Complacent tech investors face a reality check

In today’s market, both bulls and bears seem to find some support—or perhaps, neither side can find any clear support.

Investors are closely watching the confirmation process for Federal Reserve candidate Stephen Miran, nominated by President Trump. The progress of this process could continue to push up U.S. Treasury yields: over the past week, yields have risen as investors worry about the Fed’s independence and surging government debt, putting pressure on the stock market.

Goldman Sachs’s view that “gold prices could rise to $5,000 per ounce” has also failed to boost market sentiment; in addition, this morning’s ADP employment report was similarly lackluster, offering no highlights.

Perhaps, for the bulls, there is simply no good news in today’s market.

Salesforce (stock code: CRM), C3.ai (stock code: AI), Figma (stock code: FIG), and other core artificial intelligence (AI) companies released earnings reports that fell short of market expectations, causing their stock prices to plunge sharply today.

Wall Street professionals told me that the once red-hot AI trading frenzy may now be “losing its luster.”

Market Overview

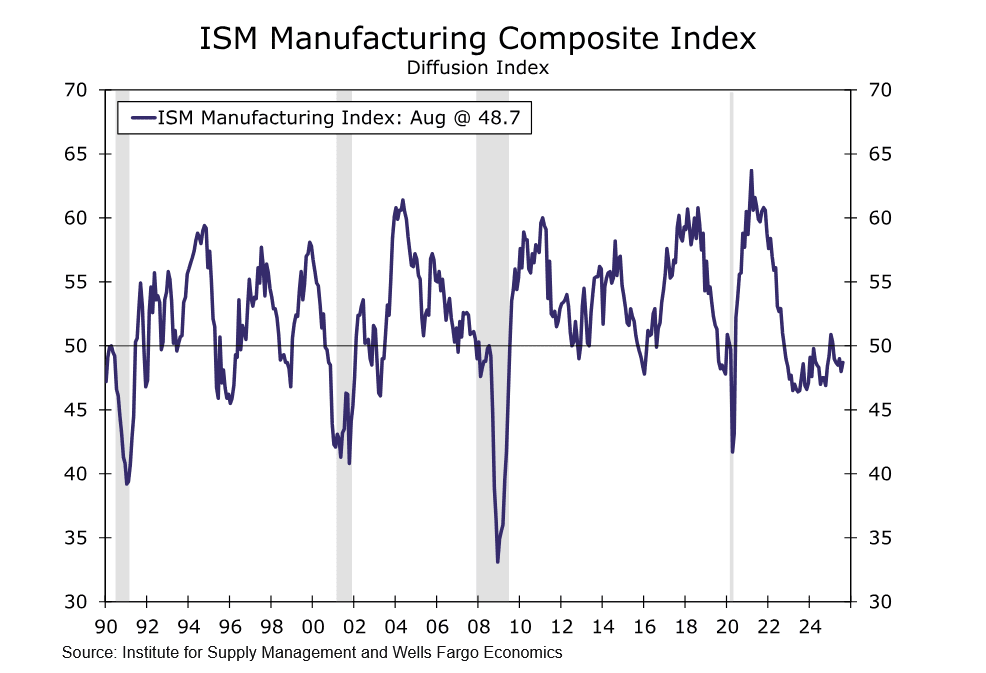

Everything revolves around the Federal Reserve

The current market is near historic highs, and there is only one core reason behind this: investors believe the Federal Reserve will not only cut rates in the coming weeks but will also maintain a rate-cutting path throughout 2026. However, top investors have told me that the market’s expectations for this outlook may be overly optimistic—because monetary policy remains a potential risk factor for inflation. Therefore, analyzing economic data such as today’s ADP employment report is particularly important. The report shows that only 54,000 jobs were added in the U.S. in August, setting the stage for tomorrow morning’s official employment report (which is also expected to be weak). The general market expectation for the official report is that about 80,000 jobs will be added in August.

If the AI trading frenzy fades, where will the market go?

The strong performance of the market in 2025 has been largely driven by optimism in the AI sector. Now, this extreme optimism is facing a severe test. The earnings reports from Salesforce, C3.ai, Figma, and others failed to surprise the market, causing their stock prices to fall sharply today—clearly, the optimistic tone set during their earnings calls was not enough to mask the weak results revealed in the reports. Given the apparent slowdown in U.S. economic growth, Wall Street’s concerns about “the pace of enterprise AI demand growth” are mounting.

Gold’s strong weekly performance

Driven by investor concerns over the inflation outlook, gold prices have continued to hit record highs. Over the past year, gold prices have risen by about 42%, with today’s trading price around $3,600 per ounce. Goldman Sachs says the gold rally is just beginning! Samantha Dart, co-head of commodities research at Goldman Sachs, wrote in a report: “If private investors significantly increase their allocation to gold, we believe gold prices could break through our baseline target of $4,000 per ounce by mid-2026. Therefore, gold remains our most confident bullish recommendation.” Dart also pointed out that if governments increase their gold purchases, it is not out of the question for gold prices to reach $5,000 per ounce.

Stock Analysis: C3.ai

A few weeks ago, C3.ai issued an early warning of poor quarterly results; now, after the full earnings report has been released, its stock price is under further pressure. The company’s earnings call was not only brief but also lacked any optimism—the newly appointed CEO, who took office last night, is working on new plans, and the company has withdrawn its full-year guidance.

The new CEO, Stephen Ehikian, previously served in the Trump administration as a key figure in the Department of Government Efficiency (DOGE), responsible for cutting government spending (especially on government office building leases). In addition, he has a strong background in the tech industry (having sold two companies to Salesforce), which has helped him facilitate large-scale AI collaborations between private enterprises and the government.

Ehikian said on the “Opening Bid” program: “Frankly, I am familiar with the federal government procurement process and understand the key focus areas for AI applications. I believe this perspective will give C3.ai a unique advantage in driving business growth with the federal government as well as state and local governments.”

Ehikian will replace company founder Thomas Siebel as CEO. Siebel announced in July that he would step down as CEO due to an autoimmune disease that has caused “severe vision impairment.”

Judging by his resume, Ehikian is undoubtedly a good choice. But he must act quickly to restore investor confidence.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Price Warning: Why a 50% Crash May Be Unstoppable?

Bitcoin may not be ready for what’s coming next. Charts indicate that Bitcoin could face a nearly 50% plunge, much closer than most people expect.

Betting on XRP’s 2017-style gains could be extremely risky in 2025

Trump Opens 401(k) Investments to Crypto: What Are the Implications?

Crypto assets are being considered for inclusion in the most important wealth management systems in the United States.

Asia Bitcoin Summit: Eric Trump on Crypto and Freedom