Ondo Price Prediction 2025, 2026-2030: Can the New ETF Push ONDO Crypto to New Highs?

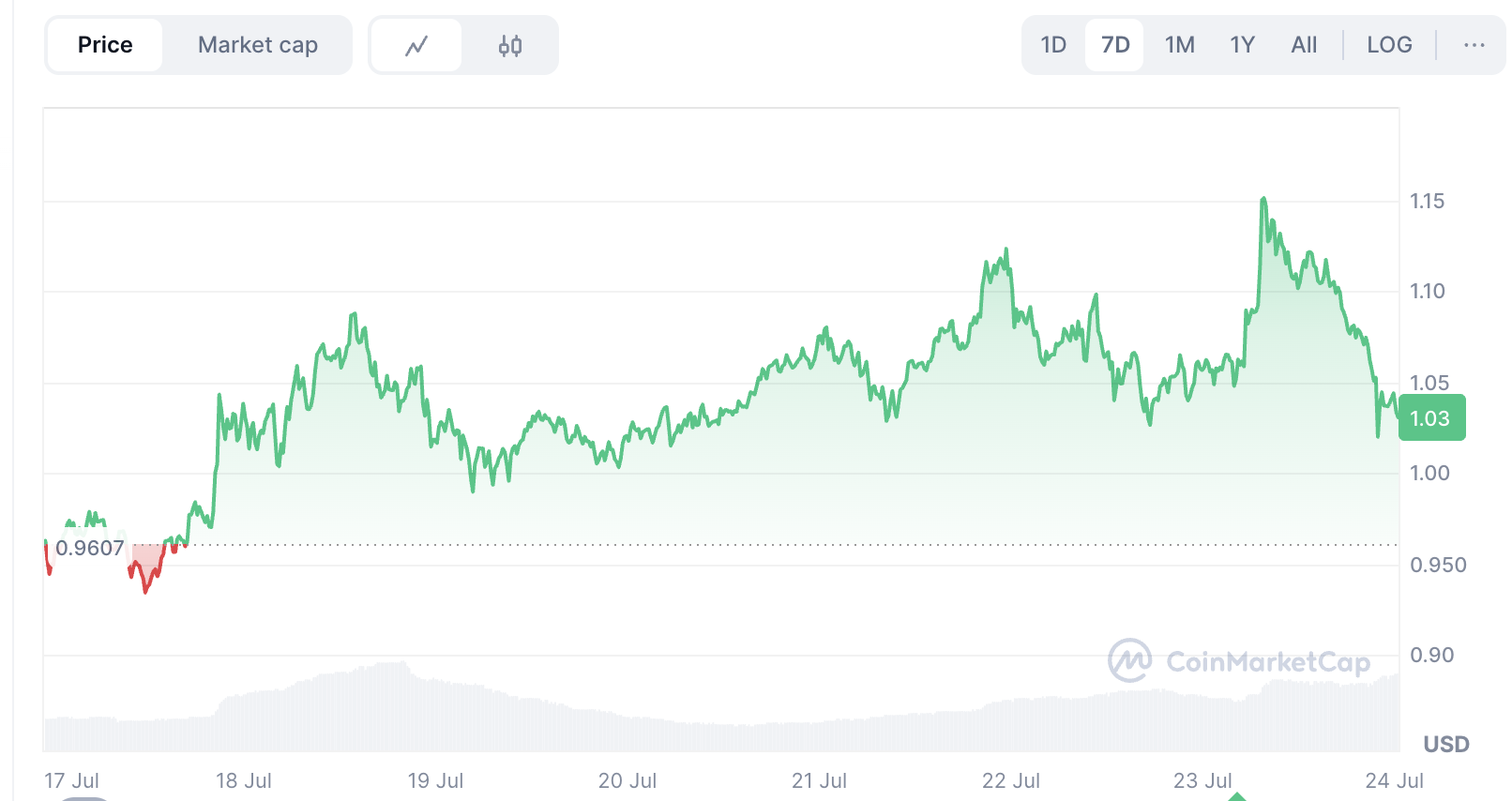

Ondo Finance and the ONDO crypto token are quickly gaining traction among both retail and institutional investors, largely due to their cutting-edge approach to real-world asset (RWA) tokenization, growing political relevance, and recent price volatility. As of July 2024, the ondo price sits at $1.12 with a market capitalization of $3.5 billion and a circulating supply of 3.1 billion tokens. In this article, we’ll provide a comprehensive overview of what Ondo Finance is, detail its unique position in the DeFi landscape—including institutional and political connections—discuss recent ondo price movements, and offer a technical outlook with expert ondo crypto price predictions through 2030.

Source: CoinMarketCap

What is Ondo Finance?

The Core of Ondo Finance

Ondo Finance is an advanced decentralized platform focused on creating and managing tokenized financial products, especially those backed by real-world assets such as U.S. Treasury bonds and money market instruments. The native utility token, ONDO, powers the recently launched Ondo Chain—a custom Layer-1 proof-of-stake blockchain built to serve institutional-grade financial operations. Ondo Chain is engineered for direct settlement, low-fee governance, and seamless transaction processing, positioning Ondo crypto as a top choice for both compliance and innovation in DeFi.

Strategic Institutional Partnerships

The Ondo ecosystem has formed powerful alliances with world-leading financial institutions like BlackRock and Franklin Templeton. These partnerships enable both retail and institutional investors to access diversified yields through on-chain financial instruments, all while assuring security and regulatory compliance. The momentum for ondo crypto has been further accelerated by the upcoming launch of the 21Shares Ondo Trust ETF. This U.S.-regulated exchange-traded fund (ETF), with Coinbase appointed as the custodian, will allow mainstream investors easy exposure to the ondo price by passively tracking the CME CF Ondo Finance-Dollar Reference Rate. The ETF’s creation and redemption process also offers flexibility for institutional participants, removing significant barriers to ONDO adoption.

Ondo’s Connection to the U.S. Political Landscape

A unique feature of Ondo Finance is its connection to the Trump family. Through World Liberty Financial—its DeFi investment platform—the Trump family has openly supported Ondo by acquiring ONDO tokens. In December 2023, World Liberty Financial bought $250,000 worth of ONDO and currently holds roughly 342,000 tokens, now valued at around $383,000. This high-profile endorsement has sparked much discussion about potential regulatory shifts, particularly as Donald Trump’s recent campaign adopts an increasingly pro-crypto stance. These political ties could influence the long-term perception of ondo crypto and may impact U.S. regulatory policy in ways that benefit compliant, institutional-grade blockchain projects like Ondo.

ONDO Price Performance and Analysis

After reaching an all-time high of $2.14 in December 2023, the ondo price experienced a retracement, stabilizing near $1.12 by July 2024. Despite this price correction, the latest technical analysis indicates growing momentum and renewed investor interest. News about the 21Shares ETF filing triggered a surge in trading volumes, establishing a clear support level for ONDO crypto near the $1.00 mark. Since its correction, the ondo price has formed a series of higher lows, showing persistent accumulation by both retail and institutional investors. Technical indicators such as the Relative Strength Index (RSI) suggest ONDO is trading in a neutral zone, reducing the risk of sudden reversals and indicating that another upward movement could be on the horizon.

Moving averages also hint at a bullish scenario for ONDO. The 50-day moving average is nearing a crossover with the 100-day moving average, which historically signals the potential for a bullish run. Sustained daily closes above major support and increased on-chain activity reinforce the argument for continued growth in ONDO crypto demand.

ONDO Price Prediction 2025

Looking into 2025, the ondo price has a solid foundation for further appreciation. Technical support at $1.00 has remained reliable, giving ONDO crypto a strong base for future gains. If the 21Shares ETF launches successfully and institutional inflows accelerate, the ondo price could retest the major resistance zone at $1.50 and aim for a breakout past the previous all-time high of $2.14. Increasing trading volumes and persistent upward trends in price highlight an accumulation phase which, if maintained, might see ONDO hitting the $2.50–$3.00 zone. On the downside, a break below $1.00 could open the door toward $0.85; however, historical price action shows that buyers are likely to step in at these levels.

ONDO Price Prediction 2026

Moving into 2026, the technical setup shows potential for further growth. Should institutional demand remain strong, and if Ondo Chain continues to see adoption through new RWA partnerships and compliance product launches, the ondo price could move toward $3.50 to $4.00. Fibonacci extensions using the peak and correction points put expanded targets in the $3.80–$4.20 range. Volume patterns and blockchain analytics will serve as important indicators to confirm the health and sustainability of any uptrend in ONDO crypto.

ONDO Price Prediction 2027–2030

Long-term projections for ondo crypto are increasingly optimistic if Ondo remains a frontrunner in RWA tokenization and institutional DeFi. As public and private sector adoption deepens and the regulatory environment becomes more crypto-friendly—particularly if U.S. policy shifts support compliant DeFi innovation—the ondo price could surpass historical highs and enter new territory. Technical resistance at $5.00 would likely turn into support, enabling the next push toward $8.00 or even the ambitious $10 mark by 2030. This scenario assumes consistent ETF flows, regular product rollouts, and a favorable political climate.

Can Ondo Price Hit $10?

Achieving a $10 ondo price would require perfect alignment of bullish conditions, including rapid uptake by institutions, regulatory clarity, and relentless accumulation on increasing volume above key levels. The growing support from political heavyweights, continued technological advancement, and the success of the ETF could drive ONDO crypto into a new era of market leadership. While $10 remains a stretch target, it has grown more realistic given the recent trajectory and the powerful momentum behind the RWA sector.

Conclusion

Ondo Finance—powered by the ONDO crypto token—is at the intersection of DeFi, traditional finance, and politics. Currently priced at $1.12 and backed by a $3.5 billion market cap, the platform’s rich blend of compliance, innovation, and institutional support makes it a top candidate for long-term growth. As more investors seek exposure to the fast-growing RWA sector, and as political and regulatory winds shift in favor of compliant crypto projects, ondo price predictions for 2025–2030 remain highly bullish. For those seeking a promising DeFi project with strong fundamentals and mainstream appeal, ONDO crypto stands out as a leading opportunity.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before investing in cryptocurrency assets.