What Is Spark Crypto? Spark Airdrop Explained & How to Claim SPK

Spark (SPK), the governance token of Spark Protocol, has recently found itself in the spotlight following an impressive price rally. According to recent analysis, SPK’s value has more than doubled within days and has seen daily trading volumes soar above $486 million, while the market cap has increased from $30 million to over $62 million. This price appreciation coincides directly with the anticipation and launch of Spark’s major airdrop campaigns—Ignition and Overdrive—prompting a flurry of user interest and participation. In this article, we explore the core of Spark Protocol, how it works, its tokenomics, recent price performance and factors behind its surge, how users can claim the SPK airdrop, as well as price outlooks for the coming months.

Source: CoinMarketCap

What is Spark Crypto?

Spark crypto represents both the governance and incentive token for Spark Protocol—a next-generation DeFi ecosystem designed to deliver leading stablecoin yields, robust lending, and high-efficiency capital management across multiple blockchains. Developed in close alignment with MakerDAO, Spark Protocol leverages deep DAI liquidity, the DAI Savings Rate (via sDAI), and flexible cross-chain infrastructure to offer superior user experiences for both newcomers and sophisticated DeFi participants.

Users of Spark Protocol can lend or borrow crypto assets—such as DAI, USDC, ETH, or sDAI—on SparkLend while automatically earning top-tier DeFi returns. Spark crypto is central to this ecosystem, granting holders voting power over the protocol’s development, economic incentives, and ultimate direction.

How Does Spark Protocol Work?

Spark Protocol is engineered for optimal efficiency and security. It channels user deposits of DAI or other assets into SparkLend, an advanced lending module. Unique among DeFi lending markets, deposited DAI is routed through the sDAI mechanism, capturing the highest available stablecoin yield by default. Borrowers can access loans at some of the lowest rates in the space, made possible by Spark’s direct integration and liquidity supply from the Maker vaults.

A crucial component of Spark is its cross-chain capability. Users can engage with Spark’s savings and lending features not only on Ethereum mainnet, but also across leading Layer-2 solutions such as Arbitrum, Base, and Optimism. This modular architecture breaks down the typical barriers between blockchains and ensures continuous liquidity and yield optimization. Spark crypto thus serves as the backbone for secure, high-return, and user-driven DeFi innovation.

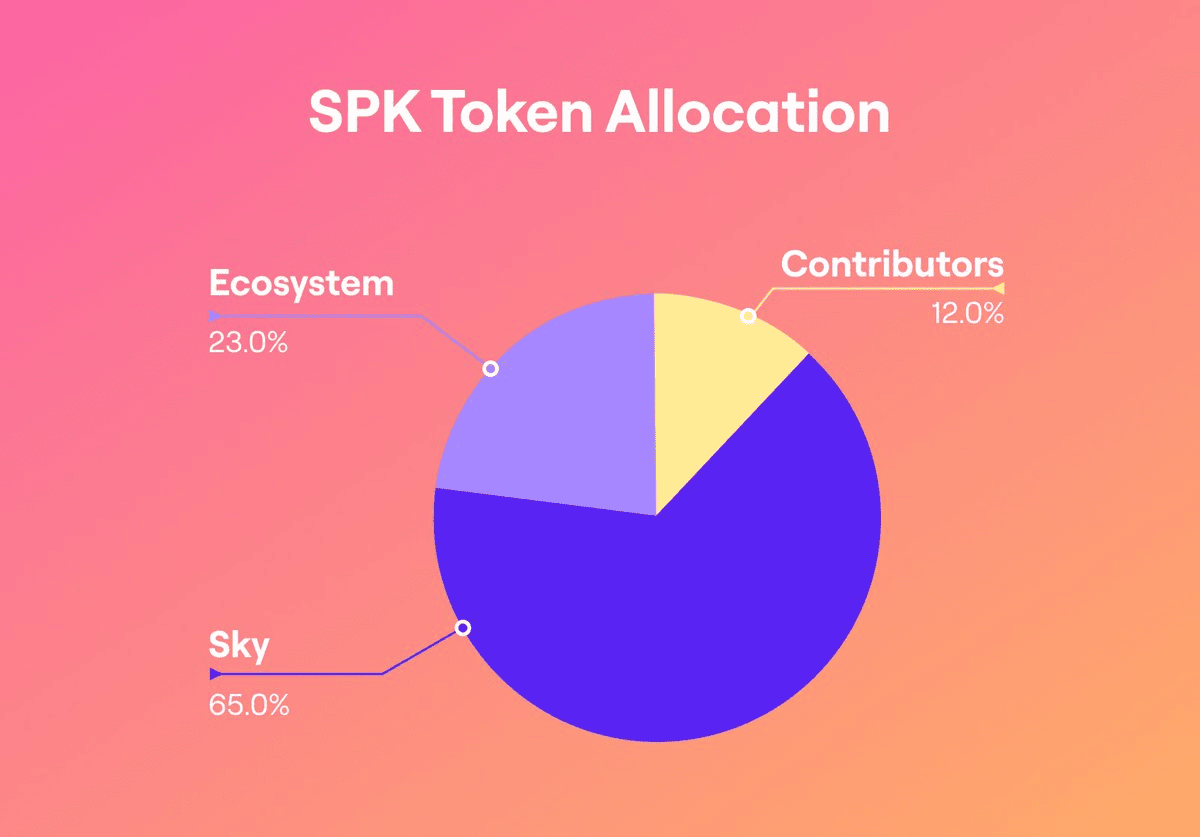

Tokenomics of Spark Crypto

Spark Protocol’s tokenomics are crafted to promote long-term ecosystem health, community involvement, and sustainable price dynamics.

Source: Spark Protocol on X

The key points include:

-

Maximum Total Supply: 7.8 billion SPK tokens.

-

Community Distribution: 37.5% of the supply is allocated for spark airdrop events, future ecosystem initiatives, and liquidity mining programs, empowering a user-centered growth model.

-

Contributor & Partner Reserves: Portions of the supply are reserved for ongoing development, strategic partners, and protocol maintenance, ensuring continuous innovation.

-

Utility: SPK serves as a governance token, granting holders voting rights on protocol upgrades, risk management, asset listings, and funding proposals.

-

Incentives: SPK is positioned for future roles in staking, liquidity incentives, and as a collateral asset within Spark’s evolving product suite.

-

Emission Structure: The release schedule and multi-phase airdrop reduce the risk of excessive early selling and align incentives for both new and existing participants.

-

Alignment: By rooting the largest share of tokens with the community, Spark Crypto ensures decentralized governance and market-driven protocol evolution.

Spark Airdrop: How to Participate and Why It Matters

The spark airdrop is a central catalyst for the current surge in SPK price and protocol activity. It is rolled out in two main phases:

The first phase, known as “Ignition,” enabled thousands of DeFi users, DAI stakers, and early Spark supporters to claim their allocation of SPK tokens. This phase concludes today, marking a critical cut-off for eligible users to secure their rewards.

Immediately following is the “Overdrive” phase, designed for those committed to the long-term vision of Spark crypto. Participants must stake their claimed SPK through SymbioticFi by July 29, 2025, and maintain their stake until August 12, 2025, to be eligible for Overdrive rewards. This phase will redistribute unclaimed Ignition SPK among participating stakers, further tightening circulating supply. Moreover, users who save at least $1,000 in USDS or USDC during the qualification period can earn a 2x boost on their Overdrive allocation—a powerful incentive to remain engaged and to hold spark crypto.

Notably, the staking requirement for the Overdrive campaign is a direct factor in SPK price’s recent upward move. The more tokens locked in the system, the greater the supply scarcity, driving increased competition among investors and fueling further price gains.

To safely participate in either phase of the spark airdrop, users should visit the official Spark portal (app.spark.fi/spk/airdrop), connect a secure crypto wallet, and follow the clear, on-chain instructions provided.

SPK Price Prediction and Technical Analysis

The technical outlook for Spark price is closely watched by traders, especially given the historic volatility surrounding major token events like the spark airdrop. In recent sessions, Spark price decisively broke through its resistance level in the $0.045–$0.050 range, with trading volumes regularly exceeding $450 million. Technical momentum is further reflected in SPK trading solidly above its 50-day moving average, a bullish signal suggesting trend continuation.

Moreover, the Relative Strength Index (RSI) for SPK price is near 70, indicating sustained buying enthusiasm but also a potential for near-term profit-taking. Should Spark price consolidate above the $0.050 support, chart analysts suggest the next upside target is near $0.065. However, if post-airdrop selling pressure materializes, a pullback towards the $0.045 level is plausible, especially if broader DeFi sector sentiment softens.

The ongoing Overdrive staking phase remains an important support for Spark price, decreasing supply and incentivizing long-term holding. With strong fundamentals, community backing, and technical catalysts, spark crypto could continue to challenge higher resistance levels in the coming weeks, provided market conditions remain favorable.

Conclusion

Spark crypto has proven itself as one of the most dynamic protocols in today’s DeFi landscape, attracting attention for its sophisticated product design and community-centric approach. The powerful effects of the spark airdrop and SPK’s innovative tokenomics have contributed to a dramatic rise in both Spark price and user participation. As Spark Protocol continues its development and prepares for further adoption, the outlook for spark crypto remains closely tied to its ability to drive yield, deliver on roadmap commitments, and reward active community members.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before investing in cryptocurrency assets.