XRP Whales vs Long-Term Holders: Who Will Decide The Price Action Path?

XRP whales are accumulating hundreds of millions while long-term holders sell, leaving the token rangebound near $2.81 with $3.00 as the key breakout target

XRP continues to struggle with downward pressure, as its price faces resistance while skeptical holders add to selling pressure. Despite the bearish sentiment, whales have returned to accumulation, countering declines with large purchases.

This tug-of-war between cautious long-term holders and confident whales is shaping XRP’s short-term price trajectory.

XRP Investors Move To Accumulate

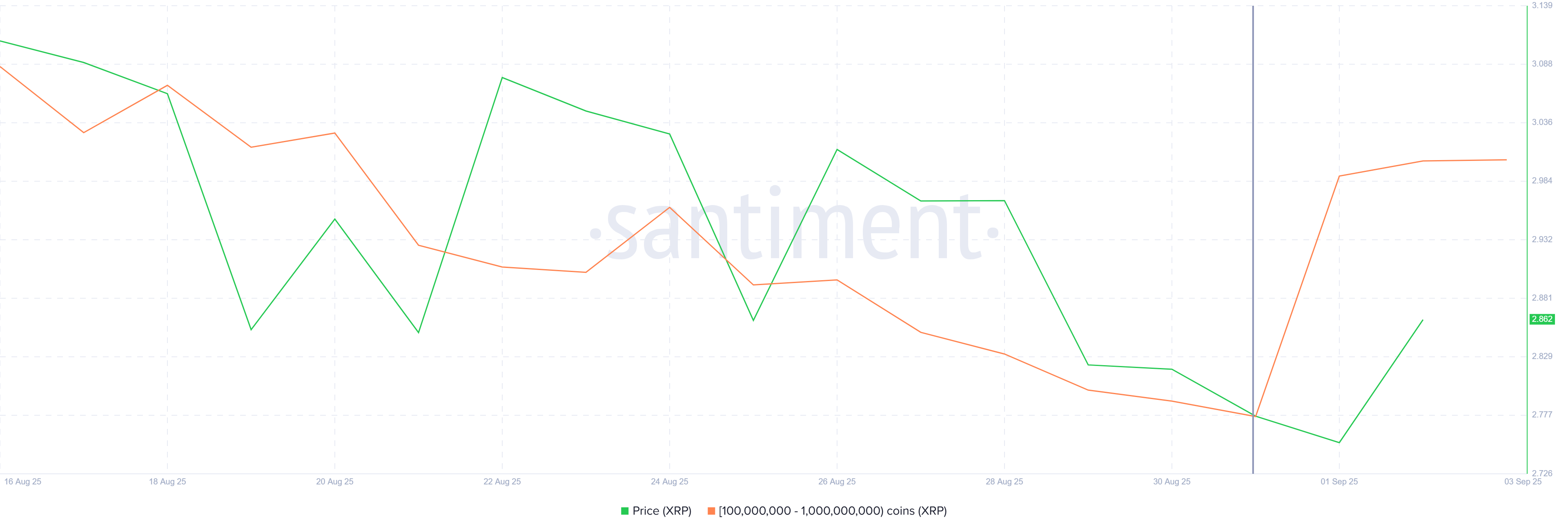

After nearly three weeks of reduced activity, XRP whales are once again accumulating. Data shows that addresses holding between 100 million and 1 billion XRP have purchased more than 400 million tokens over the past three days. At current prices, this accumulation represents an investment exceeding $1.1 billion.

Such significant buying reflects strong confidence among whales that XRP may recover in the near term. Their aggressive accumulation signals optimism, suggesting these influential investors believe current levels present an opportunity.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

XRP Whale Holdings. Source:

Santiment

XRP Whale Holdings. Source:

Santiment

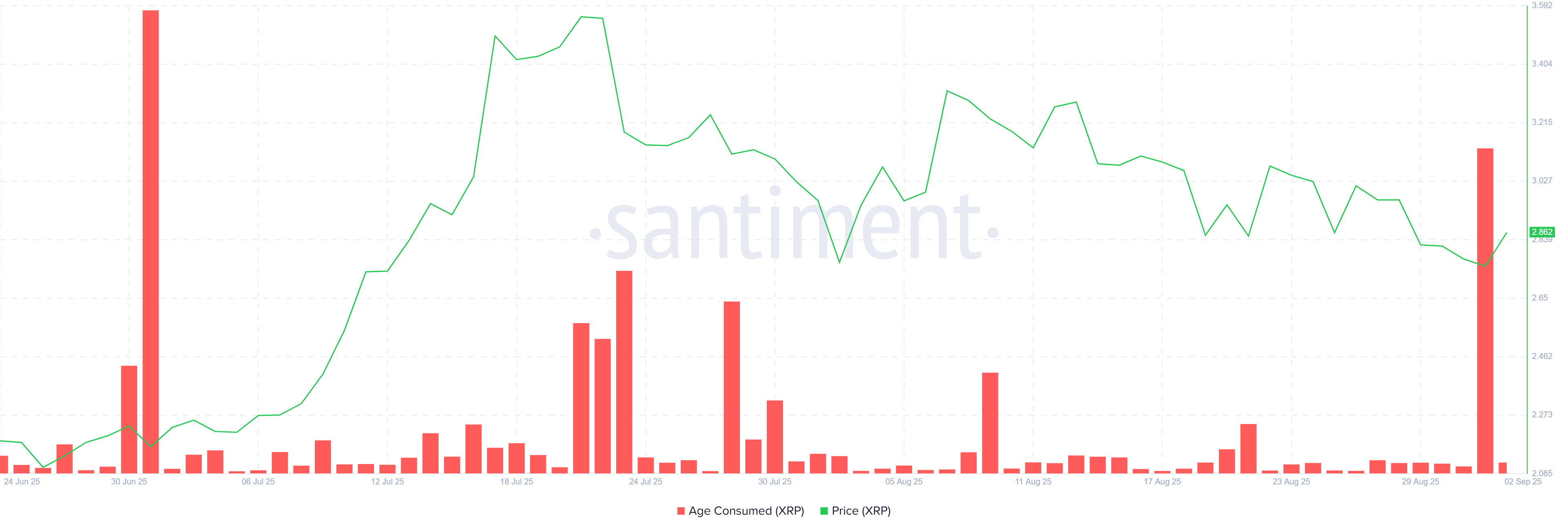

At the same time, long-term holders have shown a different stance. The age consumed metric, which tracks the movement of dormant tokens, has spiked sharply. This suggests long-held XRP is being sold into the market. The current surge is the largest in more than two months, indicating notable distribution.

Historically, such spikes have aligned with price corrections, as selling from long-term holders adds downward pressure. With XRP facing this increased activity, the asset remains vulnerable to declines. Unless whale accumulation outweighs long-term selling, the mixed signals may prevent XRP from building the momentum required for a strong recovery.

XRP Age Consumed. Source:

Santiment

XRP Age Consumed. Source:

Santiment

XRP Price Is Stuck

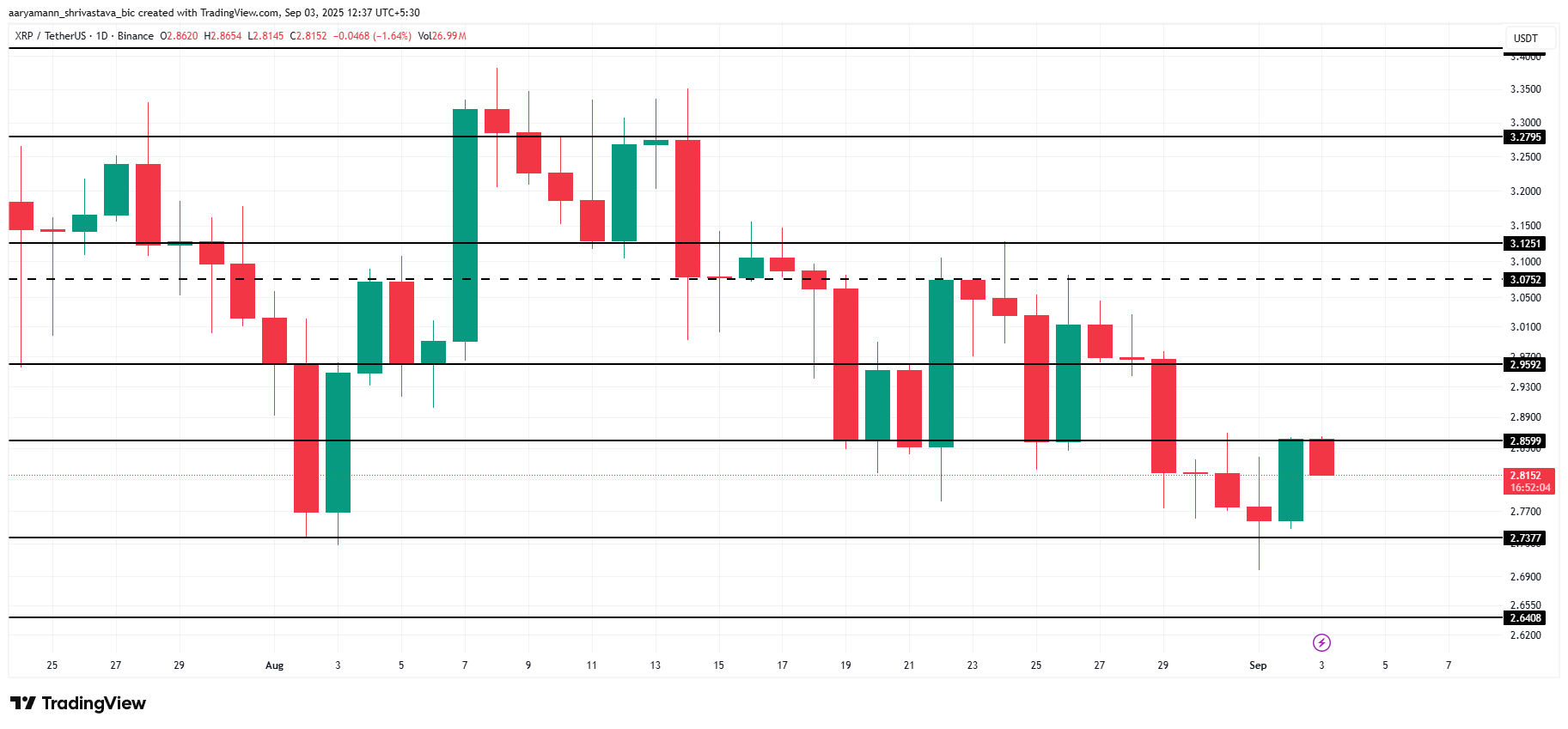

XRP trades at $2.81 at the time of writing, remaining stuck under the $2.85 resistance. The closest support is at $2.73, a level that has repeatedly held. This support zone will likely continue to play a crucial role in stabilizing XRP if selling persists.

With competing signals from whales and long-term holders, XRP may remain rangebound. Consolidation between $2.85 resistance and $2.73 support is likely in the short term.

XRP Price Analysis. Source:

TradingView

XRP Price Analysis. Source:

TradingView

If whales succeed in overpowering long-term selling, XRP could flip $2.85 into support. A breakout toward $2.95 would then be possible, leaving $3.00 as the next critical barrier. A close above this level could mark renewed bullish momentum and signal a shift in market sentiment.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

TRON Leads Blockchain Fees in 30 Days, Surpassing Ethereum by 28%

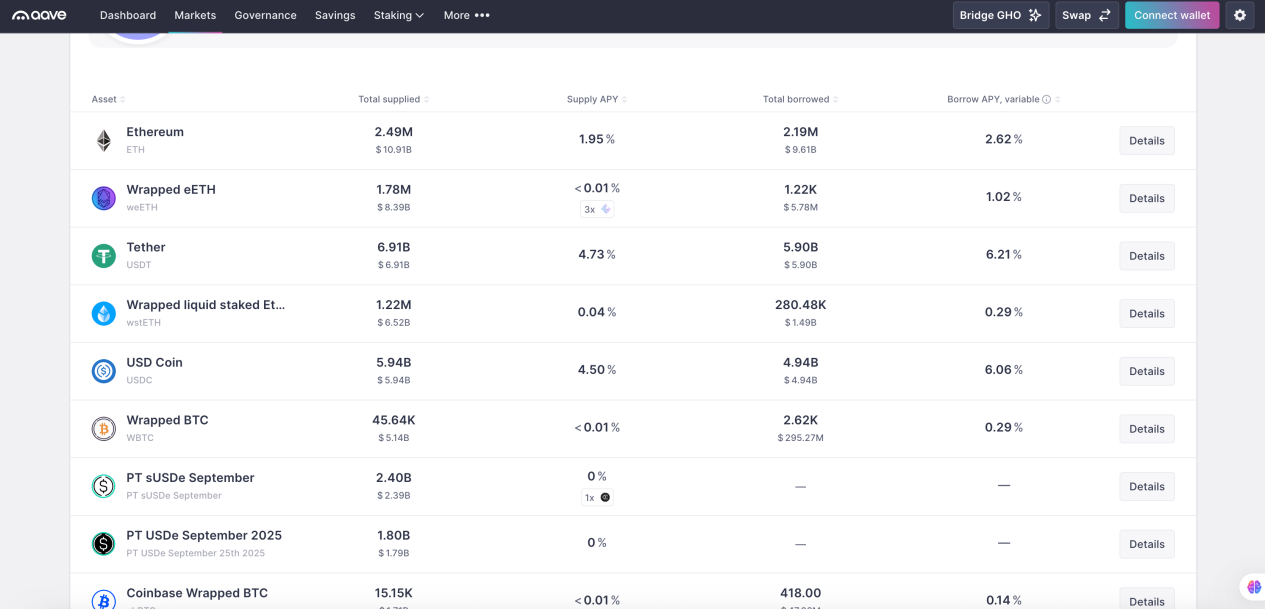

DeFi Beginner’s Guide (Part 1): How AAVE Whales Use $10 Million to Arbitrage Interest Rate Spreads and Achieve 100% APR

A quick introduction to DeFi, analyzing the returns and risks of different strategies based on real trading data from DeFi whales.

Rate Cuts Could Spur Bitcoin Gains as Analysts Forecast Multiple Fed Cuts in 2025

![[Bitpush Daily News Selection] Trump Media completes acquisition of 684 million CRO tokens worth about $178 million; Ethena Foundation launches new $310 million buyback plan; Vitalik Buterin: Low-cost stablecoin transactions remain one of the core values of cryptocurrency; Spot gold rises to $3,600, hitting a new all-time high](https://img.bgstatic.com/multiLang/image/social/28ccebdba840f2fa20c951ded37503be1757072702741.png)