Messari Report: USDD 2.0 Over-collateralization Remains Strong, Reserves Peak Exceed $620 Million

The Messari report analyzes the latest developments of USDD 2.0, including multi-chain ecosystem expansion, over-collateralization mechanisms, PSM, and innovative designs such as smart allocators, demonstrating its robust growth and long-term value potential. Summary generated by Mars AI This summary is generated by the Mars AI model, and the accuracy and completeness of its content are still undergoing iterative updates.

On September 26, the globally renowned crypto data research institution Messari released an in-depth report titled "USDD 2.0 - New Horizons," providing a comprehensive analysis of the latest developments and strategic layout of the decentralized stablecoin USDD. The report points out that USDD has achieved multi-chain ecosystem expansion through native deployment on Ethereum, and is gradually building a self-sustaining and sustainably growing on-chain financial system through innovative designs such as an over-collateralization mechanism, Peg Stability Module (PSM), and Smart Allocator.

Messari's analysis shows that since its relaunch in January 2025, the USDD 2.0 protocol has demonstrated robust development momentum. As of early September 2025, the total value of its reserve collateral peaked at over $620 million, consistently exceeding the circulating supply of USDD, strictly maintaining an over-collateralized state, and fully demonstrating USDD's strong risk resistance and long-term value potential.

In the report, Messari particularly affirmed USDD's native deployment on Ethereum, noting that this move enabled USDD to achieve a strategic leap to a "TRON-Ethereum" dual-chain architecture. The deep liquidity and broad application scenarios of the Ethereum ecosystem provide a solid foundation for USDD's further development. According to the report, the value of USDD's reserve collateral in the third quarter increased by 5% quarter-on-quarter, outpacing the 3% growth in stablecoin supply. This indicates that during the transition to multi-chain deployment, USDD's collateralization rate continues to strengthen.

The PSM (Peg Stability Module), as the core mechanism for maintaining USDD price stability, received special attention from Messari. This module supports 1:1 exchanges between USDT/USDC and Ethereum-based USDD, effectively maintaining the peg through arbitrage mechanisms. Messari emphasized that the arbitrage mechanism of the PSM has established a solid price anchor for USDD, keeping it consistently near $1 in the secondary market, thereby strongly safeguarding liquidity and user confidence.

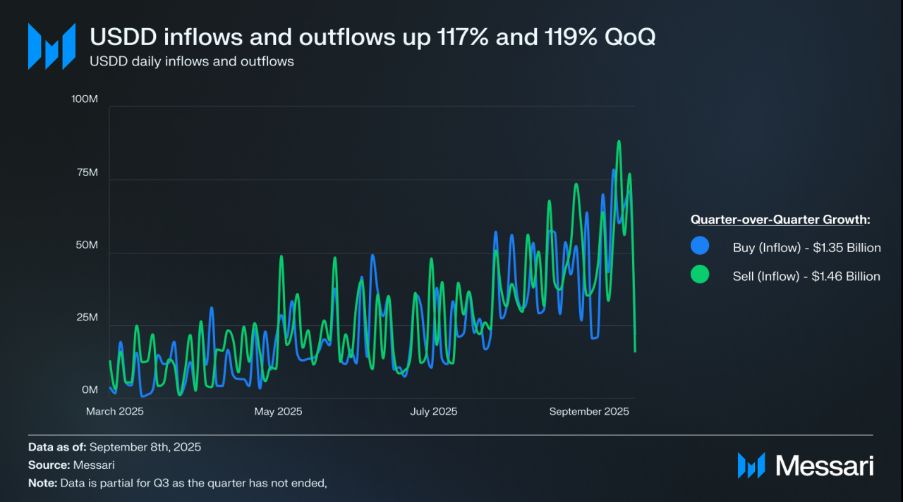

Liquidity data from the past two quarters further confirms the core role of the PSM: as of September 8, 2025 (even though the third quarter had not yet ended), the total amount of USDT/USDC exchanged for USDD by users had increased from $1.15 billion in the second quarter to $2.5 billion, a quarter-on-quarter growth of 117%. During the same period, redemptions rose from $1.24 billion to $2.7 billion, a quarter-on-quarter increase of 119%. This shows that the PSM is now able to effectively respond to large-scale demand fluctuations and maintain USDD at its pegged price through arbitrage mechanisms.

Messari also conducted an in-depth analysis of the innovative value of the Smart Allocator. This mechanism generates real yields by allocating reserve funds to low-risk DeFi protocols, with profits continuously flowing back into the system. Messari believes that this model will drive USDD from subsidy-driven growth to self-sustaining profitability, establishing a long-term stable economic engine.

In addition, USDD's new contract on Ethereum has passed a comprehensive audit by the well-known blockchain security company CertiK, providing security assurance for its large-scale application. Messari concluded that through its multi-chain strategy and capital efficiency optimization, USDD has not only strengthened its own stability but also injected new foundational financial tools into the DeFi ecosystem.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After Plasma and Falcon, how can one participate in USD.AI, the highly anticipated "next-generation miracle mining project"?

This year, Framework has led investments in two stablecoin projects: one is Plasma, which has surpassed 10 billion, and the other is USD.AI.

What will happen to bitcoin if the US government shuts down?

Traders who rely on U.S. employment data to determine whether the Federal Reserve will cut rates again may need to wait for a while.

How A U.S. Government Shutdown Could Affect The Bitcoin Price?

Uptober 2025: Will Bitcoin and Ethereum Lead a Crypto Rally?