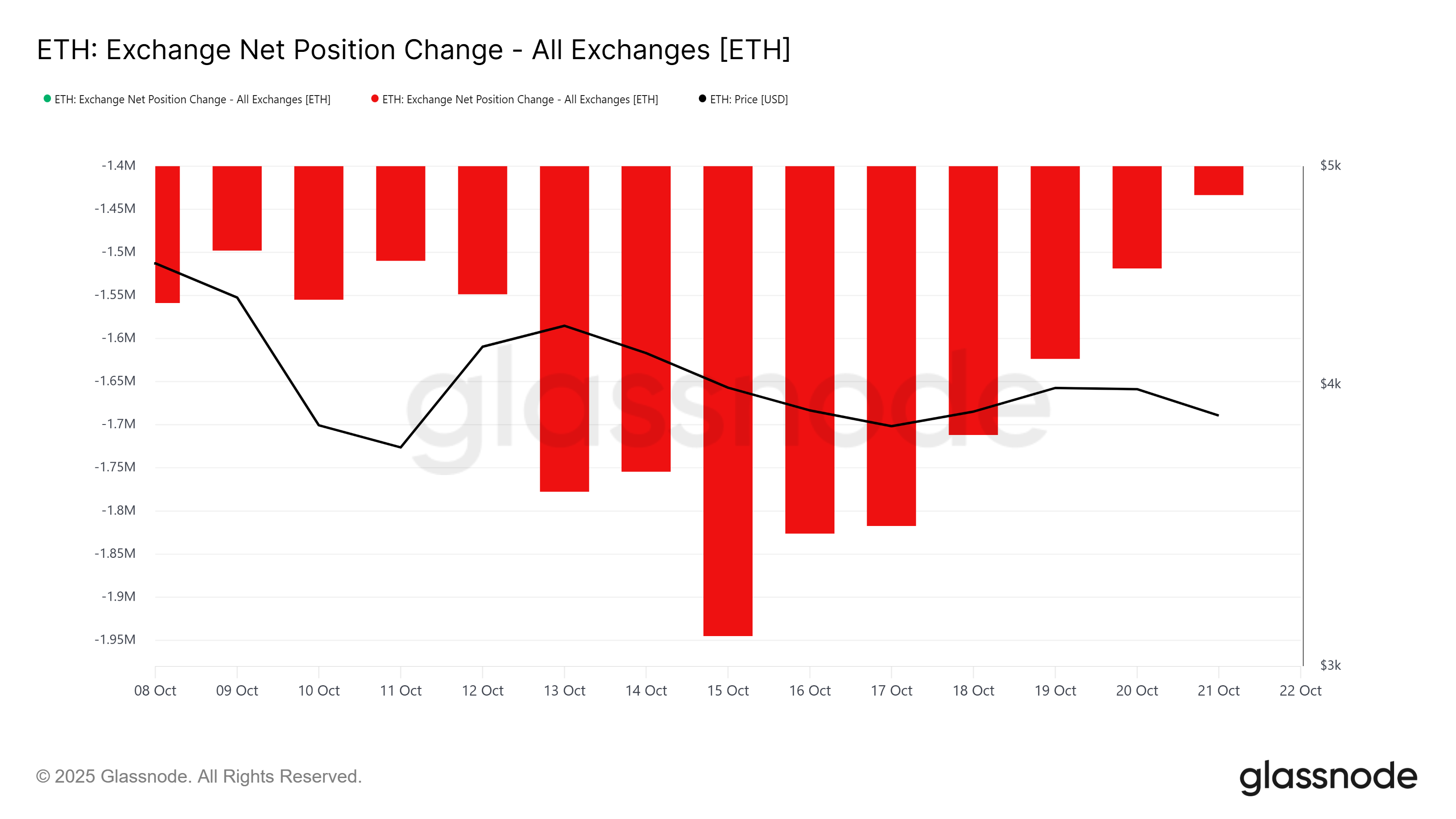

Exchange net position data reveals a notable shift in trader behavior over the past 10 days. Outflows from exchanges, typically signaling accumulation, have dropped sharply. This slowdown suggests investors are pulling back from buying, reflecting uncertainty in Ethereum’s near-term performance as the market digests recent price swings.

As outflows decline, inflows are gaining momentum, indicating more ETH is moving onto exchanges for potential selling. This shift often precedes increased bearish pressure, as traders look to secure profits or mitigate losses.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Ethereum Exchange Net Position Change. Source:

Glassnode

Ethereum Exchange Net Position Change. Source:

Glassnode

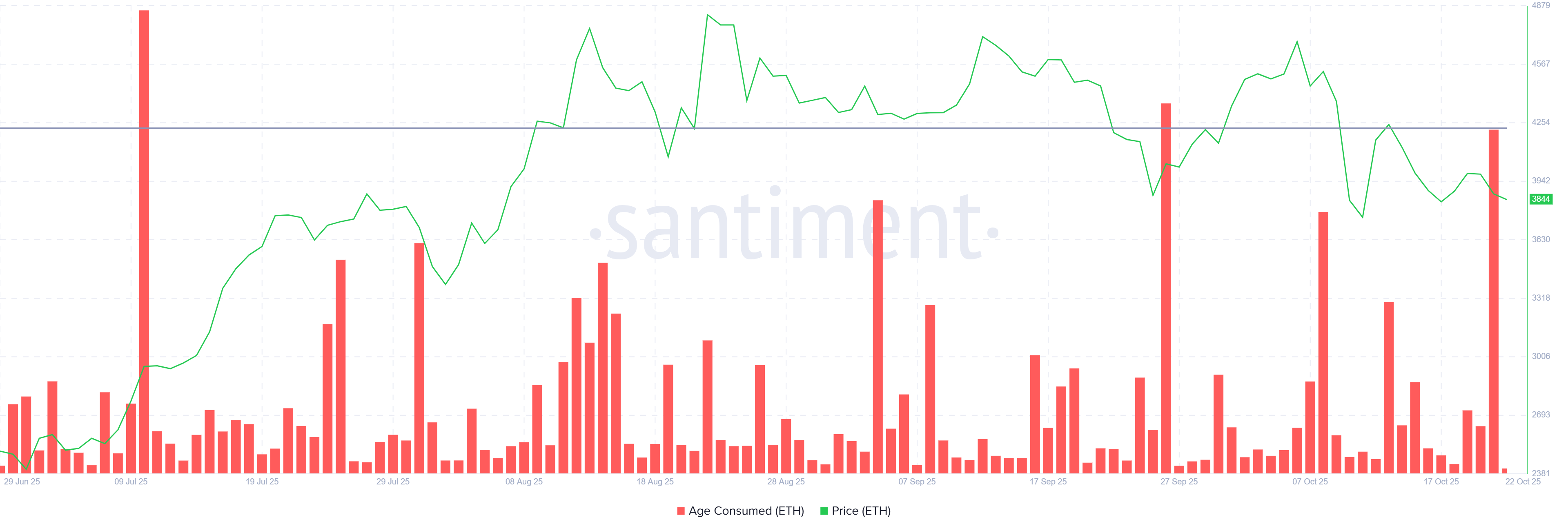

Ethereum’s on-chain data highlights weakening macro momentum. The Age Consumed metric—an indicator of dormant coins being moved—recorded a significant spike within the past 24 hours. This surge marks the third-largest movement in over three months, suggesting that previously inactive long-term holders are beginning to sell their assets.

Such a rise in Age Consumed typically signals a wave of profit-taking or loss prevention. As LTHs move their holdings back into circulation, it shows growing impatience with stagnant prices.

Ethereum Age Consumed. Source:

Santiment

Ethereum Age Consumed. Source:

Santiment

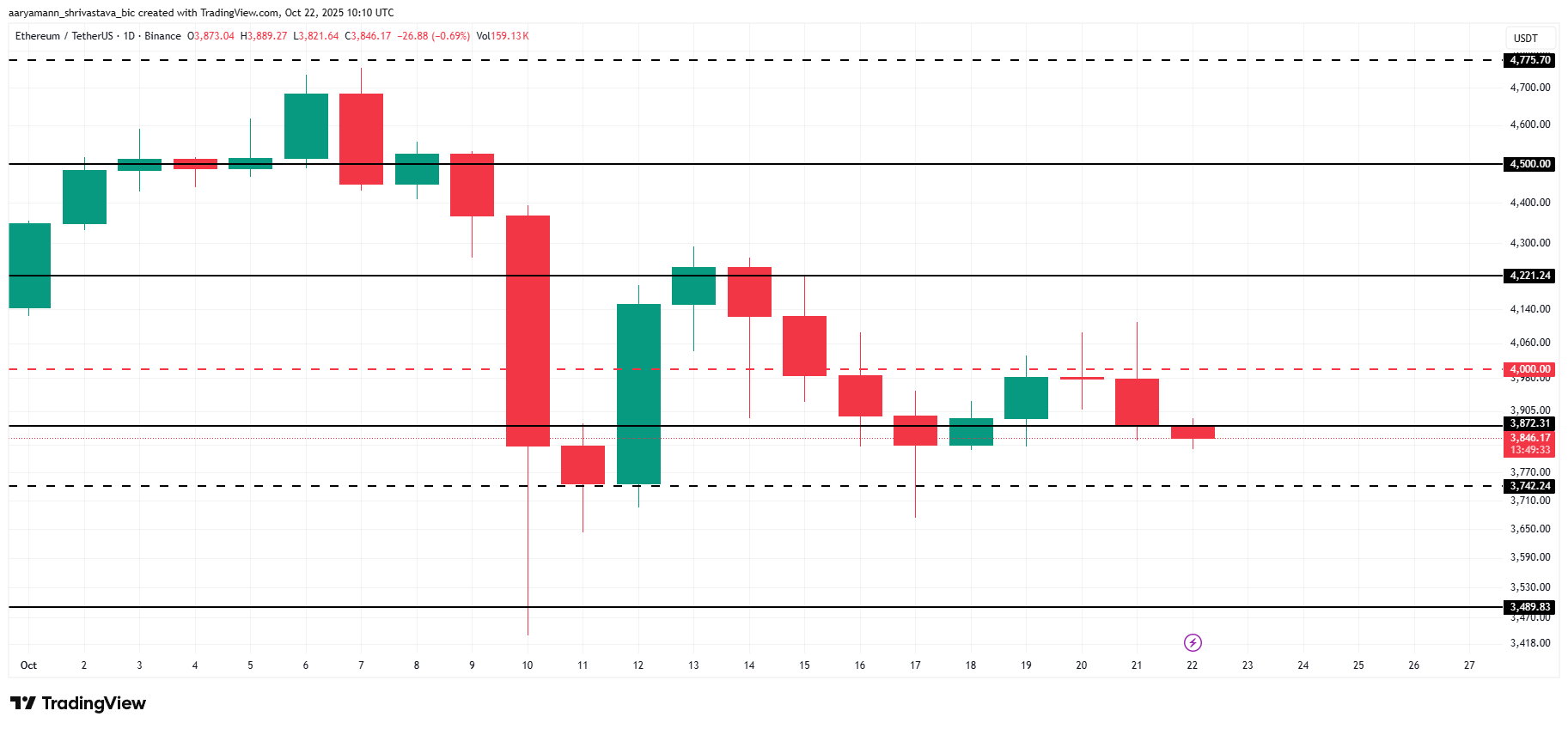

ETH Price Can’t Flip This Resistance

Ethereum’s price trades at $3,846 at press time, slipping below the $3,872 support level. The altcoin king has remained stuck under $4,000 for nearly a week, reflecting fading momentum and tightening volatility in the broader crypto market.

Given the prevailing selling pressure and weak inflows, Ethereum’s price could fall further toward the $3,742 support zone. If this level fails to hold, a deeper correction could follow, pushing ETH down to $3,489. Such a decline would reinforce the current bearish outlook.

ETH Price Analysis. Source:

ETH Price Analysis. Source:

However, if Ethereum holders curb their selling and demand strengthens, ETH could rebound above $4,000. A decisive break of this resistance could lift prices toward $4,221, signaling renewed optimism and invalidating the prevailing bearish setup.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Castle Island Ventures partner: I don’t regret spending eight years in the cryptocurrency industry

Move forward with pragmatic optimism.

Undercurrents Surge: Crypto Whales Spark Another Wave of Accumulation

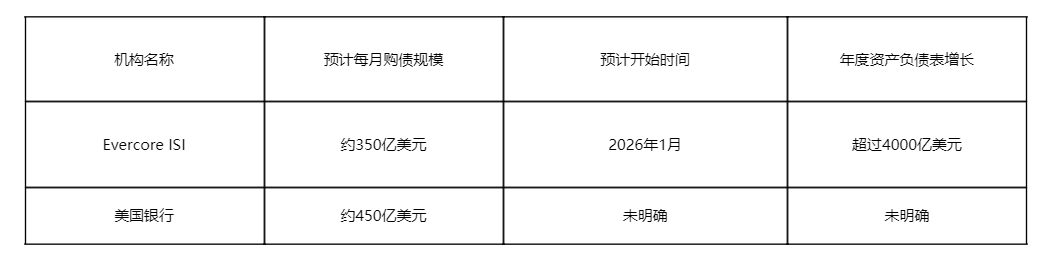

Fed Decision Preview: Balance Sheet Expansion Signals Are More Important Than Rate Cuts

The Federal Reserve cuts interest rates as expected, what happens next?