Honeypot Finance: A rising full-stack Perp DEX, can it challenge Hyperliquid?

Author: momo, ChainCatcher

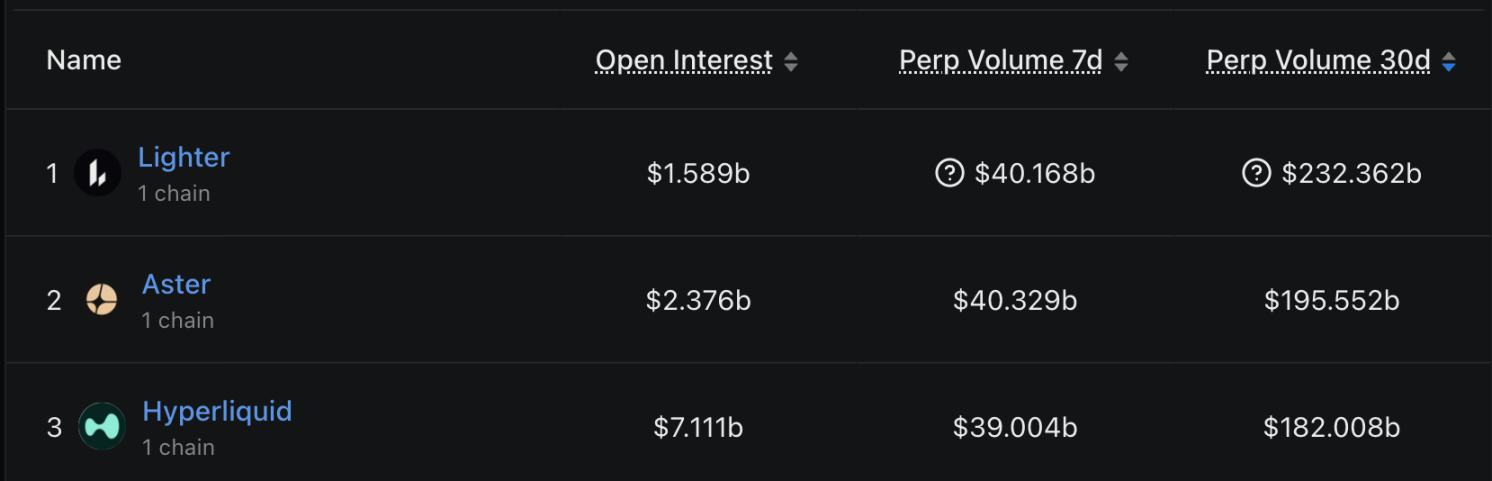

The current decentralized perpetual contract (Perp DEX) market is undergoing a new round of reshuffling. Following Hyperliquid, protocols such as Aster and Lighter have successively entered the market, breaking the original landscape. This indicates that before the infrastructure matures, market competition is far from over.

Against this backdrop, Honeypot Finance, as a new challenger, provides an interesting case study. It recently completed a new round of financing at a valuation of $35 million, with support from well-known institutions such as Mask Network.

Unlike mainstream solutions, Honeypot differentiates itself with its "full-stack" approach, combining AMM and order book models. It not only optimizes the trading experience but also attempts to integrate token issuance, liquidity management, and derivatives trading into a synergistic system. Since its launch, the trading volume of its perpetual contracts has exceeded $20 million.

This article will analyze Honeypot's products and mechanisms, exploring whether its full-stack integration model can establish a sustainable practical advantage in the current competitive landscape.

From Meme Launchpad to Full-Stack Perp DEX

Before entering the Perp DEX field, Honeypot's core battleground was the Meme Launchpad. The team created the flagship product Pot2Pump, directly addressing and attempting to solve the core pain point of the Memecoin economy at the time: how to capture and retain real long-term value for the protocol during a frenzied but short-lived issuance cycle, rather than just one-off traffic.

Pot2Pump revolutionarily transformed early participants directly into native liquidity providers (LPs), allowing the liquidity pool and token to be born simultaneously. This design changed the vicious cycle of early Memecoin "scientists" arbitraging and rapid liquidity exhaustion, turning high volatility into sustainable fee income for LPs.

Through Pot2Pump, Honeypot successfully validated an important model: in the high-volatility, high-game asset field of Memecoins, sophisticated mechanism design can guide liquidity behavior and convert market heat into a stable income stream that can be shared by the protocol and the community.

However, Honeypot quickly realized that Memecoins are more of an entry point for liquidity experiments rather than the final form. What determines the long-term vitality of the protocol is whether capital can continue to trade, price, and settle within the system.

Based on this judgment, the team expanded its perspective from single issuance to a complete structure covering market making, trading, and risk management, with perpetual contracts becoming a natural choice. Compared to spot or one-time issuance, Perp DEX can sustainably carry trading demand, generate stable fees, and turn volatility into manageable risk exposure.

Honeypot Finance's Differentiation and Innovation

When Honeypot Finance entered the perpetual contract field, it faced two mainstream paradigms, each with its own flaws.

On one side is the order book model relying on market makers, which is highly efficient in calm markets, but when volatility increases, liquidity can evaporate instantly, causing price gaps and leading to liquidations under harsh conditions.

On the other side is the AMM model represented by GMX, which uses oracle pricing to avoid information lag but makes liquidity providers the direct counterparties to all traders. In one-sided markets, these capital providers will continuously incur losses, resulting in capital fleeing just when the protocol needs support the most.

A deeper problem lies in the imbalance of risk and fairness: to ensure the system does not collapse, some protocols adopt automatic deleveraging mechanisms, sacrificing the interests of some profitable traders in extreme situations to cover losses, which has triggered widespread concerns about fairness. At the same time, indiscriminately pooling all funds together hinders the entry of capital with different risk preferences (especially large funds seeking stability).

1. Building Full-Stack Liquidity: Order Book and AMM Working Together

To address these structural issues, Honeypot did not choose to patch the old paradigms, but instead proposed an integrated approach. Its core is to build a "full-stack" perpetual DEX, allowing the order book and AMM to work together and automatically adapt to different market conditions.

The order book is responsible for efficiency and depth: by integrating a high-performance on-chain order book in cooperation with Orderly Network, Honeypot provides traders with a low-slippage, high-speed trading experience similar to centralized exchanges during stable markets, meeting the needs of high-frequency and professional traders.

AMM provides resilience and assurance: Honeypot's self-developed AMM mechanism is centered around a dynamic price band based on oracle prices. When the market experiences sharp volatility or black swan events and order book liquidity dries up, the AMM becomes the final execution guarantee layer, ensuring that trades can be executed at any time.

The system will automatically select the optimal execution path (order book or AMM) for users' trades based on market volatility and order book depth, so users can enjoy the best experience without manual intervention. This truly achieves "efficient trading in calm times, and predictable execution during storms."

2. Implementing Structured Risk Control: Layered Vaults and Fair Liquidation Process

In the core aspect of risk management, Honeypot's thinking is equally profound.

They started with capital structure and introduced a layered vault system.

This allows conservative funds seeking stable returns (such as potential institutional capital) to enter the "senior vault," enjoying priority in fee distribution and bearing losses last, thus achieving risk isolation. Crypto-native players can voluntarily choose to enter the "junior vault," becoming the first line of defense to absorb losses in exchange for higher returns. This design transforms risk from a "passive, mixed burden" into an "active, clearly priced choice."

On this basis, they reconstructed the liquidation process, designing a "waterfall" sequence with multiple buffers.

That is, when a position is close to liquidation, the system does not directly liquidate, but instead tries "partial deleveraging," conducts "micro-auctions" to marketize the position, and lets the junior vault absorb the loss in turn; after this, the insurance pool intervenes as a protocol-level buffer to cover extreme tail risk events; only when all of the above mechanisms are insufficient to stabilize the system will the ADL automatic deleveraging—which has minimal impact and is fully auditable—be activated as a last resort. This transparent design, which postpones punitive measures, is intended to truly fulfill its commitment to "process fairness."

From market feedback, this systematic design—from liquidity foundation to risk bottom layer—is receiving initial validation. According to industry information, the platform's total trading volume has exceeded $120 million, and the trading volume of perpetual contracts has also surpassed $20 million since launch.

These figures strongly confirm that its risk-tiered structure has converted the appeal to robust capital into real capital accumulation. Through this series of designs, Honeypot is not only trying to solve existing pain points, but also exploring the construction of a next-generation on-chain derivatives infrastructure that can accommodate more complex capital and place greater emphasis on fairness.

Tokenomics and NFT Mechanism: How to Achieve a Revenue Closed Loop?

Honeypot Finance does not just aim to improve the trading experience, but attempts to build a self-sustaining revenue system. Its token and NFT design revolve around the same core goal: to ensure that the real income generated by the protocol can be continuously recycled, redistributed, and in turn support the ecosystem itself.

1. HPOT: The Carrier and Distribution Tool for Revenue

In many DeFi protocols, tokens mainly serve as incentives or governance tools, with limited connection to actual protocol income. Honeypot's token $HPOT, with a fixed total supply of 500 million, is designed as a hub connecting trading activity and value distribution.

A portion of the trading fees generated by the protocol in perpetual contracts and other products will enter the All-in-One Vault, which is managed by the vault and participates in on-chain strategies, thus converting into sustainable real income. These earnings are not simply retained, but are clearly allocated: part is used to buy back and burn $HPOT, creating continuous supply contraction; another part is distributed to users participating in the vault as claimable rewards.

Under this structure, $HPOT is not just a speculative asset waiting for price fluctuations, but a value carrier linked to the actual operating results of the protocol, acting more as a "revenue relay" rather than a one-way incentive tool.

2. NFT: Turning Long-Term Participation into Revenue Weight

Honeypot's HoneyGenesis NFT is not simply an identity or membership certificate, but a revenue component designed around "long-term participation."

Holders can choose to stake their NFTs, accumulating revenue weight over time; or they can choose to burn their NFTs in exchange for a permanent, higher yield coefficient. Essentially, this design guides users to exchange time and commitment for higher long-term returns, rather than short-term arbitrage.

Here, NFTs do not emphasize collectibility, but serve as "revenue weight amplifiers," making participation itself a quantifiable and upgradable capital investment.

In summary, Honeypot seeks to avoid the "incentive consumption" model, instead building ecosystem growth on real usage and income. The end result is not a one-way subsidy, but a positive feedback system revolving around revenue recycling and redistribution.

Conclusion:

With the token about to launch, Honeypot Finance is transitioning from a project driven by early adopters and ecosystem builders to a broader and more complex public market.

Currently, Honeypot's practices have already provided the on-chain derivatives sector with a profound case study on structure, risk, and fairness. Its core value does not lie in deepening a single function, but in a series of coherent design philosophies:

First, compatibility and scalability of structure. The "full-stack" model is not only a hybrid solution for coping with market volatility, but also reserves underlying interfaces for accommodating more long-term and diverse capital and trading scenarios. The layered vault design transforms risk from "passive sharing" to "active choice," paving the way for attracting traditional conservative capital.

Second, a long-term orientation in economic mechanisms. Whether it is feeding protocol income back to users through token buybacks and burns and claimable rewards, or designing NFTs as upgradable "revenue positions," the goal is to build a value closed loop of "participation equals accumulation." This logic aims to reduce reliance on one-off liquidity mining incentives and explore the possibility of continuing to operate on real use cases and sustainable revenue distribution after incentives taper off.

Third, the synergistic potential of the ecosystem. Honeypot's Perp DEX is not an isolated product, but a key link in its full-chain liquidity path from asset issuance and spot trading to derivatives hedging. This deep integration means that different products are likely to form a positive cycle of capital and user behavior, building a deeper moat.

But after the initial hype fades, can Honeypot turn its carefully designed structural advantages into stable capital accumulation, sustained real trading demand, and healthy protocol income? Can it prove that its advocated "process fairness" and risk layering can truly protect users and maintain system stability in extreme market environments? This still needs to be tested by the market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

IMF Highlights Strong Growth and Ongoing Bitcoin Discussions in El Salvador

Hyperliquid personally reconciles accounts; behind the perfect PR is a fundamental crackdown on competitors.

Solana Falls 39%: Officially Worst Quarter of 2025

Leading ETH Treasury Firm Reaches Tremendous Milestone