Key points:

-

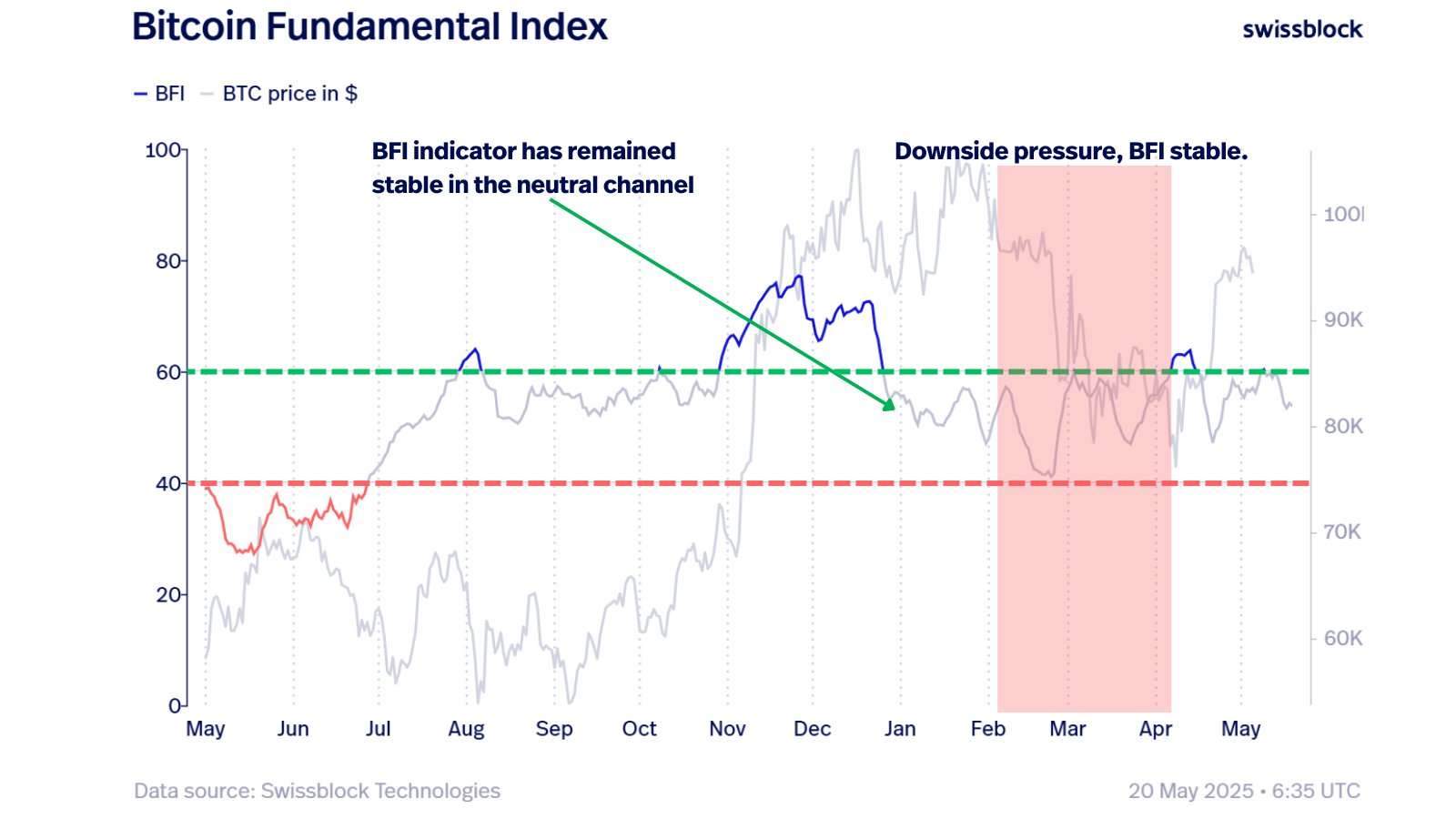

Bitcoin is not in line to cancel its attack on all-time highs, says the Bitcoin Fundamental Index (BFI).

-

BTC price strength remains “intact,” says Swissblock Technologies, removing the risk of a double top.

-

Historically, a return to within 10% of all-time highs delivers price discovery almost every time.

Bitcoin ( BTC ) does not risk a “double top” bull market reversal with its trip past $107,000, new analysis says.

In one of its latest X updates , private wealth manager Swissblock Technologies described BTC price strength as “intact.”

BTC price indicator ignores double top “noise”

Bitcoin shows “no signs of bearish divergence,” as seen through the lens of a basket of network indicators.

Commenting on the latest signals from its Bitcoin Fundamental Index (BFI), Swissblock argued that despite being less than $5,000 from all-time highs, BTC/USD is not about to abandon its push into price discovery.

“A lot of noise about a potential double top as $BTC struggles to break ATH,” it said.

BFI combines various extant indicators into a single oscillator to provide insight into trend strength at a given price point.

Since August 2024, BFI has stuck rigidly to its middle territory around the 50/100 mark, irrespective of price action.

“Even during the Feb–Mar pullback, it held neutral, never dipped into weakness,” the post notes.

Swissblock explained that if BTC/USD were to reverse now and head lower, leaving all-time highs untouched, BFI would already be “breaking down.”

“On-chain strength is intact,” it concluded.

“Bears: not this time, got to wait.”