The Birth of ETHGas and Block Space Pricing

Key Points:

- ETHGas redefines Ethereum block space from transaction fees that fluctuate with demand into a priceable resource. Through block space futures and pre-confirmation mechanisms, it allows large-scale users to lock in costs and time certainty in advance.

- By introducing block space futures and validator-backed pre-confirmations, ETHGas brings a structure to Ethereum similar to traditional financial markets, enabling applications and institutions to plan, hedge, and operate in a more predictable environment.

- ETHGas signals an important direction for Ethereum's evolution: Ethereum is moving from a purely technical protocol to a settlement layer centered on economic management, where time and block space begin to have explicit value.

The Real Bottleneck of Ethereum Has Never Been Just Scalability

In recent years, Ethereum’s technical narrative has been almost entirely dominated by “scalability.” Layer 2, modularity, and data availability have become the focus of discussion, as if increasing transaction throughput would naturally resolve all structural issues. However, in real market environments, a deeper limitation has gradually emerged, and it is not written in the technical parameters.

This limitation is called uncertainty.

On Ethereum, block space is a highly ephemeral and non-storable resource. The available space in each block can only be auctioned and consumed within a very short time window, after which it immediately expires. All users and applications are forced to participate in spot bidding, with no tools to lock in costs in advance and no mechanisms to buffer volatility. Even though EIP-1559 has somewhat smoothed out the base fee, gas prices still spike dramatically during periods of concentrated demand.

When Ethereum was still in its experimental phase, this structure was acceptable. But as it began to support high-frequency financial activities such as exchange settlements, rollup data submissions, and market-making strategy execution, this uncertainty became more than just a user experience issue—it evolved into systemic friction. For institutions, gas is no longer a simple transaction fee, but an operational risk that cannot be planned or managed.

ETHGas emerged in this context. It does not attempt to make Ethereum faster, but rather to make Ethereum more predictable.

When Block Space Is Treated as a Resource for the First Time

The core of ETHGas is not a complex technical breakthrough, but a change in perspective. It redefines block space as a resource that needs to be seriously managed, rather than just a carrier for transaction fees.

In the real world, any key production factor, once it enters the stage of large-scale use, undergoes a process of financialization. Electricity, oil, and transportation capacity do not support the modern economy because they are cheap, but because they can be priced in advance, have locked-in costs, and can be incorporated into long-term planning. It is the futures markets and forward curves that turn these resources from random costs into manageable variables.

Ethereum has long lacked such a structure. Block space can only be bought and used immediately, with no forward prices, no hedging tools, and no stable cost anchors. This naturally exposes all participants to short-term volatility and limits the formation of long-term business models. As researchers pointed out in Ethereum blockspace is increasingly discussed as an economic resource rather than a simple fee mechanism, block space is being reinterpreted as an economic resource, not just a technical byproduct.

ETHGas introduces block space futures, formally bringing time into Ethereum’s fee system. Future blocks are no longer just fleeting opportunities to be seized, but assets that can be purchased in advance, priced, and written into budget models. This step may seem subtle, but it is profoundly significant. It gives Ethereum, for the first time, the possibility of being used like real-world infrastructure.

Pre-Confirmation Makes Time No Longer a Free Byproduct

If block space futures solve price uncertainty, then the pre-confirmation mechanism solves time uncertainty.

Ethereum’s 12-second block time is not particularly slow, but it cannot be reliably depended upon by applications. After a transaction is submitted, applications can only wait, unable to confirm results in a short time. This delay is often unacceptable for high-frequency trading, real-time interactions, and complex financial logic.

The pre-confirmation mechanism of ETHGas does not modify Ethereum’s consensus rules, but adds a layer of time commitment on top. Through validators’ cryptographic signature commitments to future block space, transactions can receive a highly credible inclusion guarantee even before they are actually packaged. This mechanism is widely regarded by the research community as a practical path, as discussed in preconfirmation is widely viewed as a path toward making Ethereum feel real time, introducing a near real-time system experience to Ethereum.

From the application layer perspective, this means that time, for the first time, shifts from a technical parameter of the blockchain to a capability that can be purchased and planned. Ethereum has not become a millisecond-level blockchain, but it is beginning to possess the most critical feature of real-time systems: determinism has a price.

Why ETHGas Is More Like Financial Infrastructure Than a Crypto Experiment

The biggest difference between ETHGas and many Ethereum-native research projects is that it is not built around academic ideals. Its design logic is closer to traditional financial infrastructure.

The project team has a clear financial engineering background, with funding led by Polychain Capital and early participants including many validator operators and professional trading institutions. This allowed ETHGas to prioritize solving the authenticity of supply from the outset, rather than relying on narrative to drive market adoption.

By locking in validator commitments in advance, ETHGas ensures that block space futures are not just paper trades, but a market with real delivery capability. On the demand side, mechanisms like Open Gas hide complex financial structures behind the protocol, making changes almost imperceptible to end users, while turning gas costs into protocol-controllable business expenditures.

This design is not romantic, but extremely pragmatic. It acknowledges a fact: Ethereum is becoming institutionalized, and the prerequisite for institutionalization has never been faster blocks, but a more stable and predictable environment.

Ethereum Is Being Repriced

The significance of ETHGas is not that it provides a new tool, but that it reveals an ongoing structural shift. Ethereum is evolving from a technology-centric protocol into a settlement network that requires systematic management.

When block space can be purchased in advance, when time can be priced, and when uncertainty can be hedged, Ethereum is no longer just a decentralized ledger, but begins to acquire the economic attributes of real-world infrastructure. This path will inevitably be controversial and introduce new risks, but it also marks an important signal of Ethereum’s entry into a mature stage.

ETHGas is not the end, but it is likely the first project to directly answer this question for Ethereum: If blockchains are to serve real-world financial activities, then what should their time and space actually be worth?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Trust Wallet browser extension attacked with losses exceeding $6 million, official patch urgently released

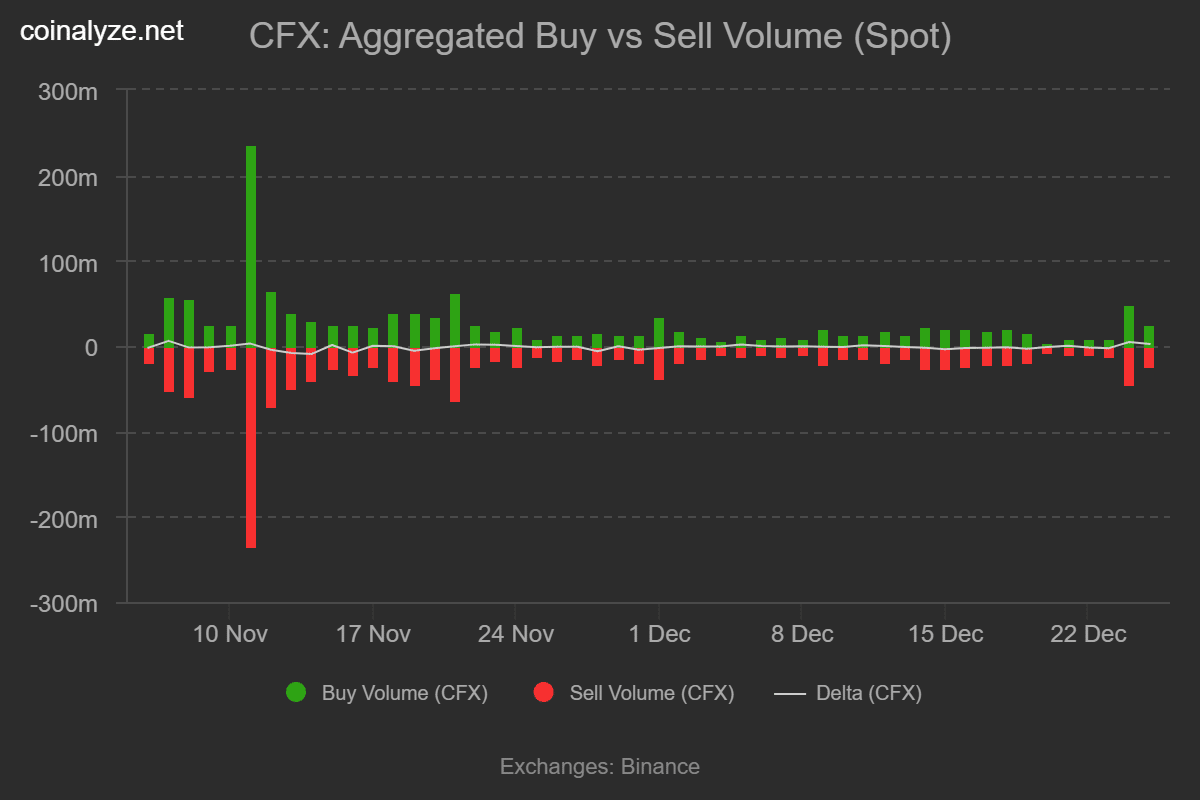

Conflux jumps 9% on AI gaming deal – $0.093 next ONLY IF…