Morgan Stanley recommends a “conservative” cryptocurrency allocation for certain portfolios

financial services giant Morgan Stanley has released a guide to the allocation of cryptocurrencies in a multi-asset investment portfolio, and in a report submitted to investment advisors by the Global Investment Committee (GIC) in October, it recommended taking a "conservative" approach.

Morgan Stanley analysts recommend allocating cryptocurrencies to up to 4% in the "opportunity growth" investment portfolio, which aims to achieve higher risk and higher returns.

The report states, "Although the emerging asset class has experienced excess total returns and decreased volatility in recent years, during macro and market pressure periods, cryptocurrencies may experience higher volatility and higher correlation with other asset classes."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trading 212 Launches Crypto Trading under Its Cyprus Unit

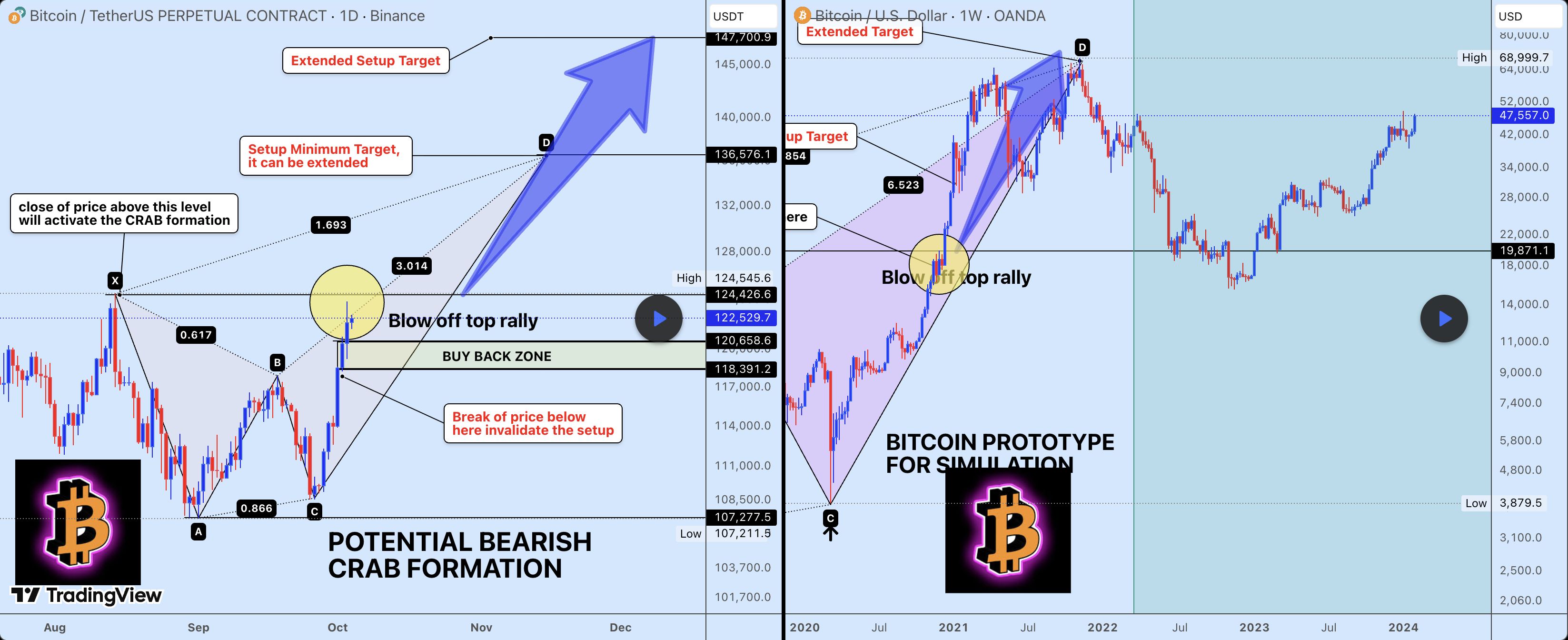

Bitcoin’s 2021 Playbook Shows The Final Price Target For This Bull Cycle

Europe’s Stock Markets Log Their Strongest Week in Six Months

Bitcoin Reaches Record High In Turbulent Markets