The market remained calm after the Federal Reserve's interest rate decision in the early hours, yet several whale addresses transferred hundreds of millions of dollars to exchanges. On-chain data reveals an undercurrent of capital flows unnoticed by most.

As of the morning of December 11, the address known as the "1011 Insider Whale" held about 120,000 ETH, with a total value approaching $400 million. Its unrealized profit on 5x leveraged long positions exceeded $12 million.

Another high-profile "BTC OG Insider Whale" underwent a massive asset restructuring over the past few months, reducing its BTC holdings from 88,000 to about 37,000, and reallocating most of the funds into ETH, involving capital on the scale of several billions of dollars.

I. Market Background

● In the early hours, the Federal Reserve announced its latest interest rate decision, lowering the benchmark rate by 25 basis points to 3.50%-3.75%. This rate cut, in line with market expectations, did not trigger significant volatility in the crypto market. While macro news became clearer, the market's technical side presented complex signals.

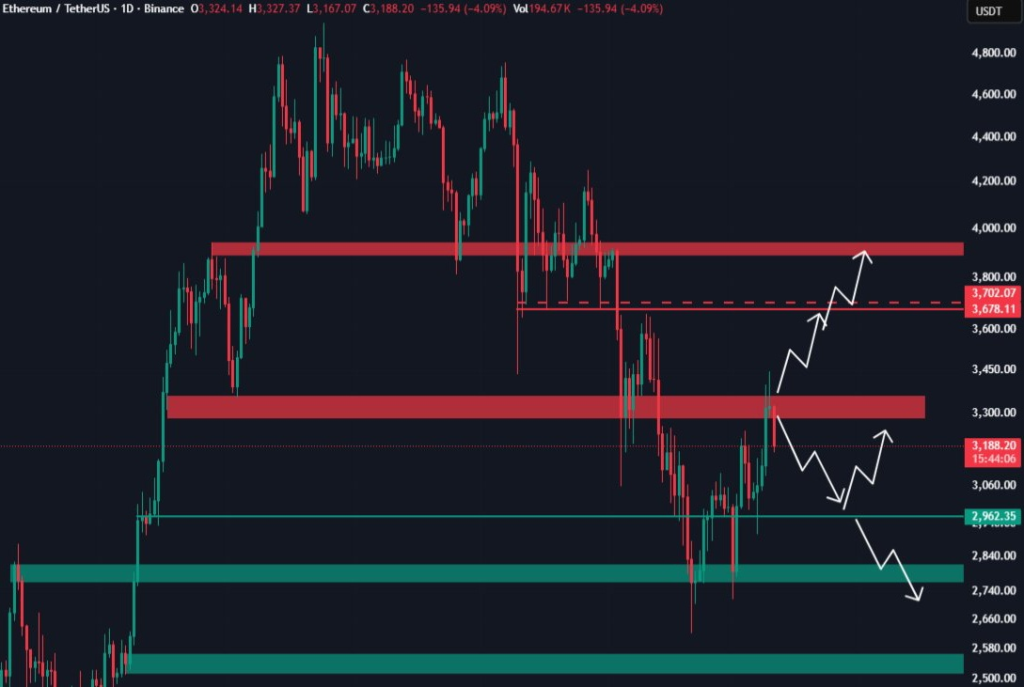

● On December 11, bitcoin's price fell below 91,000 USDT, with a daily drop of 1.11%. More notably, some analysts observed a "bear flag pattern" forming on bitcoin's daily chart.

● This technical pattern suggests that if bitcoin's price breaks below the key support at the lower boundary of the flag, around $90,000, it could further decline to around $67,000, representing a potential drop of about 25% from the current price.

II. Latest Whale Moves

In such a complex market environment, crypto whales did not choose to sit on the sidelines but instead actively positioned themselves.

● Between 1:32 and 2:32 AM (UTC+8) on December 11, the "1011 Insider Whale" aggressively increased its position by 20,000 ETH, bringing its total 5x leveraged ETH long position to 100,985 ETH.

At the current price, these ETH are worth about $335 million, with an average entry price of $3,158. The current unrealized profit is $17.05 million, yielding a return of 25.45%.

● Almost at the same time, another address known as the "Insider Whale" made a similar move, increasing its position by 19,108.69 ETH.

This address now holds a total of 120,094.52 ETH, worth about $392 million, with an average entry price of $3,177.89 and an unrealized profit of about $10.13 million.

● Both whales are using 5x leverage, with liquidation prices as low as $2,015 and $2,234 respectively, showing their strong confidence that ETH prices will not fall below these levels.

III. Analysis of Whale Strategies

A deep analysis of these whales' operation patterns reveals that they are not betting blindly, but rather following a clear strategic logic.

● The "BTC OG Insider Whale" demonstrated more sophisticated capital maneuvers. During the market crash on December 1, this whale collateralized ETH to borrow over 220 million USDT, then transferred these funds to trading platforms.

● This was clearly to prepare ammunition for subsequent operations. Then, on December 7, the whale used $70 million to open ETH long positions. This move exemplifies a typical event-driven strategy—positioning ahead of major macro events (the Federal Reserve rate decision) in anticipation that the event will catalyze the market in a specific direction.

● The whale's trading record shows that since August 21, there have been seven major contract trades, with six being profitable and only one loss. This track record includes successfully shorting before the big drop in October and precisely catching the market rebound at the end of November.

IV. Cross-Asset Positioning

In addition to focusing on ETH, whales are also seeking opportunities in other asset classes.

● In the early hours of December 11, a whale withdrew 101,365 SOL from the Kraken exchange, worth about $13.89 million. This whale now holds a total of 628,564 SOL, valued at about $84.13 million, most of which is stored in private wallets, with some staked.

● This behavior of withdrawing tokens from exchanges to private wallets is usually interpreted as a signal of long-term holding, as it means these assets will not be sold on the market in the short term. Looking at longer-term on-chain data, it is clear that whales' positioning is much broader than just a single asset. In the payment/cross-border settlement sector, XRP has become a favorite among whales.

● In the past 30 days, addresses holding 100 million to 1 billion XRP have net increased their holdings by 970 million XRP, while addresses holding more than 1 billion XRP have net increased by 150 million XRP. These increases may be related to the gradual realization of expectations for an XRP ETF.

V. Changes in Market Structure

The large-scale operations of whales are quietly changing the market structure, especially the distribution of ETH holdings.

● After the "1011 Insider Whale" and "Insider Whale" each increased their ETH holdings by tens of thousands, their respective ETH positions have exceeded 100,000 and 120,000. This means these two whales control more than 220,000 ETH, worth over $700 million at current prices.

● This highly concentrated holding structure may have a dual impact: on one hand, the whales' large purchases provide support for the market; on the other hand, such concentration could become a destabilizing factor during future market volatility.

● From market data, the whales' accumulation stands in stark contrast to the behavior of ordinary investors. The latest report from Glassnode points out that the BTC spot cumulative volume delta indicator has further declined over the past week, clearly indicating stronger potential selling pressure.

VI. Risks and Outlook

● Although the whales' moves are eye-catching, they also come with significant risks. They generally use 3-5x leverage, which, while not extreme in the crypto market, can still lead to rapid liquidations during sharp volatility.

● Take the "1011 Insider Whale" as an example: its ETH long position has a liquidation price as low as $2,015. This means that if ETH drops by about 38%, the position will be forcibly liquidated, potentially triggering a chain reaction.

● From the overall market perspective, although whales are actively accumulating, multiple indicators show the market is still under pressure. Bitcoin spot ETF outflows continue; on December 9 alone, these products saw $60 million in outflows.

● Analysts point out that the absence of new buyers and weakening ETF demand are key factors limiting bitcoin's price from breaking above $93,000. If the market fails to attract new capital inflows, it may be difficult to sustain a long-term uptrend relying solely on whale support.