FIS +140.85% in 24 Hours Amid Sharp Short- and Medium-Term Gains

- FIS surged 140.85% in 24 hours, with 157.68% and 533.56% gains over 7 days and 1 month, contrasting a 7356.37% annual drop. - Technical indicators show overbought RSI and bullish moving average crossovers, suggesting continued upward momentum despite unconfirmed on-chain activity. - A backtesting strategy using moving averages, RSI thresholds, and volume analysis aims to validate the recent trend under historical conditions.

On AUG 28 2025, FIS rose by 140.85% within 24 hours to reach $0.1226, FIS rose by 157.68% within 7 days, rose by 533.56% within 1 month, and dropped by 7356.37% within 1 year.

A sharp and concentrated price move characterized FIS in the last 24 hours, with the asset surging 140.85% to reach $0.1226. This upward momentum follows a 157.68% increase over seven days and a 533.56% jump in the past month, suggesting a recent reversal in sentiment. While the asset has experienced a dramatic 7356.37% drop over the last year, recent performance has diverged sharply from long-term trends.

Technical indicators suggest a potential continuation of bullish momentum. The asset’s RSI stands in overbought territory, reflecting strong short-term buying pressure. Moving averages have crossed to the upside, confirming a trend shift. Analysts project that the recent volatility may be linked to on-chain activity or liquidity events, though definitive details remain unconfirmed.

Backtest Hypothesis

A proposed backtesting strategy aimed to validate the recent upward momentum through a structured framework. The approach incorporates moving average crossovers, RSI thresholds, and volume analysis to gauge the reliability of the current trend. By isolating trade signals based on these technical metrics, the strategy seeks to replicate the observed price action under controlled historical conditions. If the results confirm the strategy’s validity, it could provide a framework for future positioning within the asset class.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

TRON Leads Blockchain Fees in 30 Days, Surpassing Ethereum by 28%

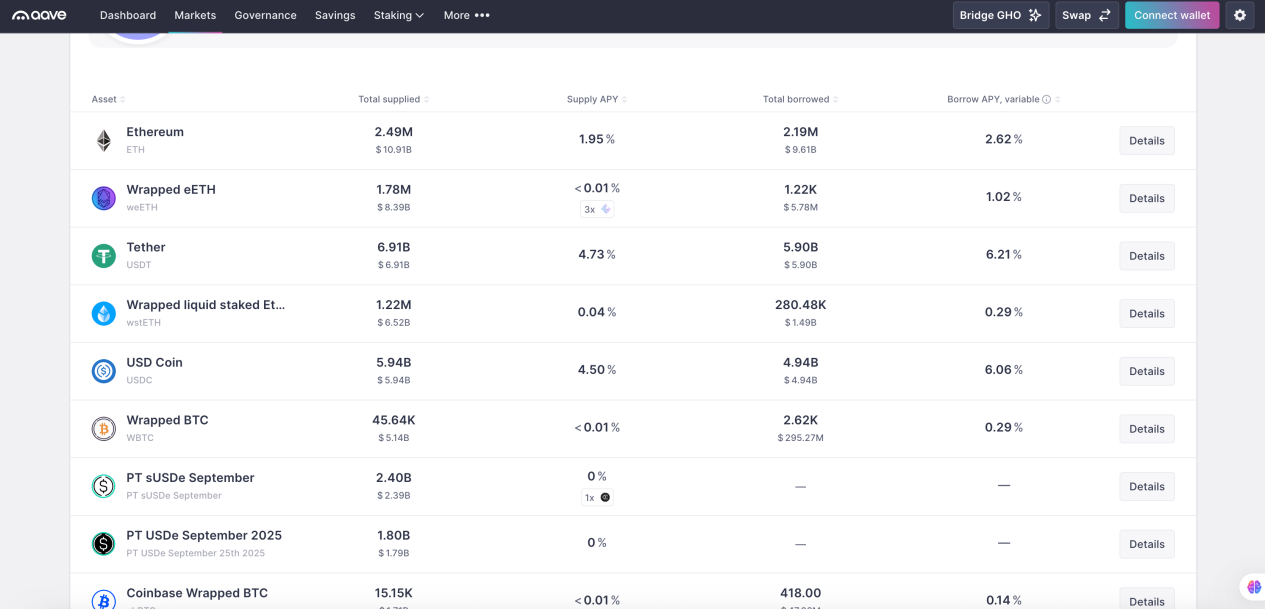

DeFi Beginner’s Guide (Part 1): How AAVE Whales Use $10 Million to Arbitrage Interest Rate Spreads and Achieve 100% APR

A quick introduction to DeFi, analyzing the returns and risks of different strategies based on real trading data from DeFi whales.

Rate Cuts Could Spur Bitcoin Gains as Analysts Forecast Multiple Fed Cuts in 2025

![[Bitpush Daily News Selection] Trump Media completes acquisition of 684 million CRO tokens worth about $178 million; Ethena Foundation launches new $310 million buyback plan; Vitalik Buterin: Low-cost stablecoin transactions remain one of the core values of cryptocurrency; Spot gold rises to $3,600, hitting a new all-time high](https://img.bgstatic.com/multiLang/image/social/28ccebdba840f2fa20c951ded37503be1757072702741.png)