New York Fed Survey: Corporate AI Adoption Rate Rises, No Significant Impact on Employment Yet

A new study by the New York Fed shows that the number of companies using artificial intelligence (AI) has increased significantly over the past year and is expected to continue growing, but so far, few companies have laid off employees as a result.

The study found that about 40% of service sector companies reported using AI to handle tasks, up from 25% last year. This proportion is expected to continue rising, as 44% of companies said they plan to use AI in the next six months.

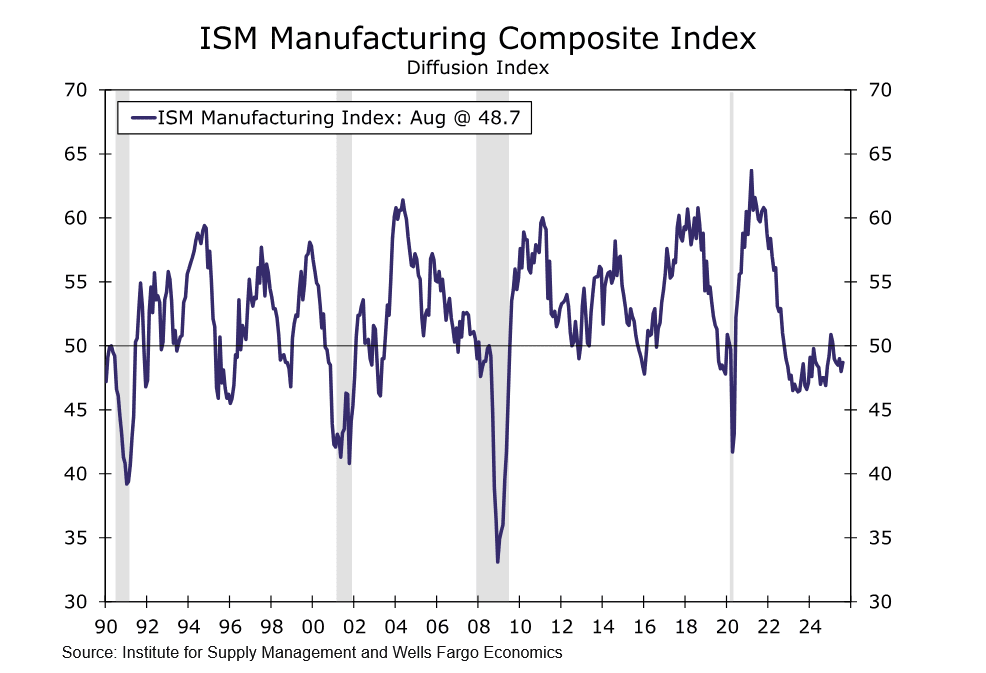

The use of this tool has also expanded to 26% of manufacturers, and about one-third said they will use it in the next six months. The study is based on a survey of businesses in the New York–Northern New Jersey area.

As artificial intelligence becomes more widespread, economists and policymakers are discussing its impact on the economy, especially changes to the labor force structure. Federal Reserve Chair Jerome Powell told lawmakers at the end of June that it is "clear" the tool could bring "truly enormous changes," but there is still great uncertainty about the timing and overall impact.

Several surveys have found that companies mainly use the tool to save time on routine tasks, so the impact on employees is still difficult to measure. Service sector companies surveyed by the New York Fed said they mainly use AI for information retrieval, while manufacturing companies use it for marketing and advertising.

More than half of companies in the information, finance, and professional and business services sectors reported using AI, but no companies in the agriculture sector reported using it.

The study shows: "While layoffs due to artificial intelligence are uncommon, service sector companies expect to see more layoffs in the coming months."

About 13% of companies expect to lay off employees in the next six months, but researchers noted that this proportion is the same as the percentage of companies that reported plans to lay off employees last year, and few actually followed through. In addition, about 11% of service sector companies said that the use of artificial intelligence has led them to hire more employees.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Price Warning: Why a 50% Crash May Be Unstoppable?

Bitcoin may not be ready for what’s coming next. Charts indicate that Bitcoin could face a nearly 50% plunge, much closer than most people expect.

Betting on XRP’s 2017-style gains could be extremely risky in 2025

Trump Opens 401(k) Investments to Crypto: What Are the Implications?

Crypto assets are being considered for inclusion in the most important wealth management systems in the United States.

Asia Bitcoin Summit: Eric Trump on Crypto and Freedom