XRP Price Analysis: Massive Trend Reversal Incoming

The cryptocurrency market is buzzing as XRP/USD shows signs of a potential major turnaround. After months of persistent downtrend and bearish pressure, technical indicators are signaling that the tide may be turning. Traders and investors are now watching closely, as XRP could be on the verge of one of its most significant trend reversals of 2025.

According to STEPH IS CRYPTO on X, the daily XRP chart on Bitstamp is hinting at a bullish shift. Steph highlights that the MACD line has crossed above the signal line, while the RSI is rebounding from deeply oversold territory following a prolonged decline from August highs near $2.50.

These early signals suggest that the selling pressure may be easing, potentially setting the stage for a renewed upward push.

🚨 $XRP: MASSIVE TREND REVERSAL INCOMING!

— STEPH IS CRYPTO (@Steph_iscrypto) December 19, 2025

Extended Downtrend Challenges

XRP has faced months of downward pressure, with resistance at key moving averages and descending channels capping rallies. Analysts have pointed to prior death cross formations — where short-term averages drop below long-term averages — as signals of prolonged bearish momentum.

Coupled with broader market volatility and macroeconomic uncertainty, XRP has struggled to reclaim critical support levels, leaving traders cautious.

Despite this, the prolonged downtrend may be setting the stage for a classic technical rebound. Historical patterns show that periods of extended oversold conditions often precede sharp recovery phases, making the current market setup particularly noteworthy.

Technical Momentum Indicators Signal Reversal

The MACD crossover highlighted by Steph is a textbook sign of momentum shifting in favor of buyers. When paired with a rising RSI from oversold levels, the signal gains more weight, indicating that XRP could be preparing for a bullish run.

Similar scenarios in past cycles have led to rapid price recoveries, particularly when downward momentum has been exhausted over several months.

This combination of technical signals suggests that a significant trend reversal is increasingly likely if XRP can maintain upward momentum and breach key resistance zones.

Institutional Activity Strengthens Bullish Case

Adding to the technical outlook, institutional participation in XRP has been increasing. Spot XRP ETFs and other regulated investment vehicles are attracting capital, reducing the available supply on exchanges, and creating upward price pressure. This convergence of technical and institutional factors amplifies the probability of a meaningful bullish breakout.

Looking Ahead: Trend Reversal in Sight

The coming days and weeks will be decisive for XRP. A confirmed breakout above resistance levels, supported by the MACD and RSI momentum, could mark the start of a sustained upward trend. Conversely, failure to hold these gains may lead to a temporary pause or sideways consolidation.

For traders and investors, the convergence of oversold conditions, bullish technical indicators, and growing institutional activity suggests that XRP is poised for a massive trend reversal, offering a potentially lucrative opportunity while cautioning against complacency amid broader market volatility.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

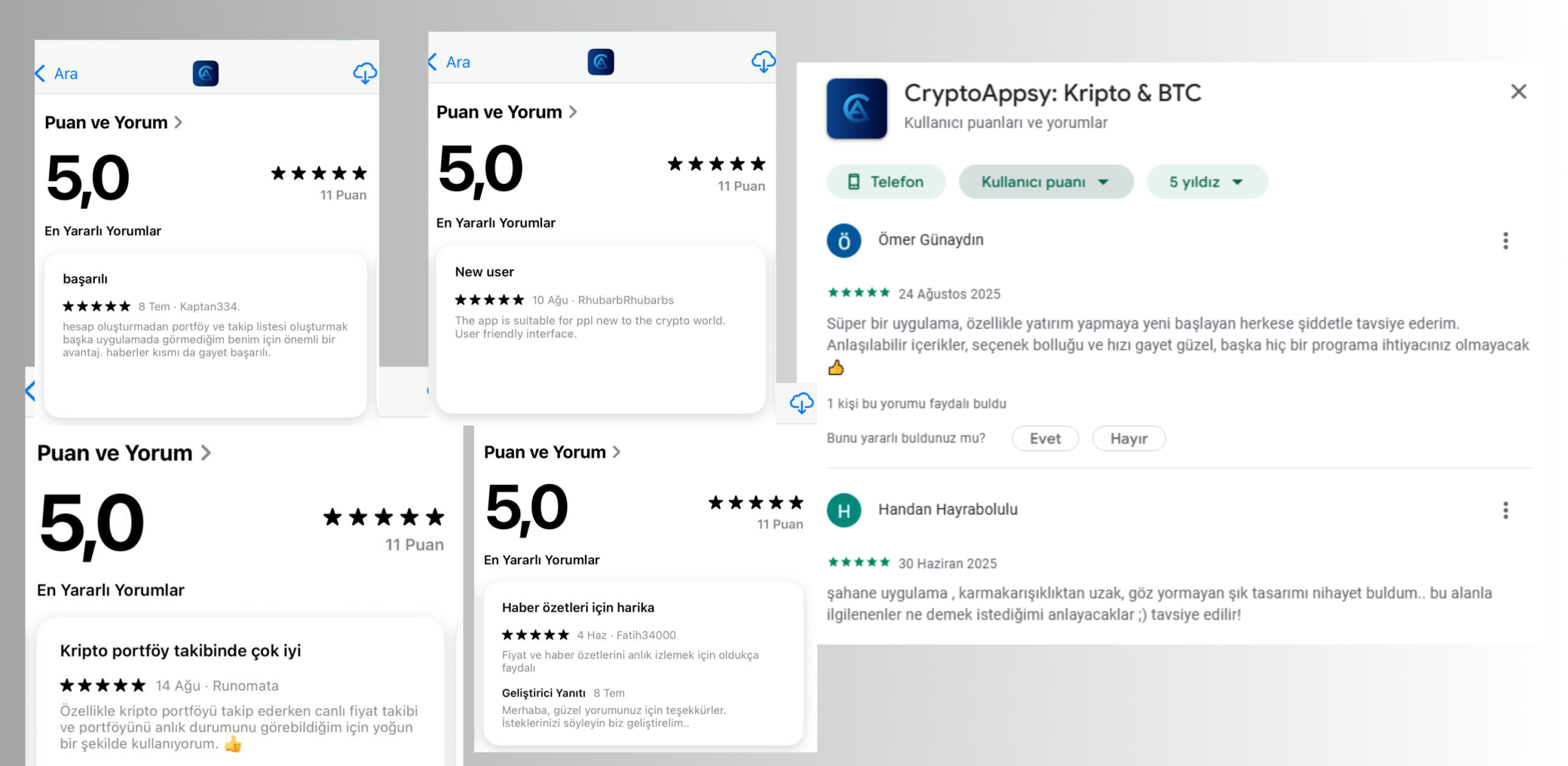

CryptoAppsy Empowers Crypto Enthusiasts with Instant Market Insights

Shardeum Surpasses 700 Million SHM Tokens Staked as Staking Delegators Program Expands

Crypto Industry Must Make Progress Before Trump Leaves Office: Etherealize Co-Founder

One of the Most Anticipated Altcoins May Be Approaching Launch – Tokens Are Moving, Here Are the Latest Data