BlackRock Adds $72.9M Bitcoin to Spot ETF

- BlackRock purchases $72.9M Bitcoin for iShares ETF.

- Institutional demand for Bitcoin remains strong.

- Market sees steady Bitcoin ETF inflow trends.

BlackRock, the world’s largest asset manager, acquired $72.9 million worth of Bitcoin for its iShares Bitcoin Trust on September 3, 2025, reinforcing its substantial foothold in the crypto market.

This significant acquisition underscores continued institutional interest in Bitcoin, impacting its market dynamics and affirming the asset’s role in diversified investment strategies.

BlackRock, the world’s largest asset manager, recently expanded its Bitcoin holdings with a net inflow of $72.9 million to its iShares Bitcoin Trust (IBIT) . This move emphasizes ongoing institutional interest in Bitcoin ETFs .

The acquisition was made by BlackRock’s iShares Bitcoin Trust, listed on NASDAQ. Larry Fink, Chairman and CEO of BlackRock, remains silent on this recent purchase, highlighting a focus on strategic asset growth.

Impact of the Acquisition

The impact of this acquisition is centered on increased confidence in Bitcoin as an institutional asset. Investors view the ETF’s rise as evidence of a steady demand curve for physical Bitcoin holdings.

This acquisition further solidifies BlackRock’s position as a dominant player in the institutional Bitcoin space, with historical trends showing similar inflows spur bullish sentiment and price momentum.

Market Reactions

Bitcoin’s price remains above $100,000, driven by ETF inflows and institutional interest. No effects on Ethereum or altcoins are reported from this purchase.

Financial analysts believe that BlackRock’s sustained ETF growth will likely continue influencing Bitcoin’s market dynamics. Over 3.56% of all Bitcoin is now under IBIT’s custody, showcasing a solid institutional backing.

Larry Fink, Chairman and CEO, BlackRock – “BlackRock has declined to comment on recent ETF flows or Bitcoin ETF strategy developments.” Source

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

TRON Leads Blockchain Fees in 30 Days, Surpassing Ethereum by 28%

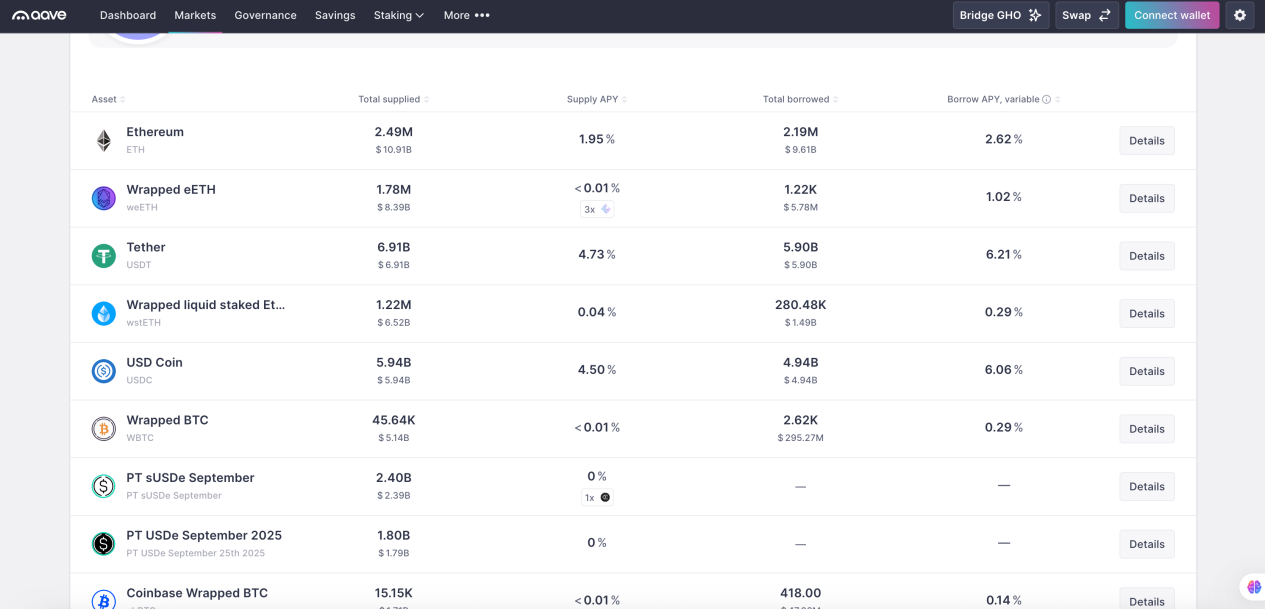

DeFi Beginner’s Guide (Part 1): How AAVE Whales Use $10 Million to Arbitrage Interest Rate Spreads and Achieve 100% APR

A quick introduction to DeFi, analyzing the returns and risks of different strategies based on real trading data from DeFi whales.

Rate Cuts Could Spur Bitcoin Gains as Analysts Forecast Multiple Fed Cuts in 2025

![[Bitpush Daily News Selection] Trump Media completes acquisition of 684 million CRO tokens worth about $178 million; Ethena Foundation launches new $310 million buyback plan; Vitalik Buterin: Low-cost stablecoin transactions remain one of the core values of cryptocurrency; Spot gold rises to $3,600, hitting a new all-time high](https://img.bgstatic.com/multiLang/image/social/28ccebdba840f2fa20c951ded37503be1757072702741.png)