This Historical Recurrence Suggests Bitcoin Price May Not Slip Below $110,000

Bitcoin shows signs of stability above $110,000, but historical recurrence suggests extended consolidation may follow before any sustained rally

Bitcoin is attempting a recovery after recent volatility, with prices stabilizing above key support levels.

The crypto king is benefiting from steadier market conditions, though signs point toward a phase of consolidation rather than an extended rally. Historical trends suggest Bitcoin may be entering a familiar cooling-off period.

Bitcoin Risk Is Reducing

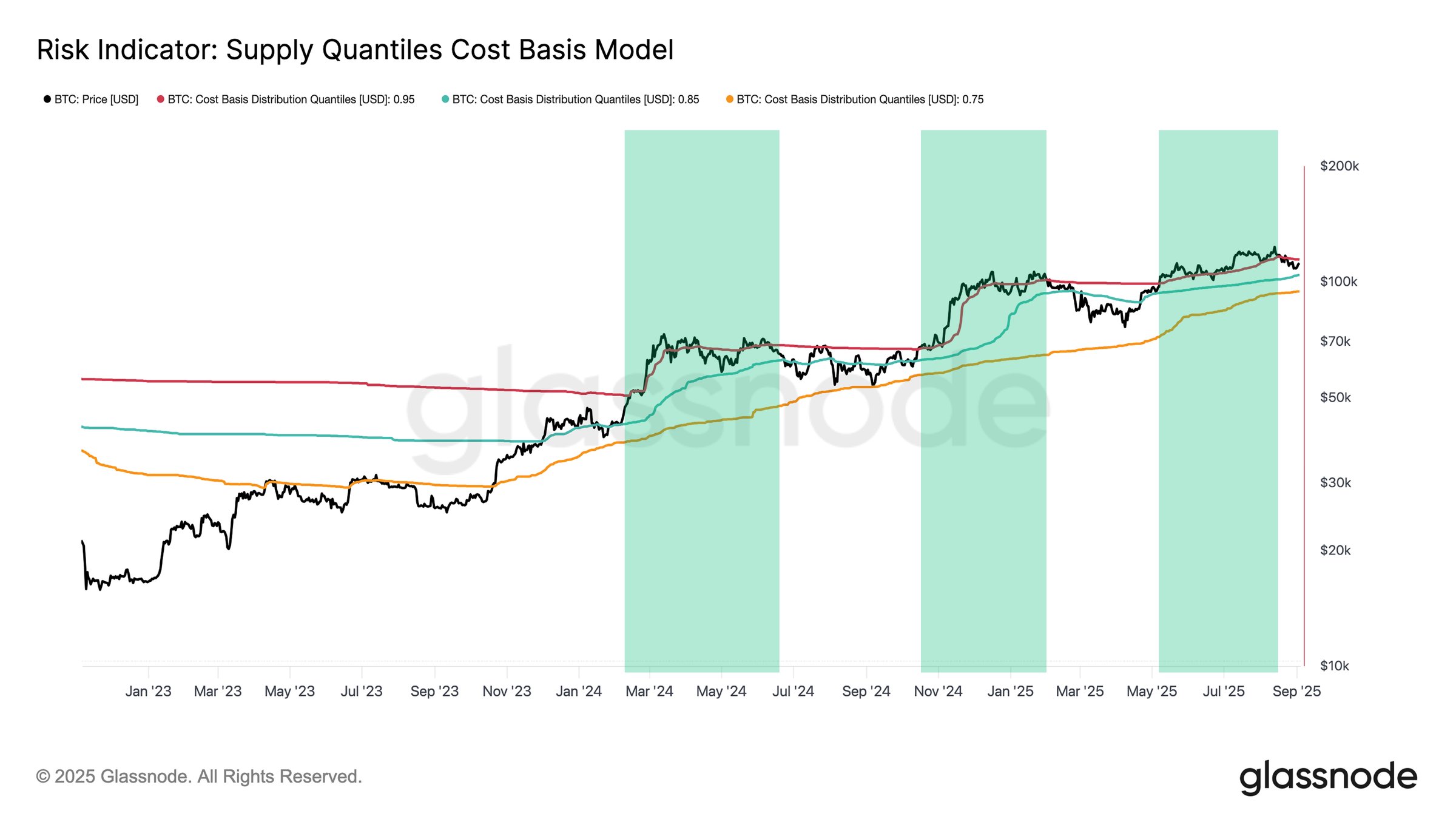

The supply quantiles risk indicator highlights this development. Bitcoin’s mid-August rally to new highs marked the third multi-month euphoric phase of this cycle, defined by surging momentum that placed nearly all supply in profit. This behavior is reflected by the 0.95 quantile cost basis, where 95% of supply holds unrealized gains.

The latest euphoric phase lasted about 3.5 months before demand showed exhaustion. At present, Bitcoin trades between the 0.85 and 0.95 quantile cost basis, or roughly $104,100 to $114,300. Historically, this range has functioned as a consolidation corridor following euphoric peaks, producing sideways action as buyers and sellers balance.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Bitcoin Supply Quantiles CBM. Source:

Glassnode

Bitcoin Supply Quantiles CBM. Source:

Glassnode

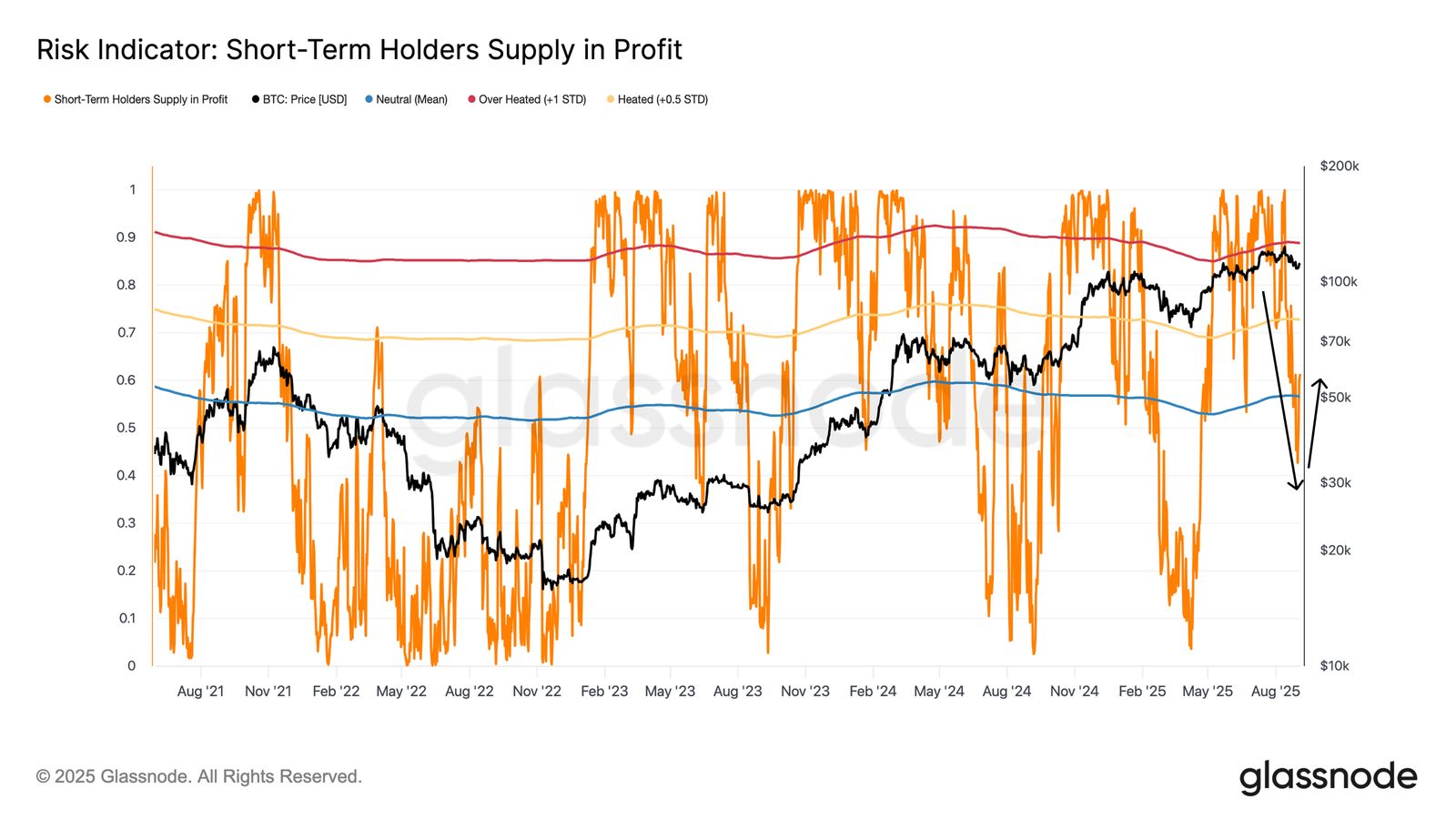

The percentage of short-term holder supply in profit offers further clarity. As Bitcoin slipped to $108,000, the share of short-term supply in profit collapsed from above 90% to just 42%. This sharp reversal reflected fear-driven selling, a common feature of overheated markets.

Following that drawdown, exhausted sellers fueled a rebound to $112,000. Currently, more than 60% of short-term holders are back in profit, a neutral condition compared to recent extremes. However, confidence remains fragile.

A sustained recovery above $114,000–$116,000, where over 75% of short-term holder supply would be profitable, is needed to restore stronger demand.

Bitcoin Short-Term Holders Supply in Profit. Source:

Glassnode

Bitcoin Short-Term Holders Supply in Profit. Source:

Glassnode

BTC Price May Witness Extended Consolidation

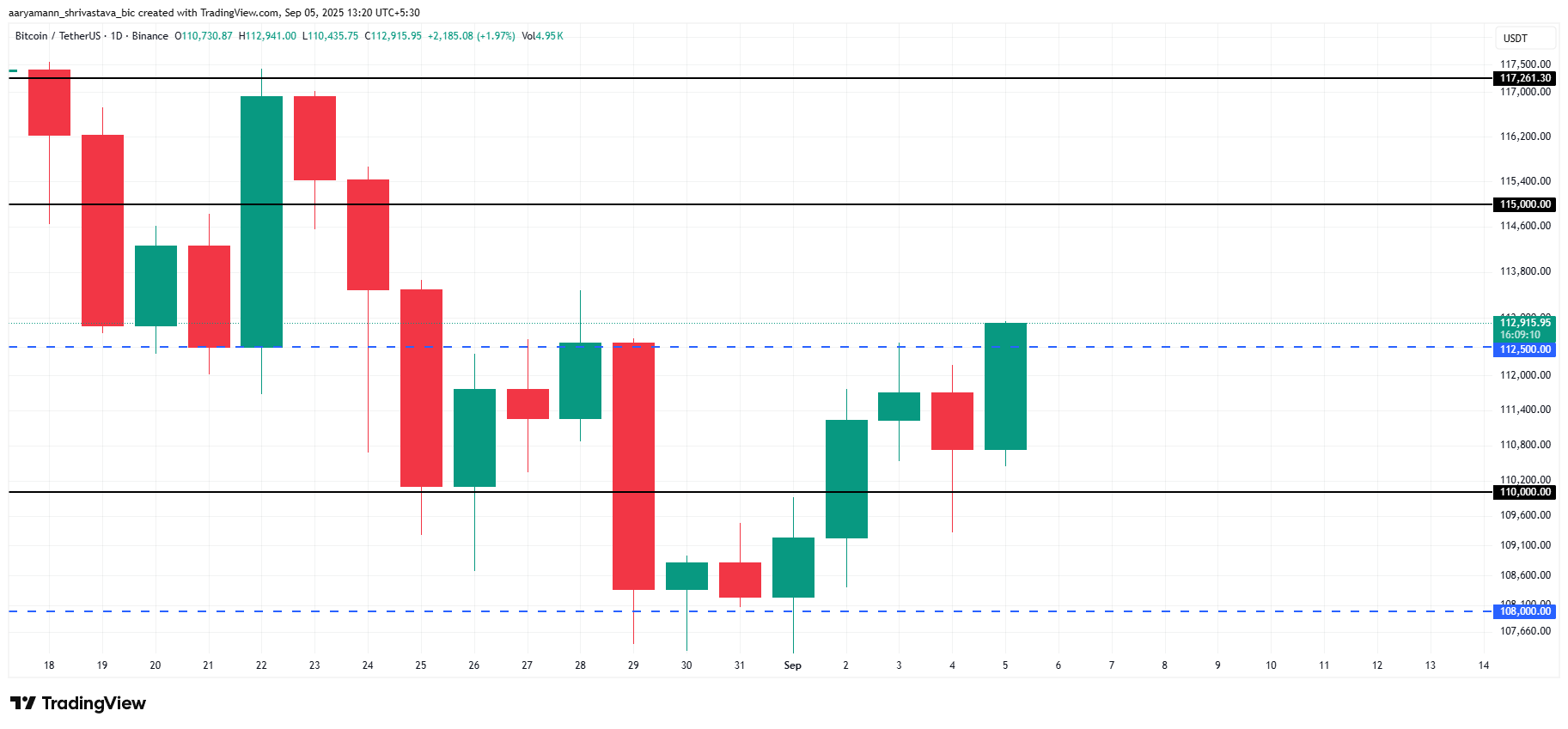

Bitcoin crossing the $112,500 resistance is encouraging, providing a path toward $115,000. This level is crucial for attracting new capital inflows, which would validate the recovery and increase the likelihood of sustained upward momentum.

However, historical patterns suggest consolidation remains likely. Bitcoin may settle under $115,000 or slip below $112,500, with sideways price action dominating the short term as the market absorbs recent volatility.

“This level of price consolidation is healthy and should be read as strength. We’re seeing deep liquidity from institutions, derivative positioning, and spot accumulation from long-term holders absorbing supply, which creates a solid base. Periods of stability in Bitcoin often lead to major moves and are rarely signs of capped upside. In fact, a $100K+ floor makes Bitcoin feel less like a high-beta trade and more like a global reserve asset in the making,” Vikrant Sharma, CEO of CakeWallet told BeInCrypto.

Bitcoin Price Analysis. Source:

TradingView

Bitcoin Price Analysis. Source:

TradingView

If profit-taking accelerates, Bitcoin could face sharper declines. A drop back to $110,000, or even a loss of this support, would weaken sentiment and invalidate the bullish thesis, leaving BTC vulnerable to extended consolidation or further downside.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

InfoFi Faces a Slump: Rule Upgrades, Shrinking Yields, and Platform Transformation Dilemma

Creators and projects are leaving the InfoFi platform.

TRON Leads Blockchain Fees in 30 Days, Surpassing Ethereum by 28%

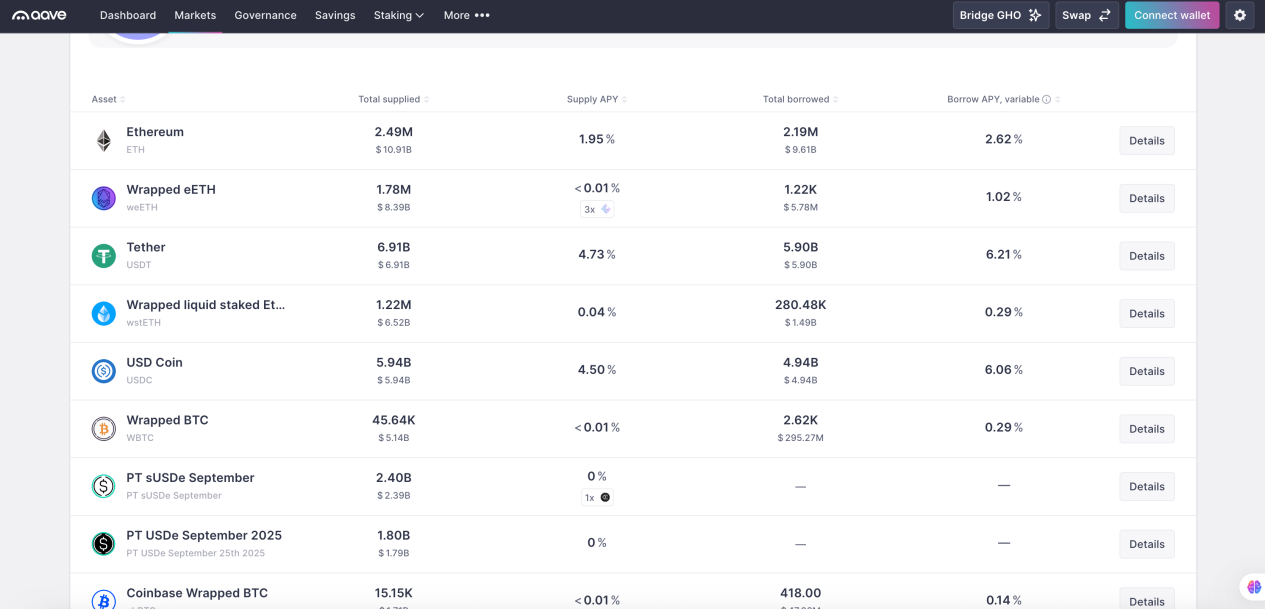

DeFi Beginner’s Guide (Part 1): How AAVE Whales Use $10 Million to Arbitrage Interest Rate Spreads and Achieve 100% APR

A quick introduction to DeFi, analyzing the returns and risks of different strategies based on real trading data from DeFi whales.

![[Bitpush Daily News Selection] Trump Media completes acquisition of 684 million CRO tokens worth about $178 million; Ethena Foundation launches new $310 million buyback plan; Vitalik Buterin: Low-cost stablecoin transactions remain one of the core values of cryptocurrency; Spot gold rises to $3,600, hitting a new all-time high](https://img.bgstatic.com/multiLang/image/social/28ccebdba840f2fa20c951ded37503be1757072702741.png)