R2 Vaults Upgrade: Official Launch of a Clear Dual-Layer Yield Structure

R2 Vaults has undergone a significant upgrade. This upgrade will be officially launched with Season 2 (S2), providing clearer yield stratification to meet the needs of users with different risk and liquidity preferences. At the same time, R2 always adheres to its core principle:

Bringing real, transparent Real World Asset (RWA) yields on-chain.

After the upgrade, R2 will offer two clearly positioned Vaults with distinct risk and liquidity characteristics:

- sR2USD: A core yield Vault with high liquidity and low risk

- sR2USD+: An enhanced yield Vault for long-term capital, operating on a Season cycle

The underlying yields of both Vaults are 100% derived from institutional-grade Real World Assets (RWA), with no reliance on leverage or token inflation.

sR2USD: Core Stable Yield Vault

Target APY: approximately 5.0%–5.5% (pure RWA yield)

sR2USD is designed for users seeking stable returns, high liquidity, and a predictable redemption experience, positioned as R2’s core low-risk yield product.

Asset Portfolio

- VBILL (25%): Liquidity anchor asset and quick redemption buffer

- USCC (40%): Enhanced liquidity yield (T+3)

- STAC (25%): Stable and predictable cash flow (T+3)

- MB (10%): Short-term, cash flow-supported yield enhancement asset

Core Features

- Risk Level: Low

- Liquidity: High

- Redemption Cycle: T+3

- Yield Distribution: Settled every 90-day Season cycle

The goal of sR2USD is to become a high-quality on-chain “cash management” product, balancing stability, liquidity, and real yield.

sR2USD+: Enhanced Yield Season Vault

Target APY: approximately 8.0%–10.0% (pure RWA yield)

sR2USD+ is designed for users willing to lock in funds for a full Season cycle in exchange for higher yields, achieving higher returns through a longer duration and a more diversified asset structure.

Asset Portfolio

- VBILL (5%): NAV stability and minimal liquidity buffer

- USCC (35%): Enhanced liquidity yield (T+3)

- STAC (10%): Stable cash flow asset (T+3)

- MB (30%): Short- to mid-term yield enhancement asset

- Apollo (20%): Long-term, institutional-grade yield asset

Core Features

- Risk Level: Low–Medium

- Liquidity: Medium

- Redemption Method: Redeem at the end of the Season

- Yield Distribution: Settled every 90-day Season cycle

While maintaining transparency and prudent risk management, controlled duration and credit exposure are introduced to unlock higher real yield potential.

Why is this upgrade important?

- Clearer product positioning: Liquidity first or yield maximization, clear at a glance

- Pure RWA yield: No leverage, no synthetic yield design

- Institutional-grade asset structure: Diversified assets, clear cash flow paths, predictable redemption

- Season mechanism design: Natural matching of fund duration and underlying assets

Through this upgrade, R2 further strengthens its positioning as On-chain Real Yield Infrastructure, enabling real-world yields to flow more naturally into Web3.

In the future, R2 will continue to optimize asset portfolios, transparency disclosures, and ecosystem integration, making real yields simpler, more trustworthy, and more globalized.

Season 2 is about to begin. Please stay tuned for more details and performance data.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

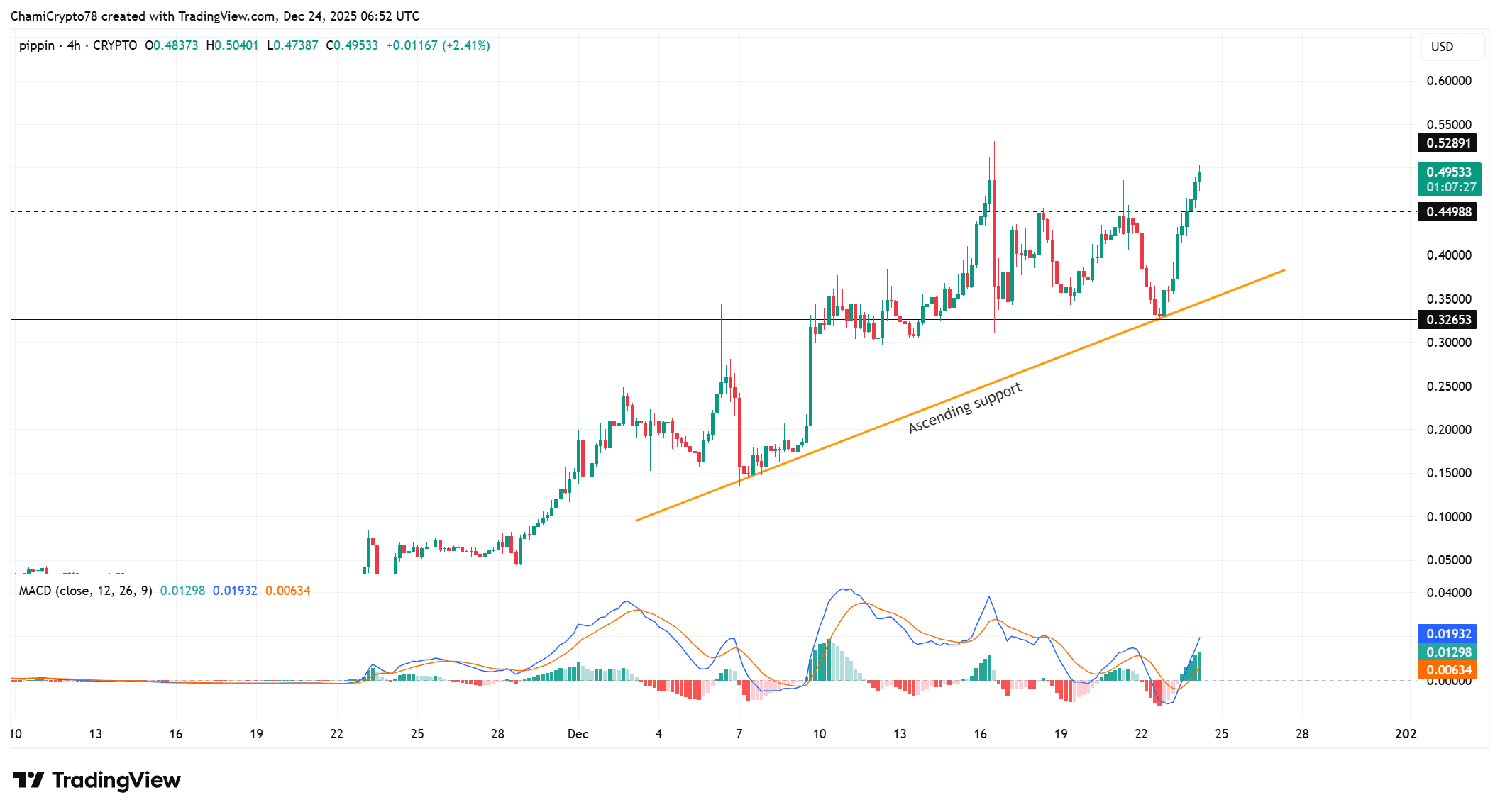

Pippin’s 32% surge meets rising leverage – Can bulls sustain the rally?

Upexi Files $1B Shelf Registration, Shares Slide on Solana Treasury Signal

Crypto Analytics Company CryptoQuant Announces the Crypto Market is Undergoing a Reset! Here Are the Details

ZKsync Announces New Protocol Upgrade to Redefine Interoperability and Settlement