Strategy Acquires 4,225 Bitcoin for $472.5 Million

- Strategy’s consistent Bitcoin acquisition enhances its market position.

- The purchase underlines a long-term accumulation plan.

- Bitcoin market exhibits bullish trends following the transaction.

The acquisition highlights Strategy’s robust approach to maintaining and expanding its Bitcoin treasury, signaling continued institutional interest.

Bitcoin Acquisition and Market Impact

Strategy, led by Executive Chairman Michael Saylor, continues its aggressive Bitcoin acquisition strategy , focusing solely on BTC. The latest purchase confirms the company’s commitment to its pivot from software to a major cryptocurrency stakeholder.

“On July 14, 2025, Strategy announced updates with respect to its bitcoin holdings: 4,225 BTC acquired… aggregate purchase price $472.5 million… average purchase price $111,827.” – Michael Saylor, Executive Chairman, Strategy

Michael Saylor has been instrumental in steering the company toward becoming a dominant Bitcoin entity. The acquisition aligns with previous strategies of funding purchases through share sales under at-the-market (ATM) equity programs .

Market Dynamics and Institutional Influence

The massive Bitcoin buy influences market sentiment, driving prices to new heights. Institutional concentration grows as Strategy’s holdings now represent a significant portion of Bitcoin’s total supply.

The transaction showcases Strategy’s ongoing role in shaping Bitcoin’s market dynamics, emphasizing its reliance on capital markets fundraising for BTC acquisitions.

Bitcoin’s price reflects Strategy’s influence, with a new high recorded. This action contributes to the ongoing institutionalization of the asset.

Historical data suggests that persistent institutional purchasing reinforces positive market trends and could potentially accelerate broader acceptance. Such actions by industry leaders like Strategy bolster Bitcoin’s standing as a reliable store of value.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

TRON Leads Blockchain Fees in 30 Days, Surpassing Ethereum by 28%

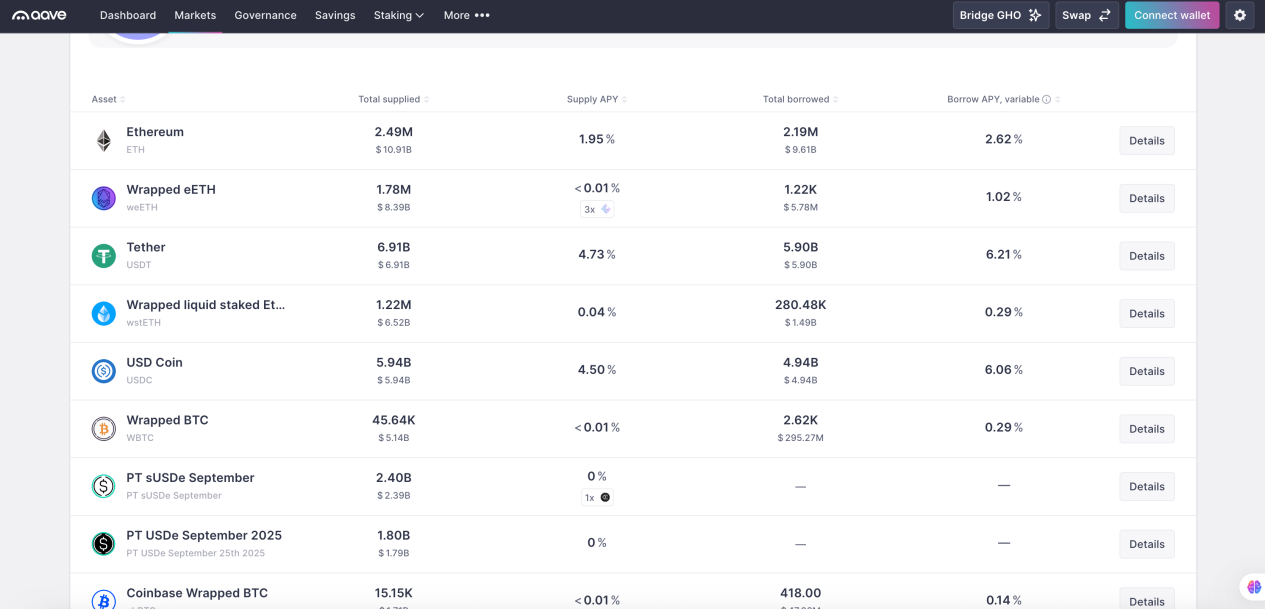

DeFi Beginner’s Guide (Part 1): How AAVE Whales Use $10 Million to Arbitrage Interest Rate Spreads and Achieve 100% APR

A quick introduction to DeFi, analyzing the returns and risks of different strategies based on real trading data from DeFi whales.

Rate Cuts Could Spur Bitcoin Gains as Analysts Forecast Multiple Fed Cuts in 2025

![[Bitpush Daily News Selection] Trump Media completes acquisition of 684 million CRO tokens worth about $178 million; Ethena Foundation launches new $310 million buyback plan; Vitalik Buterin: Low-cost stablecoin transactions remain one of the core values of cryptocurrency; Spot gold rises to $3,600, hitting a new all-time high](https://img.bgstatic.com/multiLang/image/social/28ccebdba840f2fa20c951ded37503be1757072702741.png)