Polkadot DOT trading stable with support around $1.72-$1.74 as trading volume rises.

Polkadot’s DOT is stable over the last 24 hours, trading around $1.85, supported between $1.72 and $1.74, primarily influenced by market dynamics rather than new protocol events.

This indicates a consolidation phase, driven by increased trading volume and liquidity concentration, signaling potential price stabilization without direct intervention from Polkadot’s leadership.

Stability Amid Market Shifts

Polkadot’s DOT has shown stability over the past 24 hours, maintaining support around $1.72-$1.74. Traders observed no major shifts driven by protocol events.

Polkadot’s DOT Remains Stable Amid Market Activity is highlighted on exchanges such as Binance and Coinbase. The spot and derivatives exchanges reflect this stability with order books showing solidified support, reflecting how technical market conditions have influenced this trend.

Market Implications

This price stabilization carries implications for traders and market dynamics. Market makers are actively managing order flows at these support levels. The market impact is purely technical, with a 55% surge in trading volume but no significant protocol developments contributing to this stability.

Polkadot’s DOT price remains stable at $1.85, despite a 55% surge in trading volume above the 30-day average… support identified between $1.72 and $1.74. However, resistance near $1.86 continues to limit further price gains. – Phemex Analyst, Market Analyst, Phemex

Market Outlook

The absence of new announcements from Polkadot leadership underlines the market’s reliance on technical levels. Historical trends suggest potential reactions could include consolidation or price breakout depending on broader market cues. Traders remain keenly observant.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

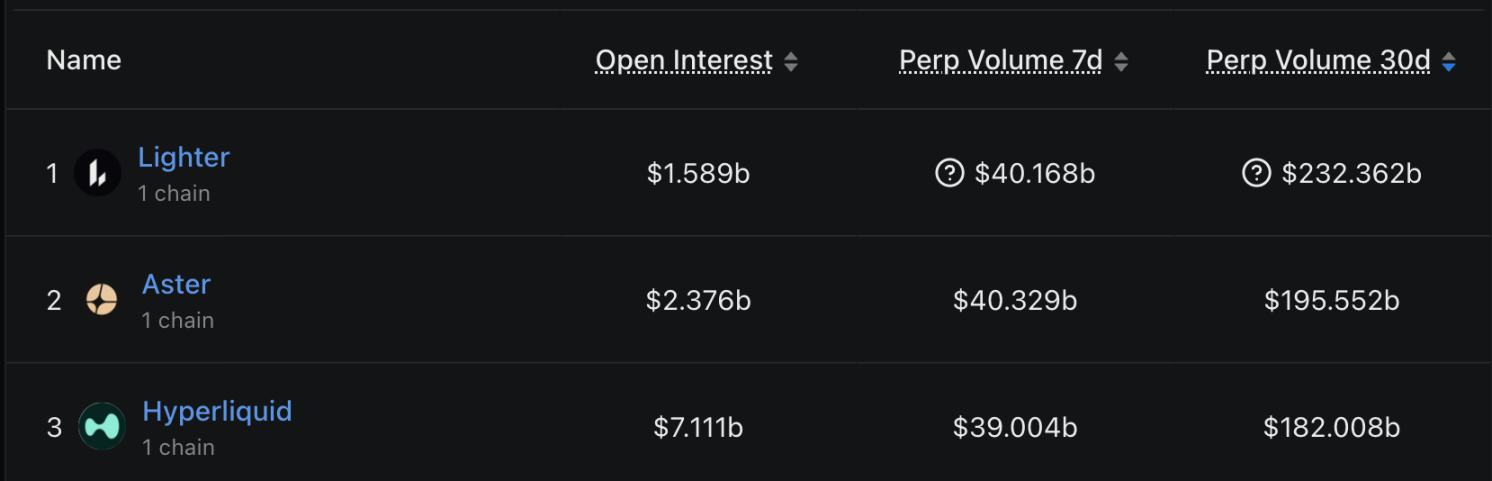

Hyperliquid personally reconciles accounts; behind the perfect PR is a fundamental crackdown on competitors.

Solana Falls 39%: Officially Worst Quarter of 2025

Leading ETH Treasury Firm Reaches Tremendous Milestone

BTC Price Could Bottom at $37,500 in 2026: Analyst