CNBC: Why Investors Rotate Into XRP from BTC and ETH

Crypto investor and trader Xaif Crypto recently highlighted a notable change in institutional behavior within the digital asset market, involving XRP.

He referenced recent CNBC coverage that examines why capital is moving away from Bitcoin and Ethereum exchange-traded funds and into XRP-linked products. The observation centers on a segment aired on CNBC’s Crypto World, where the network reviewed the outlook for crypto ETFs heading into 2026 and highlighted a clear divergence in recent fund flows.

During the segment, the presenter noted that several spot crypto funds tied to Bitcoin and Ether have faced pressure in recent weeks. In contrast, ETFs tracking XRP were identified as attracting steady inflows, despite the general uncertainty across the digital asset market.

🚨 CNBC is now covering why investors are rotating from BTC & ETH into $XRP.

ETF inflows don’t lie. 👀🔥

— Xaif Crypto🇮🇳|🇺🇸 (@Xaif_Crypto) December 18, 2025

ETF Inflows Signal Institutional Preferences

Xaif Crypto’s commentary emphasizes that ETF inflows are not speculative indicators but recorded capital movements that reflect deliberate allocation decisions. In this context, the continued inflows into XRP-focused ETFs suggest that some investors are reassessing relative value and risk within the crypto sector.

While Bitcoin and Ethereum remain dominant in market capitalization, recent ETF data suggest that institutional portfolios are becoming more selective.

This shift appears to be occurring at a time when macroeconomic pressures and market volatility have weighed on flagship digital assets. As a result, XRP-linked products are increasingly being treated as a differentiated exposure rather than as part of a uniform crypto basket.

Sustained Inflows Reinforce the Trend

According to a report published on the 17th, Ripple CEO Brad Garlinghouse referenced CoinDesk data showing strong performance among XRP spot ETFs since their launch. These products began trading on November 13, 2025, and have since recorded 30 consecutive days of net inflows, a performance rarely seen in newly introduced crypto investment vehicles.

Over this period, cumulative inflows were around $1 billion, while assets under management have risen to approximately $1.18 billion. The consistency of these inflows suggests sustained institutional participation rather than short-term positioning. This stands in contrast to Bitcoin and Ethereum spot ETFs, which have experienced periods of net outflows over the same timeframe.

XRP Positioned as a Distinct Institutional Allocation

The divergence in ETF flows indicates that institutions may be viewing XRP through a different lens, one more closely tied to utility-driven fundamentals and long-term use cases. Rather than tracking broader market sentiment, capital allocation into XRP ETFs appears to be guided by asset-specific considerations.

As CNBC’s coverage and ETF data both illustrate, the current rotation is less about abandoning established digital assets and more about reallocating toward products showing resilience and consistency. For market observers, the sustained inflows into XRP-linked ETFs provide measurable evidence that institutional strategies within crypto are evolving.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

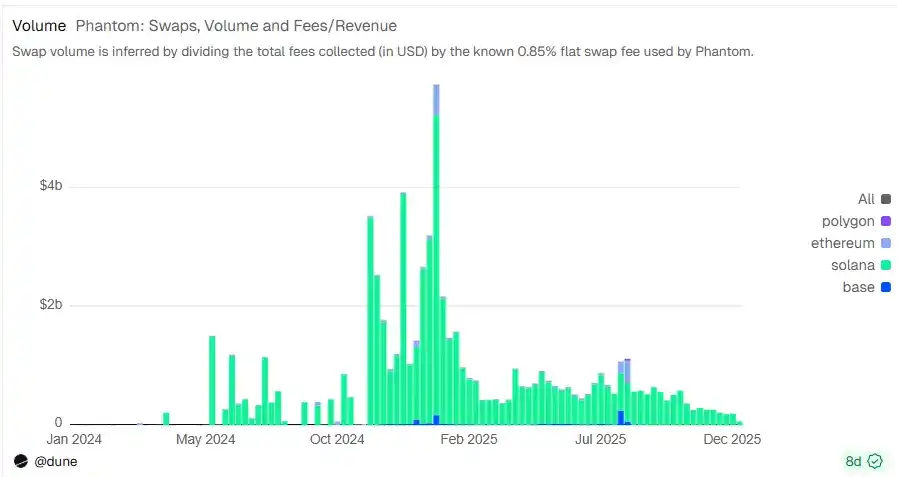

Behind the $3 billion valuation: Phantom's growth anxiety and multi-chain breakout

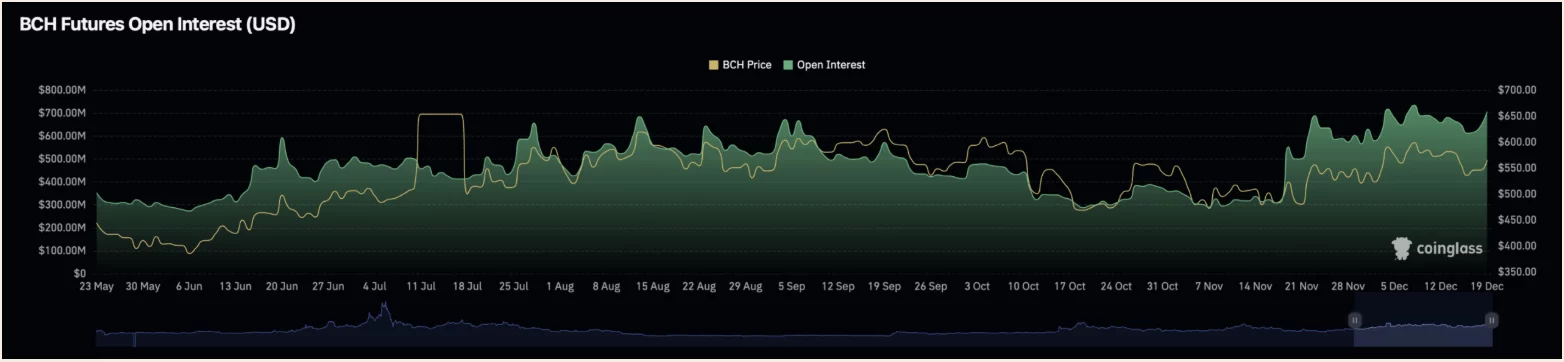

Bitcoin Cash Surges: BCH’s Mixed Market Reaction

Pepecoin (PEPE) vs $0.035 DeFi Coin: Which Has the Cleaner Long-Term Setup as Market Conditions Shift?

DEIN Rolls Out Insurance Marketplace on Arbitrum, Expanding Further to DeFi Ecosystems