How A U.S. Government Shutdown Could Affect The Bitcoin Price?

As Washington edges closer to a government shutdown, markets brace for impact. With nearly 900,000 federal workers facing furloughs and key economic data set to be delayed, uncertainty is mounting. The big question now: will Bitcoin price act as a safe-haven hedge against political dysfunction or get dragged down with the broader economy?

Bitcoin News: The Political Standoff and Market Anxiety

US Shutdown

US Shutdown

The U.S. government faces a looming shutdown starting October 1 as Republicans and Democrats remain locked in a funding battle. If no resolution is reached, nearly 900,000 federal workers could be temporarily laid off, and key economic data like the September jobs report would be delayed.

For traditional markets, that creates uncertainty and hesitation. For Bitcoin price, however, the story is more complex. BTC price thrives in environments where trust in government systems weakens. A shutdown may fuel its safe-haven narrative, but the short-term volatility it brings cannot be ignored.

The odds of a US shutdown in 2025 have surged dramatically, with prediction market Polymarket now pricing in an 86% chance—up more than 60% in recent weeks. The chart shows how sentiment has shifted from relative calm earlier in the year to a sharp spike in September, reflecting growing political deadlock in Washington.

This surge in shutdown expectations mirrors broader investor anxiety, as markets brace for potential disruptions to federal operations, delayed economic data, and ripple effects across the U.S. economy. For BTC price , such heightened uncertainty could either amplify volatility or reinforce its appeal as a hedge against systemic dysfunction.

Bitcoin News: Economic Slowdown and Bitcoin’s Dual Role

Analysts expect the economic hit of a shutdown to be modest at first, reducing GDP growth by about 0.1–0.2 percentage points weekly. But the timing is dangerous. Inflation is already climbing due to tariffs, and the job market is cooling. If confidence slips further, consumer spending could slow, sending ripple effects across equities and risk assets.

Bitcoin price sits at the intersection of two narratives: it is both a speculative asset tied to liquidity and a hedge against systemic risk. A prolonged shutdown could initially push investors toward cash, causing Bitcoin weakness, but the longer trust in government erodes, the stronger Bitcoin’s hedge appeal becomes.

Impact of Delayed Economic Data

The Federal Reserve relies on timely reports like jobs data to guide interest rate decisions. A shutdown that stalls data releases blinds the Fed, raising policy uncertainty. In traditional markets, that means choppier price action in bonds and equities. For Bitcoin price, the lack of clarity can invite speculative trading. Historically, when economic visibility decreases, volatility spikes. If the Fed delays or avoids hawkish moves due to missing data, Bitcoin could benefit from expectations of looser conditions.

Bitcoin Price Prediction: Bitcoin’s Current Position

BTC/USD Daily Chart- TradingView

BTC/USD Daily Chart- TradingView

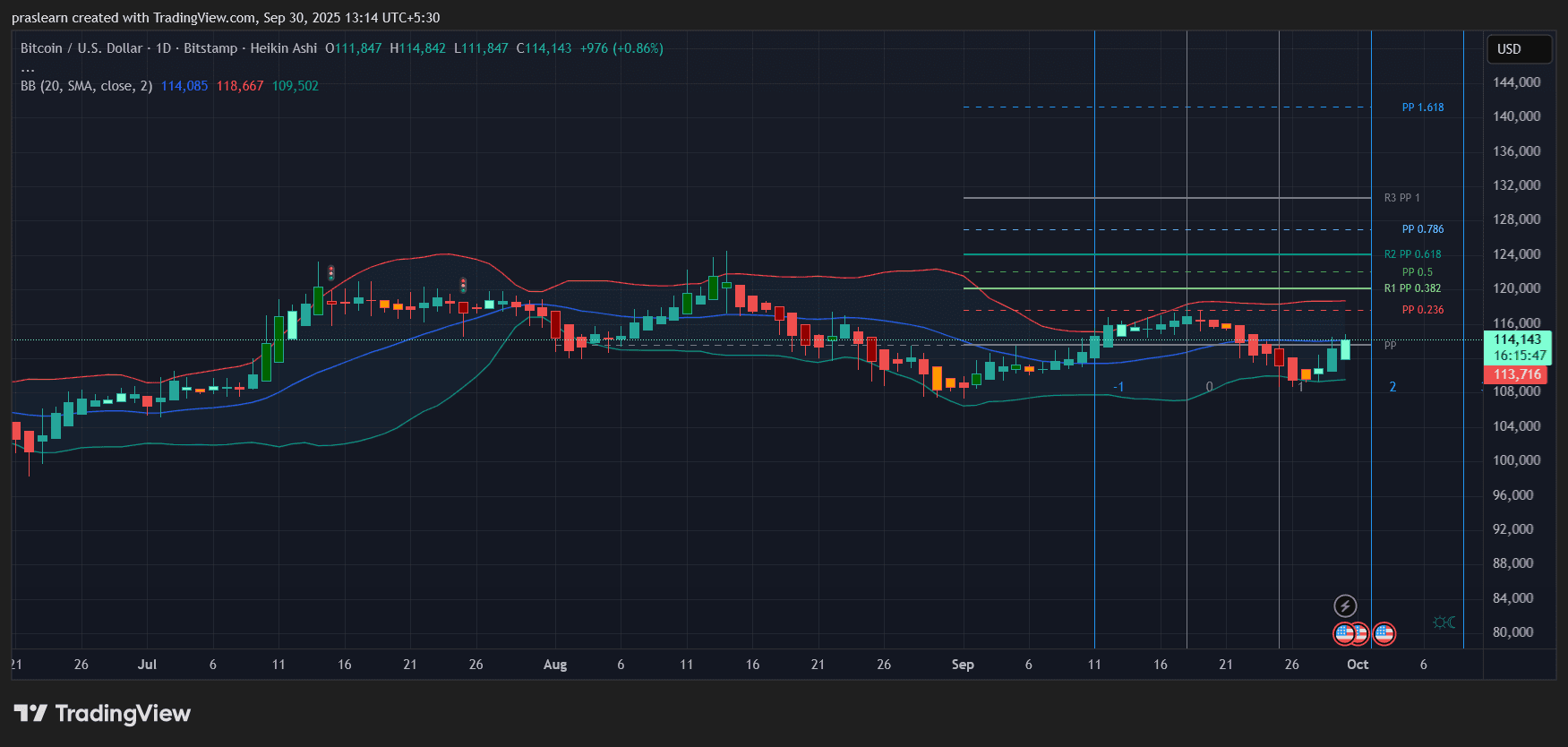

Looking at the daily BTC/USD chart , Bitcoin trades around 114,143, sitting above its 20-day moving average near 114,085. The Bollinger Bands show a recent squeeze, followed by an upside break, signaling volatility expansion. The nearest resistance lies around 118,600, while pivot levels stretch toward 123,000 and higher if momentum strengthens.

On the downside, support sits near 109,500. The Heikin Ashi candles have shifted to green after weeks of mixed sentiment, hinting at the possibility of a bullish reversal. If the shutdown narrative fuels risk-off flows, BTC could test the lower Bollinger band again. But if investors see Bitcoin as a hedge, a breakout toward 120,000 is very possible.

Historical Lessons from Past Shutdowns

The 2018–2019 shutdown , the longest in U.S. history, coincided with high volatility in equities and a sluggish economy. Bitcoin price at that time was still in a post-2017 bear market, and it failed to attract major inflows. The difference today is structural: institutional involvement, ETFs , and broader acceptance of Bitcoin as a macro hedge. This time, the correlation with gold and risk-off assets is stronger, suggesting Bitcoin could behave more like digital gold than just a speculative bet.

Bitcoin Price Prediction: Where Could Bitcoin Price Head?

If the shutdown lasts only a week or two, expect choppy range-bound trading between 110,000 and 118,000 as liquidity remains cautious. A prolonged standoff lasting several weeks could tilt sentiment in Bitcoin’s favor, with a possible breakout toward 125,000–128,000 if traditional markets falter.

Conversely, if panic spreads and investors rush to cash, $Bitcoin could briefly dip under 110,000 before recovering. The real driver will be how investors perceive $BTC: as another risk asset to dump, or as an independent hedge against political dysfunction.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Could Rally Toward $140K as Soaring Volumes and Technical Setups Support Further Gains

Bitcoin Double Retest Near $100K May Signal Rally as MicroStrategy Adds 196 BTC

Bitcoin Core v30 Could Rekindle Debate Over Removing 80-Byte OP_RETURN Limit