Ethereum whale accumulation is the ongoing transfer of ETH from retail wallets into large addresses, signaling strengthening demand by long-term holders; growing whale balances versus shrinking retail supplies often precede major rallies and suggest a market shift from speculative to institutional control.

-

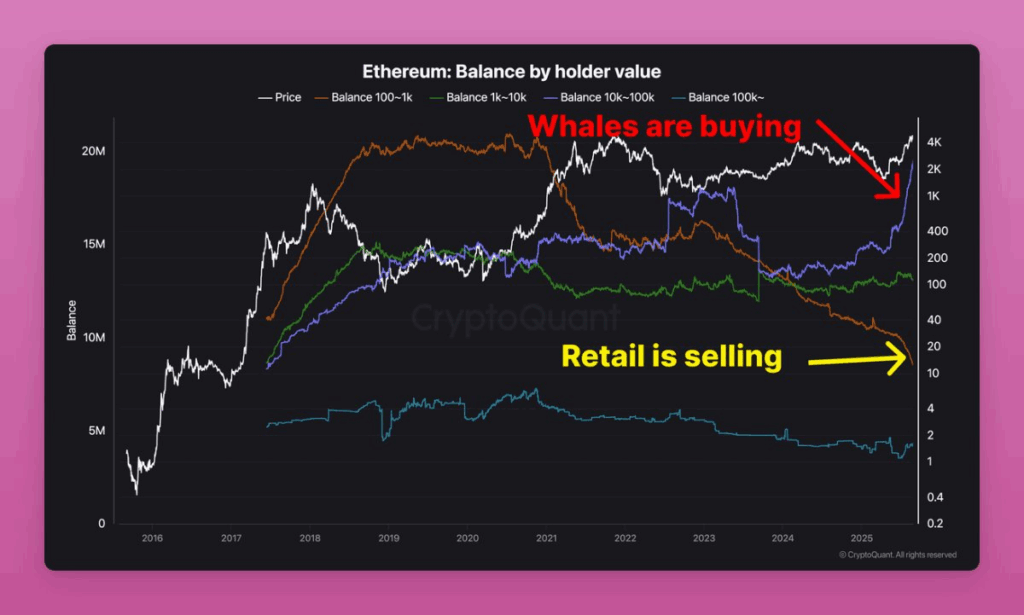

Whales accumulating while retail sells

-

Supply is shifting from 100–1,000 ETH wallets into 10,000+ ETH holders

-

Historic precedents show similar flows often lead to multi-month rallies (on-chain data)

Ethereum whale accumulation: on-chain data shows whales buying as retail sells—monitor balance shifts and position now for potential upside. Read the breakdown and key signals.

What is Ethereum whale accumulation?

Ethereum whale accumulation describes the steady increase of ETH held by large addresses while smaller wallets reduce balances. This transfer of supply from retail to whales indicates stronger long-term demand and can set up price appreciation when liquidity tightens and selling pressure subsides.

How does retail capitulation affect Ethereum?

Retail capitulation—declining balances in 100–1,000 ETH wallets—reduces short-term liquidity and can concentrate supply in hands that trade less frequently. On-chain charts referenced by analysts show these wallets fell from ~21 million ETH in 2021 to below 10 million ETH in 2025, while top whales grew holdings substantially.

Ethereum whales are buying while retail keeps selling, showing a supply shift that signals growing strength and sets up the next possible bull run.

- Ethereum whales keep buying big while small investors are selling, showing a shift in strength as retail hands grow weaker each cycle.

- Retail wallets keep shrinking fast while whales quietly load up, proving that supply is moving from short-term sellers to long-term holders.

- History shows this whale buying and retail selling often leads to big rallies, hinting that Ethereum may be ready for its next major run.

Ethereum is entering a critical stage as analysts note a pronounced shift in balance distribution. Crypto analyst Ignas and on-chain observers report that wallets holding 100–1,000 ETH have been reducing positions while addresses above 10,000 ETH expand theirs. This dynamic signals supply moving toward more durable holders.

The balance distribution chart spanning 2016–2025 illustrates a widening gap between large and small holders. Wallet cohorts holding 100–1,000 ETH dropped sharply, while the top-tier addresses increased by millions of ETH. These trends suggest strong accumulation under the surface despite muted spot price action.

Why are whales accumulating now?

Whales often accumulate during consolidation when retail sentiment is weak. Large holders with over 100,000 ETH grew balances through cycles—today owning over 20 million ETH versus roughly 10 million in 2017—indicating sustained confidence among major addresses even as retail exits create buying opportunities.

Source: Ignas

Medium-size whales (10,000–100,000 ETH) show mixed behavior—initial declines after 2021 highs but renewed accumulation as prices stabilized. Smaller whales (1,000–10,000 ETH) held steady with occasional buys. The largest structural change remains the retail segment’s contraction.

What are the market implications?

Flat spot prices amid growing whale balances and ETF flows imply short-term selling by retail is masking underlying accumulation. Historically, when supply concentrates with long-term holders, price moves become sharper once demand reaccelerates.

| 100–1,000 ETH | 21 million ETH | Below 10 million ETH |

| 10,000+ ETH | ~10 million ETH | ~20+ million ETH |

| 1,000–10,000 ETH | ~15 million ETH (peak) | Stable near peak |

Frequently Asked Questions

How can investors spot whale accumulation on-chain?

Look for rising balances in large addresses, decreasing supply in retail cohorts, and clusters of transfers to cold wallets or custodial addresses. Confirm with multi-source on-chain metrics and timing of inflows.

Does whale accumulation guarantee a price rally?

No. While accumulation by whales historically precedes rallies, price catalysts, macro conditions, and liquidity events determine timing. Use whale signals alongside broader market analysis.

Key Takeaways

- Supply shift: Retail wallets (100–1,000 ETH) have shrunk sharply while whales added ETH.

- Concentration risk/reward: More supply in long-term hands can lead to larger, faster moves when demand returns.

- Data-driven watchlist: Track cohort balances, large transfers, and custody inflows to time exposure.

Conclusion

On-chain data points to a clear Ethereum whale accumulation trend as retail capitulates, concentrating supply with larger holders. Investors should monitor balance distributions and custody flows to gauge risk and opportunity. COINOTAG will continue updating this analysis as new data and on-chain signals emerge.