New research suggests fragmentation across blockchain networks is already draining up to $1.3B per year from tokenized asset markets. The report highlights how price gaps, capital friction, and cross-chain inefficiencies are preventing tokenized markets from functioning as a unified financial system.

These findings are feeding directly into Cardano price prediction discussions, as investors reassess which networks are best positioned to support scalable, efficient tokenized finance.

DeepSnitch AI is also gaining traction as it’s creating tools to help traders get market intelligence in real time. This reduces reliance on delayed headlines when market conditions change quickly. Momentum continues to build as the token is up 92% already.

Fragmentation highlights infrastructure gaps across blockchains

The report argues that identical or economically equivalent tokenized assets frequently trade at different prices across blockchains. Spreads of 1% to 3% persist because arbitrage remains impractical due to fees, delays, and operational risk. These inefficiencies prevent markets from self-correcting.

Capital movement across non-interoperable chains carries an estimated loss of 2% to 5% per transaction, which compounds into a material drag on market growth at scale. When applied at scale, these costs compound into a significant drag on market growth.

Analysts increasingly factor these realities into Cardano price prediction models, especially as Cardano emphasizes methodical development and system design.

Analysts increasingly highlight DeepSnitch AI as a high-upside project during periods of infrastructure reassessment. It’s offering real utility and is carving out an impressive niche in the AI token sector. That’s why analysts believe 250x potential isn’t too much of a stretch.

Cardano price prediction & two other cryptos to boom in 2026

1. DeepSnitch AI: A possible 250x moonshot

The broader AI market continues to expand rapidly, and many believe AI remains undervalued within crypto.

Only a small number of AI tokens exceed $1B market caps, and none directly target retail traders. That gap is why DeepSnitch AI is frequently mentioned alongside Cardano price prediction discussions as a speculative complement with asymmetric upside.

Capital continues to rotate aggressively into AI investments, with projections that the sector could grow 25x by 2033. DeepSnitch AI is in its own lane, as no other platform offers the same level of real-time market intelligence.

The most recent developer update added even more usability. SnitchFeed, SnitchGPT, and SnitchScan are all now operating in a single cohesive layer, which means users will be able to turn raw data into actionable insights.

The platform currently offers a live test dashboard, with three AI snitches active and two more planned. The project also includes a dynamic, uncapped staking program that adjusts returns based on participation. Two independent audits support legitimacy and transparency.

Rumors are also doing the rounds about Tier-1 or Tier-2 listings. Nothing is confirmed as of yet. Even a single confirmed listing would add meaningful credibility during the launch window.

The combination of growing hype, community engagement, and impressive utility is why analysts are pointing to DeepSnitch AI as having 250x potential.

2. Cardano price prediction: Institutional interest shines through

Cardano is very careful with any new developments. It emphasizes security, scalability, and governance at all times. The fragmentation report reinforces why infrastructure quality matters when tokenized assets are scaling.

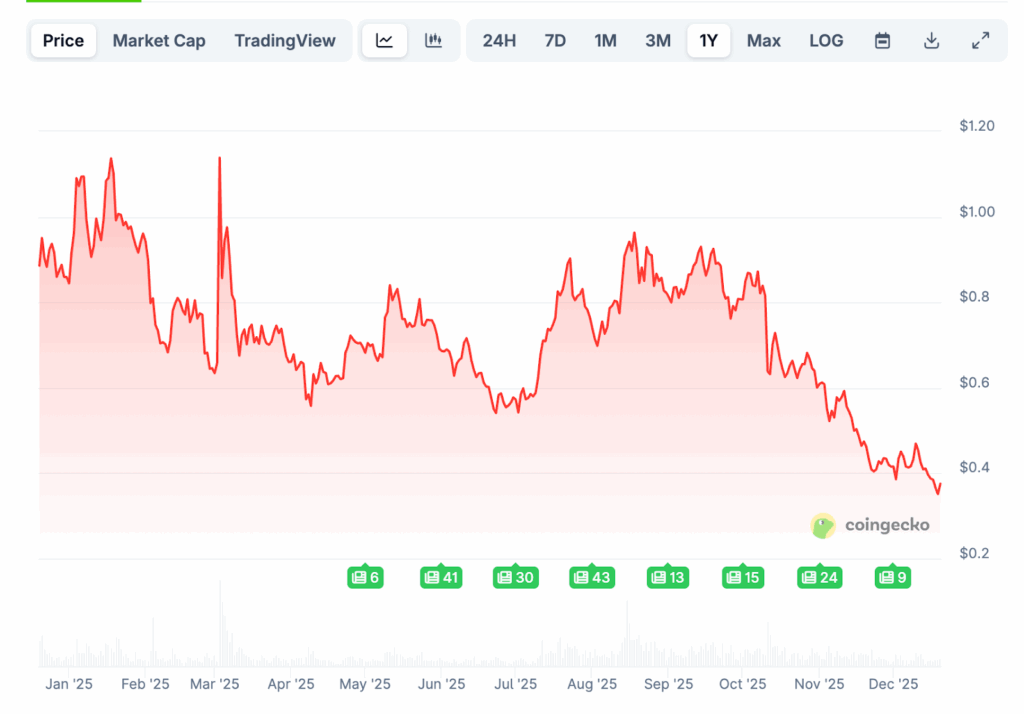

Cardano network fundamentals support a long-term narrative centered on interoperability and resilience. A realistic Cardano ADA forecast favors steady appreciation over short-term price spikes. Analysts see a possible jump back towards $2 from the current $0.37 levels amid an uptick in trading volume and its inclusion in all six US-listed crypto index ETFs:

The broader ADA long-term outlook improves if capital increasingly favors networks that reduce inefficiency.

3. Binance Coin: Could benefit handsomely from B2B payments

Binance Coin benefits from its close integration with one of the largest crypto exchanges. A key moment for BNB this week was the Better Payment Network (BPN) rolling out support to let AWS customers pay invoices with BNB. This helps them bypass traditional banking roadblocks. This expands the project’s use cases beyond just trading and now into B2B payments.

VanEck also applied for a spot BNB ETF, which could see institutional inflows coming. Analysts predict continuing bullish signals leading to a price uptick towards $1,500 in a more bullish environment.

Final verdict: A wakeup call for tokenized assets

The fragmentation report highlights how inefficiencies already cost the tokenized asset market billions each year. This reality is changing Cardano price prediction models as investors focus on infrastructure quality and long-term scalability.

DeepSnitch AI stands out by offering visible progress and trader-focused utility during this transition. Analysts continue to frame it as a high-upside opportunity due to the Tier-1 listing rumors and strong momentum, as well as testable utility. Predictions of 250x mean that plenty of investors are getting on board at this early point.

FAQs

How does market fragmentation affect DeepSnitch AI?

Fragmentation increases demand for tools that help traders understand liquidity, pricing and narrative shifts. DeepSnitch AI focuses on awareness rather than execution.

Is DeepSnitch AI fully launched?

No. Full rollout is planned after the current testing phase.

Can DeepSnitch AI help traders understand crosschain inefficiencies?

DeepSnitch AI does not execute trades or bridge assets, but its tools aim to help traders observe how liquidity, attention and pricing behavior shift across markets when inefficiencies emerge.