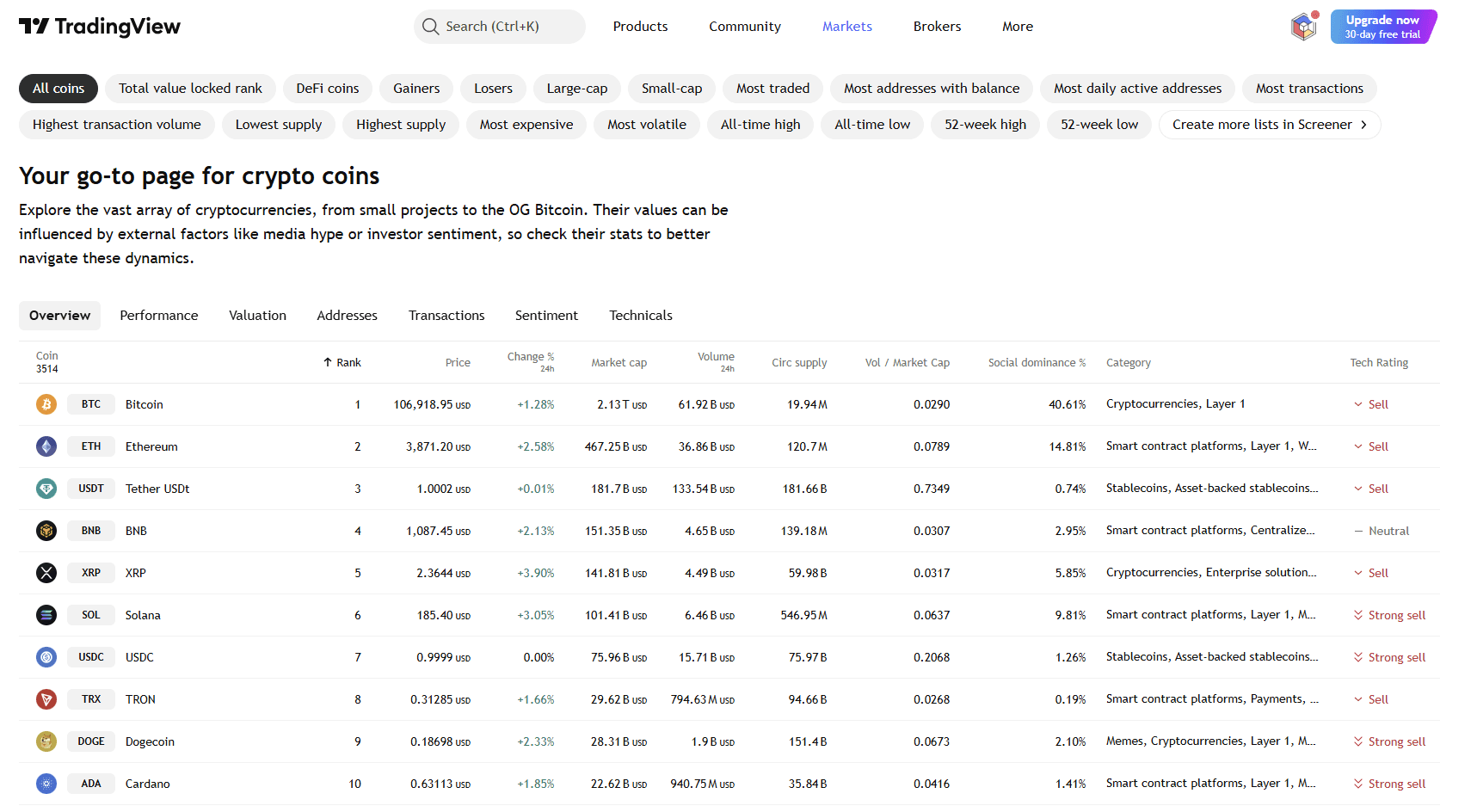

Chainlink has been one of the quiet winners of the last year, more than doubling in value while most altcoins struggled to keep pace.

But the tide may be turning. After a relentless climb that added nearly 70% in just the past three months, LINK slipped almost 10% in the final week of August, prompting traders to ask whether the rally has finally run out of steam.

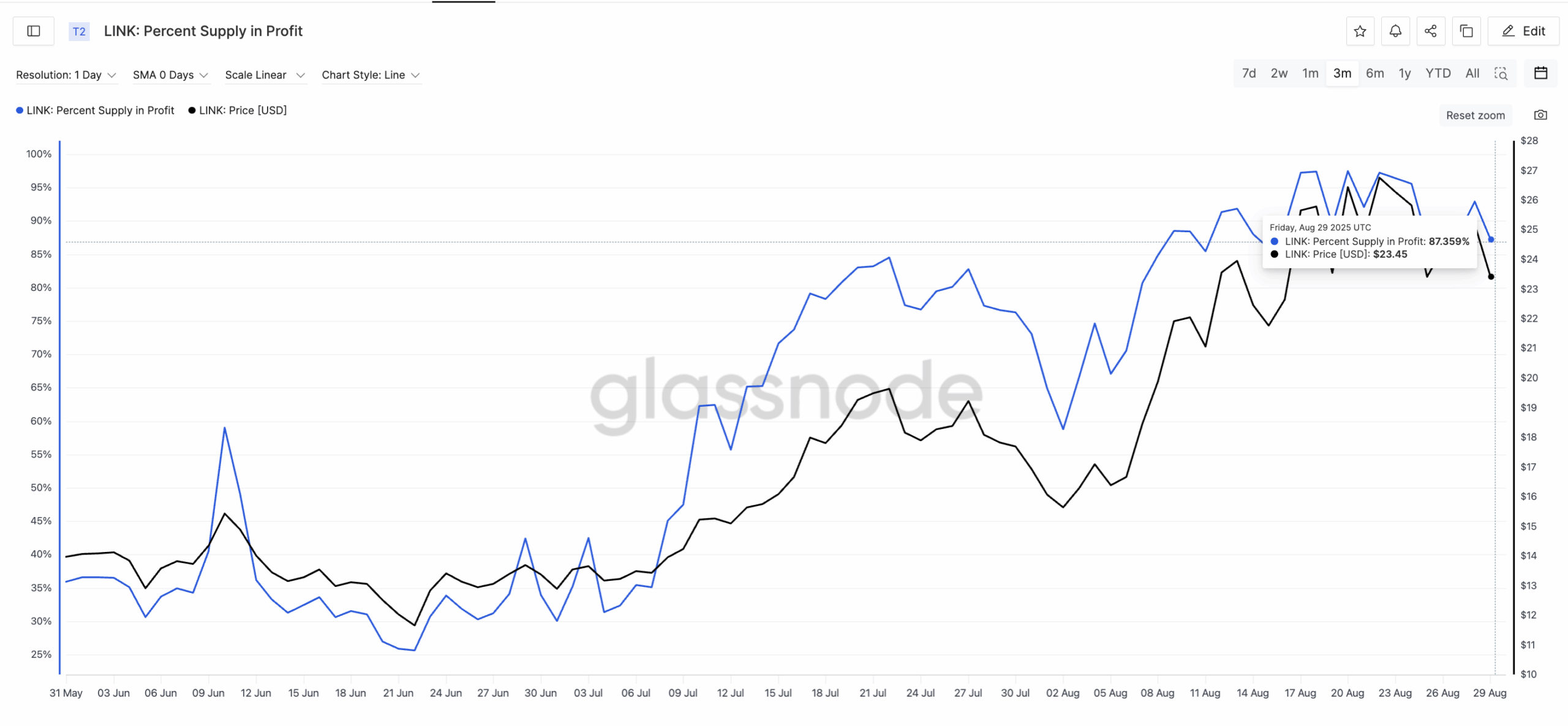

Whales Sitting on Profits

The problem isn’t just price. On-chain trackers show that the vast majority of LINK holders are now in profit. When more than 80–90% of supply sits above water, history suggests the temptation to sell grows too strong to ignore. That same pattern preceded heavy pullbacks earlier this summer, and the latest reading is flashing the same caution signal.

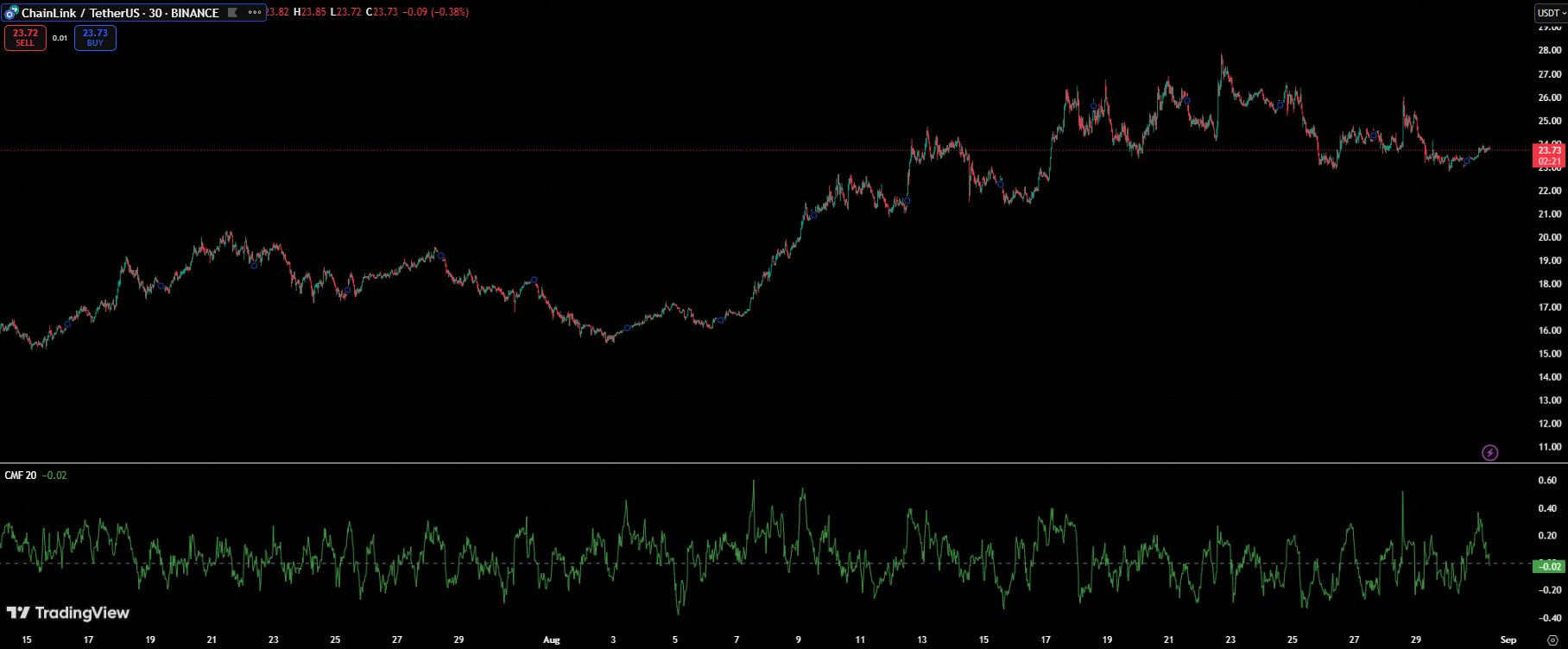

Capital Flow Weakens

Adding to the unease, indicators that measure whether new money is entering the market have begun to sour. The Chaikin Money Flow — often used to spot inflows and outflows — flipped negative at the end of August. It was the first such reading in weeks and could be a hint that buyers are stepping aside just as profit-takers begin to dominate.

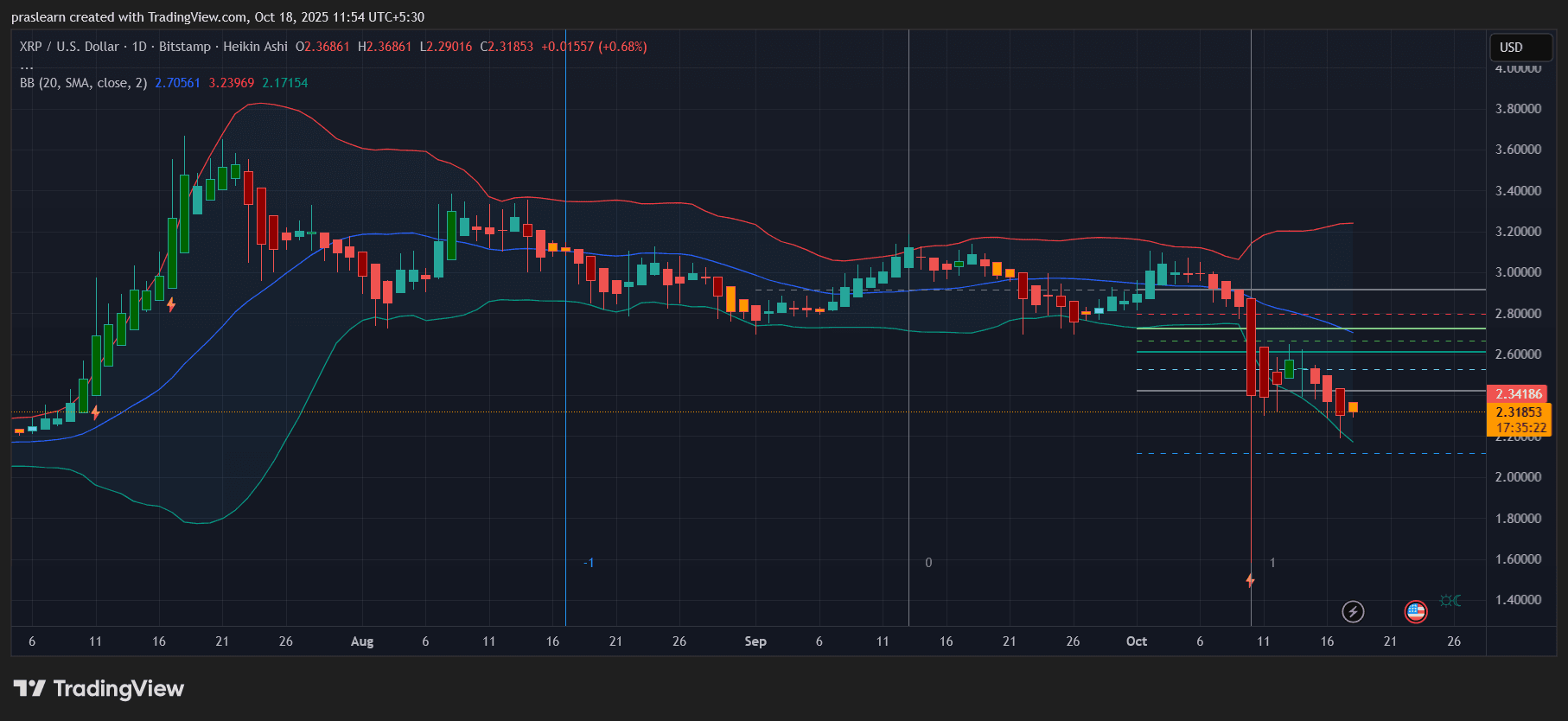

Charts Signal Fragile Ground

Technically, LINK is walking a tightrope. It’s trading inside a broad wedge pattern that usually marks a tired rally. If the token loses support near $22, analysts warn the next stop could be closer to $21 or even lower. Bulls, meanwhile, are watching the $27–28 range: only a clean breakout above that zone would restore confidence that the broader uptrend has legs.

Scenarios for What Comes Next

- Bullish Case:

If LINK manages to reclaim momentum and break above $27, a retest of the $30 mark becomes plausible. Beyond that, the next major target sits around $35, which would mark the highest level in nearly two years. Continued institutional demand for oracle infrastructure could be the catalyst. - Bearish Case:

Failure to defend $22 support could set off a sharper correction, with $21 and $18 highlighted as potential downside zones. A prolonged sell-off by whales — combined with fading inflows — could push LINK into a wider retracement, erasing much of this summer’s gains. - Base Case:

The most likely path may be sideways trading . LINK could consolidate between $21 and $27 for several weeks, building a stronger base before its next major move. In this scenario, the token avoids a deep correction but also struggles to break out until broader crypto market momentum returns.

For now, the market feels torn. On one hand, LINK has built a strong reputation as critical infrastructure for DeFi and real-world asset tokenization, narratives that have supported its 109% gain over the past year. On the other, short-term signals are leaning bearish, with profit-taking and weakening inflows threatening to knock the token back.

Whether September turns into a consolidation phase or the start of a deeper correction could depend on how LINK behaves around those support levels in the coming days.