Weekly Outlook: Gold and Silver Battlefields! CPI Confronts Fed Firepower, Geopolitical Tensions Face Index Sell-off Wave

In the first full trading week of 2026, cross-asset rallies have reignited risk appetite on Wall Street.

Investors' appetite for risk is obvious. The S&P 500 Index rose by 1.6% this week, while the Russell 2000 Index jumped 4.6%. The Vanguard S&P 500 ETF (VOO) attracted $10 billion in inflows within just a few days—a staggering pace for a passive fund. These signal a strong start to the year.

This backdrop has driven gains in cyclical sectors, commodities, and speculative assets. Strategists from firms such as Nomura Securities International agree, citing resilient employment, rising freight costs, and robust auto demand as factors driving this shift. Investors are moving away from last year’s safe bets and tech giants, turning instead to riskier parts of the market that typically lead early economic recoveries.

This week, spot gold ended up over 4%, climbing more than $177, while spot silver surged by nearly 10%, gaining more than $7. The precious metals complex showed extraordinary strength, fueled by both geopolitical instability and shifting expectations for Federal Reserve monetary policy.

After the release of the U.S. ISM Manufacturing Report, precious metals saw some mid-week profit-taking as the report depicted robust economic conditions and temporarily dampened expectations of imminent Fed rate cuts. However, this bearish sentiment was short-lived. Friday’s nonfarm payrolls report showed a clear downside surprise in job creation, immediately reigniting speculation that the Fed will maintain a dovish cycle this year, albeit with rate cuts possibly delayed. On Tuesday, the U.S. will release the December Consumer Price Index (CPI), which could greatly influence market sentiment and determine the direction of gold and silver prices for the week ahead.

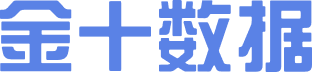

The following are key points the market will focus on in the new week (all in GMT+8):

Central Bank Developments: Intensive Fed Speeches Next Week—No Rate Cut Before Powell’s Successor Takes Office?

Federal Reserve:

Tuesday 01:30, 2027 FOMC voting member and Atlanta Fed President Bostic speaks;

Tuesday 01:45, 2027 FOMC voting member and Richmond Fed President Barkin speaks;

Tuesday 07:00, Permanent FOMC voting member and New York Fed President Williams speaks;

Tuesday 23:00, 2028 FOMC voting member and St. Louis Fed President Musalem speaks;

Wednesday 05:00, 2027 FOMC voting member and Richmond Fed President Barkin speaks;

Wednesday 22:50, 2026 FOMC voting member and Philadelphia Fed President Harker delivers economic outlook remarks;

Wednesday 23:00, Fed Governor Milan speaks in Athens;

Thursday 01:00, 2026 FOMC voting member and Minneapolis Fed President Kashkari speaks; 2027 FOMC voting member and Atlanta Fed President Bostic speaks;

Thursday 03:00, Fed releases Beige Book of economic conditions;

Thursday 03:10, Permanent FOMC voting member and New York Fed President Williams gives opening remarks at an event;

Thursday 21:35, 2027 FOMC voting member and Atlanta Fed President Bostic speaks;

Friday 01:40, 2027 FOMC voting member and Richmond Fed President Barkin discusses Virginia’s economic outlook;

Other Central Banks:

Wednesday 16:20, ECB Vice President Guindos speaks;

Wednesday 17:15, Bank of England Monetary Policy Committee member Taylor speaks at National University of Singapore;

Wednesday 23:30, Bank of England Deputy Governor Ramsden speaks at King’s College London;

Thursday 17:00, ECB releases Economic Bulletin;

Next week will see a large number of speeches from Fed officials, from which investors will seek more clues.

Friday’s nonfarm payrolls report was unremarkable, but the decline in the unemployment rate weakened expectations for further near-term Fed rate cuts. According to CME Group data, futures traders now expect no further rate cuts until at least May, or possibly even later. Despite the report showing only 50,000 jobs created last month, JPMorgan Chief U.S. Economist Michael Feroli said this was “good enough” to keep the job market stable.

Bank of America Global Research strategists said Friday’s data reinforced their belief that the Fed will not cut rates again before Chair Powell’s successor takes office.

Tim Musial, Head of Fixed Income at CIBC Private Wealth, said: “I don’t think a January rate cut will be considered; absolutely not now. I still expect the Fed to cut rates, but that will take place after the first quarter.”

Morgan Stanley, Barclays, and Citigroup have all pushed back their Fed rate cut expectations to later in 2026.

Morgan Stanley economists now forecast rate cuts in June and September (instead of January and April previously). Barclays updated its forecast to June and December (instead of March and June). Citigroup dropped its call for a January cut, now forecasting 25 basis point cuts in March, July, and September.

Key Data: CPI in Focus—A Rallying Cry for Dollar Bulls?

Tuesday 21:30, U.S. December unadjusted CPI YoY, seasonally adjusted CPI MoM, seasonally adjusted core CPI MoM, unadjusted core CPI YoY;

Wednesday 01:00, EIA releases monthly Short-Term Energy Outlook report;

Wednesday, OPEC releases monthly crude oil market report (exact time to be determined, usually around 18:00-21:00 GMT+8);

Wednesday 21:30, U.S. November retail sales MoM, U.S. November PPI YoY/MoM, U.S. Q3 current account;

Thursday 15:00, UK November three-month GDP MoM, manufacturing output MoM, seasonally adjusted goods trade balance, industrial output MoM;

Thursday 18:00, Eurozone November seasonally adjusted trade balance, industrial output MoM;

Thursday 21:30, U.S. initial jobless claims for the week ending January 10, U.S. January New York Fed/Philadelphia Fed manufacturing indexes, U.S. November import price index MoM;

The most critical data next week is undoubtedly the U.S. December CPI report. This is expected to show inflation remains elevated, supporting a Fed pause.

Analyst Eren Sengezer notes that December’s CPI is unlikely to have a major impact on the Fed’s January decision, but if the numbers deviate significantly from expectations (especially core CPI MoM), the market may react. If the monthly rate comes in at 0.3% or higher, it could rekindle concerns about sticky inflation and temporarily boost the dollar. Conversely, a reading below 0.2% could have the opposite effect on the dollar and give a modest lift to international spot gold.

Atlanta GDP Now estimates suggest the U.S. could see yet another quarter of strong growth data, further intensifying debate over whether more easing is urgently needed.

Dollar bulls remain in the driver’s seat, with the index breaking above an ascending triangle formed around the Christmas holiday lows this week. On Friday, the dollar index also successfully broke above the key 200-day moving average near 98.85, a sign of possible further short-term upside, paving the way for a potential return to the November 2025 peak at 100.39. Once breached, the index could attempt to move toward the May 2025 high of 101.97.

On the other hand, if bears step up, the dollar index could slide back toward the late 2025 low at 96.21. A break below this level could expose the February 2022 trough of 95.13, followed by the 2022 bottom at 94.62.

Key Events: Geopolitical Tensions and Commodity Index Rebalancing—Opportunity or Trap for Gold and Silver?

Investors will closely monitor next week’s geopolitical headlines.

U.S. Secretary of State Rubio is scheduled to meet with officials from Denmark and Greenland. In an interview with The New York Times, Trump reiterated his intention to take over Greenland. “Ownership is very important,” Trump told the paper. It’s difficult to predict the next steps, but if tensions rise between the EU and the U.S., investors may seek safe-haven assets. In such a scenario, international spot gold could gather upward momentum.

Additionally, nationwide unrest in Iran (including in the capital Tehran) triggered by anti-government protests may also affect market risk sentiment in the short term. Trump stated that if Iranian authorities use lethal force against protesters, the U.S. may take military action against Iran. In response, Iranian Foreign Minister Araghchi said, “The U.S. and Israel have tested attacks on Iran, and those attacks and strategies failed completely. If they repeat the mistake, they will face the same result.” He added that while Iran does not want war, it is prepared. If the Iran conflict deepens and the U.S. becomes actively involved, international spot gold may continue to benefit from safe-haven inflows.

The latest Kitco News weekly gold survey shows that Wall Street is nearly unanimously bullish on gold in the near term, while retail investors maintain a mostly bullish bias.

Darin Newsom, Senior Market Analyst at Barchart.com, said, “According to Newton’s First Law of Motion as applied to markets: a trending market will continue in that trend until acted upon by an external force. I don’t see the external force changing, most obviously investor and central bank buying interest.”

Rich Checkan, President and COO of Asset Strategies International, said: “The calendar changed from 2025 to 2026... but the market fundamentals haven’t changed. Central banks are still buying. Tensions in Ukraine, Gaza, and Venezuela continue to escalate. Fiat currencies are still mismanaged by fiscally irresponsible politicians. The dollar is still weak. Interest rates are still low. Investors are seeking gold as a safe haven.”

James Stanley, Senior Market Strategist at Forex.com, stated: “I think the $4,500 level could be a hurdle for bulls, but so far, they’ve supported pullbacks, so I haven’t seen any evidence the current rally is over. I’ll stick with the trend until there’s evidence otherwise.”

Adam Button, Head of Currency Strategy at Forexlive.com, said, “The breakdown of international law and norms we’re seeing at the start of 2026 will have profound effects on the dollar and gold... Going into the new year, we’re seeing the U.S. arrest foreign presidents, talk about occupying Cuba, Iran, and other places, talk about bombing Mexico, and using Venezuela’s oil funds as they see fit. The government is using allies’ reserves in whatever way it chooses.”

Button said that while each of these topics is significant in its own right, Greenland is the most important. “Denmark holds about $90 billion in foreign exchange reserves, and while they haven’t disclosed the specifics, it’s safe to assume that half is in dollars. If you’re Denmark or the Danish central bank, would you want to hold dollar reserves in the face of some sort of confrontation over Greenland? Even in negotiations, you don’t want to be threatened by the U.S. with reserve confiscation. Trump likes to take these extreme stances, and (the Biden administration) seized Russian reserves. I think Trump has made it clear again this year he’s willing to break international rules and laws. The government is openly plundering allies internationally.”

In this context, the entire world order is at risk, with the dollar at its center. “The dollar has nowhere to go but someplace lower in the international system,” he said.

Button also believes that the upcoming Supreme Court ruling on Trump’s tariff powers will be a pivotal moment for gold. The Supreme Court delayed the tariff decision this week. “The real question is whether the Supreme Court is now seen as a department of government, or is it still an independent, sober constitutional body? The answer to this could swing gold prices by $500.”

CPM Group analysts issued a sell recommendation after Thursday’s close, with an initial target price of $4,385 per ounce, a stop-loss at $4,525, and a timeframe of January 9–20, 2026. Analysts added, “In the longer term, through the end of January and the rest of Q1, prices seem more likely to rise, as political and economic risks remain unresolved. However, a short-term selloff may occur first.”

Jim Wyckoff, Senior Analyst at Kitco, said: “Technically, for February gold futures, the next upside price objective for the bulls is to close above the strong resistance at the all-time high of $4,584. The bears’ next near-term downside price objective is pushing futures below solid technical support at $4,284.30. The first resistance is at $4,500, then at this week’s high of $4,512.40. The first support is at $4,415, then $4,400.”

Next week, gold and silver will also have to contend with an annual event: the yearly rebalancing of major commodity indexes such as the S&P GSCI and Bloomberg Commodity Index, which may trigger significant selling in gold and silver futures.

Saxo Bank noted that the rebalancing-related selling has been well telegraphed over the past few months. This reduces the risk of disorderly price action and increases the likelihood that much of the adjustment has already been priced in. Thus, market behavior during the rebalancing window may provide more information than the flows themselves. If gold and silver stabilize or rebound amid persistent mechanical selling, it would indicate robust underlying demand and that the recent rally is not purely momentum or FOMO-driven. Conversely, if these flows can’t be absorbed, positioning may become more fragile and the risk of a deeper (albeit still technical) correction would increase. Key signals to watch include changes in open interest, intraday liquidity conditions, and whether price weakness is concentrated during predictable execution windows or spills over into broader trading sessions.

In summary, the annual commodity index rebalancing is a brief but powerful technical force, especially after an extraordinary year like 2025. For gold and silver, it is a mechanical test rather than a fundamental judgment. While short-term volatility risks have increased, any weakness from flow rebalancing should be viewed from a technical perspective. Once this process ends, attention will likely shift back to the structural forces that drove last year’s price gains. Therefore, how gold and silver fare during these rebalancing days may offer valuable clues about the persistence of demand.

Corporate Earnings: U.S. Earnings Season Begins, Supreme Court Tariff Case Still Pending—Can the S&P Break Through 7,000?

The Q4 U.S. earnings season kicks off with major banks such as JPMorgan (JPM.N), Citigroup (C.N), and Bank of America (BAC.N) set to report next week, along with Delta Air Lines (DAL.N).

On Friday, despite federal funds futures showing limited odds of another rate cut before the second half of the year, U.S. stocks rose. As more cyclical sectors break higher while the information technology sector struggles, investors appear hopeful that an accelerating U.S. economy could deliver broad-based gains and earnings growth. This has been a popular theme in 2026 outlooks from major Wall Street banks and investment firms.

Jose Torres, Senior Economist at Interactive Brokers, said: “AI is getting tired and Wall Street is searching for other parts of the market that can drive stock appreciation—when the economy reaccelerates and rates fall, it’s a real positive for many market areas that haven’t participated like tech has in recent years.”

FactSet data shows Wall Street analysts already expect strong earnings growth—not just for large-cap companies, but for small caps as well. This should help continue pushing up stocks across the size spectrum.

After a strong start to 2026 trading, the S&P 500 is approaching the 7,000 level, and the Dow is nearing the 50,000-point mark.

Cayla Seder, Macro Multi-Asset Strategist at State Street Bank, said: “Friday’s labor data was more about labor market balance than weakness. The number is strong enough to show the economy is in good shape, but not so strong that the market needs to drastically change its policy expectations, which is positive for stocks.”

Meanwhile, the Supreme Court did not issue its long-awaited decision on the legality of Trump’s tariffs this week. The tariff ruling remains one of the major tests ahead for U.S. stocks and Treasuries, with the court potentially releasing more opinions in the next two weeks. Removing tariffs could boost profit margins and ease consumer burdens, thereby lifting stocks. Meanwhile, Treasuries could come under pressure as potential stimulus complicates the Fed’s rate cut outlook and could worsen the government’s budget deficit.

Market Closures:

On Monday (January 12), Japan observes Coming of Age Day. CME Group's U.S. Treasury futures contracts begin trading at 15:00 GMT+8; the Tokyo Stock Exchange will be closed for the day.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

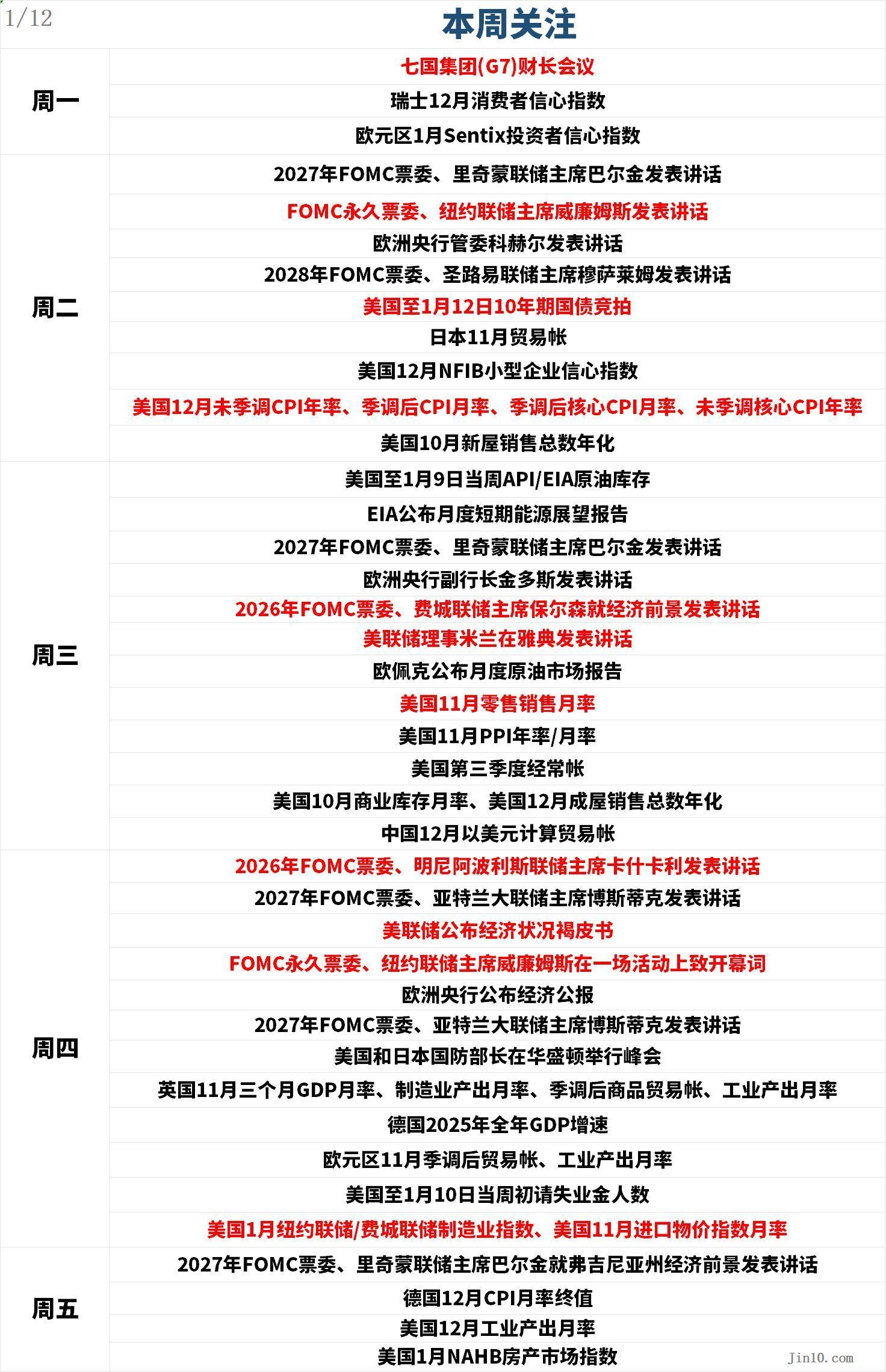

Is Chainlink Heading To $18? Analyst Points Out A Range-Bound Pattern Suggesting 36.3% LINK Rally Amid Growing Buying Pressure

Dan Ives: Massive AI Investments Mark Only the Beginning of the ‘Fourth Industrial Revolution’

Borderlands Mexico: Flexport cautions importers that tariff concerns will remain prominent in 2026

XRP Hits $2.17 But Digitap ($TAP) Is Technically The Best Crypto To Buy 2026