Borrowing, Interest, and Repayment in the Unified Trading Account

[Estimated Reading Time: 4 mins]

This article explains how borrowing, interest, and repayment work in Bitget’s unified trading account (UTA), including calculations, limits, and repayment methods.

Borrowing in the Unified Trading Account

Borrowing in UTA is automatic. It will be triggered whenever your balance is insufficient to place or maintain a trade. The borrowed amount is included in both initial margin and maintenance margin calculations under the tier system.

Borrowing calculation (advanced mode)

Formulas

-

Debt = abs[min(balance + unrealized PnL, 0)]

-

Loan per order = trading volume – available balance

Borrowing limits

The maximum loan you can receive is determined by the lowest value among:

-

Available margin in your account

-

Leverage tier limit

-

Individual borrowing limit

This prevents over-leveraging and ensures risk management under the UTA system.

Auto-borrow Scenarios

In advanced mode, if your order size is larger than your available balance, the system borrows the missing amount automatically. Auto-repayment happens when you transfer funds, settle trades, or realize profits.

| Auto-borrow scenario | Example |

| Insufficient balance to place or fill a sell order | 1. User A holds only USDC in their unified account and places a USDT-M perpetual futures order. 2. The order generates a 1.5 USDT transaction fee. 3. Since User A’s available USDT balance = 0, the system borrows 1.5 USDT automatically. |

| Unrealized loss in perpetual futures | 1. User B holds 50 USDT + 100 USDC and opens a USDT-M perpetual futures position. 2. The position suffers a 100 USDT unrealized loss, reducing available USDT to -50. 3. The system borrows 50 USDT to cover the shortfall. If losses increase further, borrowing is adjusted dynamically. |

| Borrowing for margin trades | 1. User D has 100 USDT and buys 300 USDT worth of BTC/USDT using leverage. 2. The system auto-borrows the 200 USDT difference. |

Interest in the Unified Trading Account

Interest applies to all outstanding borrowed amounts.

-

Charged per asset: Each asset accrues interest separately.

-

No interest on unrealized losses: If your futures positions show an unrealized loss, no interest is charged within the interest-free range.

-

Tiered system: Rates and limits depend on your account’s leverage tier, which balances borrowing capacity with risk exposure.

Example:

-

If you borrow 200 USDT for a margin trade, interest is charged daily based on the current interest rate.

-

If you only show an unrealized loss of 200 USDT in a futures position, no interest is charged unless it turns into an actual debt.

Interest-free amount

Each asset has a set interest-free allowance. Borrowed amounts within this limit do not generate interest.

| Coin | Interest-free amount |

| ETH | 4 |

| BTC | 0.1 |

| USDC | 10,000 |

| USDT | 10,000 |

Repayment in the Unified Trading Account

Before learning how repayment works, keep in mind these restrictions:

-

You cannot close or cancel your account if there are outstanding debts.

-

You also cannot close it if a sub-account holds assets or has open positions.

Automatic Repayment

Repayment is always deducted first from incoming assets, ensuring debts are cleared before your free balance increases.

Repayment happens automatically when:

-

You transfer funds into your unified account

-

You settle or close trades

-

You realize profits

Manual Repayment

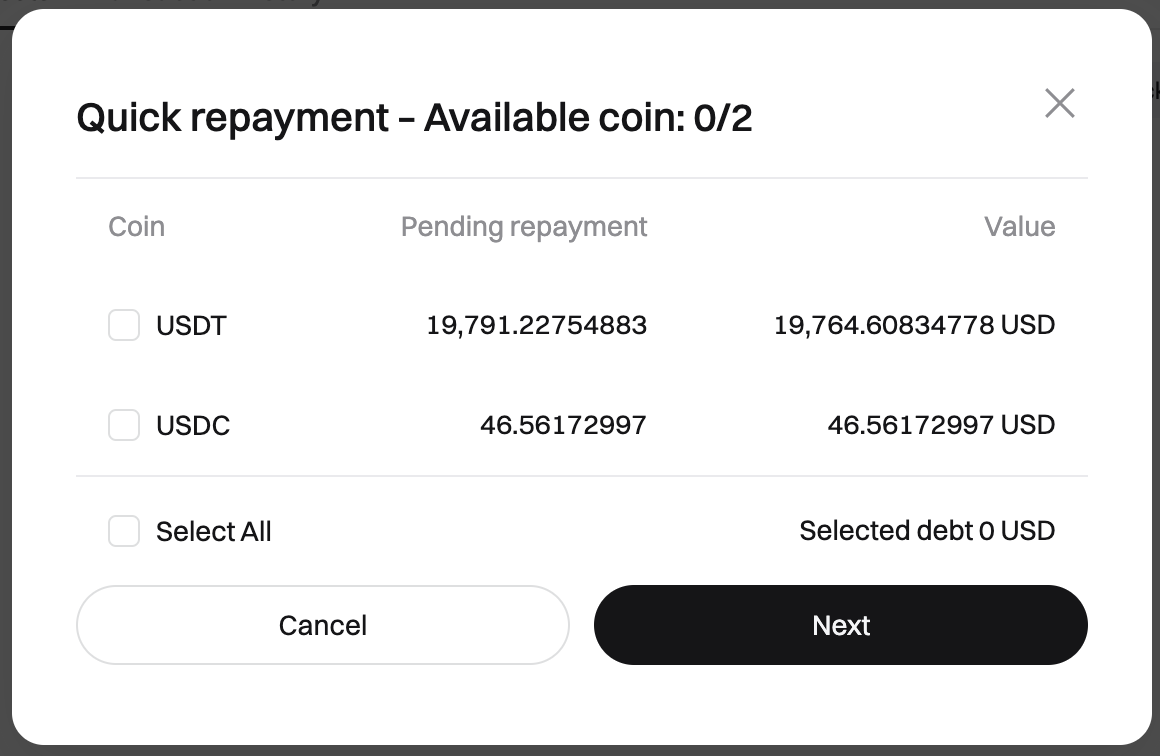

You can also choose to repay manually:

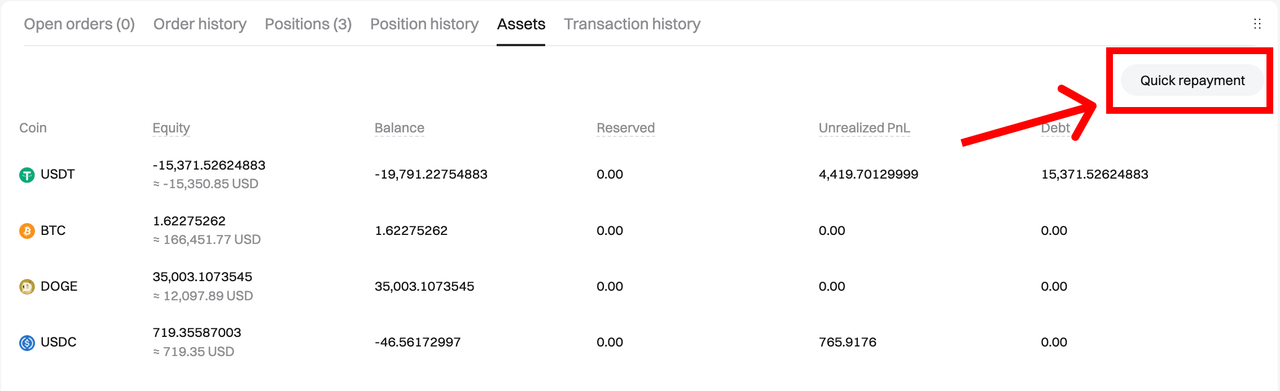

1. Go to the Assets tab on the Margin Trading page.

2. Select the borrowed asset.

3. Confirm to complete repayment.

How to Check Your Live Loan Data?

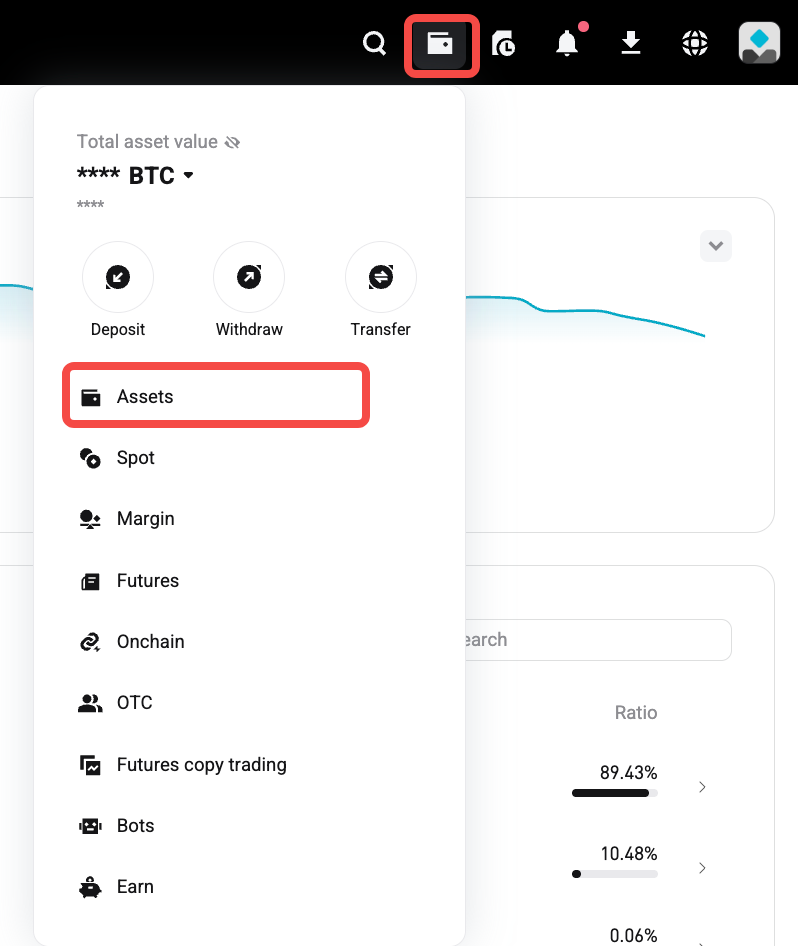

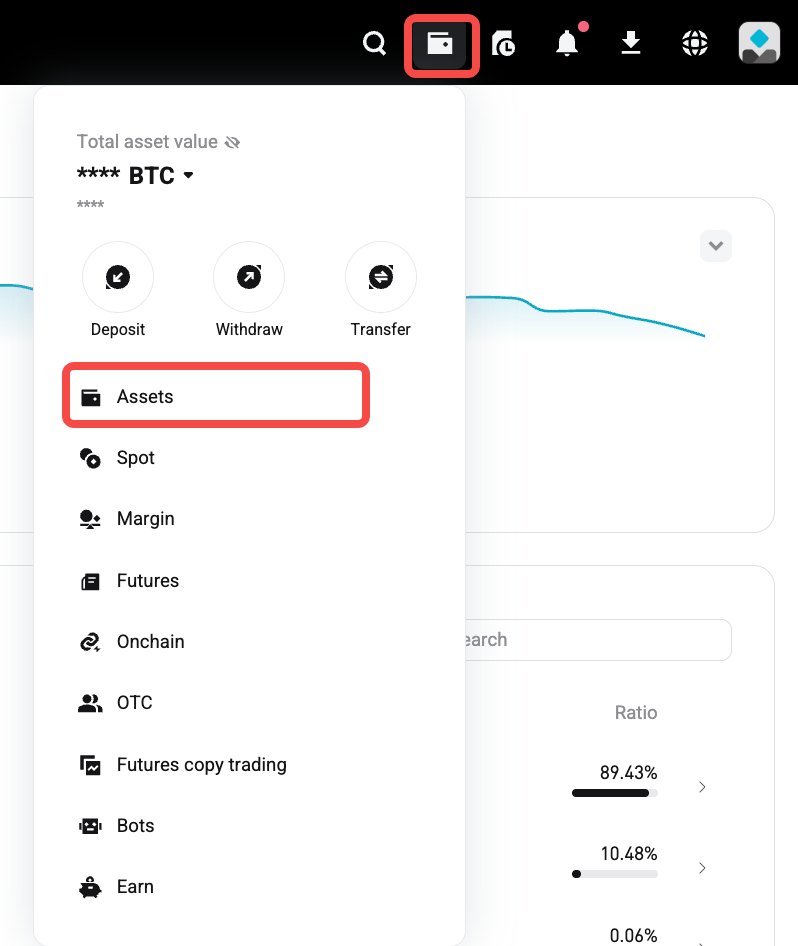

Step 1: Go to the Assets tab

1. Click the wallet icon in the top-right corner of the homepage.

2. Select Assets from the dropdown menu.

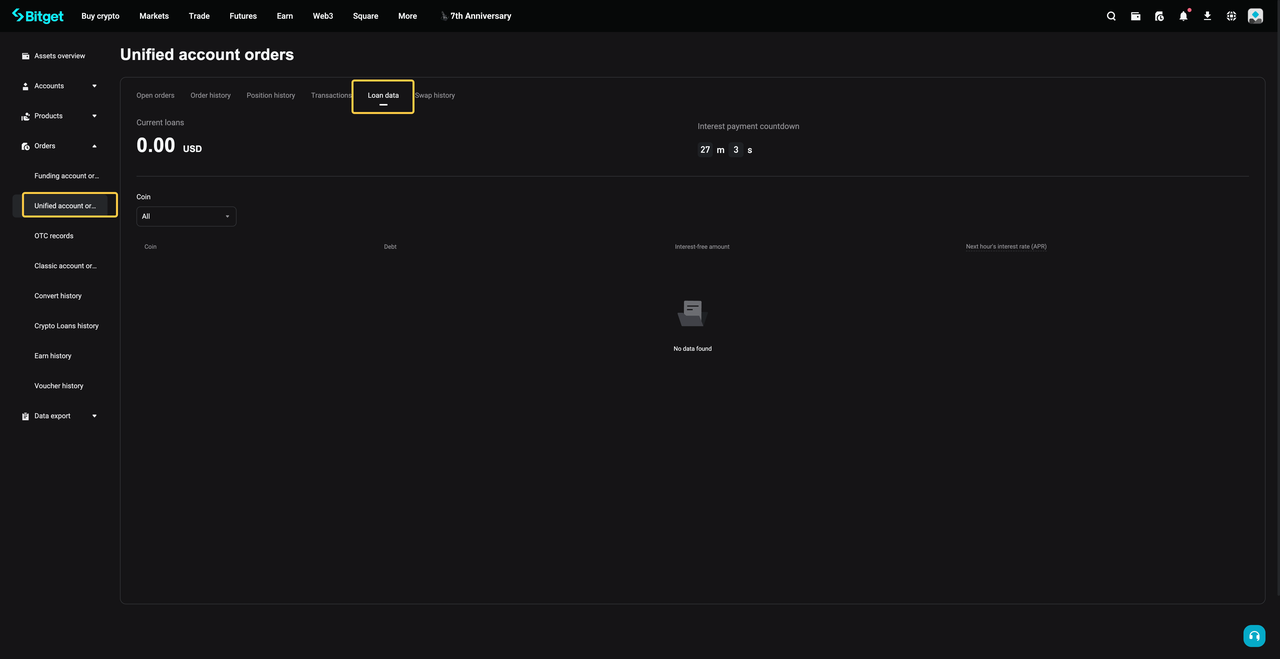

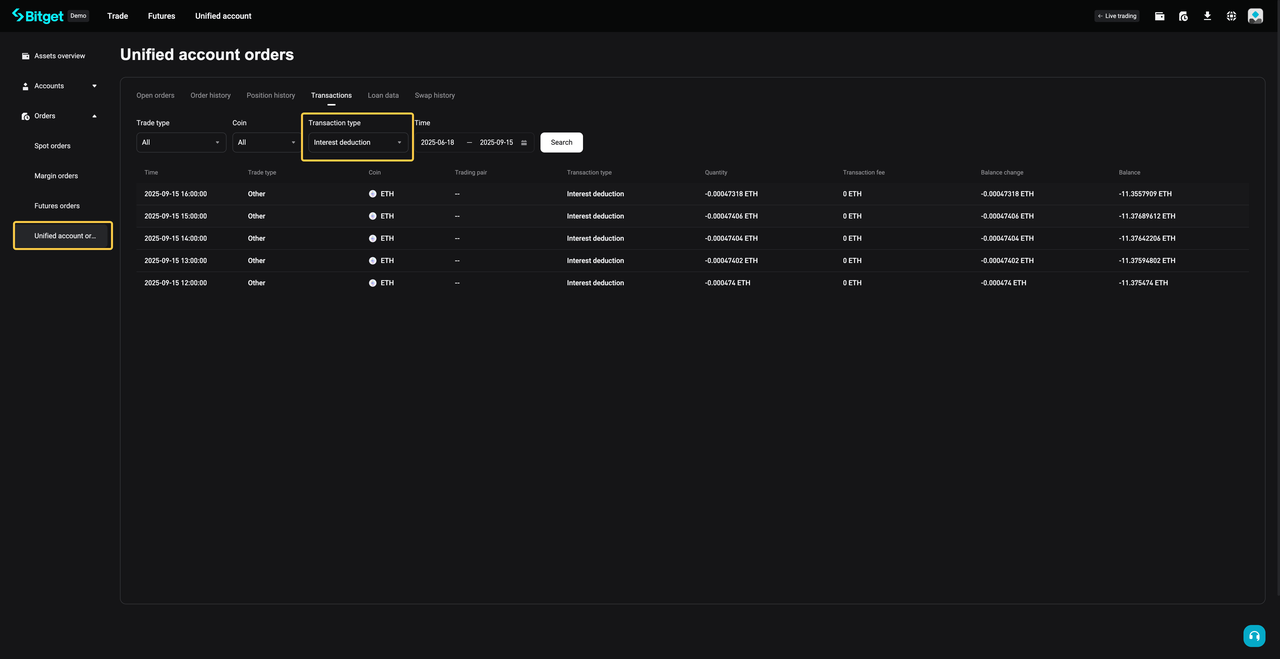

Step 2: Navigate to loan data

1. In the left-hand menu, click Unified account order under Orders.

2. Then select the Loan data tab.

Step 3: View your loan details

On the Loan data page, you can check:

-

Total loan amount

-

Time remaining until the next interest payment

-

Outstanding loan for each asset

-

Interest-free limits

-

Next hour's interest rate (APR)

How to Check Your Interest Records?

Step 1: Go to the Assets tab

1. Click the wallet icon in the top-right corner of the homepage.

2. Select Assets from the dropdown menu.

Step 2: Open transaction history

1. Navigate to Unified account history > Transaction history.

Step 3: Filter interest records

1. Select Interest deduction as the transaction type.

2. View all past interest payment records.

Key Reminders

-

Borrowing happens automatically when balances are insufficient.

-

Interest is charged only on borrowed amounts, not on unrealized losses.

-

Repayment is automatic but can also be handled manually.

-

Borrowing and interest rates are tied to the tiered leverage system, ensuring safe margin management.

FAQs

1. When is borrowing triggered?

Borrowing is triggered automatically when your available balance is not enough to place or maintain a trade.

2. Will unrealized losses generate interest?

Unrealized losses in futures positions are interest-free until they turn into actual debt.

3. Can I close my account with outstanding debts?

No. Accounts with unpaid debts or sub-accounts holding assets/open positions cannot be closed.

4. How are borrowing limits set?

The maximum borrowing amount is the smallest of: available margin, leverage tier limit, or individual borrowing limit.

5. Is interest the same for all assets?

No. Each asset accrues interest separately based on the rate and tier system.

6. How often is interest charged?

Interest is charged daily on borrowed amounts.

7. Do I need to manually repay every time?

No. Repayment is processed automatically by the system, unless you choose manual repayment.

8. Where can I check my borrowed amounts and interest?

You can check them anytime under Assets > Borrowing in your account.

Join Bitget, the World's Leading Crypto Exchange and Web3 Company

Share