Blockchain lender Figure files for $526m Nasdaq IPO, targets $4.1b valuation

Blockchain lender Figure, led by former SoFi CEO Mike Cagney, seeks to raise $526 million in its IPO

- Figure, a blockchain-based lending firm, filed for an IPO worth as much as $526M

- Co-founder and ex-SoFi CEO Mike Cagney would retain the majority voting power in the firm

Crypto firms are increasingly attracting attention in traditional markets. On Tuesday, Sept. 2, blockchain-based lending company Figure filed for an initial public offering with the U.S. Securities and Exchange Commission, according to Bloomberg. The firm and its backers aim to raise $526 million on the public market.

Figure would debut on the Nasdaq under the ticker FIGR, with an initial price range of $18 to $20 per share. The company will offer 21.5 million shares, while its shareholders will sell 4.9 million. If the company sells its shares at $20, that would put its valuation at about $4.13 billion.

In a 2021 funding round, the company’s valuation reached $3.2 billion. Apollo Global, Ribbit Capital, and 10T Holdings were among its backers. Post-IPO, the company’s co-founder, Mike Cagney, would retain majority voting control.

Figure sees $190.6M in revenues in six months

According to the listing filing, Figure reported revenue of $190.6 million for the six months ended June 30. In the same period, the firm reported net income of $29.1 million. During the same period a year earlier, the company reported $156 million in revenue and a $15.6 million loss.

The firm started out with home-equity lines of credit products and also offered crypto-backed loans. So far, the company has facilitated $16 billion in loans on the blockchain.

Its co-founder, Mike Cagney, is the ex-CEO of the U.S.-based fintech firm SoFi, which focused on creating a “super-app” for finance. He left SoFi in 2017 amid allegations of sexual harassment. He launched Figure shortly after, in 2018, to focus on blockchain-based lending.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

TRON Leads Blockchain Fees in 30 Days, Surpassing Ethereum by 28%

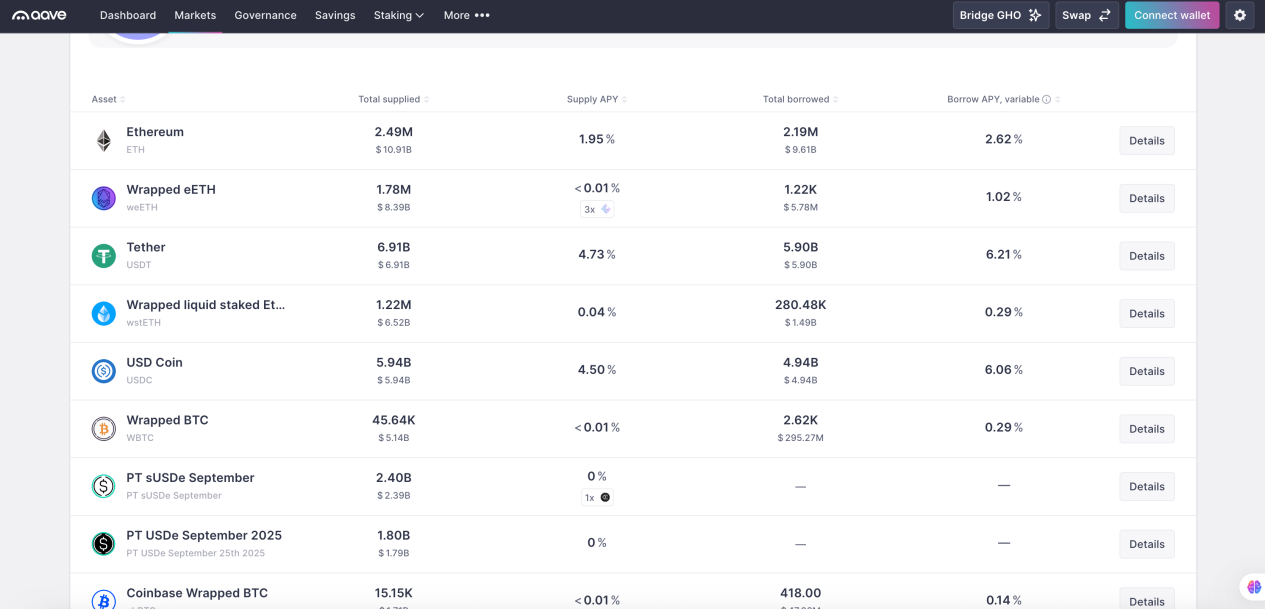

DeFi Beginner’s Guide (Part 1): How AAVE Whales Use $10 Million to Arbitrage Interest Rate Spreads and Achieve 100% APR

A quick introduction to DeFi, analyzing the returns and risks of different strategies based on real trading data from DeFi whales.

Rate Cuts Could Spur Bitcoin Gains as Analysts Forecast Multiple Fed Cuts in 2025

![[Bitpush Daily News Selection] Trump Media completes acquisition of 684 million CRO tokens worth about $178 million; Ethena Foundation launches new $310 million buyback plan; Vitalik Buterin: Low-cost stablecoin transactions remain one of the core values of cryptocurrency; Spot gold rises to $3,600, hitting a new all-time high](https://img.bgstatic.com/multiLang/image/social/28ccebdba840f2fa20c951ded37503be1757072702741.png)