- XRP price impacted by significant liquidations and SEC meeting speculation.

- XRP down more than 10% today.

- Market volatility possibly exacerbated by leveraged positions.

XRP’s value fell sharply today as liquidations totaled $89 million, primarily fueled by South Korean exchange Upbit activities amid a SEC meeting.

This event highlights market concerns over regulatory actions and extreme volatility, affecting crypto traders.

XRP Suffers $89 Million Liquidation Linked to Upbit

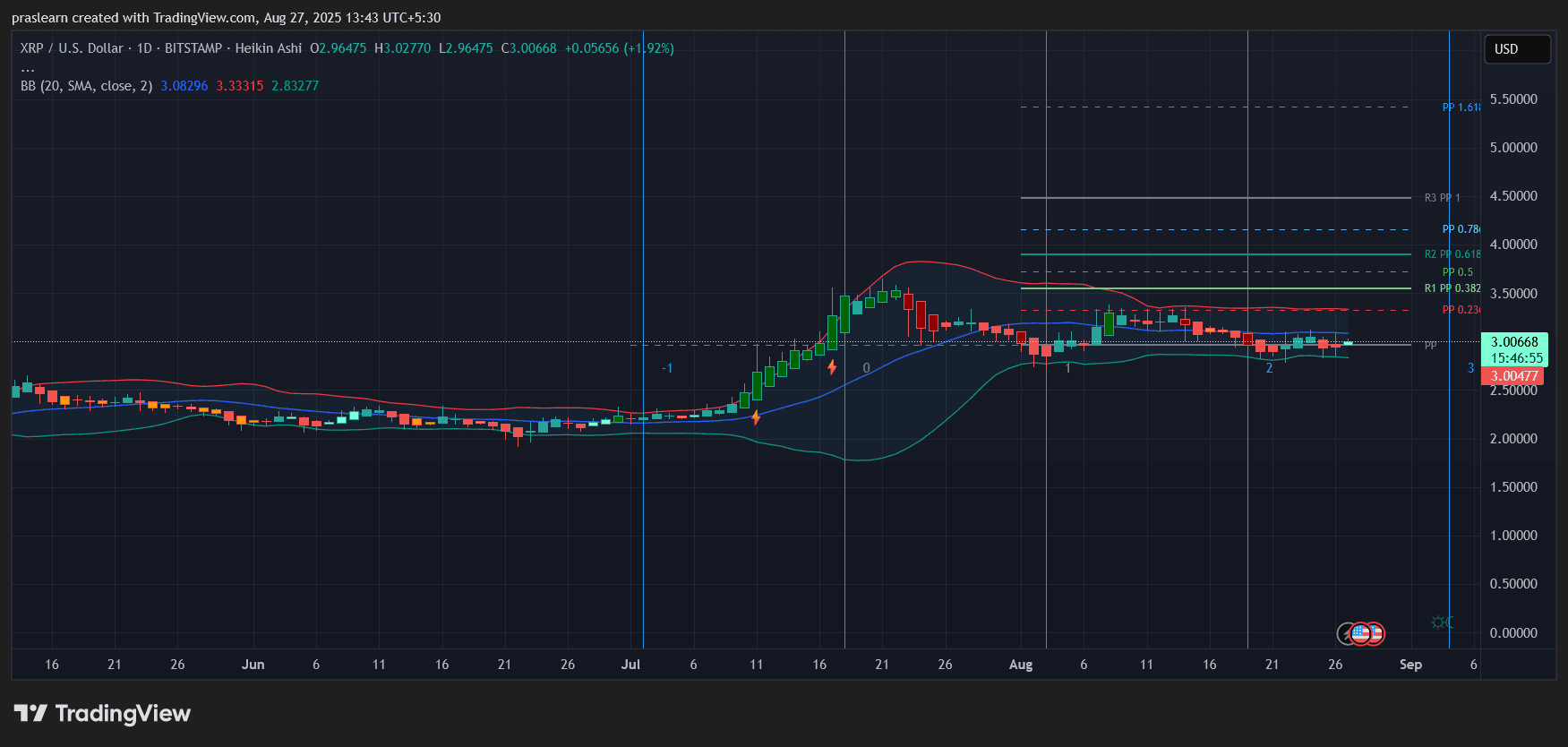

The XRP price decline is largely due to heightened market volatility following $89 million in liquidations, linked to Upbit exchange activity and technical selling after failed support tests.

Main players include Brad Garlinghouse and David Schwartz of Ripple Labs, while the U.S. SEC’s closed-door meeting adds pressure, with no official statements yet. “Settlement of injunctive actions,” “Resolution of litigation claims,” and “Other enforcement-related matters” are scheduled for today’s closed-door meeting—widely interpreted as referencing the Ripple case.

75 Million XRP Sale Intensifies Price Drop

The liquidation-driven drop impacted investors, especially on Upbit where over 75 million XRP influenced the decline. The sentiment echoes risk aversion across crypto markets .

Financial implications include a sharp drop below critical levels and increased short-term volatility. Traders react by repositioning, awaiting possible regulatory clarity.

Echoes of March’s 9% Bitcoin Drop in Context

This event is reminiscent of a 9% Bitcoin drop in March, driven by volatility and liquidations. Similar patterns emerge in today’s market sentiment.

Based on previous trends, potential outcomes suggest that regulatory decisions could trigger a sharp price rebound, should the SEC announce favorable news. Arthur Hayes, Co-founder of BitMEX, noted, “If that happens, XRP might explode—potentially pumping 50–100%, targeting $5–$7 levels.”