Bitcoin Price Warning: Why a 50% Crash May Be Unstoppable?

Bitcoin may not be ready for what’s coming next. Charts indicate that Bitcoin could face a nearly 50% plunge, much closer than most people expect.

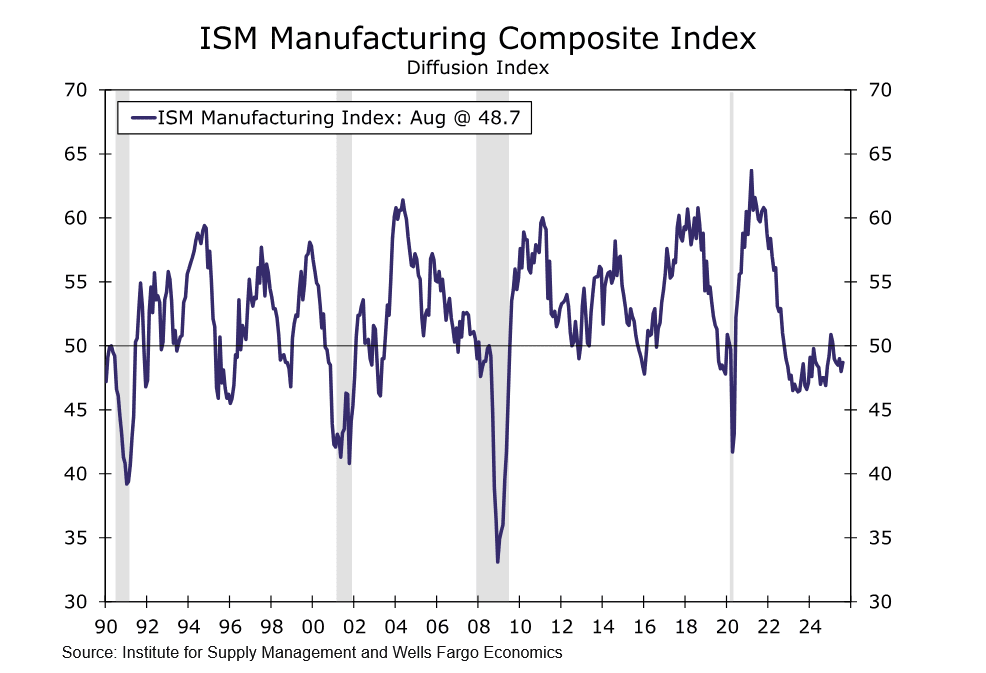

Bitcoin price is currently in an unstable state. The latest ISM manufacturing data indicates that the US economy has contracted for the sixth consecutive month, while tariffs, higher costs, and heavy tax burdens are weighing heavily on businesses and households. For risk assets like BTC price, this backdrop is harmful. The charts have already shown weakness, and if these conditions persist, the probability of a crash exceeding 50% is no longer out of reach—this is a very real risk.

Bitcoin Price Prediction: Manufacturing Contraction and Economic Weakness

The ISM Manufacturing Index stands at 48.7, indicating that US manufacturing has been in contraction for six consecutive months. Manufacturing is a core driver of the economic cycle. When it weakens, it usually signals a broader slowdown in economic growth. Although new orders have increased, production has dropped sharply, delivery times are longer, and inventories are rising.

This suggests companies are reducing production, inventories are piling up, and supply chains are clogged. Historically, this scenario aligns with risk-off behavior in financial markets, as investors flee from risk assets like Bitcoin price.

Tariffs, Costs, and Pessimism

Manufacturers are caught in tariff uncertainty. Higher material costs, unpredictable trade policies, and procurement issues are reducing investment in new equipment and forcing layoffs. This is not just an industry problem—it also amplifies broader economic pessimism. When businesses contract, capital markets tighten. Bitcoin thrives in environments with ample liquidity and high risk appetite. If tariffs and trade wars push investors toward defensive assets, BTC demand could dry up rapidly.

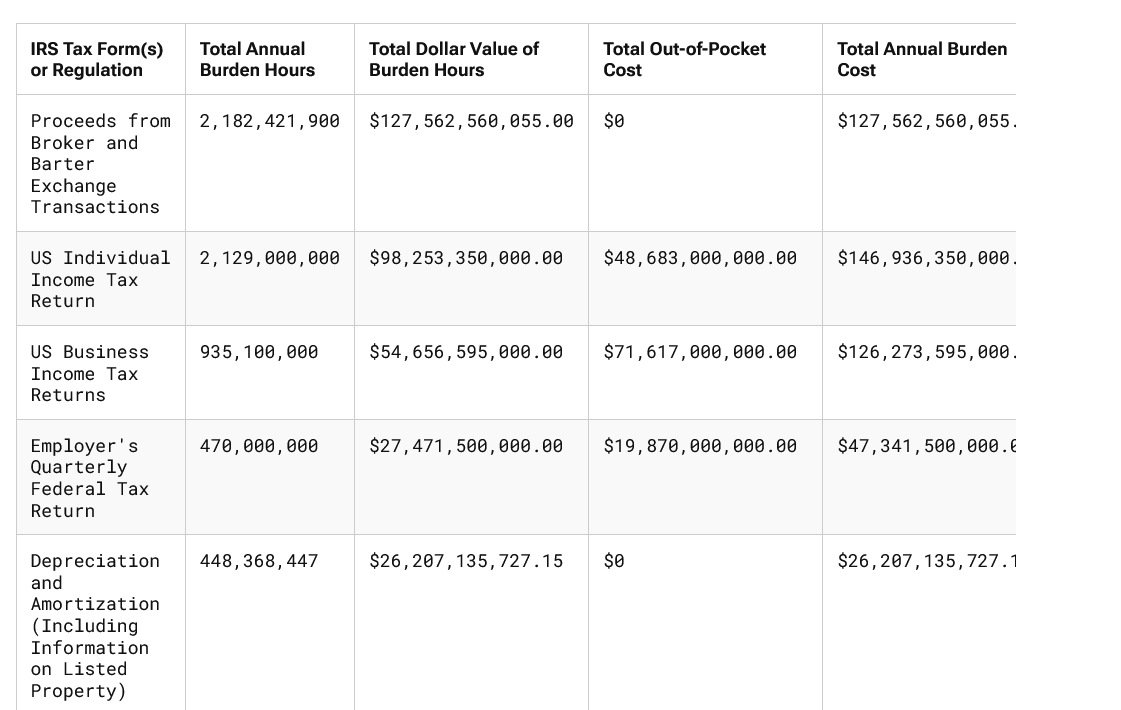

The Burden of Taxes and Compliance Costs

Tax Compliance Burden in the US for 2025: Source: Tax Foundation

Tax Compliance Burden in the US for 2025: Source: Tax Foundation According to the Tax Foundation’s Tax Complexity Report, tax law analysis adds another layer. In 2025, Americans will spend 7.1 billion hours on tax compliance, causing an economic loss of about $536 billions—almost 2% of GDP. This is a huge drag on productivity and consumption. Combine this with high interest rates and a weak manufacturing base, and you see an economy losing growth momentum. For Bitcoin price, this means less disposable income flowing into speculative investments. One of the core supports for Bitcoin price—retail demand—could collapse.

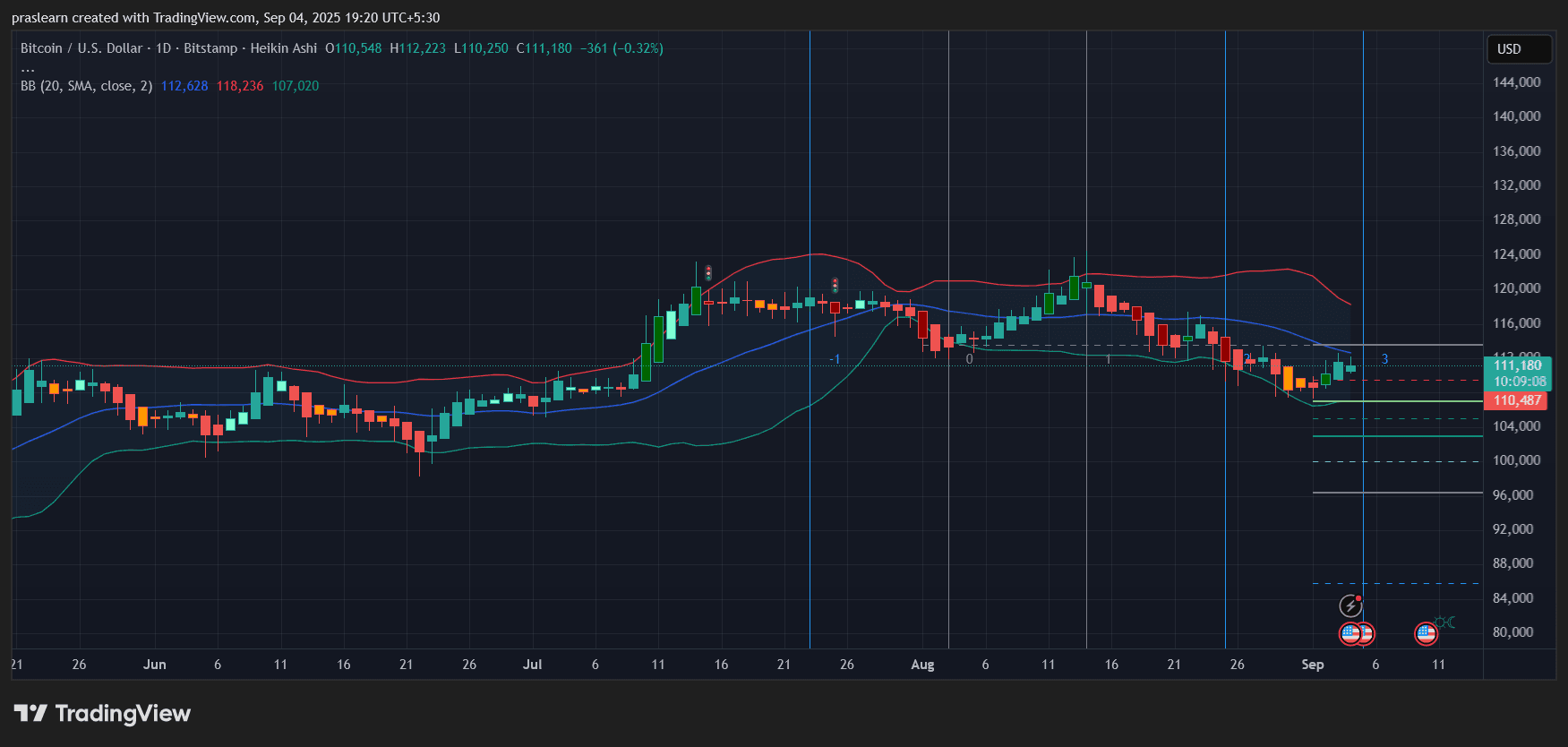

Bitcoin Price Prediction: What Does the BTC Price Chart Show?

BTC/USD Daily Chart- TradingView

BTC/USD Daily Chart- TradingView Looking at the BTC daily chart:

Bitcoin price is trading at $111,180, hovering near the middle line of the Bollinger Bands. Since mid-July, BTC has been declining from a high of $124,000. It briefly tested support around $107,000 and is now consolidating above that area. The Bollinger Bands are narrowing, indicating compression that usually precedes sharp volatility.

If BTC price fails to hold $107,000, the next clear support levels are at $100,000, $96,000, and then $88,000. Breaking through these would confirm a bearish cascade.

A drop to the lower end of the projected support (around $80,000–$85,000) would mean a decline of more than 50% from the recent high.

Bitcoin Price Prediction: Why Is a 50% Crash Possible?

If economic contraction intensifies: institutional investors will reduce exposure to speculative assets. Retail demand will shrink under higher living costs and tax burdens.

Tariff uncertainty will continue to hurt business sentiment and drag the stock market lower. Bitcoin, being correlated with tech and growth assets, will follow suit.

From a technical perspective, Bitcoin price is already in a descending structure. A break below $107,000 could trigger panic selling.

Conclusion

The ISM report, combined with tax burdens and high interest rates, paints a picture of an economy under pressure. The Bitcoin price chart shows not resilience but fragility, with multiple weak supports ahead. If conditions remain unchanged—manufacturing contraction, unresolved tariffs, and persistent tax drag—$BTC could easily crash by 50% or more in the coming months. If macro conditions deteriorate further, the $80,000–$85,000 area looks like a realistic target.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Government bond yields are pressuring everything, from home loans to equities

Share link:In this post: Government bond yields are rising fast, making it more expensive for countries to borrow and service debt. Mortgage rates are surging in the U.S., as 30-year Treasury yields jump past 5%. Stock markets are under pressure, with higher bond yields driving down equity valuations.

Thinking of buying gold for the first time? Here’s what you need to do

Share link:In this post: Investors are rushing to gold due to global wars, Fed uncertainty, and inflation fears. Major gold mining stocks like Newmont and Agnico Eagle are up over 80% this year. Spot gold is near $3,600/oz, with ETFs like GLD and IAU seen as the best way to invest.

Interest Rate Cuts and Liquidity Shift: How to Position Risk Assets for the “Roaring Twenties”?

The high volatility brought by the price surge, combined with bullish narratives, will boost market confidence, expand risk appetite, and ultimately lead to frenzy.