The year started strong for spot Bitcoin ETFs in the U.S., with notable initial inflows. However, this trend reversed briefly when the funds recorded a net outflow. Following a robust net inflow surpassing $1.16 billion in the first two trading days of 2026, there was a withdrawal of $243 million on Tuesday. The stability of Bitcoin’s price at around $92,000 indicated a market searching for balance rather than a drastic sell-off. Institutional investors’ moves were perceived as portfolio adjustments rather than risk avoidance.

Bitcoin ETF Direction Shifts: Market Seeks Stability

Spot Bitcoin ETFs Backtrack

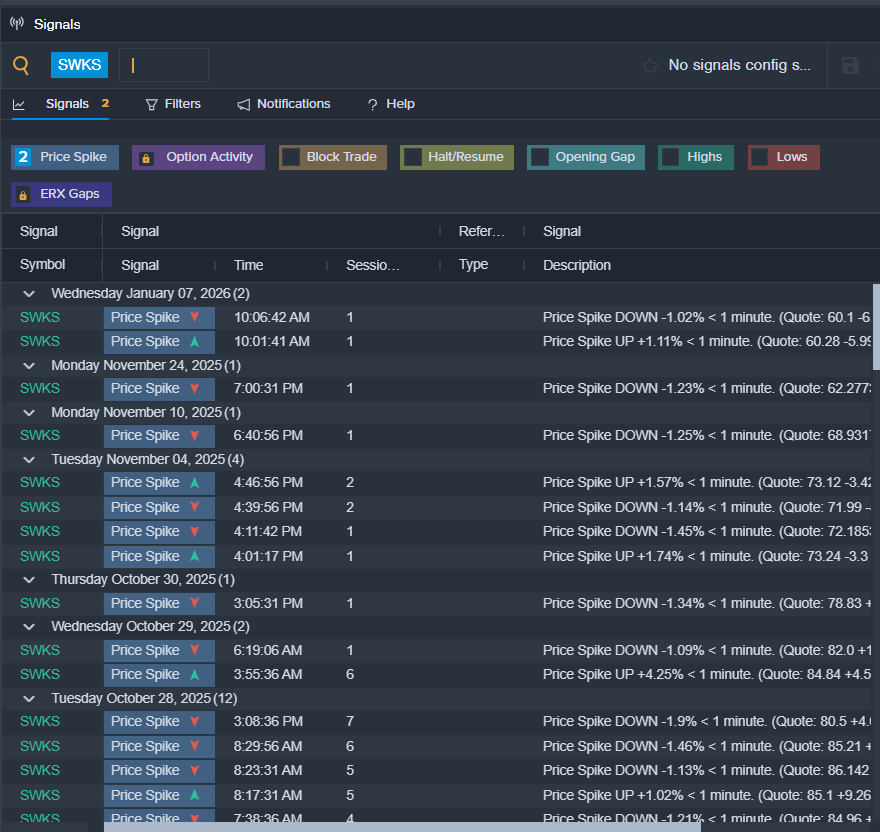

On the third trading day of 2026, spot Bitcoin ETFs recorded negative flow on the U.S. exchanges. According to SoSoValue data, the net outflow totaled $243 million, marking the year’s first negative day. Fidelity’s FBTC fund was at the center, with withdrawals exceeding $312 million. Significant liquidations were also seen in both Grayscale’s GBTC and Bitcoin Mini Trust funds, while products from Ark & 21Shares and VanEck closed the day in the red.

Conversely, BlackRock’s IBIT fund partially balanced the scenario with a net inflow of approximately $229 million the same day. This brought the total inflow into IBIT to $888 million over the first three trading days of 2026. Market experts unanimously believe that the single-day outflow didn’t overshadow the strong demand at the year’s start.

Vincent Liu, CIO of Kronos Research, emphasized that ETF outflows were a normalization following inflows, not risk aversion. According to Liu, institutions aren’t fully abandoning their positions but readjusting exposure. Despite the outflows, Bitcoin’s price stability indicated a phase of horizontal consolidation rather than drastic unravelling.

Interest Shifts to Altcoin ETFs

A similar sentiment was shared by LVRG Research. Research Director Nick Ruck described the movement as limited pullback and profit realization. Ruck sees portfolio rebalancing as a natural extension of the accelerated purchases at the year’s start.

An interesting point was the performance of altcoin ETFs. Spot Ethereum ETFs registered a net inflow of $114.7 million the same day. Despite outflows in Grayscale and Fidelity products, the overall figure remained positive. XRP and Solana ETFs also stood out by attracting $19 million and $9 million, respectively.

Jeff Mei, COO of BTSE, pointed out that investors are seeking higher return potential in Solana and XRP. He noted that these assets appear to have more room to maneuver compared to previous peaks. Liu remarked that the limited amounts directed toward Solana and XRP ETFs reflect early-stage position adjustments rather than large-scale capital shifts.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Top 3 Technology Stocks That May Deliver Your Highest Returns This Month

Ethereum Price Prediction: Descending Channel Caps ETH As Spot Outflows Persist

Goldman and BNY Pershing Enter the Client Referral Arena