[Bitpush Daily News Selection] Trump Media completes acquisition of 684 million CRO tokens worth about $178 million; Ethena Foundation launches new $310 million buyback plan; Vitalik Buterin: Low-cost stablecoin transactions remain one of the core values of cryptocurrency; Spot gold rises to $3,600, hitting a new all-time high

Bitpush editors’ daily selection of Web3 news:

[Trump Media completes acquisition of 684 million CRO tokens, worth approximately $178 million]

According to Bitpush, Trump Media & Technology Group (Trump Media, ticker DJT) announced the completion of a transaction with Crypto.com, acquiring 684.4 million Cronos (CRO) tokens at approximately $0.15 per token. The deal was structured as 50% cash and 50% stock swap, valued at about $178 million, accounting for roughly 2% of CRO’s circulating supply. This partnership will facilitate the integration of CRO into the rewards systems of the Truth Social and Truth+ platforms, with institutional-grade custody provided by Crypto.com. Previously, Trump Media also established the Trump Media Group CRO Strategy, planning to create a digital asset treasury company centered on CRO through a merger with Yorkville Acquisition Corp.

[Ethena Foundation launches new $310 million buyback plan]

According to Bitpush, Ethena announced an additional $530 million StablecoinXPIPE transaction, and the foundation has launched a new $310 million open market buyback plan.

On July 21, stablecoin issuer StablecoinX announced the completion of a $360 million financing round to acquire ENA tokens, and plans to list Class A common stock on the Nasdaq Global Market under the ticker USDE. Among them, the Ethena Foundation will contribute ENA tokens worth $60 million.

To initiate the acquisition plan, StablecoinX will use the $260 million net cash proceeds from the financing (after deducting related fees) to purchase locked ENA tokens from a subsidiary of the Ethena Foundation.

[Vitalik Buterin: Low-cost stablecoin transactions remain one of crypto’s core values]

According to Bitpush, Ethereum co-founder Vitalik Buterin stated that low-cost stablecoin transactions remain one of the most important large-scale value sources in the current crypto industry. He also mentioned his excitement about Codex joining the Ethereum L2 ecosystem and acknowledged the project’s emphasis on synergy with Ethereum L1 since its inception.

[Spot gold rises to $3,600, setting a new all-time high]

According to Bitpush, spot gold rose 1.5%, reaching a high of $3,600.15 per ounce, setting a new all-time high. Year-to-date, spot gold has increased by $976, a gain of 37%.

[US SEC and CFTC to hold joint roundtable on September 29, focusing on crypto asset regulatory coordination]

According to Bitpush and official sources, the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) issued a joint statement today, announcing a joint roundtable to be held on September 29, 2025, from 1:00 to 5:00 p.m. (ET), to explore opportunities for regulatory coordination.

SEC Chairman Paul Atkins and CFTC Acting Chair Caroline Pham stated that the two agencies will work closely together to provide clarity for the market and turn the unique U.S. regulatory structure into an advantage for market participants, investors, and the public.

The statement noted that the previous joint staff statement on spot crypto asset products was only the first step. The two agencies will consider coordinating product and trading platform definitions, streamlining reporting and data standards, unifying capital and margin frameworks, and establishing coordinated innovation exemption mechanisms to better serve the public interest.

[Strategy not included in S&P 500 Index]

According to Bitpush, the company Strategy, founded by Michael Saylor, failed to be included in the S&P 500 Index.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

InfoFi Faces a Slump: Rule Upgrades, Shrinking Yields, and Platform Transformation Dilemma

Creators and projects are leaving the InfoFi platform.

TRON Leads Blockchain Fees in 30 Days, Surpassing Ethereum by 28%

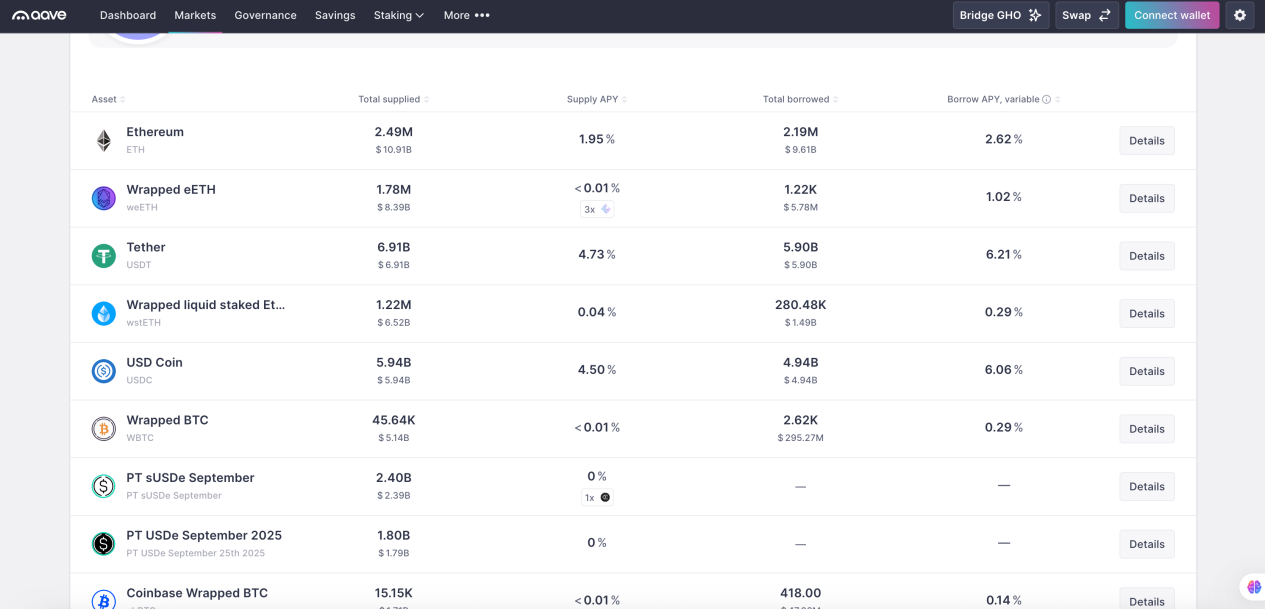

DeFi Beginner’s Guide (Part 1): How AAVE Whales Use $10 Million to Arbitrage Interest Rate Spreads and Achieve 100% APR

A quick introduction to DeFi, analyzing the returns and risks of different strategies based on real trading data from DeFi whales.

Rate Cuts Could Spur Bitcoin Gains as Analysts Forecast Multiple Fed Cuts in 2025