New Super PAC Commits Over $100M to Protect US Crypto Leadership

The new Fellowship PAC enters the political arena with a $100 million pledge to defend crypto innovation and leadership, signaling a major shift in the industry’s political clout.

The Fellowship PAC made headlines today after announcing over $100 million in funding for pro-innovation candidates ahead of the United States midterm elections.

Operating independently from Fairshake, this political action committee announced a stated mission to safeguard America’s global competitive edge in the cryptocurrency sector.

A New Crypto Player in Politics

The Fellowship PAC, a new independent expenditure committee, announced today that it has pledged over $100 million to support pro-crypto and pro-innovation candidates.

According to its press release on X, the new Fellowship PAC aims to stand out from other pro-crypto groups like Fairshake and affiliates like Defend American Jobs and Protect Progress by focusing on openness and transparency.

Introducing The Fellowship PAC: launching with $100M+ committed to back pro-innovation, pro-crypto candidates—and keep America #1 in digital assets & entrepreneurship. Built on transparency and trust.

— Fellowship PAC (@Fellowship_PAC) September 15, 2025

“The Fellowship PAC represents the next step in the industry’s evolution-building on the unprecedented momentum that innovators, entrepreneurs, and investors have already created. Unlike past political efforts, the Fellowship PAC’s mission is defined by transparency and trust, ensuring political action directly supports the broader ecosystem rather than narrow or individual interests,” the release read.

Despite its statements, Fellowship has not yet disclosed who is behind its launch or its major backers.

What is certain, however, is that crypto lobbying is becoming increasingly intertwined in American politics.

Crypto’s Growing Political Momentum

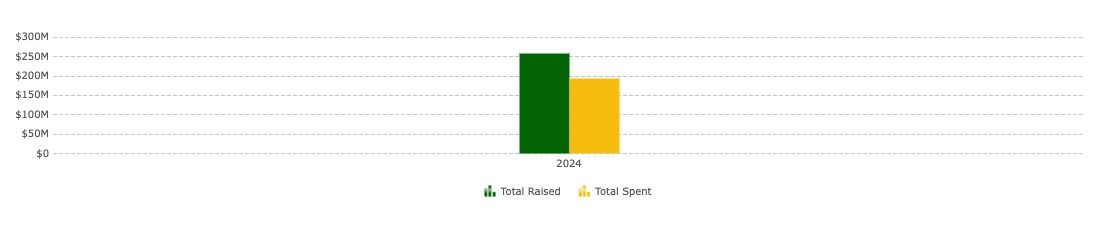

Crypto lobbying had a historic impact on the 2024 US federal elections. According to OpenSecrets, Fairshake—the industry’s leading super PAC—raised over $260 million and spent $195 million to help elect pro-crypto lawmakers.

Total raised and spent by Fairshake PAC in the 2024 election cycle. Source:

OpenSecrets.

Total raised and spent by Fairshake PAC in the 2024 election cycle. Source:

OpenSecrets.

The PAC’s external spending reached over $40 million last year and significantly swayed elections. This contributed to the defeat of several prominent congressional representatives, including Jamaal Bowman of New York, Cori Bush of Minnesota, Katie Porter of California, and Sherrod Brown of Ohio.

Meanwhile, individual billionaires closely tied to the crypto industry spent millions on Donald Trump’s reelection campaign.

This momentum has continued and shows signs of growing as the United States prepares for the November 2026 midterm elections.

In July, a Fairshake spokesperson announced it has $140 million in store for the US midterms. The latest Federal Election Commission (FEC) filing also showed that the super PAC raised more than $59 million in the first half of this year alone. Coinbase was the top contributor, making five donations totaling a little over $33.2 million.

Other notable contributors included Uniswap Labs, which gave just under $1 million, and Ripple Labs, which donated $23 million. Robert Leshner, CEO of Superstate Funds and an investor at Robot Ventures, contributed a little over $300,000, while the Solana Policy Institute donated $10,000.

The addition of the Fellowship PAC and its $100 million commitment demonstrates the crypto industry’s determination to influence American politics. This significant financial move is a strong signal that congressional candidates will not ignore as they enter the next election cycle.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DeFi duo take action again: Curve founder targets BTC, AC prepares all-in-one exchange

Messari Report: USDD 2.0 Over-collateralization Remains Strong, Reserves Peak Exceed $620 Million

The Messari report analyzes the latest developments of USDD 2.0, including multi-chain ecosystem expansion, over-collateralization mechanisms, PSM, and innovative designs such as smart allocators, demonstrating its robust growth and long-term value potential. Summary generated by Mars AI This summary is generated by the Mars AI model, and the accuracy and completeness of its content are still undergoing iterative updates.

Full Text of Arthur Hayes' Speech in South Korea: War, Debt, and Bitcoin—Opportunities Amid the Money Printing Frenzy

This article summarizes Arthur Hayes' key viewpoints at the KBW 2025 Summit, stating that the United States is heading towards a politically driven “money-printing frenzy.” It details the mechanisms of financing reindustrialization through Yield Curve Control (YCC) and commercial bank credit expansion, emphasizing the potentially significant impact this could have on cryptocurrencies.

Full statement from the Reserve Bank of Australia: Interest rates remain unchanged, more time needed to assess the effects of previous rate cuts

Australia's financial environment has become more accommodative and certain effects are already evident, but it will still take time to see the full impact of earlier interest rate cuts. The bank believes it should remain cautious and continually update its outlook as new data emerges.